KEYTAKEAWAYS

- Current market resembles 2017 mid-cycle correction phase with Bitcoin in "cheap" range per on-chain metrics; next major uptrend expected after June Fed meeting.

- Short-term strategy focuses on survival: reduce leverage, implement strict stop-losses, use grid trading during consolidation, and dollar-cost average into quality assets.

- Portfolio recommendation: 50% core assets (BTC/ETH), 40% emerging sectors (AI, DeFi 2.0, ZKP tech), 10% stablecoins to capture future dips.

CONTENT

Navigate the crypto market amid Trump’s fluctuating tariff policies and high interest rates. Analysis of current market cycle indicators, short/medium/long-term strategies, and portfolio allocation recommendations for 2025-2026.

Since US President Trump began his tariff war, the crypto market has continued to decline with fluctuations. Due to Trump’s inconsistent tariff policies, the market experienced extreme volatility this week, with over 460,000 traders liquidated on April 7 alone, affecting both long and short positions.

Just the implementation of reciprocal tariffs caused the market to violently surge and plunge three times:

- First, the market rose when initially announced, then crashed when the reciprocal tariffs on various countries exceeded expectations

- On the 7th, news of a 90-day tariff suspension triggered a surge, only to be quickly proven false, leading to another crash

- On the 9th, when the 90-day tariff suspension was actually implemented, the market surged on the news, only for Bitcoin to fall back to $78,000 just a day later

Whether you were bullish or bearish, if you didn’t time the market correctly, you faced liquidation! Meanwhile, Trump was boasting: “My friend made $2.5 billion in one day!” Is Trump working with Wall Street elites to repeatedly harvest retail investors? According to US media reports, about 3 hours before announcing the tariff suspension decision, shortly after the stock market opened, Trump posted on social media: “Now is a great time to buy! DJT.”

Trump’s Truth Social

With such challenging market conditions, these Wall Street capital giants are greedily profiting from retail investors, eating to their heart’s content!

Although this market has been somewhat damaged, the crypto sector is still in its early stages. Even though it’s being harvested by what feels like a combined harvester, it’s not yet a fully formed market of vested interests. Compared to other industries with solidified vested interests, there are still some opportunities for ordinary people! So how should we operate to respond to the current market conditions?

MACRO ASSESSMENT: WHAT STAGE IS THE MARKET IN?

At any time when making investment decisions, we must first determine which stage the overall market is in. This not only helps formulate investment strategies that align with the mainstream market development but also maintains a good mindset, viewing ups and downs more objectively, and preventing emotional fluctuations from causing ruin.

So what stage is the market currently in?

Let’s start with the conclusion: We’re in the early stage of the fourth halving cycle. The first phase of the bull market incubation period has ended, and we’re currently in a deep correction. Next comes the mid-bull market or explosion phase, but due to the deteriorating environment—tariff wars and the Fed maintaining high interest rates—this deep correction is lasting longer and going deeper.

Now let’s analyze the reasons:

From a big-picture perspective, looking at Bitcoin‘s own halving cycles, the duration of Bitcoin’s previous three halving bull markets were:

- First halving in November 2012: bull market lasted 1 year, with the first incubation phase lasting 3 months

- Second halving in July 2016: bull market lasted 1 year and 6 months, with the first incubation phase lasting 4 months

- Third halving in May 2020: bull market lasted 1 year and 8 months, with the first incubation phase lasting 5 months

For this halving cycle, with the approval of Bitcoin spot ETFs, more institutional money and old money entering the market, the halving bull market will likely last longer, with each stage lasting correspondingly longer.

