KEYTAKEAWAYS

- Total Value Locked (TVL) in DeFi reaches $123.54 billion

- NFT Daily Trading Volume Reaches $20.6M

- Raydium's Daily UAW Grows by 14.83%

CONTENT

Welcome to CoinRank Daily Data Report. Total Value Locked (TVL) in DeFi reaches $123.54 billion. NFT Daily Trading Volume Reaches $20.6M. Raydium’s Daily UAW Grows by 14.83%.

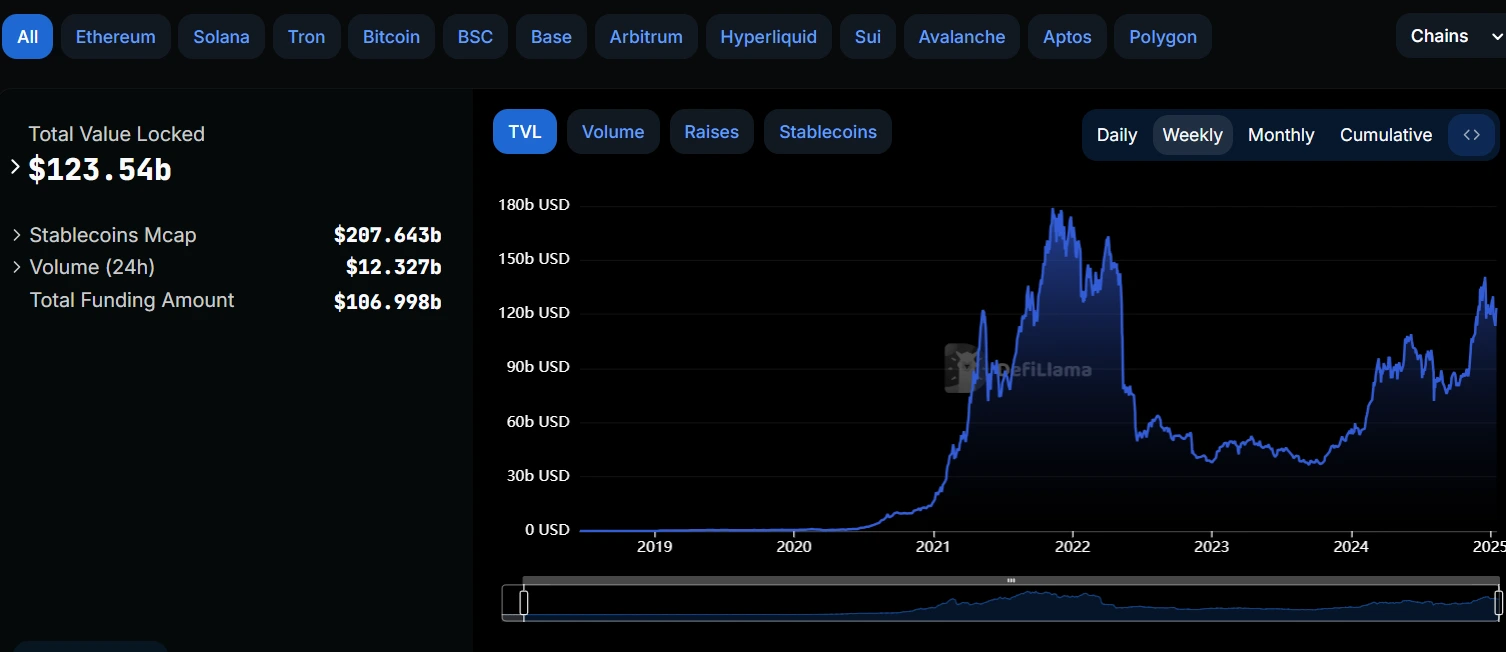

TOTAL VALUE LOCKED (TVL) IN DEFI REACHES $123.54 BILLION

On January 16th, the Total Value Locked in DeFi adjusted to $123.54 billion. All of the top 10 protocols by TVL experienced increases today. Specifically, Lido’s TVL increased by 4.36%, AAVE’s TVL rose by 2.91%, and EigenLayer’s TVL grew by 4.31%. The leading DEX UniSwap saw its TVL increase by 4.51%. JustLend showed the highest growth with a 5.2% increase in TVL today.

Source: DefiLlama

Analysis:

The data shows that all top 10 protocols by TVL achieved growth, demonstrating a positive overall recovery trend. As the leader in liquid staking, Lido’s 4.36% daily increase reflects continued user interest in Ethereum staking yields, while AAVE’s growth, as a leading lending protocol, is crucial for consolidating its market position.

Notably, EigenLayer’s 4.31% increase indicates that emerging modular staking protocols are gaining more user attention. As a representative of decentralized exchanges (DEX), UniSwap’s 4.51% increase highlights its central role in the recovery of on-chain trading demand.

