KEYTAKEAWAYS

- Stablecoin Total Market Cap Continues to Hit All-Time Highs, Up 2.98% in Past Week

- U.S. Spot Bitcoin ETF On-Chain Holdings Exceed 1.18 Million BTC

- Small Bitcoin Holders Absorbed Nearly Double the New BTC Supply Last Month

CONTENT

Welcome to CoinRank Daily Data Report. Stablecoin Total Market Cap Continues to Hit All-Time Highs, Up 2.98% in Past Week. U.S. Spot Bitcoin ETF On-Chain Holdings Exceed 1.18 Million BTC. Small Bitcoin Holders Absorbed Nearly Double the New BTC Supply Last Month.

STABLECOIN TOTAL MARKET CAP CONTINUES TO HIT ALL-TIME HIGHS, UP 2.98% IN PAST WEEK

According to DefiLlama data, the total market capitalization of stablecoins across all networks has exceeded $215 billion, currently at $215.583 billion, continuing to set new historical highs with a 2.98% increase over the past week. Among these,USDC‘s market cap increased by 9.67% over the past week, now at $52.119 billion.

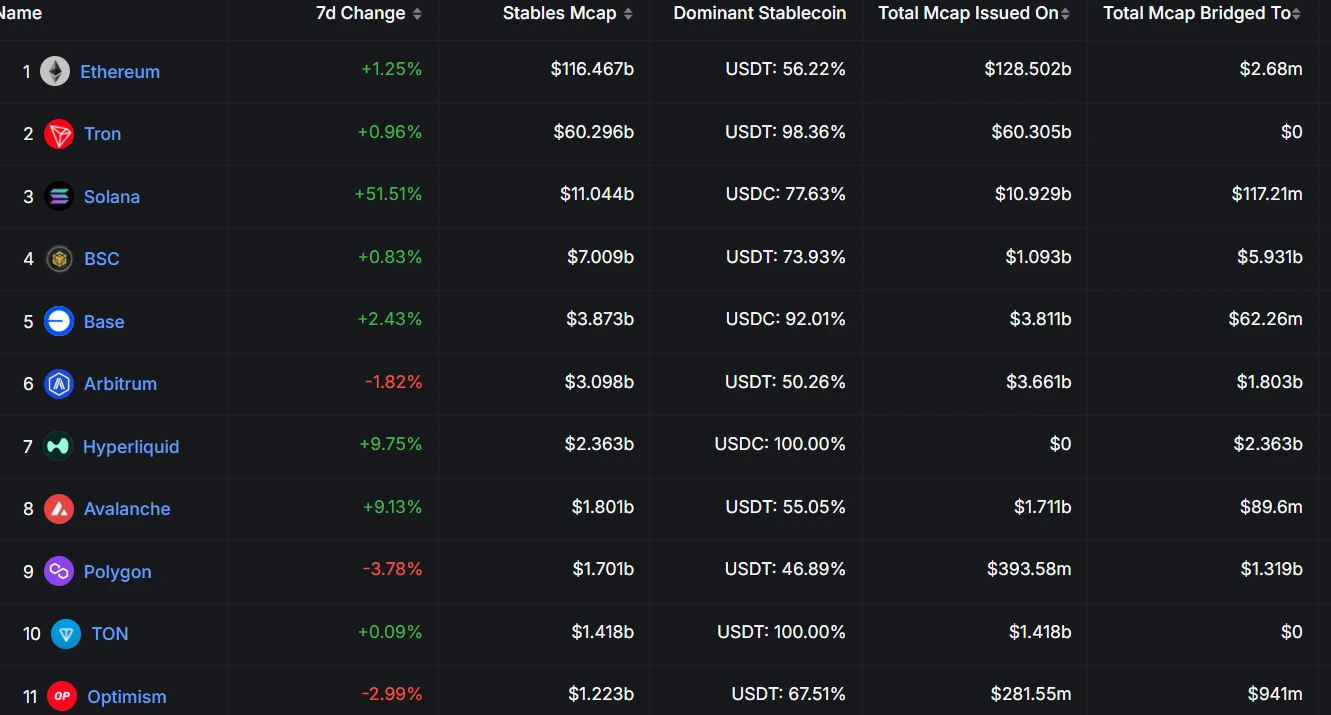

Looking at stablecoin data across different blockchains:

