KEYTAKEAWAYS

- January Solana DEX Volume Exceeds Ethereum by 268%

- zkSync Era Chain Records $1.05M Net Bridge Inflows Today

- Ethereum Spot ETF Records Six Consecutive Days of Net Inflows

CONTENT

Welcome to CoinRank Daily Data Report. January Solana DEX Volume Exceeds Ethereum by 268%. zkSync Era Chain Records $1.05M Net Bridge Inflows Today. Ethereum Spot ETF Records Six Consecutive Days of Net Inflows.

JANUARY SOLANA DEX VOLUME EXCEEDS ETHEREUM BY 268%

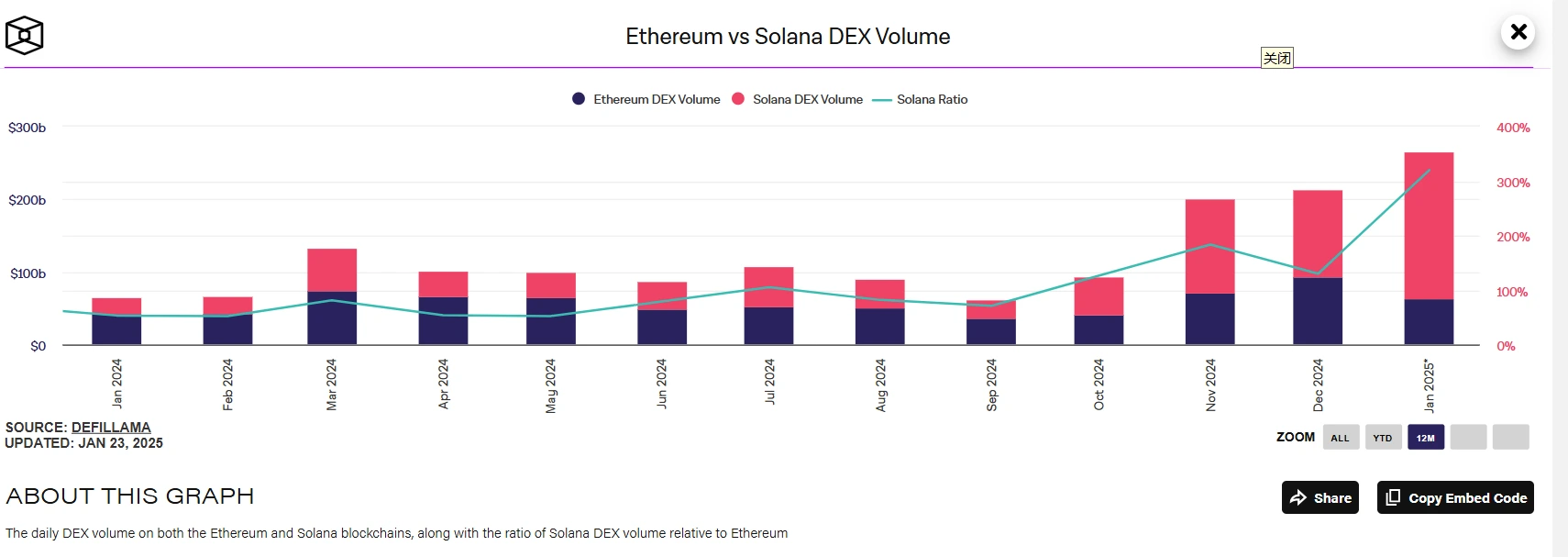

According to The Block’s data, the Original Trump (TRUMP) token surge drove Solana decentralized exchange (DEX) usage.

In January, Solana DEX volume reached an unprecedented 268% compared to Ethereum, up from 53% last year. Solana processed $122B in transactions versus Ethereum’s $45B. Raydium led the Solana ecosystem with $32B weekly volume, followed by Orca at $17B. In comparison, Ethereum’s Uniswap processed $20B during the same period.

Source: TheBlock

Analysis:

Solana’s DEX volume demonstrates its rise as a high-performance blockchain. Success stems from TRUMP momentum and strong performance from Raydium and Orca. This achievement reflects Solana’s improvements in network stability, transaction efficiency, and user experience. Jupiter aggregator integration and increased institutional support provided additional momentum. Compared to Ethereum, Solana gained user preference through lower costs and higher throughput.