Overall, this round of growth reflects the market’s long-term optimism towards the DeFi sector, indicating the resilience of its core ecosystem while creating favorable conditions for further innovation and capital inflow.

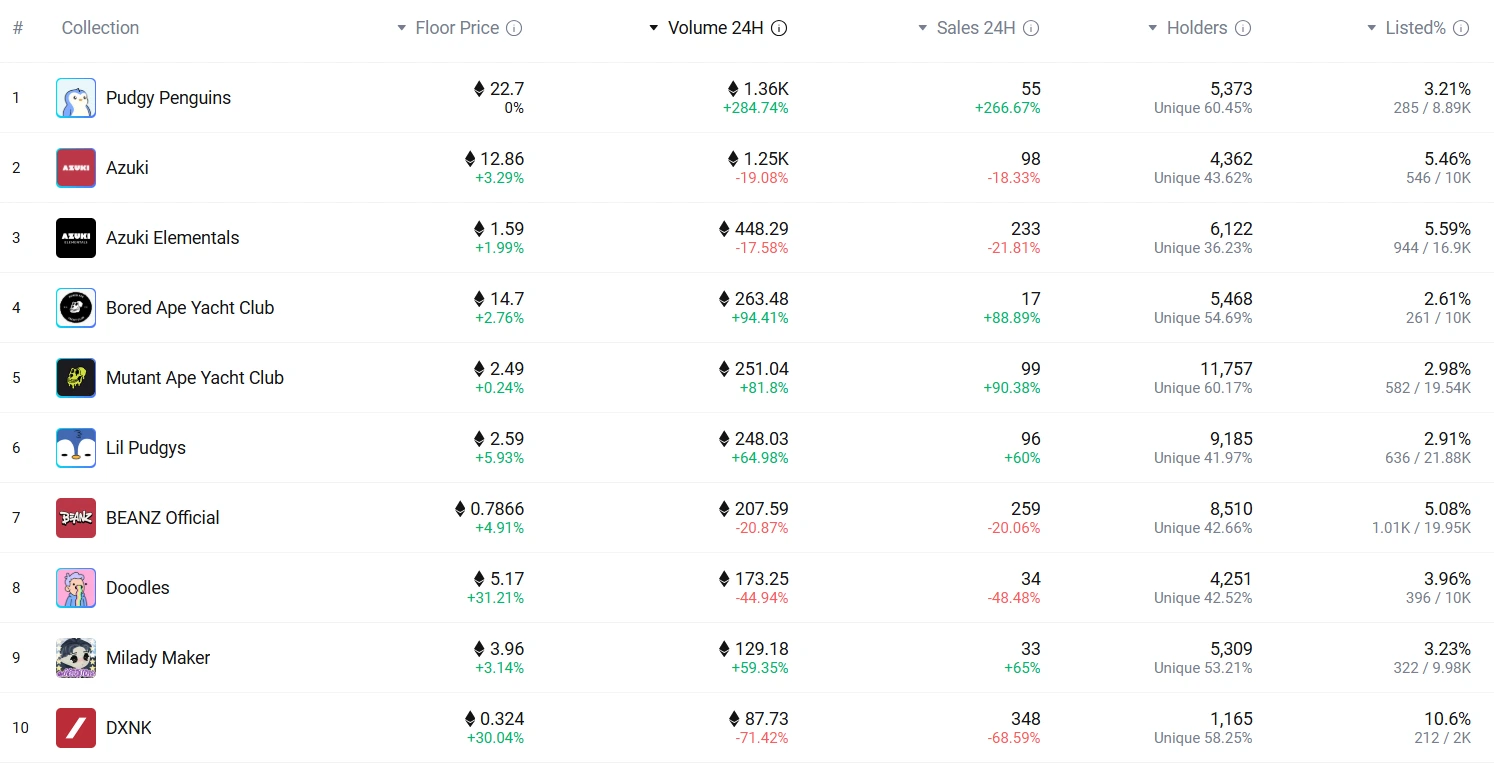

NFT DAILY TRADING VOLUME REACHES $20.6M

According to NFTGO data, NFT daily trading volume has reached $20.6M. Pudgy Penguins recorded the highest daily trading volume among NFTs, with 24-hour transactions reaching 1,362 ETH, approximately $4,576,309. Azuki ranked second with daily transactions of 1,253 ETH, approximately $4,207,492. Additionally, Bored Ape Yacht Club’s daily trading volume increased by 94.41%.

Source: NFTGO

Analysis:

The daily trading volume of $20.6 million indicates that the NFT market is experiencing a surge in trading activity. Pudgy Penguins’ leading position in trading volume demonstrates the collection’s strong community influence and market liquidity. Azuki follows closely behind, continuing to solidify its position in the premium NFT market. Meanwhile, Bored Ape Yacht Club (BAYC)’s 94.41% increase in trading volume reflects renewed investment enthusiasm for blue-chip NFTs. This growth may be related to increased demand for scarce assets and recent market confidence recovery.

