KEYTAKEAWAYS

- Berachain TVL Surges 17.01% in One Day, Firmly Holds 8th Place Among Public Chains

- PancakeSwap Claims Top Spot for 24-Hour Trading Volume, Also Leads Weekly Volume

- Ethereum Foundation Makes Large Deposits: Transfers 10,000 ETH Each to Spark and Aave

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

BERACHAIN TVL SURGES 17.01% IN ONE DAY, FIRMLY HOLDS 8TH PLACE AMONG PUBLIC CHAINS

On February 13th, Berachain’s Total Value Locked (TVL) exceeded $2.466 billion, with a remarkable daily increase of 17.01%, successfully climbing to 8th place among all public chains. Currently, Arbitrum ranks 7th with a TVL of $2.857 billion, while Sui follows in 9th place with $1.546 billion.

Source: DefiLlama

Meanwhile, leading public chains like Ethereum, Solana, TRON, and BSC showed relatively modest TVL growth, with daily increases not exceeding 6%. Ethereum maintains its top position with a TVL of $58.149 billion, while Solana holds second place with $9.084 billion.

Analysis:

Berachain’s exceptional daily TVL growth reflects the rapid expansion of its ecosystem and significantly increased market recognition. Securing 8th position shortly after launch demonstrates its strong appeal in the competitive public chain market. Compared to similarly ranked Arbitrum and Sui, Berachain’s TVL growth rate is more explosive, suggesting possible breakthroughs in technical innovation, user incentives, or ecosystem partnerships.

In contrast, the TVL growth of leading chains like Ethereum and Solana remains steady. This might indicate market funds are diversifying toward emerging chains, with investors showing greater interest in high-growth potential projects. However, Ethereum’s leading TVL position demonstrates its solid status as industry leader. Whether Berachain can maintain this rapid growth and further narrow the gap with leading chains will be a key focus for market observers.

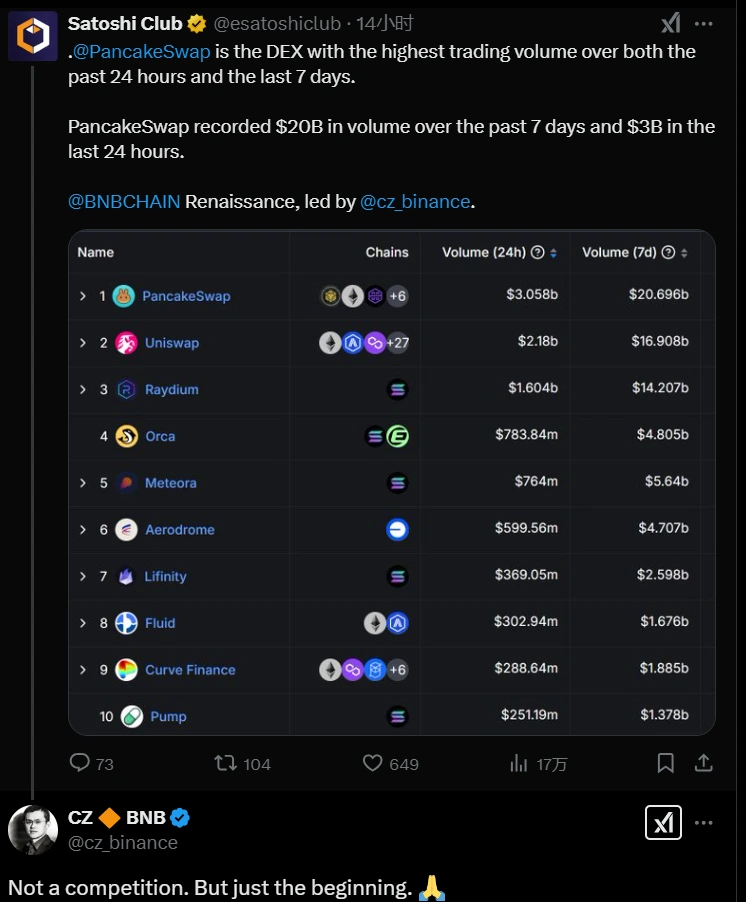

PANCAKESWAP CLAIMS TOP SPOT FOR 24-HOUR TRADING VOLUME, ALSO LEADS WEEKLY VOLUME

According to Defillama data, PancakeSwap has overtaken Uniswap with a 24-hour trading volume of $3.028 billion, claiming the top spot across all platforms. Uniswap ranks second with daily volume of $2.18 billion, while Raydium takes third place with $1.4207 billion.

Source: X

Furthermore, PancakeSwap’s weekly performance has been equally impressive, with total trading volume reaching $21.207 billion, firmly maintaining the leading position. Commenting on this, Binance CEO CZ stated: “This isn’t competition with other ecosystems – it’s just the beginning.”

Analysis:

PancakeSwap’s achievement in securing the top spot for trading volume highlights its strong competitiveness in the decentralized exchange (DEX) market. Both daily and weekly trading data reflect high user trust and active participation in the platform.

