KEYTAKEAWAYS

- DEX Trading Volume Rebounds Across the Board, Solana Leads the Increase

- Top Five FARTCOIN Addresses Generate Profits Exceeding $8.9 Million

- Strategy Bitcoin Holdings Unrealized Profit Rebounds to $9.01 Billion

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

DEX TRADING VOLUME REBOUNDS ACROSS THE BOARD, SOLANA LEADS THE INCREASE

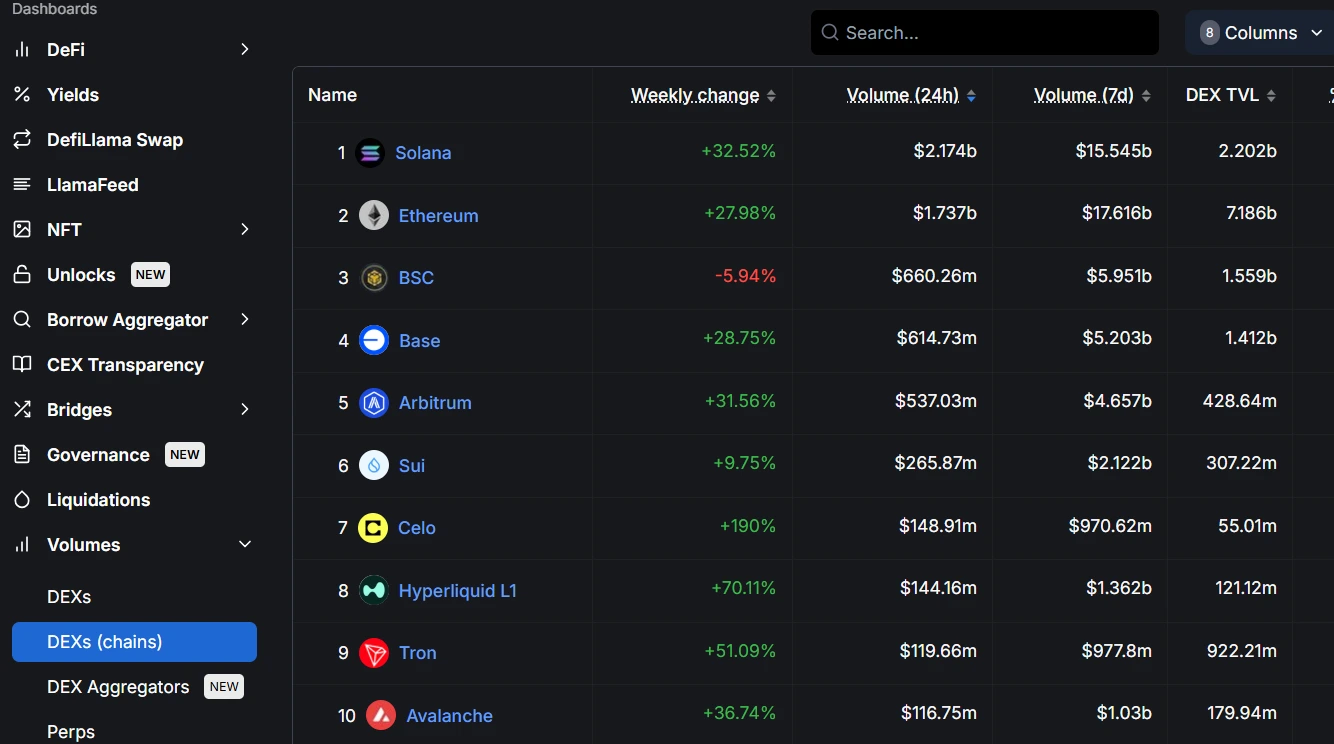

According to new data from DeFiLlama, DEX (decentralized exchange) trading volumes have generally rebounded across major public chains over the past 24 hours. Among them, Solana ranks first with a weekly increase of 32.52%, reaching a 24-hour trading volume of $2.174 billion; Ethereum follows closely with growth of 27.98% and trading volume of $1.737 billion. Base and Arbitrum showed impressive performance, rising 28.75% and 31.56% respectively.

