KEYTAKEAWAYS

- Ethereum Gas Fees Continue to Drop, Currently at 0.892 Gwei

- Top 10 Wallet Holdings Exceed 30% for SHIB, ETH, LINK, and TON

- Coinbase CEO: Platform's Customer Assets Reach $0.42 Trillion, Ranking as 21st Largest "Bank" in US

CONTENT

Welcome to CoinRank Daily Data Report. Ethereum Gas Fees Continue to Drop, Currently at 0.892 Gwei. Top 10 Wallet Holdings Exceed 30% for SHIB, ETH, LINK, and TON. Coinbase CEO: Platform’s Customer Assets Reach $0.42 Trillion, Ranking as 21st Largest “Bank” in US.

ETHEREUM GAS FEES CONTINUE TO DROP, CURRENTLY AT 0.892 GWEI

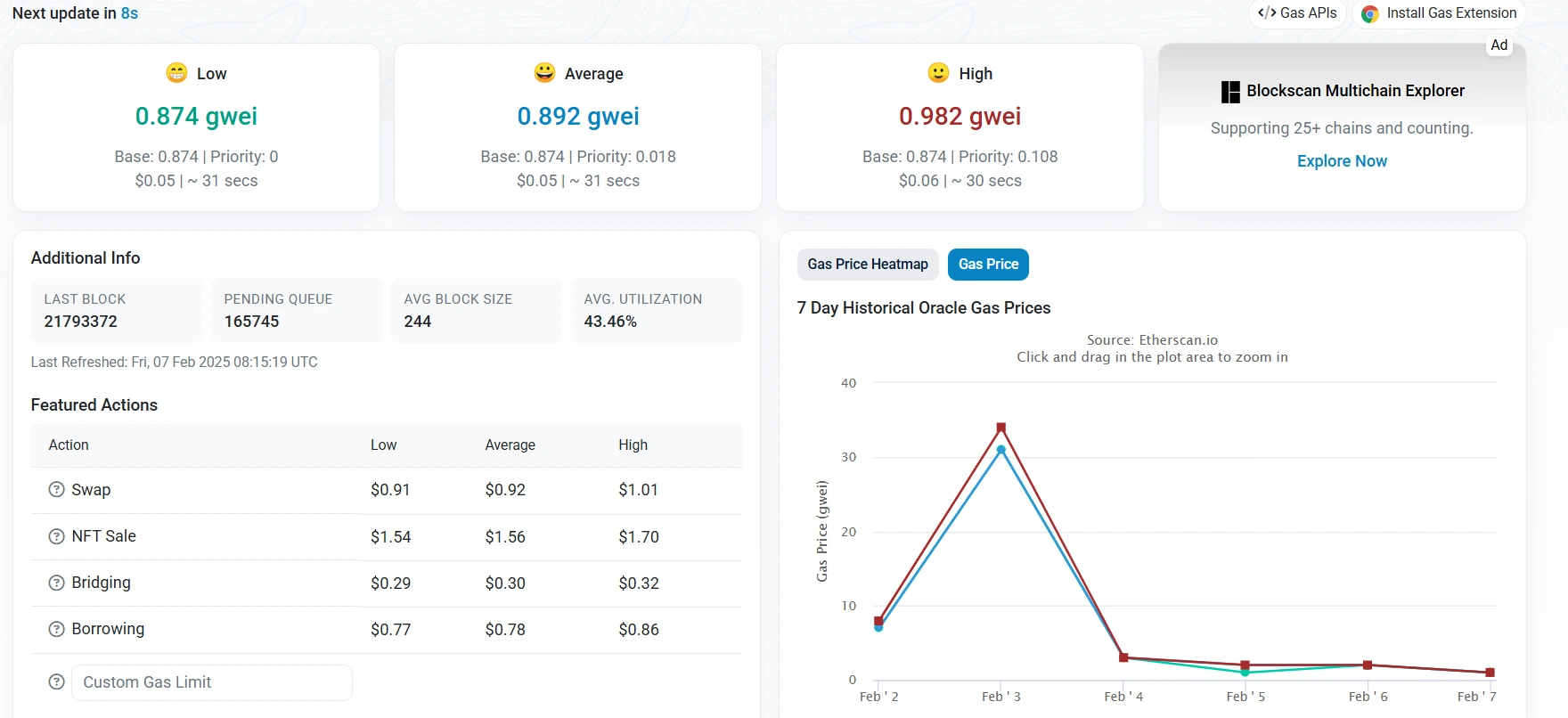

According to Etherscan data, Ethereum GAS fees continue to decline, now at 0.892 Gwei, reaching an extremely low level. Ethereum GAS fees have decreased for four consecutive days, with this figure being around 35 Gwei on February 3rd.

Source: Etherscan

Analysis:

Low gas fees indicate smooth network conditions and reduced transaction costs for users.

Ethereum gas fees are influenced by network congestion and user demand, typically fluctuating between 1-500 Gwei. The current low fees suggest the network is relatively idle, resulting in significantly reduced transaction costs. Generally, when gas fees are low, it’s an optimal time for regular transactions and smart contract interactions, while during peak periods (such as popular NFT launches or DeFi activities), fees can surge. Factors affecting gas fees include network load, transaction priority, and smart contract complexity.

