KEYTAKEAWAYS

- DEX Trading Volume Grows 174.09% Weekly

- DAPP UAW Numbers: BNB Chain, NEAR, Solana Lead the Pack

- Crypto Futures Open Interest Reaches $149.24B

- BTC Futures Lead at $69.06B

CONTENT

Welcome to CoinRank Daily Data Report. DEX Trading Volume Grows 174.09% Weekly. DAPP UAW Numbers: BNB Chain, NEAR, Solana Lead the Pack. Crypto Futures Open Interest Reaches $149.24B. BTC Futures Lead at $69.06B.

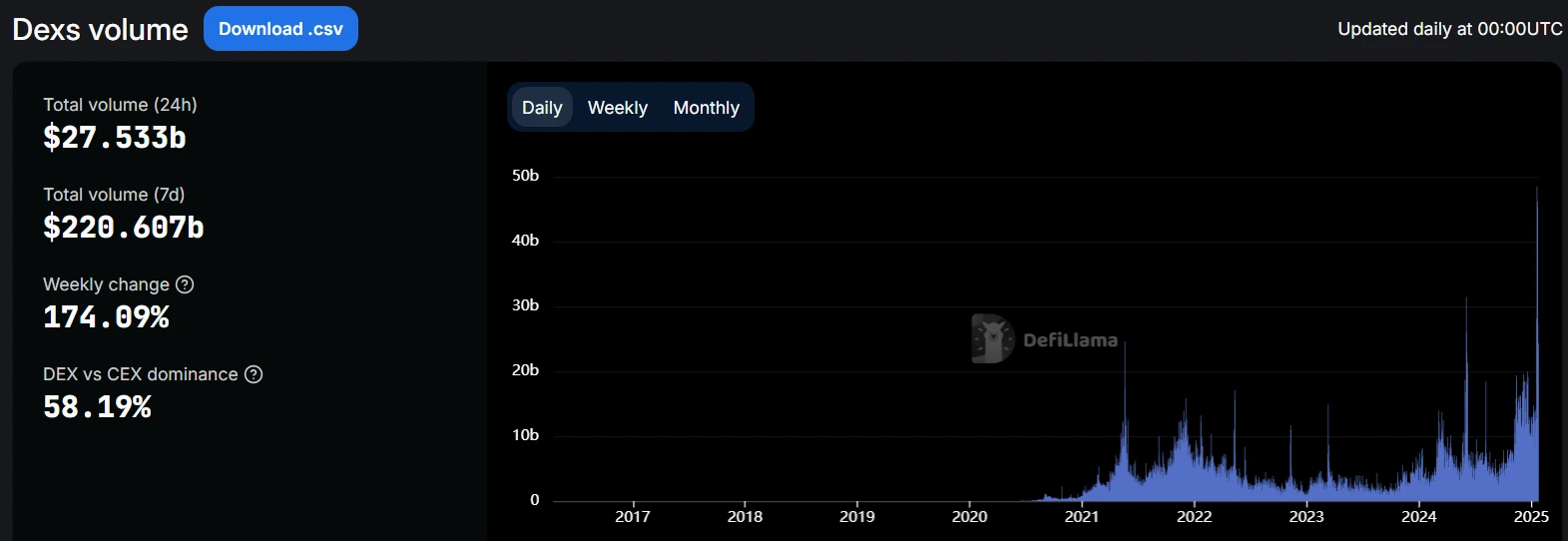

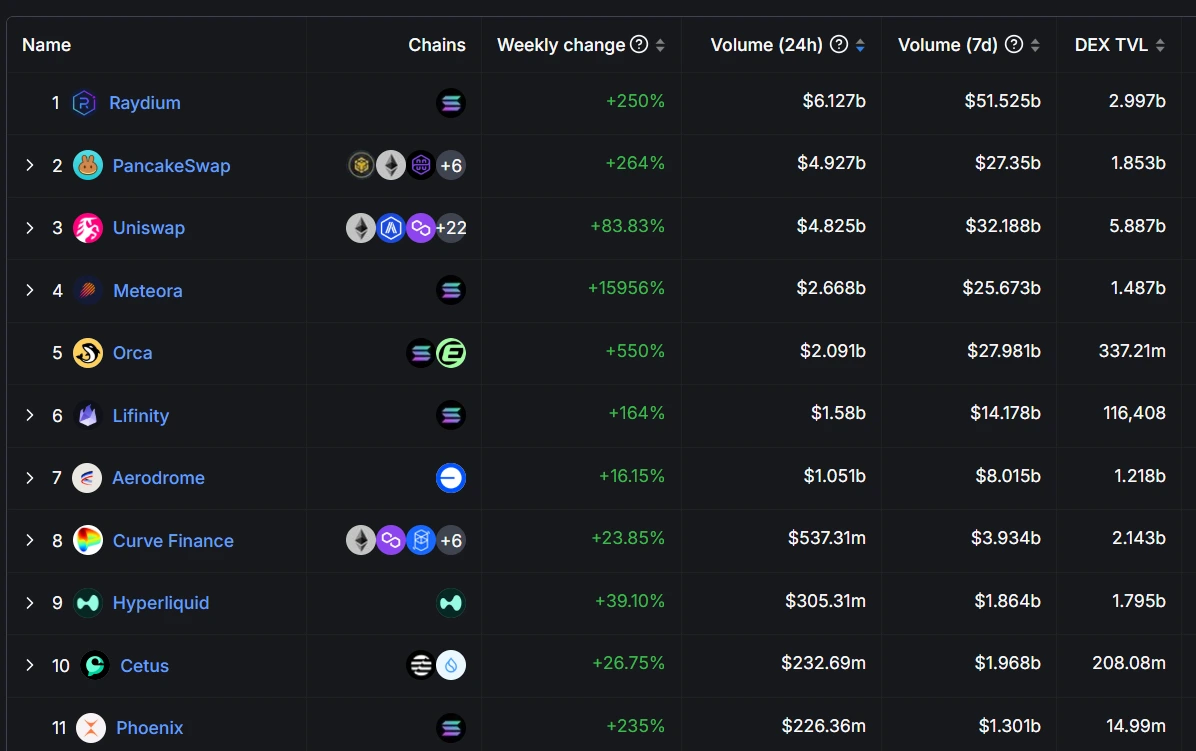

DEX TRADING VOLUME GROWS 174.09% WEEKLY

According to DefiLlama, on January 22, DEX daily trading volume reached $27.533B, with 7-day volume at $220.607B, representing 174.09% weekly growth. Raydium increased 250% to $6.127B; PancakeSwap up 264% to $4.927B; Uniswap grew 83.83% to $4.825B. All top 10 DEXs saw volume breakthroughs, with Meteora, Orca, Lifinity, and Aerodrome experiencing significant weekly gains.

Source: DefiLlama

Analysis:

The 174.09% surge in DEX weekly volume demonstrates DeFi ecosystem strength. Market recovery has driven growth led by PancakeSwap, Raydium, and Uniswap. This reflects rising on-chain trading demand and appeal of enhanced liquidity and asset diversification. For TVL, Uniswap leads at $5.887B.

