KEYTAKEAWAYS

- Public Companies Purchased 95,431 Bitcoins in Q1 2025, Total Holdings Reach 688,000 Coins

- BNB Chain: PumpBTC Receives $280,000 in Liquidity Rewards

- Ethereum DAPP Fee Revenue Exceeds $1 Billion in Q1 2025, Ranking First

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

PUBLIC COMPANIES PURCHASED 95,431 BITCOINS IN Q1 2025, TOTAL HOLDINGS REACH 688,000 COINS

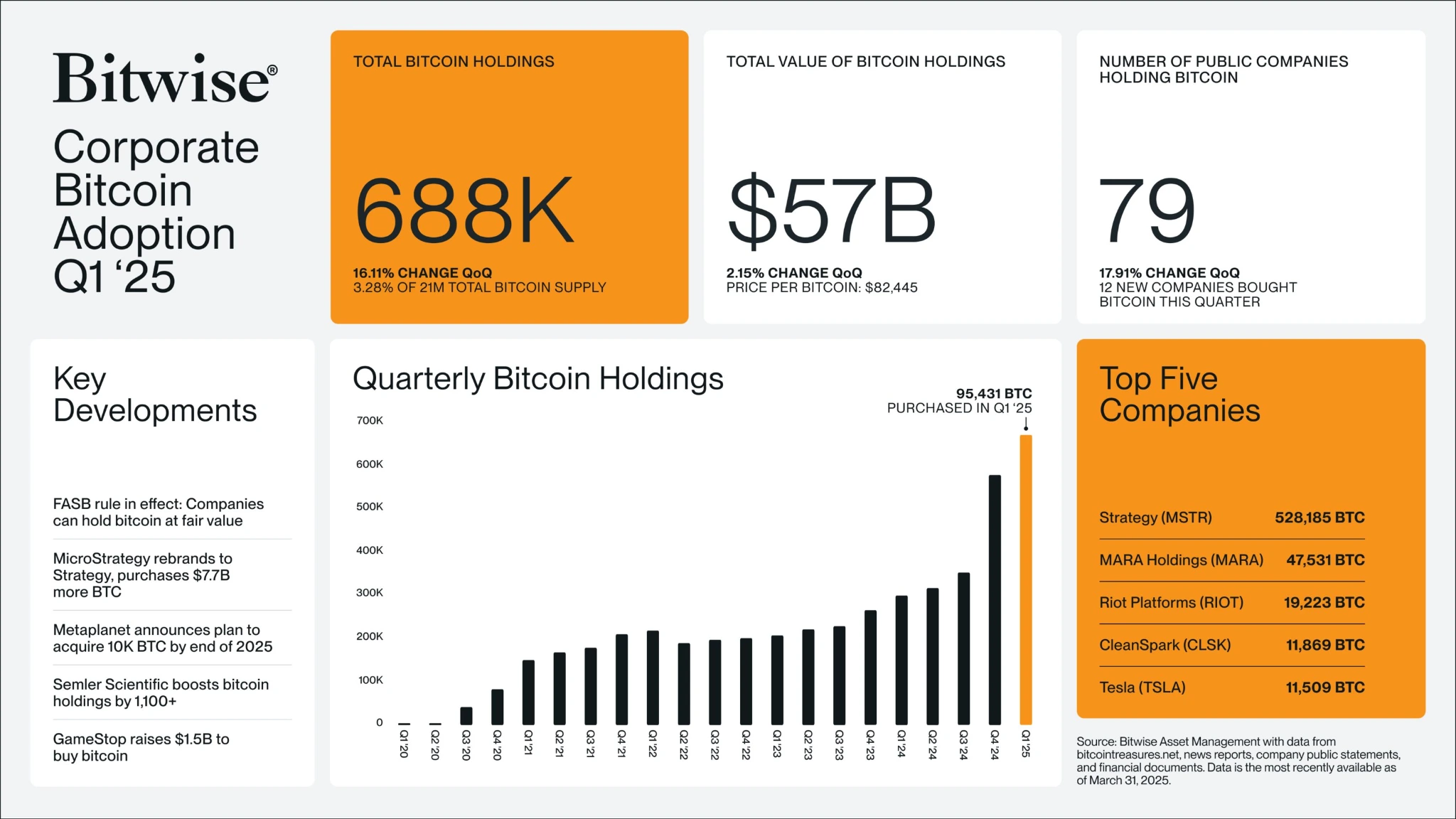

According to Bitwise’s “Enterprise Bitcoin Adoption in Q1 2025” report, public companies purchased 95,431 bitcoins in the first quarter of 2025, a 16.11% quarter-over-quarter increase, bringing their total bitcoin holdings to 688,000 coins, which represents 3.28% of the total bitcoin supply of 21 million. The number of public companies holding bitcoin reached 79, a 17.91% quarter-over-quarter increase, with 12 new companies purchasing bitcoin during the quarter.

Analysis:

The continuing growth in public companies’ bitcoin holdings indicates that institutional demand for cryptocurrency allocation is still warming up. The total holdings of 688,000 coins representing 3.28% of the total bitcoin supply highlights its gradual emergence as an important option for corporate asset allocation, reducing market circulation and supporting price trends.