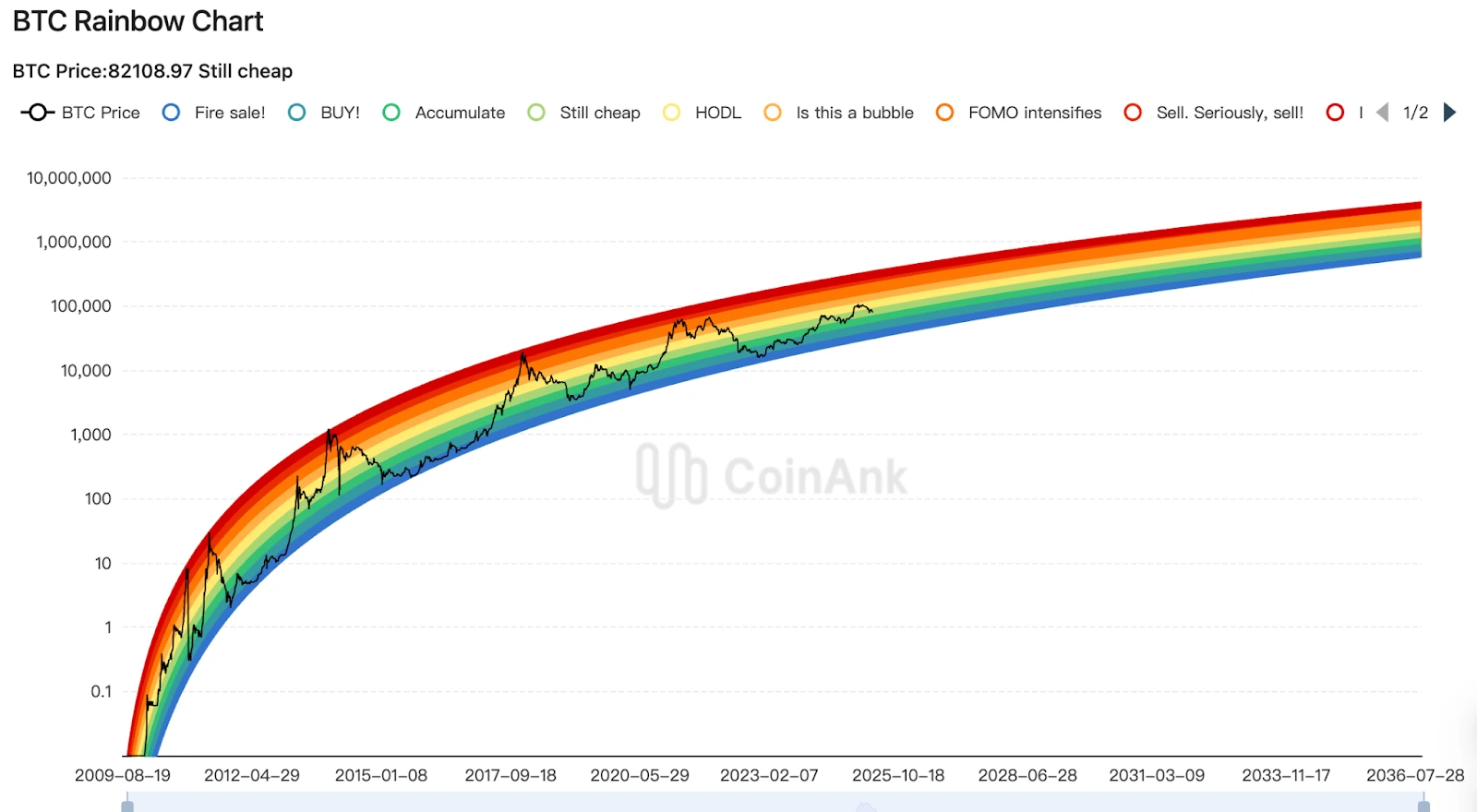

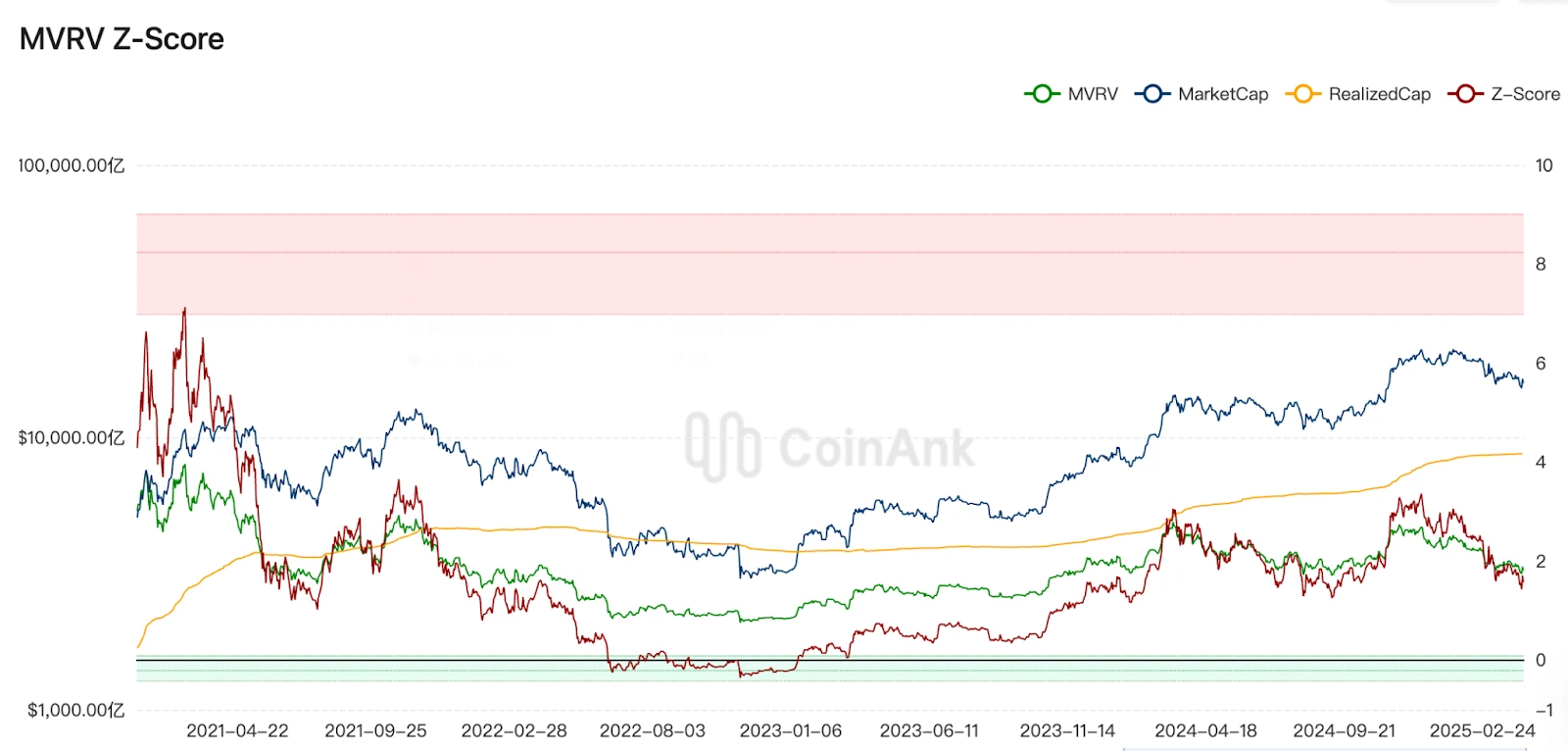

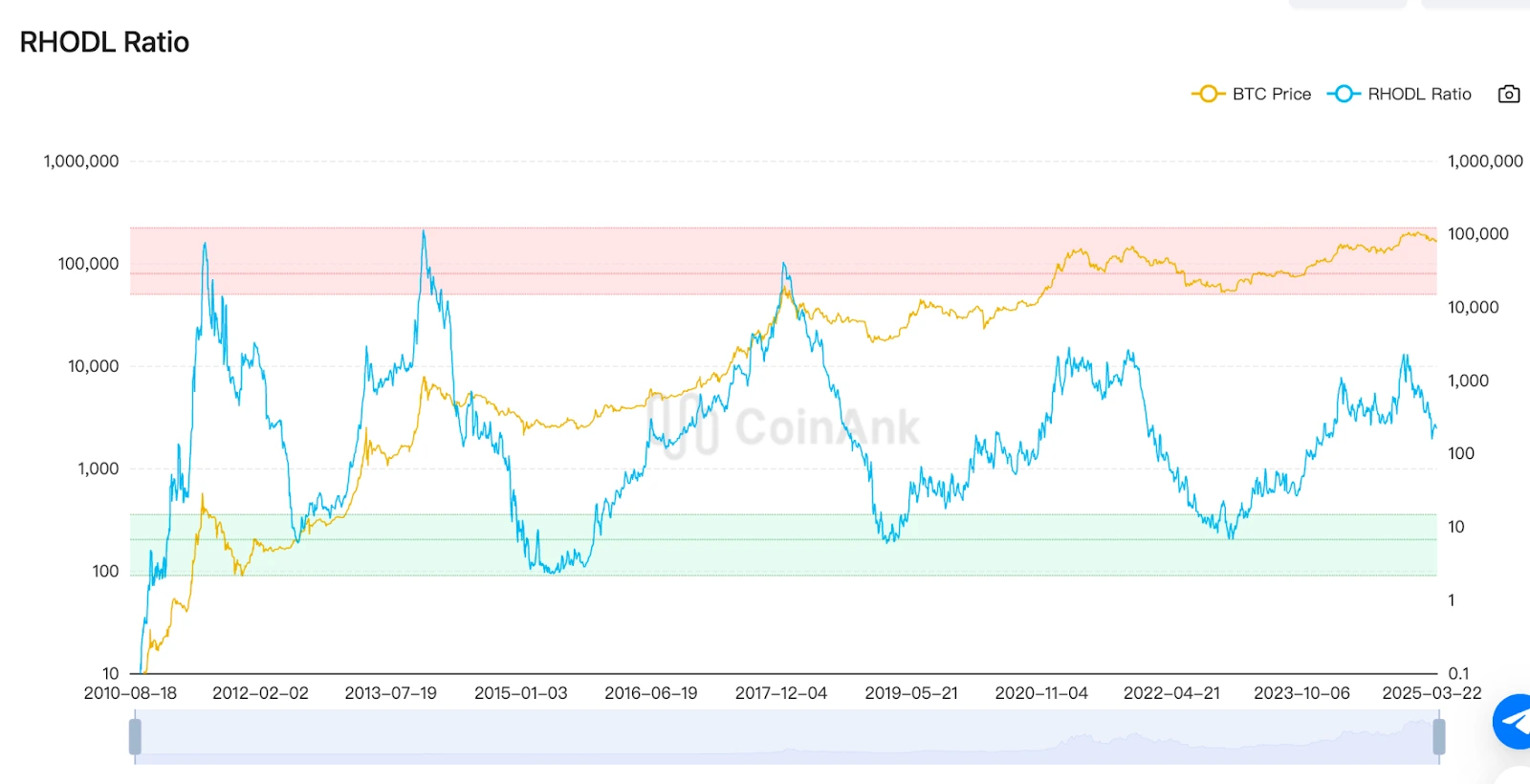

To back this up with data, let’s look at market indicators: Based on Bitcoin’s current Rainbow Chart position, MVRV, Puell Multiple, and RHODL ratio—four core indicators—combined with historical halving cycles and on-chain data, we can verify the above view by comparing Bitcoin’s current market stage with historical similarities from previous halving cycles.

The Rainbow Chart is currently in the “cheap price zone,” meaning market sentiment has not yet overheated and prices may be undervalued. Similar phases typically appear in early to mid-bull markets or correction periods. For example, Bitcoin showed a similar trend in May 2017, which was the early-mid period of the second halving cycle, more than half a year before the end of that bull run.

Bitcoin Rainbow Chart

(Source: CoinAnk)

MVRV (Market Value/Realized Value) reflects the overall profit/loss status of the market. The current value of 1.89 indicates the market is in a neutral zone, not yet in the overvalued area (typically MVRV >3.5 signals a top). Investors still have room for profit, but we haven’t reached the bubble stage. This level shows similar mid-term correction characteristics to May 2017, after which Bitcoin entered its main upward wave.

MVRV Indicator

(Source: CoinAnk)

RHODL ratio: RHODL assesses market cycles by comparing the holdings ratio between long-term and short-term holders. Current value: 2406, showing long-term holders still dominate but haven’t reached extreme accumulation levels (as seen in the 2019 bear market bottom or 2021 bull market top). This likely corresponds to a mid-bull market, where the market still has upward potential after adjustment.

