KEYTAKEAWAYS

- ETH Supply Reaches 120,524,038 Tokens, Surpasses Pre-Merge Leve

- Base Chain Stablecoin Supply Approaches $4 Billion,USDC Accounts for 92.25%

- Bhutan Government Transfers 377.77 Bitcoin, Worth Approximately $37.28 Million

CONTENT

Welcome to CoinRank Daily Data Report. ETH Supply Reaches 120,524,038 Tokens, Surpasses Pre-Merge Leve. Base Chain Stablecoin Supply Approaches $4 Billion,USDC Accounts for 92.25%. Bhutan Government Transfers 377.77 Bitcoin, Worth Approximately $37.28 Million.

ETH SUPPLY SURPASSES PRE-MERGE LEVEL

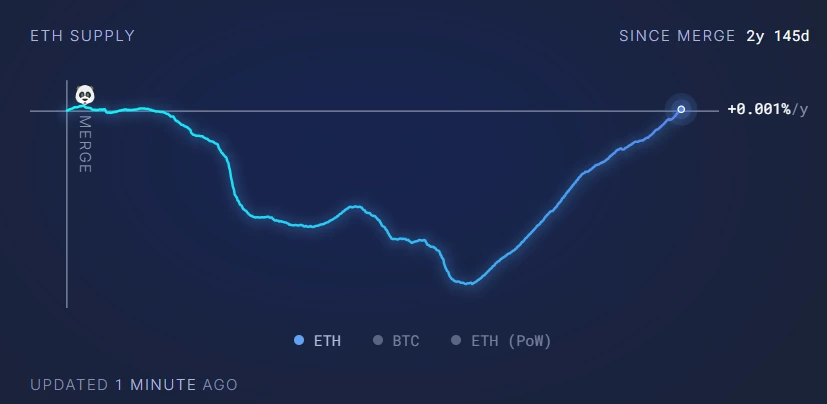

According to Ultrasound data, ETH’s current supply has exceeded its pre-PoS Merge level. Data shows that the current ETH supply is 120,524,038 tokens, an increase from 120,521,140.92 tokens at the time of the Merge on September 15, 2022.

Source: Ultrasound

Since Ethereum’s transition to Proof of Stake (PoS), 1,947,814.51 ETH have been burned, while 1,950,777.71 ETH have been newly issued, resulting in a net supply increase of 2,963.2 ETH.

Source: Ultrasound

Analysis:

Ethereum (ETH) supply surpassing pre-Merge levels has drawn significant market attention. Although Ethereum successfully transitioned to PoS in September 2022, aiming to reduce inflation through decreased issuance and fee burning, data shows that ETH’s net supply has still experienced a slight increase. This growth primarily stems from new ETH issuance slightly exceeding the amount burned, despite the burn mechanism partially controlling inflation.

From a market perspective, this data could put some pressure on ETH’s price. An increase in supply means more ETH in circulation, which could pressure prices if demand doesn’t grow correspondingly. However, as a core asset in the blockchain ecosystem, Ethereum’s price is influenced not only by supply but also by network usage, developer activity, and DeFi ecosystem health.

Looking ahead, the Ethereum community might consider adjusting burn or issuance rates to better balance supply and demand.