- Solana’s stablecoin market grew 51.51% weekly, reaching $11.04 billion, with market share rising to 5.12%

- Ethereum hosts $116.467 billion in stablecoins, representing 54% of the total

- TRON has $60.296 billion in stablecoins, accounting for 27.96%

- The emerging TON blockchain has $1.418 billion in stablecoins, ranking 10th

Source: DefiLlama

Analysis:

The stablecoin market is showing strong performance, with total market cap continuing to set new highs, reflecting sustained market demand for liquidity and safe-haven assets. USDC’s market cap growth of over 9% demonstrates increased trust in its transparency and regulatory compliance. Benefiting from the rising popularity of meme coins, Solana’s stablecoin market cap surged dramatically, with market share rising to 5.12%, highlighting its advantages in low-cost, high-performance networking. While Ethereum maintains its leading position with over 50% of stablecoin market share, the rapid growth of other chains like Base and TON indicates an emerging multi-chain landscape with diversifying capital flows. Looking ahead, as new blockchain ecosystems develop and DeFi continues to expand, stablecoin demand may further increase, potentially leading to a more distributed market structure.

U.S. SPOT BITCOIN ETF ON-CHAIN HOLDINGS EXCEED 1.18 MILLION BTC

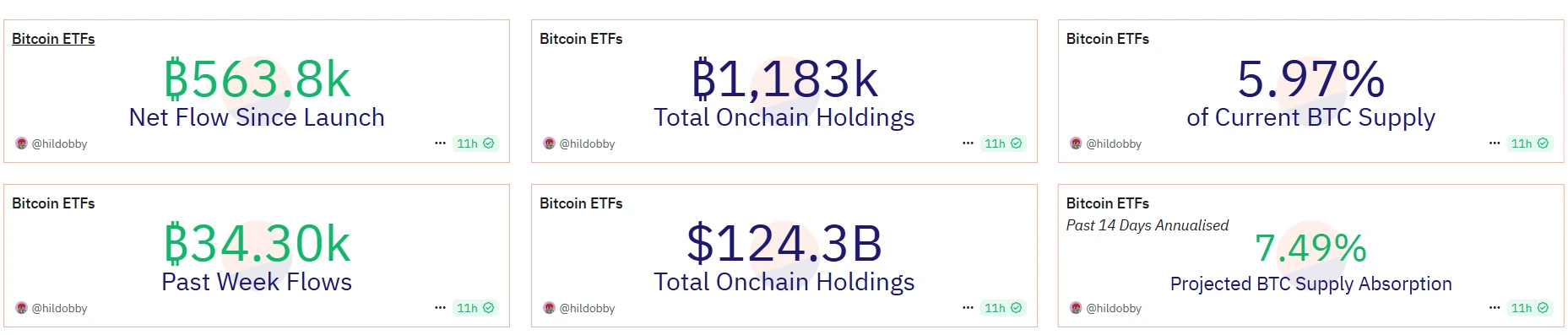

According to Dune data, total on-chain holdings of U.S. spot Bitcoin ETFs have surpassed 1.18 million BTC, reaching approximately 1.183 million BTC, representing 5.97% of current BTC supply, with holdings valued at about $124.3 billion.