TOP 10 WALLET HOLDINGS EXCEED 30% FOR SHIB, ETH, LINK, AND TON

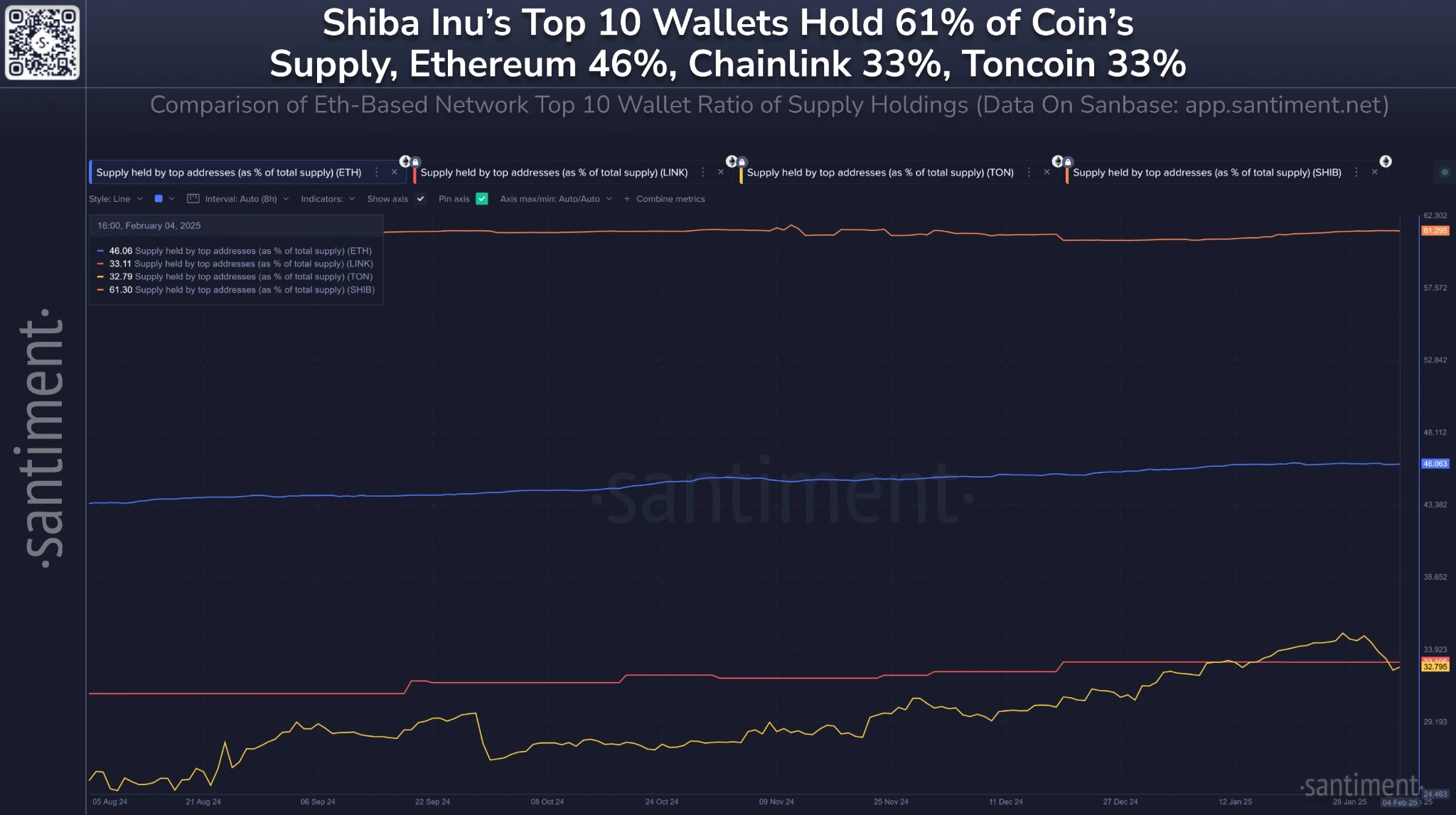

According to data published by Santiment on X, four leading altcoins show wallet concentrations exceeding 30% among their top 10 holders. The specific figures are: Shiba Inu (SHIB) top 10 wallets hold 61.3% of supply, Ethereum (ETH) at 46.1%, Chainlink (LINK) at 33.1%, and Toncoin (TON) at 32.8%.

Source: Santimentfeed

Analysis:

This high concentration could have dual implications for the market: On one hand, the actions of large holders could significantly impact price movements, especially during major transfers or sell-offs. On the other hand, this may raise concerns about the degree of decentralization, as high concentration somewhat contradicts the distributed principles advocated by cryptocurrencies.

Furthermore, ETH’s 46.1% concentration is particularly noteworthy as the second-largest cryptocurrency by market cap. Despite Ethereum’s rapid development of decentralized applications (DApps) and smart contracts, this supply concentration could pose potential risks to the network’s long-term stability and security. Investors participating in the cryptocurrency market should remain cautious of the risks of price manipulation and market volatility that such high concentration may bring.