BASE CHAIN STABLECOIN SUPPLY APPROACHES $4 BILLION, USDC DOMINATES

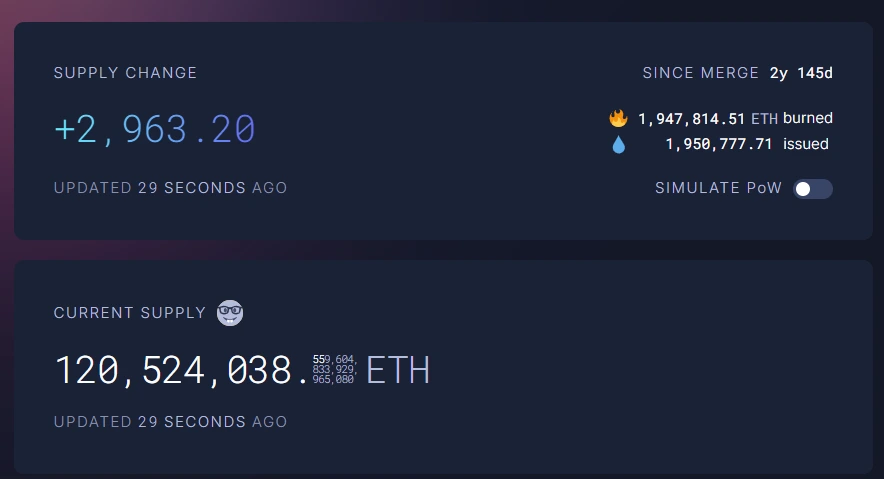

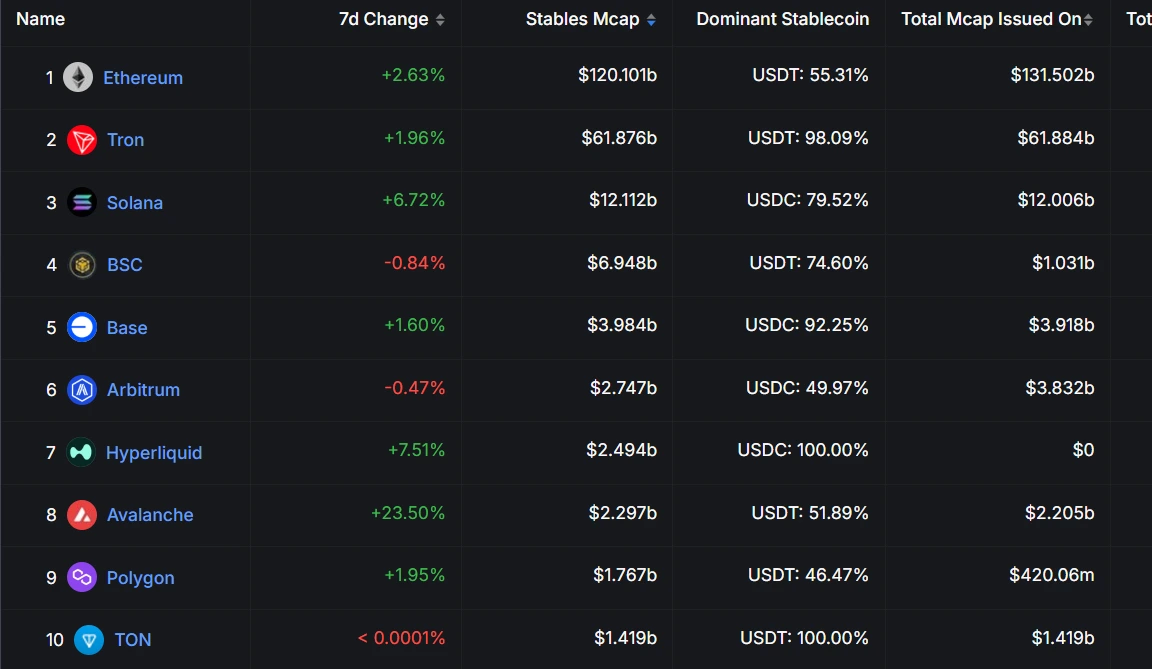

According to DeFiLlama data, the total stablecoin supply on Base chain has reached $3.984 billion, approaching the $4 billion milestone. USDC dominates with a 92.25% share, establishing itself as the primary stablecoin asset on Base.

Source: DefiLlama

In terms of public chain rankings, Base ranks fifth in total stablecoin supply. Currently, Ethereum leads with $120.1 billion in stablecoin supply, followed by TRON ($61.876 billion) and Solana ($12.112 billion) in second and third places, while BSC ranks fourth with $6.948 billion. Other public chains have stablecoin supplies below $3 billion.

Analysis:

Base chain’s stablecoin supply approaching $4 billion demonstrates its rapid rise in the stablecoin market. USDC’s 92.25% dominance reflects market preference for compliant stablecoins.

Although Base ranks fifth among public chains, it still lags significantly behind leading chains like Ethereum and TRON. This trend indicates that the stablecoin market remains dominated by a few mainstream chains, but emerging chains like Base and Arbitrum are gradually expanding their market share. Looking ahead, as more use cases develop and user base grows, Base is expected to further strengthen its position in the stablecoin market.