RHODL Ratio

(Source: CoinAnk)

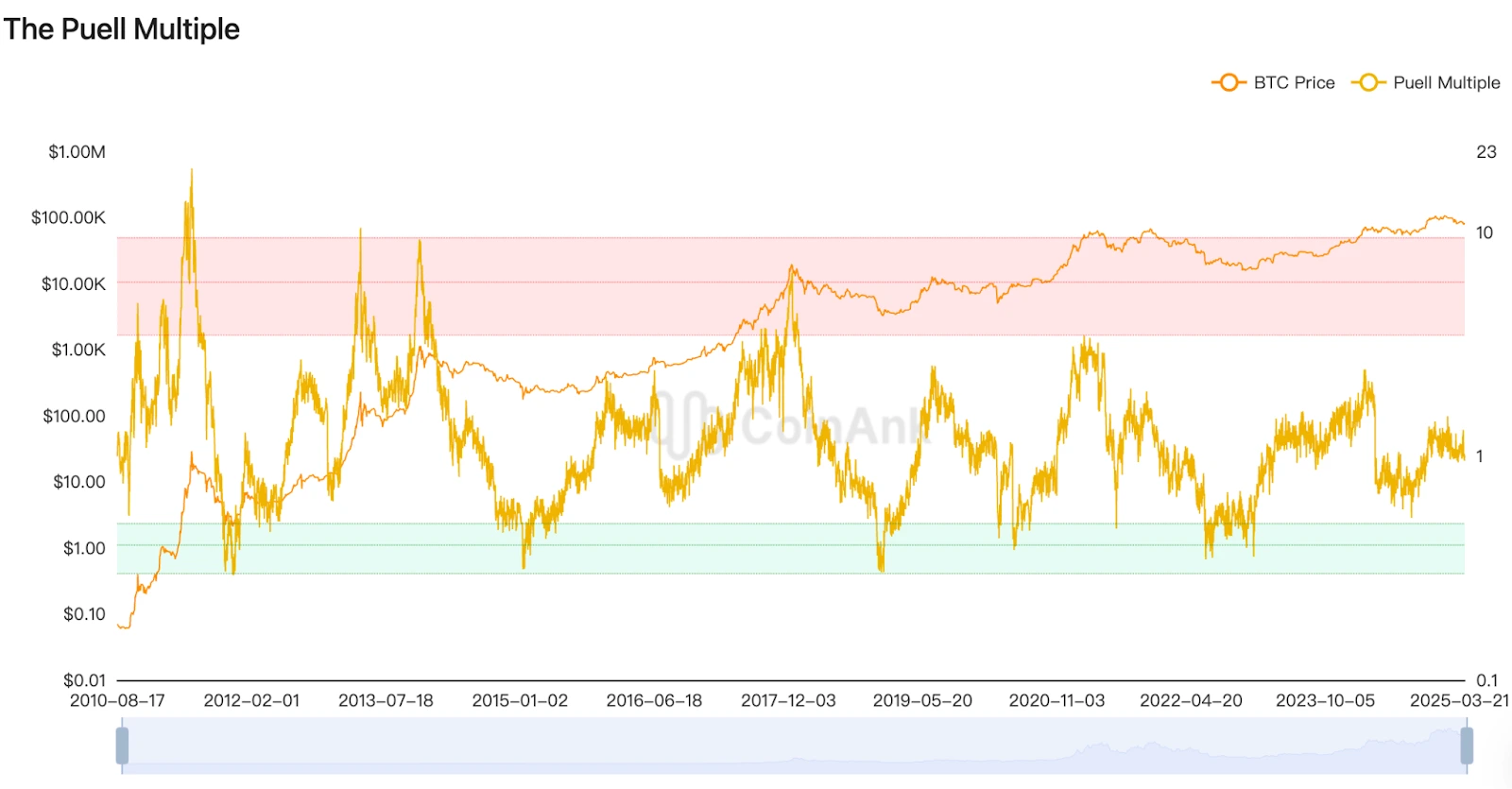

Puell Multiple: This indicator measures the ratio of miner income to the annualized average. The current value is 1.03, at a neutral-to-low level (bottoms typically <0.5, tops >4), indicating relatively low selling pressure from miners and no supply excess caused by miner selling, similar to the recovery period after the 2020 halving.