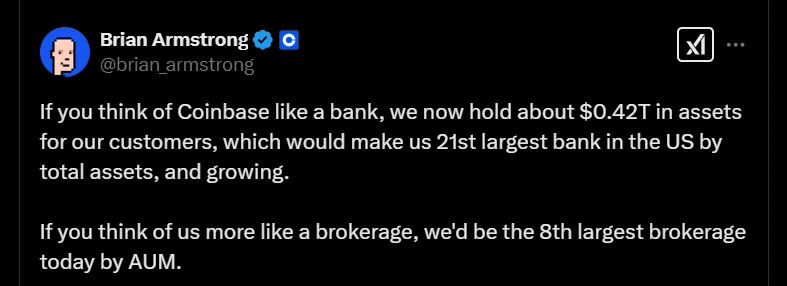

Coinbase CEO Brian Armstrong posted on X that Coinbase currently holds approximately $0.42 trillion in customer assets. If considered as a bank, this would make it the 21st largest in the United States. Additionally, if viewed as a brokerage firm, Coinbase would rank eighth by assets under management. Armstrong also noted that cryptocurrency is blurring the lines between traditional financial categories, suggesting that the future financial system will trend toward a multi-functional primary account, driving the global economy to operate on a more efficient crypto-based track.

Analysis:

Coinbase’s asset scale reflects both the maturity of the crypto market and increased user trust. However, comparisons with traditional banks or brokerages must consider differences in regulatory environments, risk controls, and business models. While the crypto industry is driving financial system transformation, traditional finance still maintains advantages in stability and regulatory frameworks. The realization of Armstrong’s “unified financial account” vision depends on market demand, policy support, and technological advancement, facing significant challenges in the short term.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!