BNB CHAIN: PUMPBTC RECEIVES $280,000 IN LIQUIDITY REWARDS

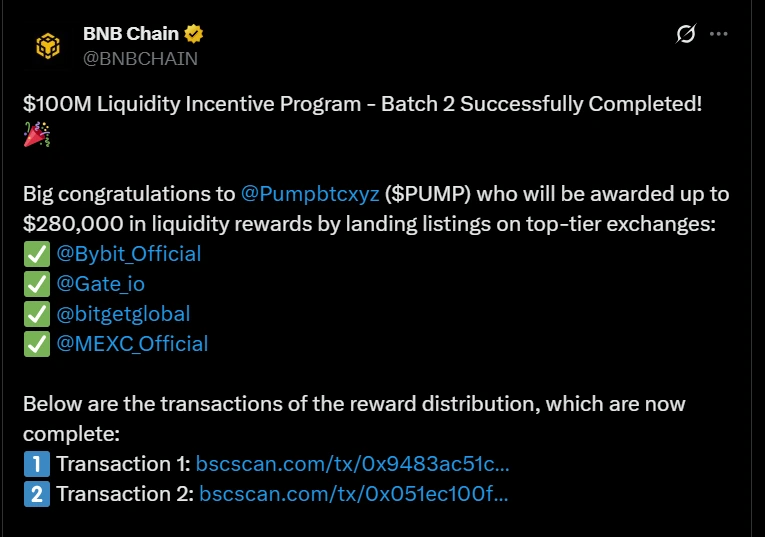

BNB Chain announces that the second batch of its $100 million liquidity incentive program has been successfully completed. PumpBTC(PUMP) received liquidity rewards of up to $280,000.

Analysis:

PumpBTC focuses on enhancing the Bitcoin trading experience through socially-driven features and community participation. Previously, Binance Wallet’s new TGE PumpBTC ended with investment, ultimately oversubscribed by 327.56 times.

PumpBTC’s potential lies in fostering a collaborative trading environment, providing users with data-driven insights, and creating a unique platform that leverages decentralized finance to optimize trading strategies.

ETHEREUM DAPP FEE REVENUE EXCEEDS $1 BILLION IN Q1 2025, RANKING FIRST

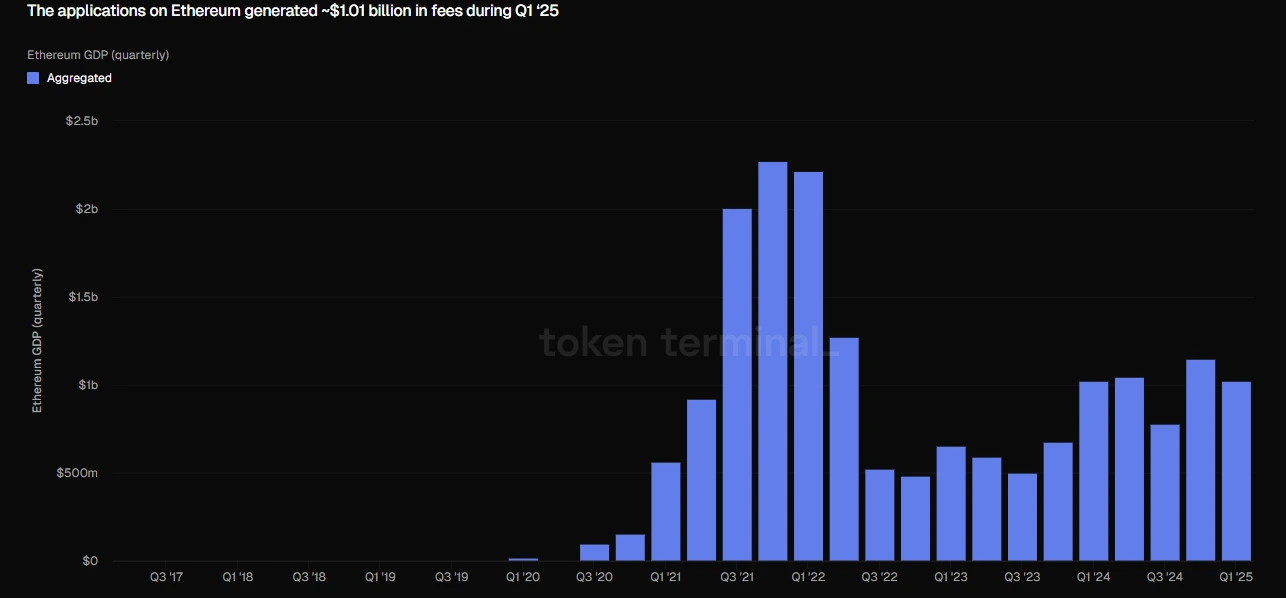

According to Token Terminal data, Ethereum continues to maintain its leading position among decentralized application (DAPP) platforms. In the first quarter of 2025, the network’s DAPP fee revenue reached $1.014 billion. Ranking second is Coinbase’s Layer 2 network Base, with DAPP fee revenue of $193 million.

BNB Chain’s DAPP fee revenue was $170 million, while the Arbitrum ecosystem fee revenue was $73.8 million. Avalanche’s C-Chain ranked in the top five, with DAPP fee revenue of $27.68 million.

Analysis:

Ethereum’s far-leading DAPP revenue demonstrates its dominance as the leading smart contract platform. The competitive landscape of Layer 2 solutions (such as Arbitrum) and emerging public chains (such as Avalanche) is being reshaped, but it will be difficult to shake Ethereum’s dominant position in the short term.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!