KEYTAKEAWAYS

- ENS Project NFT Holders Reach 1,059,951

- Total Value Locked In DeFi Reaches $1,181B With Minor Daily Fluctuation

- Funding Rates On Major CEXs And DEXs Indicate Widespread Market Bearish Sentiment

CONTENT

Welcome to CoinRank Daily Data Report. ENS Project NFT Holders Reach 1,059,951. Total Value Locked In DeFi Reaches $1,181B With Minor Daily Fluctuation.Funding Rates On Major CEXs And DEXs Indicate Widespread Market Bearish Sentiment.

ENS PROJECT NFT HOLDERS REACH 1,059,951

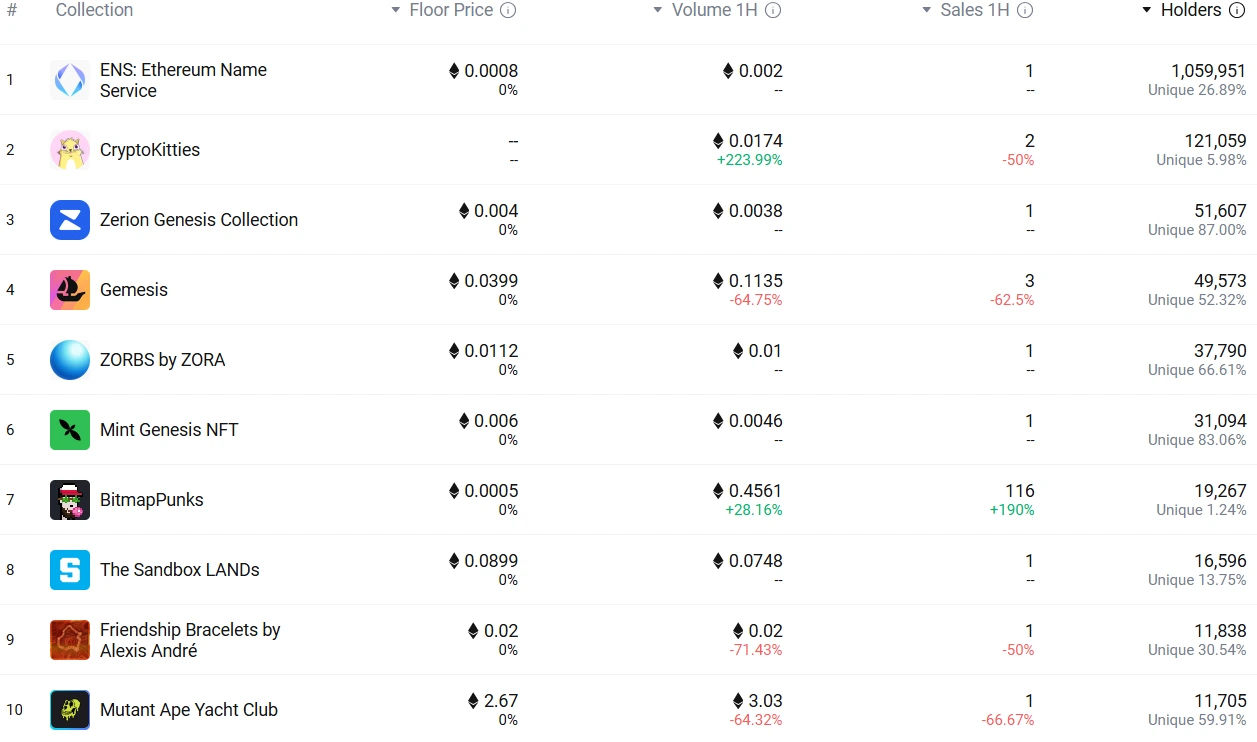

On January 10th, ENS (Ethereum Name Service) project NFT holders reached 1,059,951, while CryptoKitties project NFT holders reached 121,509. The most popular BitmapPunks has 19,267 holders. The NFT with the highest 24H trading volume is Pudgy Penguins, reaching $12,085.