Meanwhile, BNB Chain became the only mainstream public chain with declining trading volume, dropping 5.94% with a 24-hour trading volume of $660 million.

Analysis:

The comprehensive rebound in DEX trading volumes reflects warming market sentiment and increased investor activity. Solana’s strong performance may benefit from its low transaction fees and high TPS advantages, attracting more high-frequency trading and Meme coin speculation. The growth of Base chain (Coinbase ecosystem) and Arbitrum (Layer2 leader) indicates continued prosperity in the Ethereum Layer2 ecosystem.

TOP FIVE FARTCOIN ADDRESSES GENERATE PROFITS EXCEEDING $8.9 MILLION

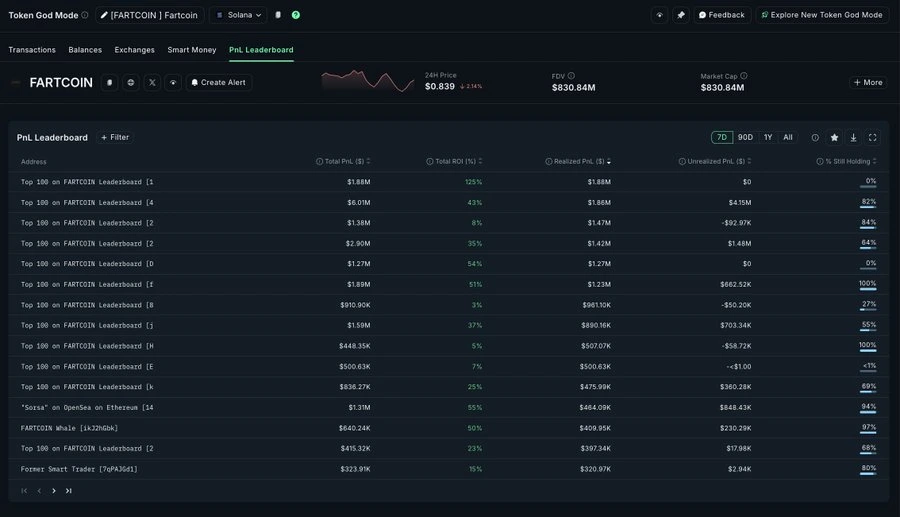

According to Golden Finance reporting, based on Nansen monitoring, the top five FARTCOIN addresses have collectively realized profits exceeding $8.9 million. One address gained $1.88 million in profit and has already exited. Another address is still holding unrealized gains worth $4.15 million.

Analysis:

The substantial profits of the top five FARTCOIN addresses reflect that early holders or institutional investors may have already secured significant market advantages, with some addresses choosing to take profits (such as the $1.88 million that has exited); while the address holding $4.15 million in unrealized gains indicates that some major holders still see potential in the future market.

STRATEGY BITCOIN HOLDINGS UNREALIZED PROFIT REBOUNDS TO $9.01 BILLION

According to Golden Finance reporting, as Bitcoin rebounded today briefly breaking through $86,000, now trading at $84,531, Strategy (formerly MicroStrategy) has seen the unrealized profit on its Bitcoin holdings rebound to $9.01 billion.

As of April 6, 2025, Strategy disclosed that it holds 528,185 bitcoins, with a total purchase cost of approximately $35.63 billion, representing an average cost of about $67,458 per bitcoin.

Analysis:

MicroStrategy (now Strategy), as the largest public company Bitcoin holder, demonstrates the resilience of its long-term holding strategy through this rebounding unrealized profit. Strategy’s holdings performance often influences market sentiment; if it continues to increase its position in the future, it may further boost market confidence. Conversely, if signs of reducing holdings appear, caution regarding correction risk would be warranted.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!