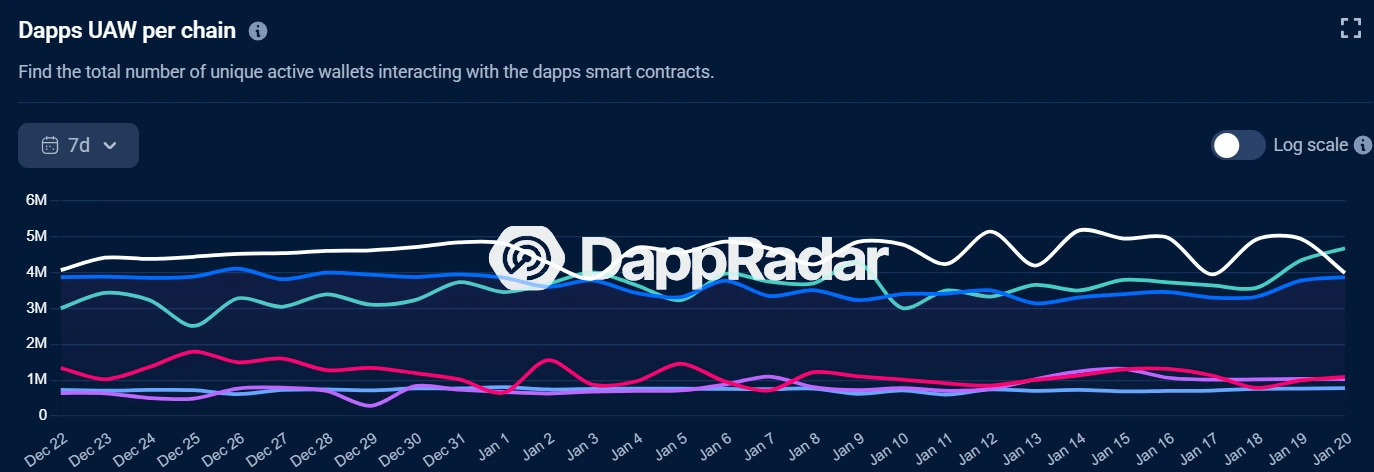

DAPP UAW NUMBERS: BNB CHAIN, NEAR, SOLANA LEAD THE PACK

DappRadar data shows on January 22, BNB Chain, NEAR, and Solana lead in DAPP unique active wallets (UAW), each exceeding 3.8M. Solana leads with 4.67M UAW, followed by BNB Chain at 3.98M and NEAR at 3.87M. Matchain, Aptos, and SKALE also show strong activity, demonstrating multi-chain ecosystem growth.

Source: DappRadar

Analysis:

DApp ecosystem accelerates with BNB Chain, NEAR, and Solana firmly in top positions, each exceeding 380M UAW. Their significant lead over emerging chains like Matchain, Aptos, and SKALE demonstrates ecosystem strength and user appeal. This dominance reinforces their core position in Web3 amid intensifying multi-chain competition.