Source: NFTGO

Analysis:

Only 2 projects have over 200,000 NFT holders: ENS and CryptoKitties. Ranked third, Rabby Desktop Genesis has only 51,607 holders. Only 28 projects have more than 5,000 NFT holders, indicating that expanding the holder base remains a significant challenge for NFT projects.

TOTAL VALUE LOCKED IN DEFI REACHES $1,181B WITH MINOR DAILY FLUCTUATION

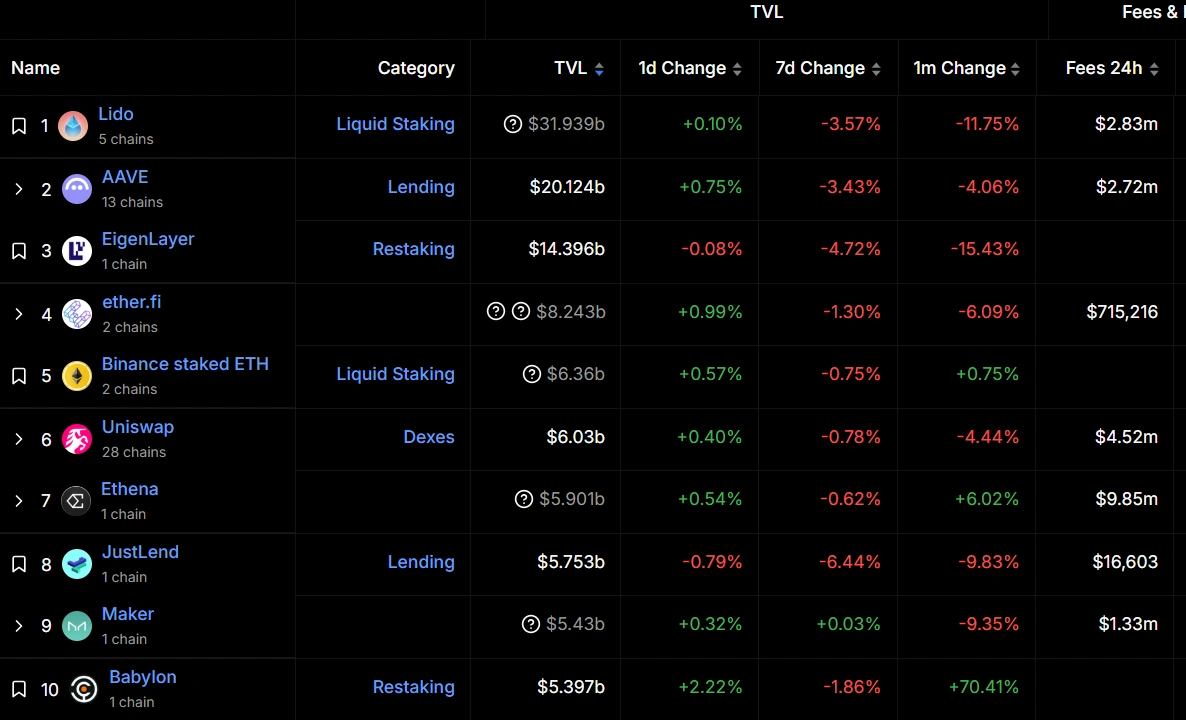

On January 10th, the total value locked in DeFi stands at $1,181B. Lido’s TVL is $31.93B, AAVE’s TVL is $20.14B, and UniSwap’s TVL is $6.03B.

Source: DefiLlama

Analysis:

DeFi projects’ TVL has stopped its significant decline and stabilized at a reasonable level, expressing users’ market optimism. Among the top 10 DeFi projects by TVL, Babylon showed the largest daily fluctuation with a 2.22% increase. Other DApp projects’ TVL daily changes were less than 1%.