CZ’s comments may suggest that PancakeSwap still has significant room for growth and market potential. This statement might indicate that PancakeSwap will continue expanding its ecosystem, launching more innovative features or collaborative projects. Looking at market trends, while competition in the DEX space is intensifying, PancakeSwap’s outstanding performance suggests it’s well-positioned to play an increasingly important role in the future decentralized finance (DeFi) market.

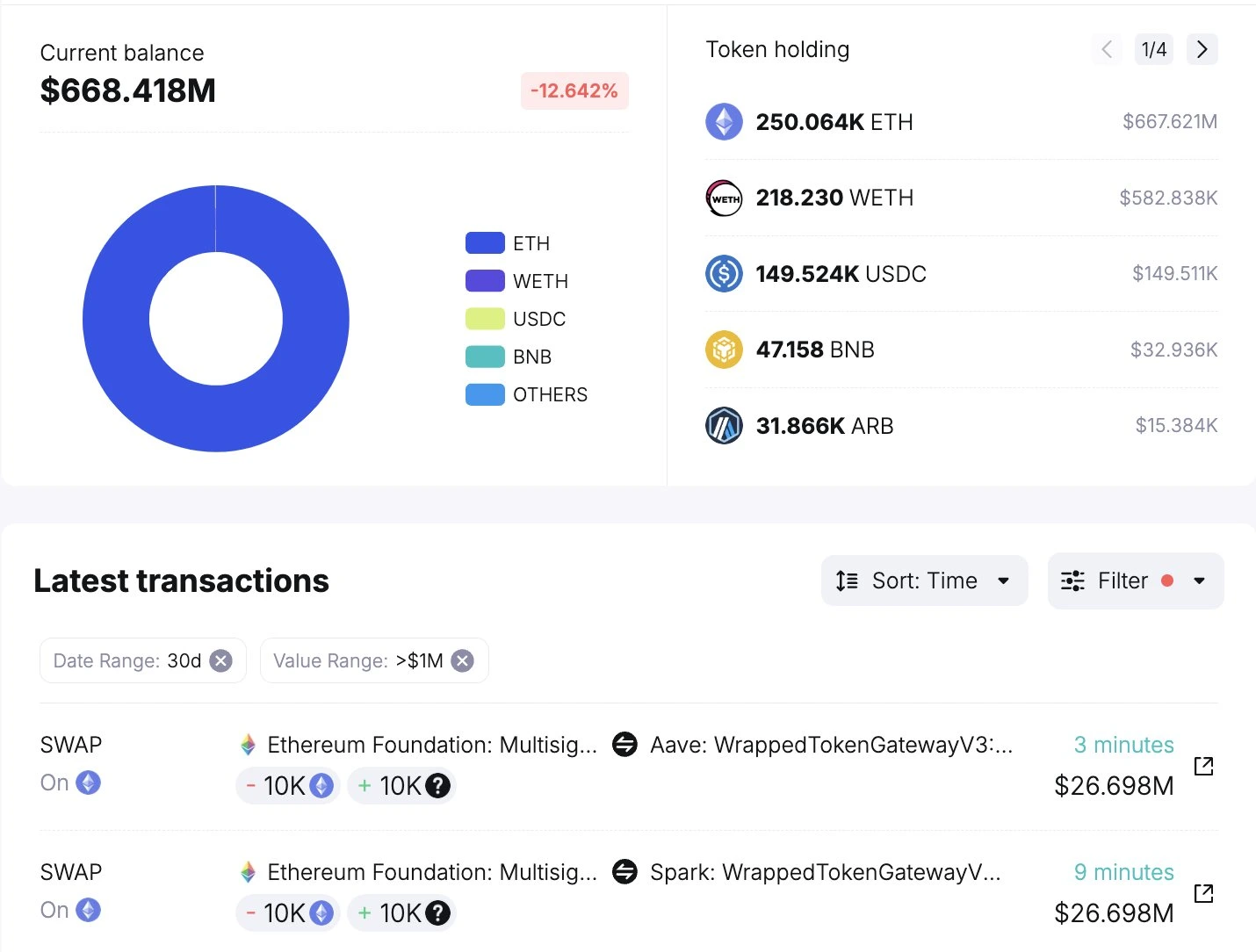

ETHEREUM FOUNDATION MAKES LARGE DEPOSITS: TRANSFERS 10,000 ETH EACH TO SPARK AND AAVE

According to Spot On Chain monitoring, the Ethereum Foundation recently deposited 10,000 ETH each into two major lending protocols – Spark (formerly under Maker) and Aave. Each deposit is worth approximately $26.7 million.

Source: Spotonchain

Analysis:

These substantial deposits not only demonstrate the Ethereum Foundation’s support for the decentralized finance (DeFi) ecosystem but may also indicate their confidence in and strategic positioning within the lending market.

As a key player in the Ethereum ecosystem, the Foundation’s move has drawn significant market attention. The deposited ETH could be used to enhance liquidity on both Spark and Aave platforms, further driving DeFi ecosystem development. This action might also potentially impact ETH’s market liquidity and price trends.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!