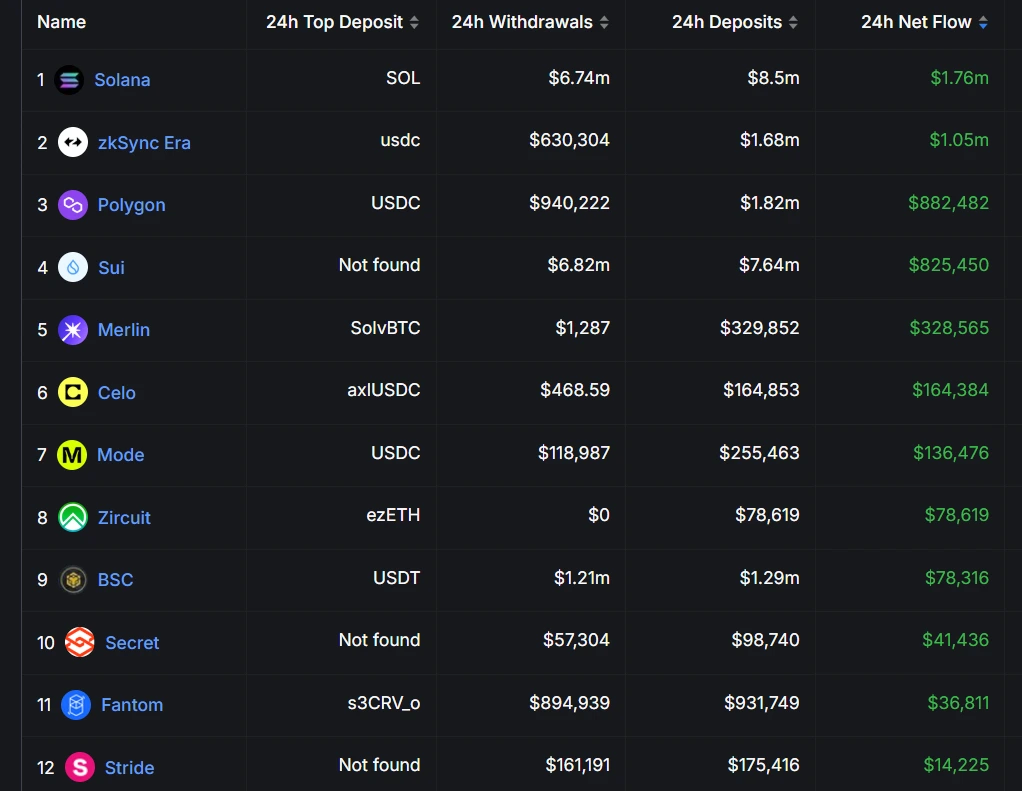

ZKSYNC ERA CHAIN RECORDS $1.05M NET BRIDGE INFLOWS TODAY

January 23rd Bridge Inflows by Chain data: On zkSync Era’s cross-chain bridge, users withdrew $630,304 and deposited $1.68M, resulting in a net inflow of $1.05M. This figure ranks second only to Solana, which saw $8.5M in net bridge inflows. Polygon chain ranked third with net bridge inflows of $882,482. Through bridges, Arbitrum saw outflows of $27.58M, Avalanche $4.6M, while Ethereum had net outflows of $3.5M.

On cross-chain bridges, the stablecoin USDC is particularly popular. It tops 24h deposits across multiple chains including zkSync Era, Avalanche, Optimism, Cronos, and Mode.

Source: DefiLlama

Analysis:

Today, zkSync Era showed outstanding net inflows on bridges, while Solana’s chain, recently hot due to MEME tokens, demonstrates its ecosystem vitality and users’ high confidence in bridge assets. This growth trend indicates zkSync Era’s increasing competitiveness in the Layer 2 space. In contrast, large-scale outflows from chains like Arbitrum and Avalanche may relate to shifting user demands or portfolio strategy adjustments. Notably, USDC’s role as the primary bridge asset reaffirms stablecoins’ central position in cross-chain transactions. As Layer 2 solutions and bridge technologies continue to optimize, the pattern of capital flows may continue to reshape, with zkSync Era potentially taking a more significant position in the bridge market.