FUNDING RATES ON MAJOR CEXS AND DEXS INDICATE WIDESPREAD MARKET BEARISH SENTIMENT

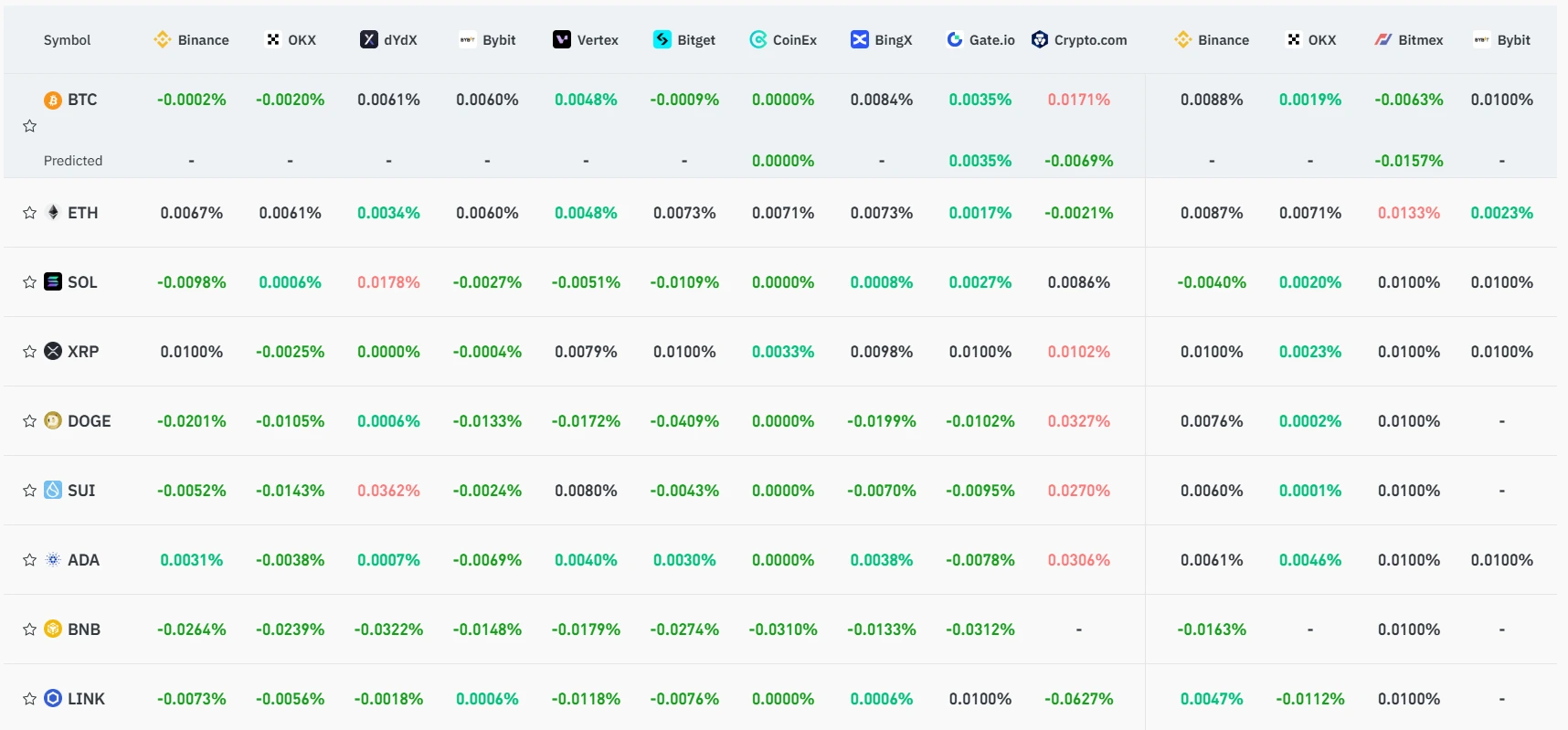

According to Coinglass data, as Bitcoin continues to test lower levels recently, current funding rates on major CEXs and DEXs indicate widespread market bearish sentiment. The specific funding rates for mainstream cryptocurrencies are shown in the figure below.

Source: Coinglass

Analysis:

When the funding rate is 0.01%, it indicates the benchmark rate. When the funding rate is greater than 0.01%, it represents a generally bullish market sentiment. When the funding rate is less than 0.005%, it represents a generally bearish market sentiment.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!