Source: Dune

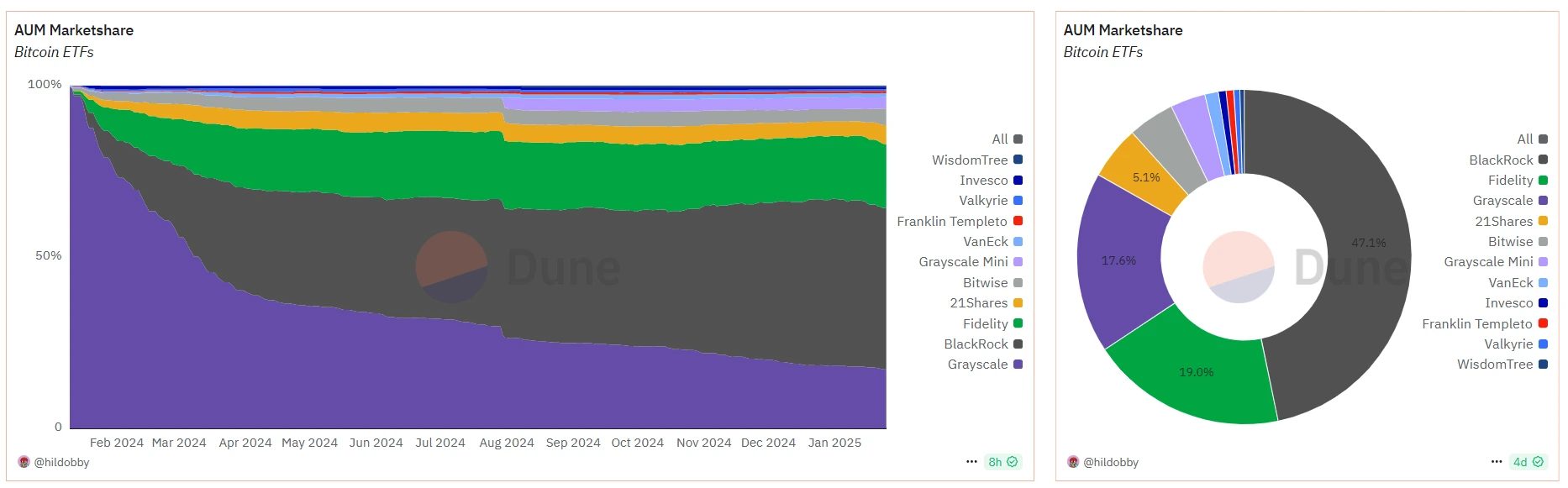

In terms of Bitcoin ETF assets under management (AUM), BlackRock, Fidelity, and Grayscale lead the top 3. BlackRock ranks first with $57.4B AUM, accounting for 47.1%. Fidelity ranks second with $23.1B AUM (19%), and Grayscale ranks third with $21.4B AUM (17.6%). 21Shares, Bitwise, Grayscale Mini, VanEck, Invesco, and others continue to see growing AUM.

Source: Dune

Analysis:

The 1.18 million BTC holdings (nearly 6%) in spot ETFs indicate growing institutional demand for long-term Bitcoin allocation. The top three managers – BlackRock, Fidelity, and Grayscale – control over 83.7% of holdings, demonstrating major players’ market dominance. This reflects large financial institutions’ deepening involvement and strengthens confidence in crypto asset legitimization. Growing AUM of emerging providers like 21Shares and Bitwise suggests expanding competition. As regulatory frameworks improve and institutional participation accelerates, the Bitcoin ETF market may see faster growth, further advancing Bitcoin’s mainstream adoption and value appreciation.