It’s clear that the increased activity in the NFT market reflects sustained investor interest in digital art and virtual assets. However, market volatility remains high, and investors should be cautious of short-term market sentiment changes while focusing on the long-term value and community ecosystem development of NFT projects.

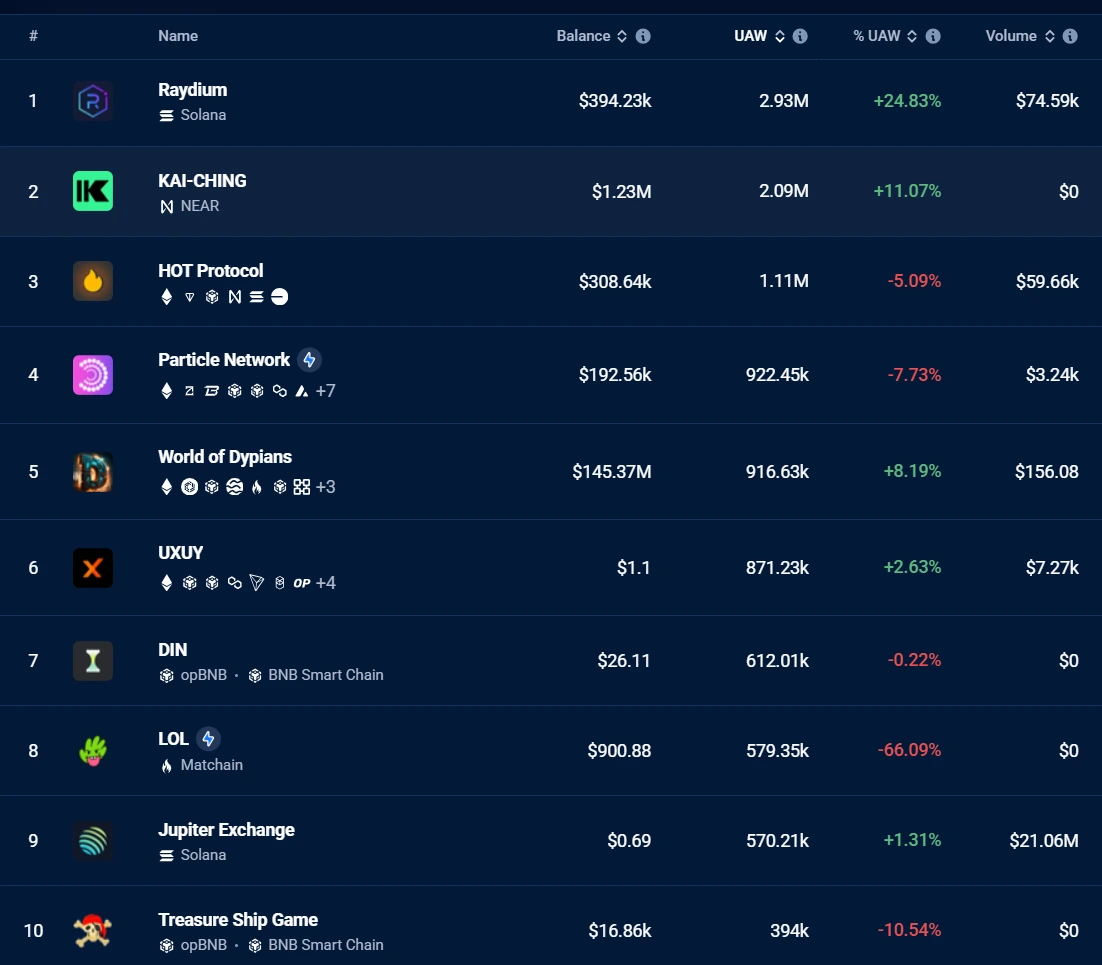

RAYDIUM’S DAILY UAW GROWS BY 14.83%

According to DappRadar platform data, Raydium’s UAW (Unique Active Wallets) increased by 14.83% daily, reaching 2.93M. KAI-CHING’s UAW grew by 11.07%, reaching 2.09M.

Source: DappRadar

Analysis:

According to DappRadar data, both Raydium and KAI-CHING have daily active users (UAW) exceeding 2 million, reflecting their strong performance in the blockchain application space. Raydium, being a core AMM (Automated Market Maker) and liquidity provision platform in the Solana ecosystem, likely saw growth due to the recent recovery of the Solana network ecosystem and increased user demand for efficient, low-cost transactions. The growth in KAI-CHING’s UAW may be related to the platform’s GameFi (Game Finance) features or other innovative services.

Both Solana and NEAR are public chains that have shown strong ecosystem development in recent years. For investors and developers, monitoring the ecosystem dynamics of these high-growth public chains could be an important direction for discovering potential projects.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!