Puell Multiple Indicator

(Source: CoinAnk)

Based on these data, the current market is in a mid-bull market correction phase. On-chain data doesn’t show overheating or crash risks, but caution is needed for short-term volatility. The closest historical comparison is the mid-2017 correction period, after which prices rose from about $2,000 to $20,000.

Comparing the current market to the previous three halving cycles, prices typically enter consolidation or correction periods 6-12 months after halving (e.g., early 2017, late 2020). The current cycle, April 2025, is about 12 months post-halving, approaching the historical upward window.

Of course, the biggest influencing factors on the current market aren’t crypto-specific but the broader economic environment: Trump’s tariff war, Fed monetary policy, etc. However, these external factors mainly affect the speed of market progress, not the overall direction. Positive factors accelerate market development; negative factors delay it.

In summary, current indicators most closely resemble the mid-2017 and post-2020 halving adjustment phases. The subsequent market may begin a new round of growth in the second half of 2025, with target prices in the $140,000-210,000 range according to institutional forecasts.

MICRO OPERATIONS: HOW TO BUILD YOUR INVESTMENT STRATEGY?

Based on the above market analysis, how should we proceed, or how should we build our investment strategy? How can we smoothly navigate the current complex and changing market conditions while waiting for the major market movement to arrive?

In the short term, for the next 2-3 months, the broader environment may not fundamentally change, so the market will likely remain weak and volatile, characterized by decline-rebound-consolidation patterns. This will continue until the Fed cuts rates in June or US-China tariff tensions ease, which would trigger a rebound; otherwise, the sideways bottoming process continues.

During this phase, operations should prioritize risk control: take profits when possible, set strict stop-loss and take-profit levels, and adhere to investment discipline.

Psychologically, avoid emotional trading. Short-term fluctuations are easily influenced by market noise, so strictly execute your trading plan, reduce frequent operations and screen-watching time, and avoid letting short-term volatility affect long-term judgment.

Specific strategies include buying quality coins on dips for long-term holding, such as monthly dollar-cost averaging into Bitcoin (e.g., 5%-10% of income), using the “Rainbow Chart deep green zone” and the ahr999 index’s DCA range to lower costs.

ahr999 Index

(Source: CoinAnk)

Use different strategies to reduce potential losses from declines, such as: using options to short and hedge downside risk, or employing grid trading in consolidation markets to automatically buy low and sell high, capturing range-bound returns.

Compared to other times, pay more attention to macroeconomic events such as Trump’s tariff policies, central bank rate decisions, and employment data that could trigger market volatility, and prepare hedging strategies in advance.

Short-term investment strategy can be summarized in one sentence: Survival is most important.

For the medium term, July-December 2025, the fourth halving cycle may continue, requiring focus on leading projects in hot sectors. But narrative shifts and regulatory developments still need confirmation.

If the Fed cuts rates as expected in June and Trump’s tariff war reaches an interim target, the halving cycle will continue. The core principles of your investment strategy should then be trend following and sector rotation, such as capturing structural opportunities in AI and DeFi 2.0 explosion.