SMALL BITCOIN HOLDERS ABSORBED NEARLY DOUBLE THE NEW BTC SUPPLY LAST MONTH

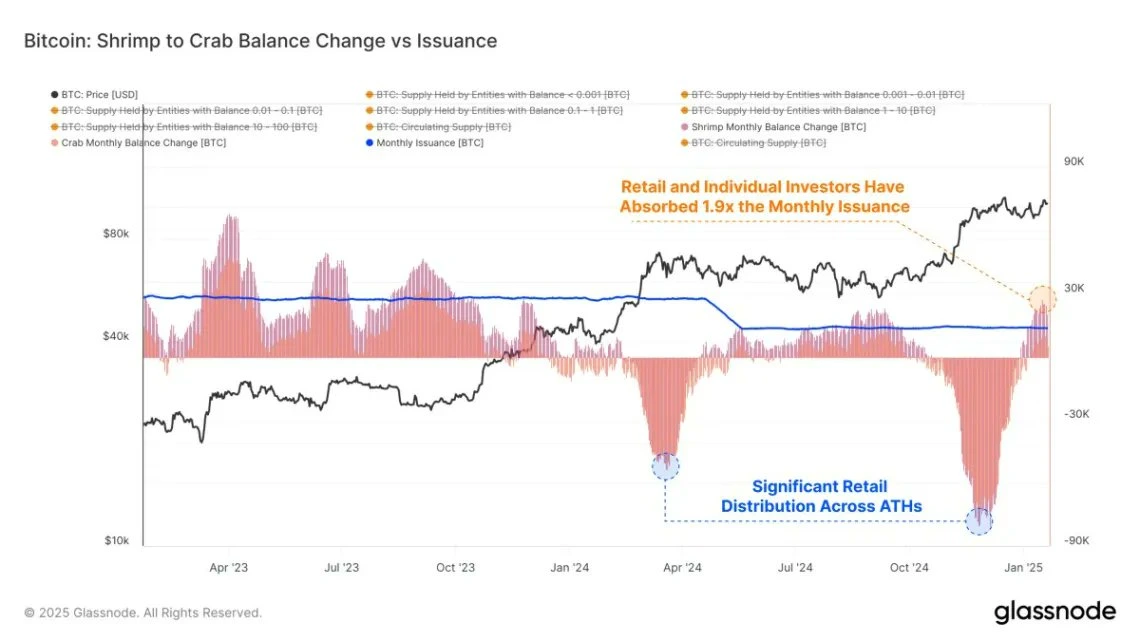

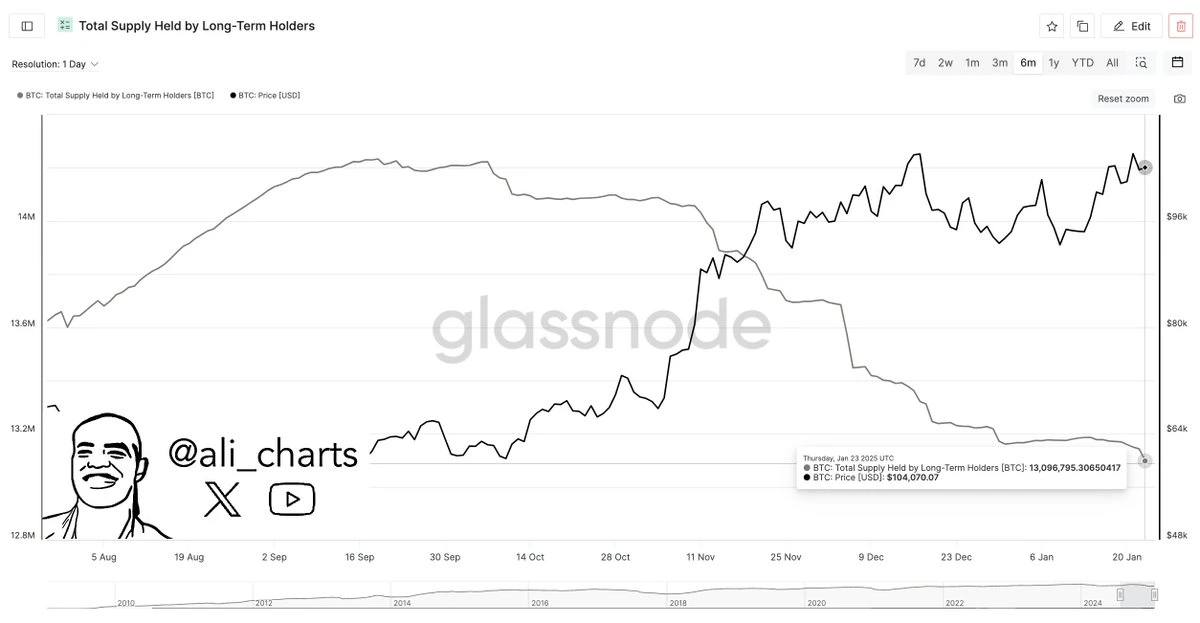

Per Glassnode data, retail demand remains strong with Bitcoin near $100,000. Holders of 1-10 BTC absorbed nearly double the new supply last month, showing sustained buying from smaller investors. Long-term holders reduced positions by over 75,000 BTC in the past week.

Analysis:

Glassnode data shows strong demand from small holders driving Bitcoin market activity. Retail absorption of nearly double new supply reflects high confidence in Bitcoin’s future value. However, long-term holders sold over 75,000 BTC last week, likely due to profit-taking or short-term volatility concerns. The current “retail buying, long-term holder selling” pattern may indicate wealth transfer from strong to weak hands. Bitcoin’s ability to maintain high prices will depend on sustained retail demand and market capacity to absorb long-term holder sales.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!