KEYTAKEAWAYS

- Telegram Game User Retention Rate Hovers at 5-20%

- Berachain's TVL Grows 18.71% Daily, Rising to 8th Place Globally

- US Eighth-Largest Bank PNC Reveals Increased Investment in Bitwise Bitcoin ETF to Approximately $67 Million

CONTENT

Welcome to CoinRank Daily Data Report. Telegram Game User Retention Rate Hovers at 5-20%. Berachain’s TVL Grows 18.71% Daily, Rising to 8th Place Globally. US Eighth-Largest Bank PNC Reveals Increased Investment in Bitwise Bitcoin ETF to Approximately $67 Million.

TELEGRAM GAME USER RETENTION RATE HOVERS AT 5-20%

According to a report by Helika, Telegram game user retention rates hover between 5-20%, significantly below the traditional gaming benchmark of 20-30%. The analytics firm also noted that disappointing airdrops, particularly from “Hamster Kombat,” led to the dissipation of excitement around Telegram’s Tap-to-Earn initiative. Hamster Kombat’s user base plummeted from 300 million in August 2024 to 41 million after the November airdrop.

Source: TonSat

According to Tonstat data, despite the disappointment many users experienced with “Hamster Kombat,” the TON blockchain added over 100 million new accounts in the past 12 months, growing from approximately 6 million to over 140 million accounts.

Analysis:

The low 5-20% retention rate for Telegram games reflects clear weaknesses in user stickiness and experience within its gaming ecosystem. Although projects like “Hamster Kombat” initially generated excitement through airdrops, the significant user exodus demonstrates that short-term incentives struggle to maintain long-term interest. However, the rapid growth in TON blockchain accounts (from 6 million to 140 million) indicates strong potential and market acceptance of the underlying technology. Moving forward, the Telegram gaming ecosystem needs to optimize gameplay design, enhance user experience, and deeply integrate with the TON blockchain to achieve sustainable growth.

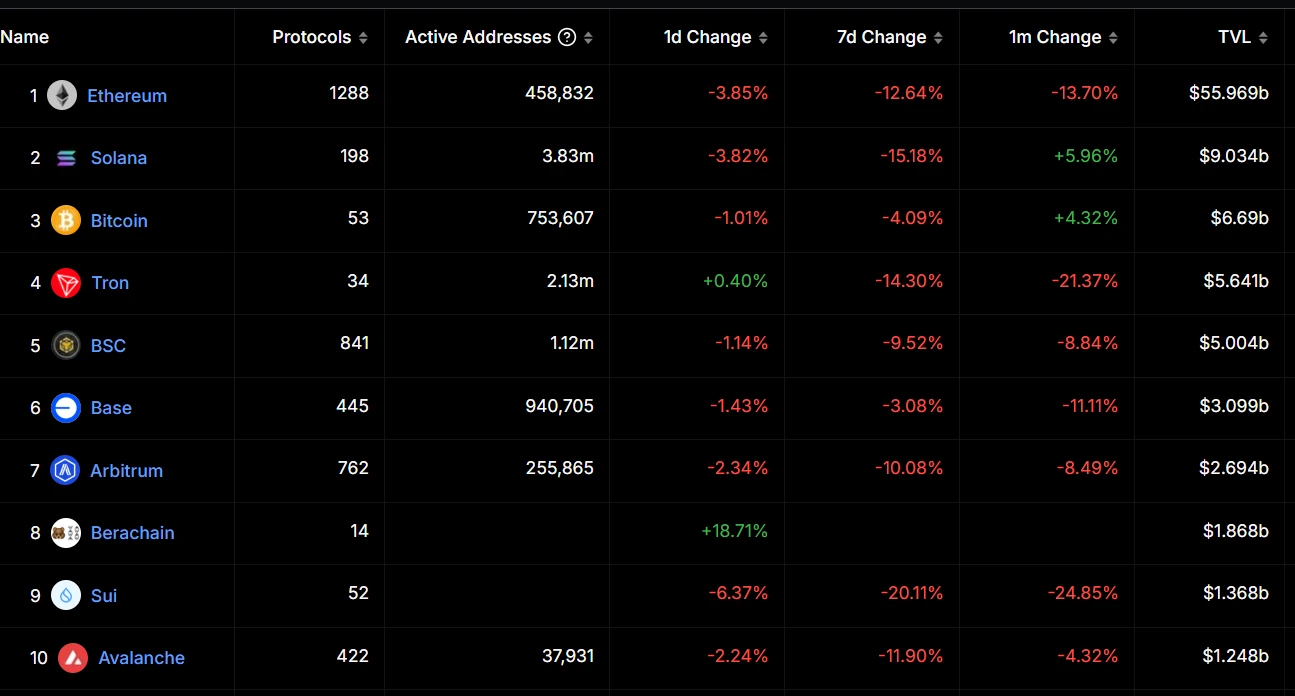

BERACHAIN’S TVL GROWS 18.71% DAILY, RISING TO 8TH PLACE GLOBALLY

Berachain’s Total Value Locked (TVL) has reached $1.868 billion, with a daily growth of 18.71%, surpassing Sui and Avalanche to reach 8th place globally.

Meanwhile, Ethereum, Solana, Tron, BSC, and Arbitrum have all seen their TVL decline by more than 10% over the past week. Ethereum leads with a TVL of $55.969 billion, maintaining its top position. Solana ranks second with a TVL of $9.034 billion, while Sui ranks ninth with a TVL of $1.368 billion.

Source: DefiLlama

Analysis:

Berachain is a public blockchain that launched less than a week ago, focusing on improving blockchain scalability and efficiency through innovative consensus mechanisms and modular architecture. The significant growth in Berachain’s TVL (18.71%) reflects market confidence in its ecosystem, particularly notable against the backdrop of declining TVL across mainstream public chains. This performance may be attributed to its technological innovations or the appeal of its ecosystem projects.

However, Ethereum’s dominant position remains unchallenged with a TVL of $55.969 billion, indicating its leadership is unlikely to be disrupted in the short term. Overall, as competition in the public chain market intensifies, emerging chains need to continuously optimize their ecosystems and user experience to maintain TVL growth momentum amid market fluctuations.

US EIGHTH-LARGEST BANK PNC REVEALS INCREASED INVESTMENT IN BITWISE BITCOIN ETF TO APPROXIMATELY $67 MILLION

According to CoinGape, the Bitcoin spot ETF market has just welcomed PNC, the eighth-largest bank in the United States, which announced its Bitcoin exposure. According to a 13F filing with the Securities and Exchange Commission (SEC), PNC Bank, which manages $325 billion in assets, has increased its Bitcoin exposure from $10 million to $67 million, primarily investing in the Bitwise Bitcoin ETF (BITB). Former Sequoia Capital analyst Julian Fahrer revealed that PNC Bank has gradually increased its investment in Bitcoin ETFs over the past year.

Source: CoinGape

Analysis:

PNC Bank’s significant increase in Bitcoin ETF investment reflects growing acceptance of the cryptocurrency market by traditional financial institutions. This move could attract more institutional investors, further driving market demand for Bitcoin spot ETFs. Meanwhile, the Bitwise Bitcoin ETF (BITB), as the primary investment target, is likely to see enhanced market share and liquidity. As institutional funds continue to flow in, Bitcoin’s legitimacy and mainstream acceptance will further increase, injecting confidence into the long-term development of the cryptocurrency market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!