BHUTAN GOVERNMENT TRANSFERS 377.77 BITCOIN, WORTH APPROXIMATELY $37.28 MILLION

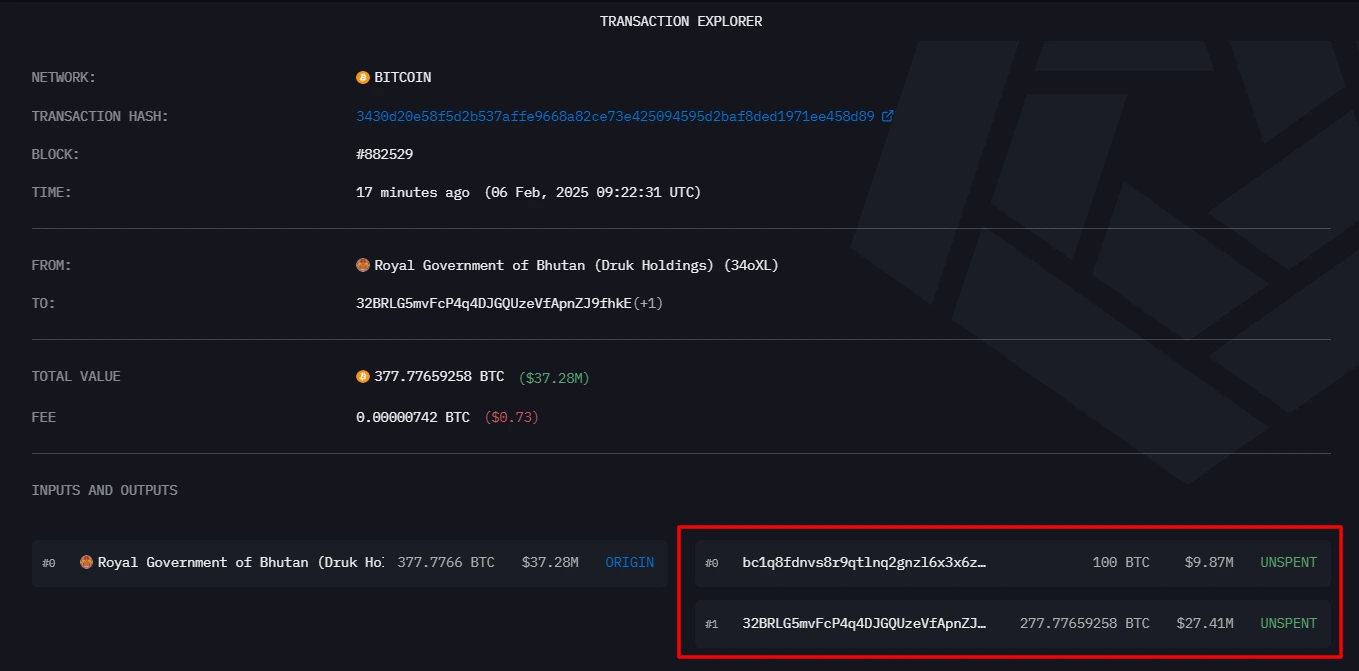

According to Onchain Lens monitoring, the Kingdom of Bhutan’s government recently transferred 377.77 bitcoin to two unknown wallets, worth approximately $37.28 million. Currently, the Bhutan government still holds 11,145 BTC, valued at around $1.1 billion. The purpose of this transfer remains unclear but has drawn market attention to Bhutan’s bitcoin strategy.

Source: OnchainLens

Analysis:

Bhutan’s bitcoin transfer may indicate an adjustment in its asset allocation or a response to market volatility. Currently, bitcoin price volatility remains high, and governments and institutional investors show divergent attitudes toward cryptocurrencies. As one of the earlier countries to venture into bitcoin, Bhutan’s moves could influence decisions of other emerging market nations.

Furthermore, this transfer might be related to Bhutan’s domestic economic policies or international payment needs. Moving forward, markets will closely monitor the Bhutan government’s subsequent actions and their potential impact on the cryptocurrency market, especially as the role and status of cryptocurrencies gain more attention amid increasing global economic uncertainty.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!