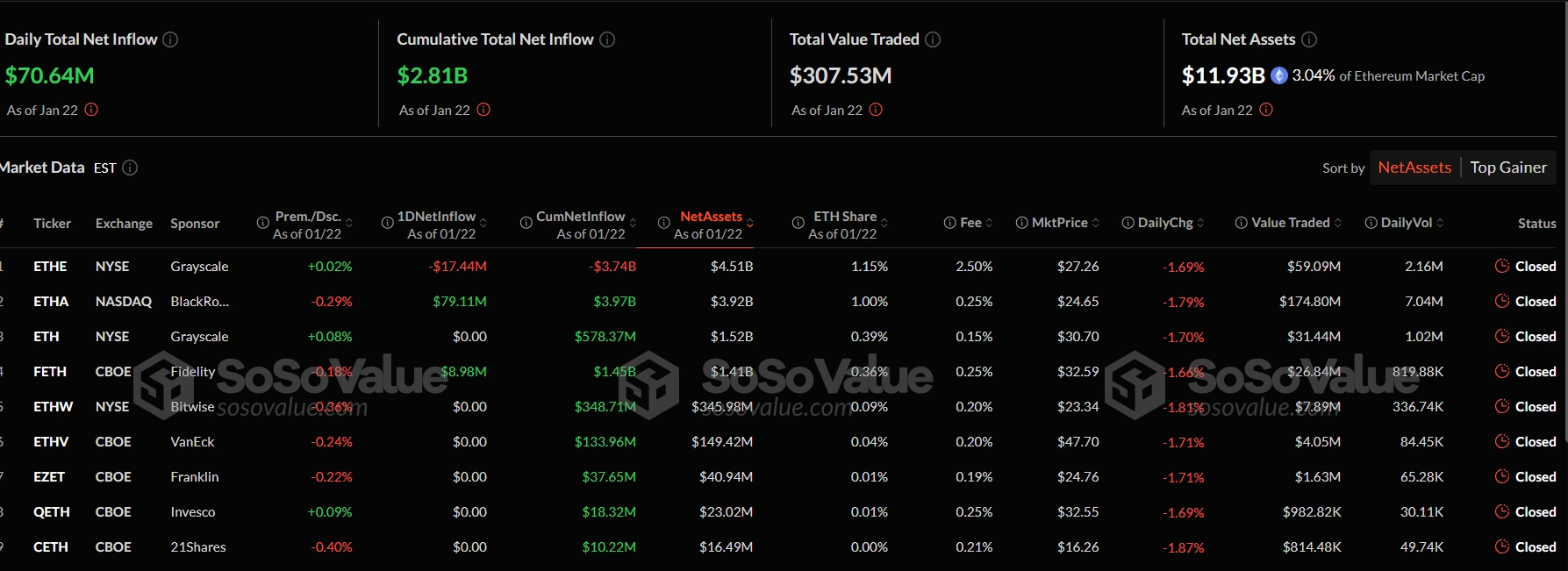

ETHEREUM SPOT ETF RECORDS SIX CONSECUTIVE DAYS OF NET INFLOWS

According to SoSoValue data, Ethereum spot ETFs saw total net inflows of $70.64M yesterday, marking six straight days of net inflows. Currently, total Ethereum spot ETF assets stand at $11.932B, with ETF net asset ratio (market cap to total Ethereum market cap) reaching 3.04%. Historical cumulative net inflows have reached $2.81B.

Yesterday, Grayscale’s Ethereum Trust ETF (ETHE) recorded net outflows of $17.44M, bringing its historical net outflows to $3.74B. Grayscale’s Ethereum Mini Trust ETF (ETH) saw no net outflows, maintaining historical total net inflows of $578M. BlackRock’s ETF (ETHA) led daily net inflows at $79.11M, reaching historical total net inflows of $3.969B. Fidelity’s ETF (FETH) followed with daily net inflows of $8.98M, bringing its historical total net inflows to $1.453B.

Source: SoSoValue

Analysis:

Sustained net inflows into Ethereum spot ETFs demonstrate institutional investors’ continued confidence in the Ethereum market. While BlackRock and Fidelity’s ETF products show strong performance, Grayscale’s ongoing outflows reflect market share redistribution. The 3.04% ETF net asset ratio marks a significant milestone, indicating increasing institutional allocation to Ethereum. This capital flow trend not only benefits Ethereum’s price stability but also brings more institutionalized, standardized investment demand to the crypto asset market, driving the industry toward greater maturity.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!