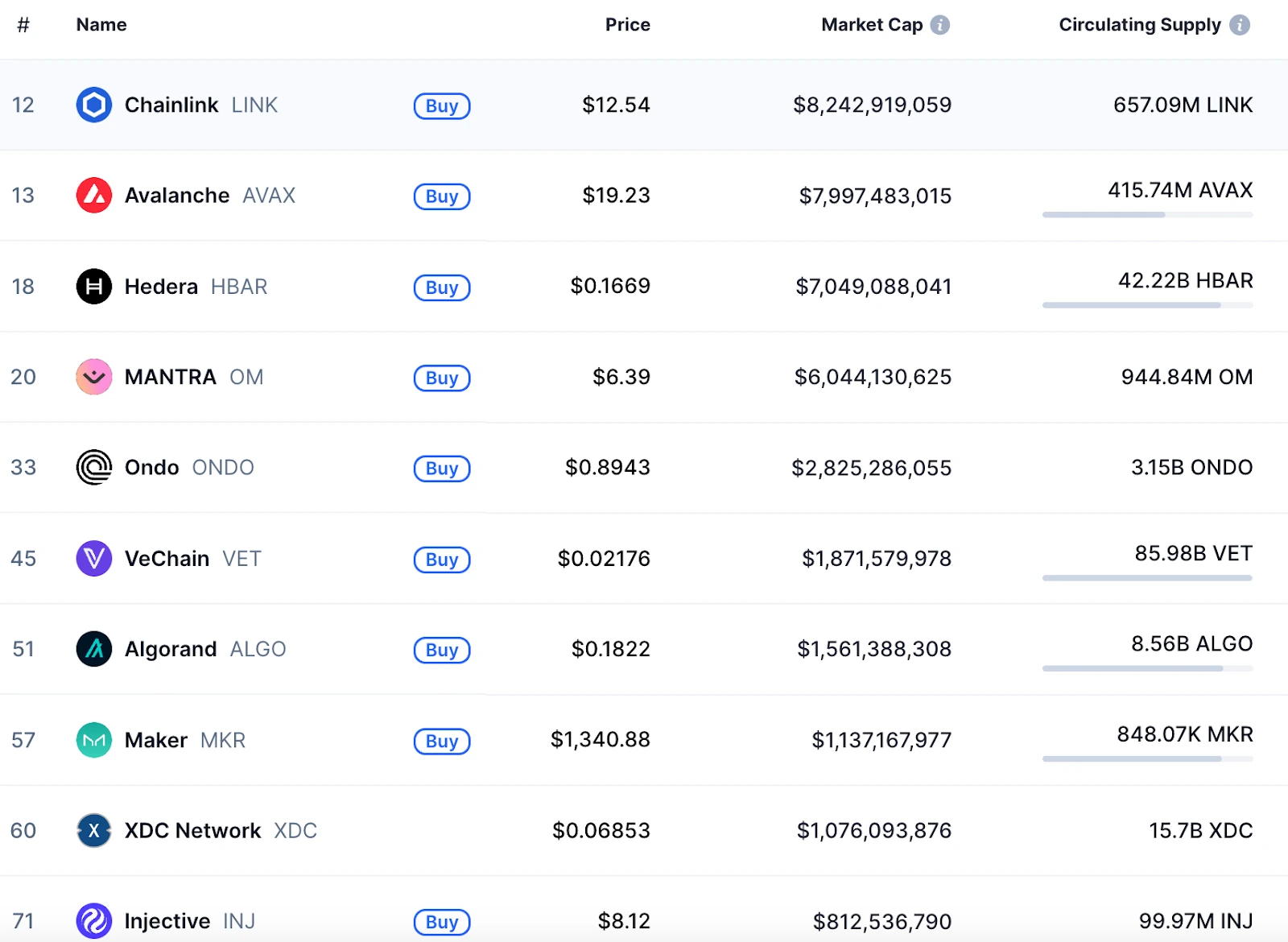

For sector allocation, core assets should comprise 50% of funds: BTC (30%) and ETH (20%) as volatility-resistant foundation. Promising sectors should take 40% of funds, such as AI and blockchain integration tokens like Swarms and Griffain, which benefit from AI technology commercialization; DeFi 2.0 and DePIN, choosing projects applying cross-chain interoperability and zero-knowledge proof (ZKP) technology, like PEAQ, as well as leading projects in L1 public chains, RWA, metaverse, and other concepts. Stablecoins should account for 10% of funds, keeping USDT and USDC to capture correction opportunities. Then evaluate holdings monthly, eliminating inefficient assets and increasing positions in tokens with leading technological iterations.

Top Market Cap RWA Concept Projects

(Source: CoinMarketCap)

FINAL THOUGHTS

The medium-term investment strategy can be summarized as: Strike when the time is right.

For the long term, January-December 2026, the fourth halving cycle may enter its climax. Focus on the cycle and hold patiently.

For risk management, view Bitcoin as digital gold, with long-term positions accounting for no less than 30% of total assets to hedge against fiat currency devaluation. For larger portfolios, use cold storage for security, storing core holdings in hardware wallets to avoid exchange risks.

For psychological building and long-term perspective, ignore short-term noise. Bitcoin’s 4-year cycle pattern has not yet been broken, so patience is needed to avoid exiting early due to short-term corrections.

The long-term investment strategy can be summarized as: Take profits in batches and secure your gains.

▶ Buy Crypto at Bitget