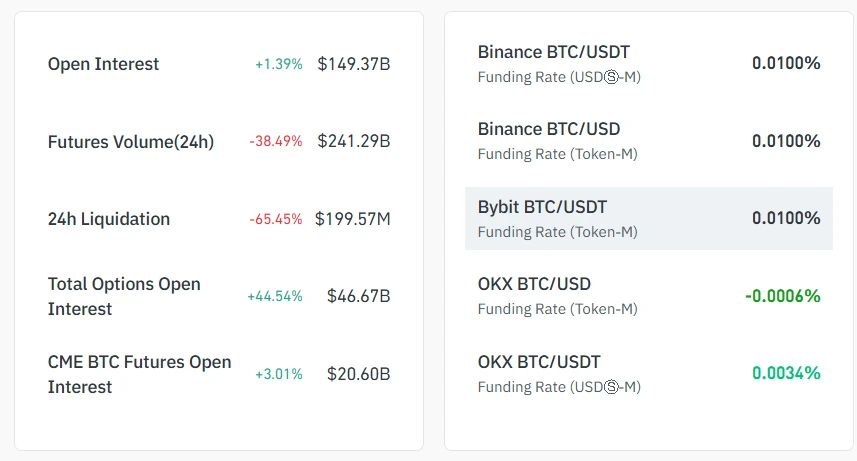

CRYPTO FUTURES OPEN INTEREST HITS $149.24B

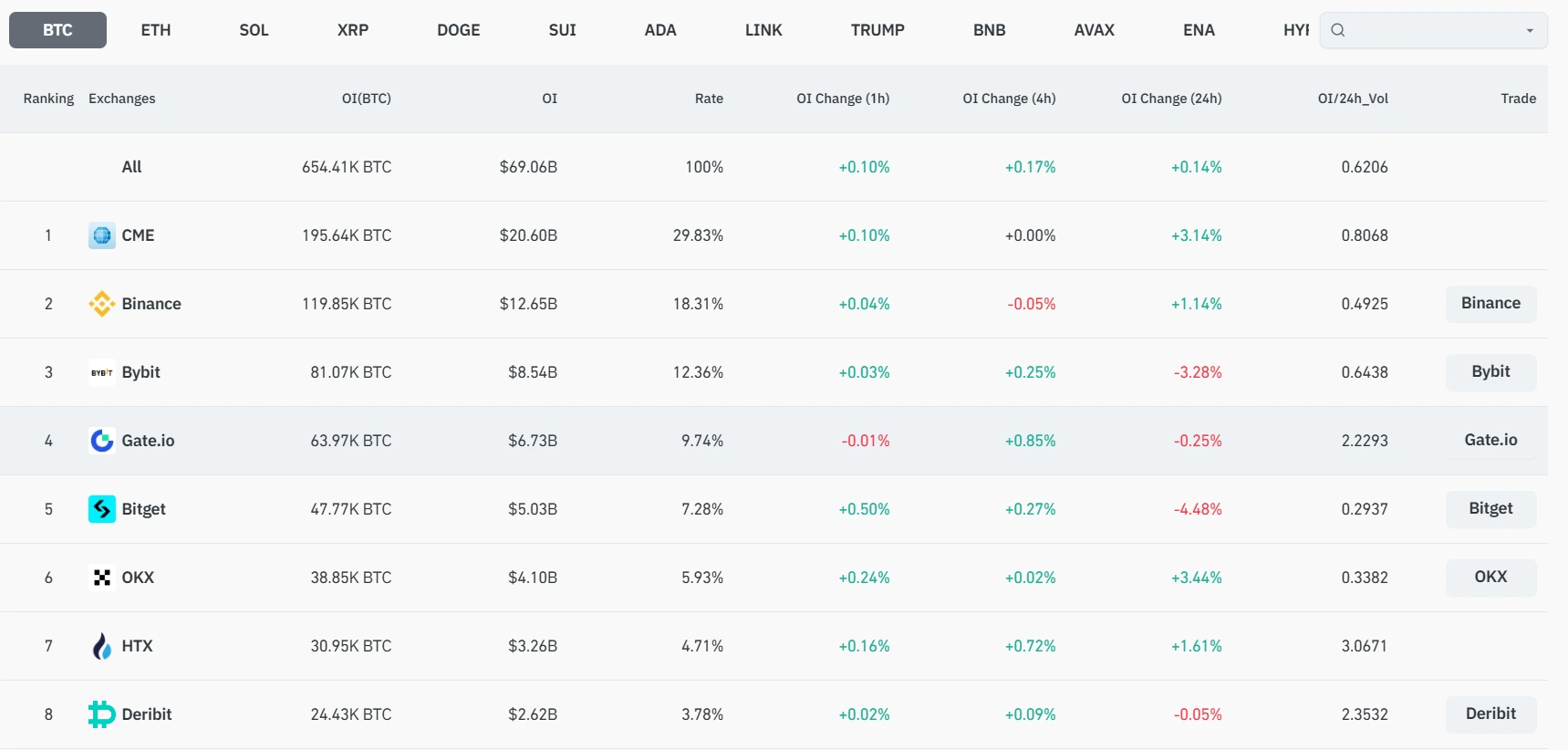

According to Coinglass data, crypto futures open interest reached $149.24B on January 22, up 1.3% daily. The 24-hour contract trading volume was $241.27B, down 38.50%. BTC futures open interest stood at $69.06B, with CME platform accounting for 29.83% ($20.6B), Binance at 18.31% ($12.65B), and Bybit at 12.36% ($8.54B).

Source: Coinglass

Analysis:

The $149.24B open interest demonstrates strong capital inflow momentum despite a 38.5% drop in daily trading volume. BTC futures lead at $69.06B, with CME’s 30% share firmly in first place, reflecting traditional financial institutions’ dominance in the Bitcoin derivatives market. Despite short-term volume pullback, growing open interest shows investors’ long-term market confidence, while increased institutional participation brings stability and momentum.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!