KEYTAKEAWAYS

- Q1 total trading volume reached $117.364 billion.Solana led with $25.849 billion (45.8% share) in absolute advantage

- Pump.fun ranked TOP3 with $4.614 billion weekly trading volume

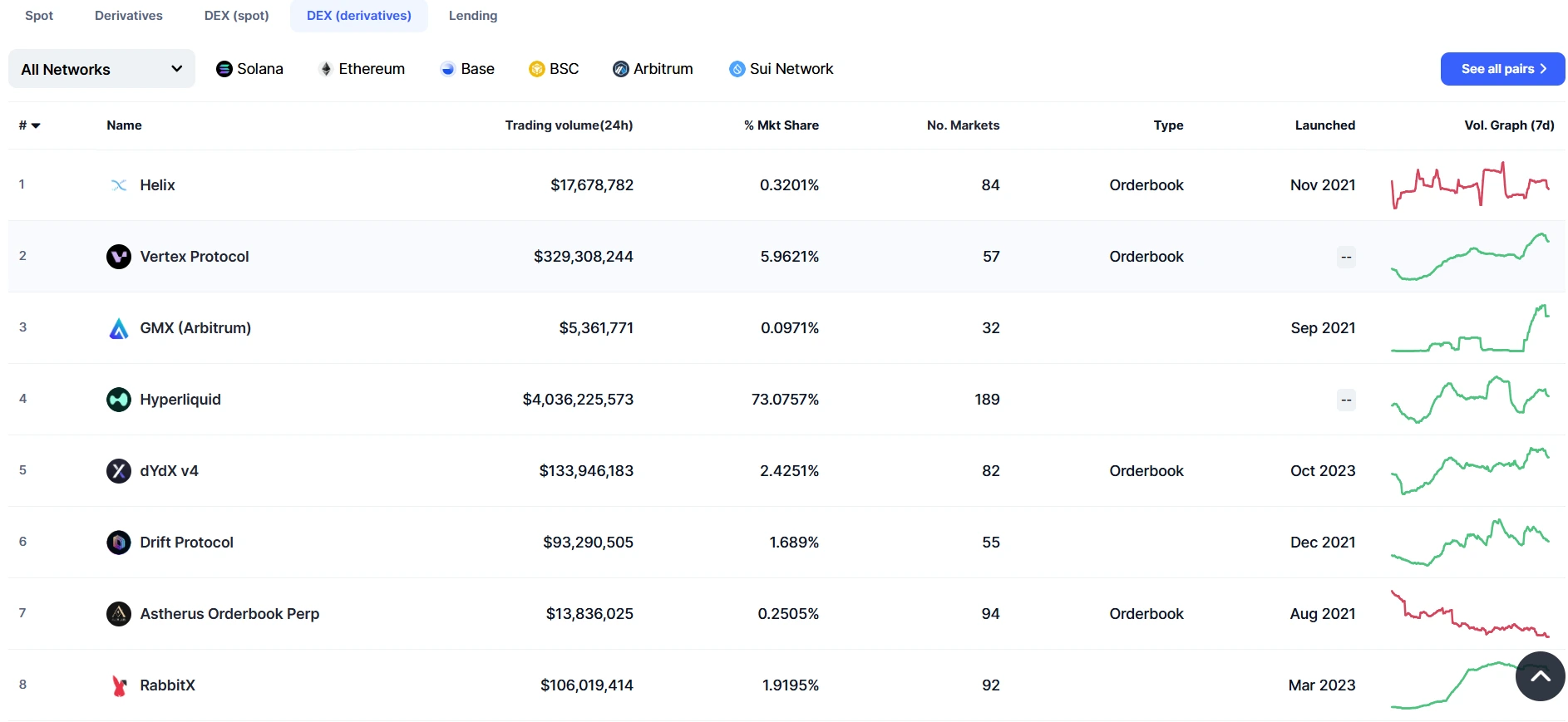

- Hyperliquid commands the market with $4.036 billion in 24-hour volume and 73.08% market share, establishing itself as the undisputed derivatives leader.

CONTENT

Analysis of Q1 2025 DEX market showing $117.34B trading volume with monthly decline, Solana’s retail dominance, Ethereum’s institutional resilience, and emerging chains like Base gaining traction amid technological innovation.

Q1 2025 DEX MARKET OVERVIEW

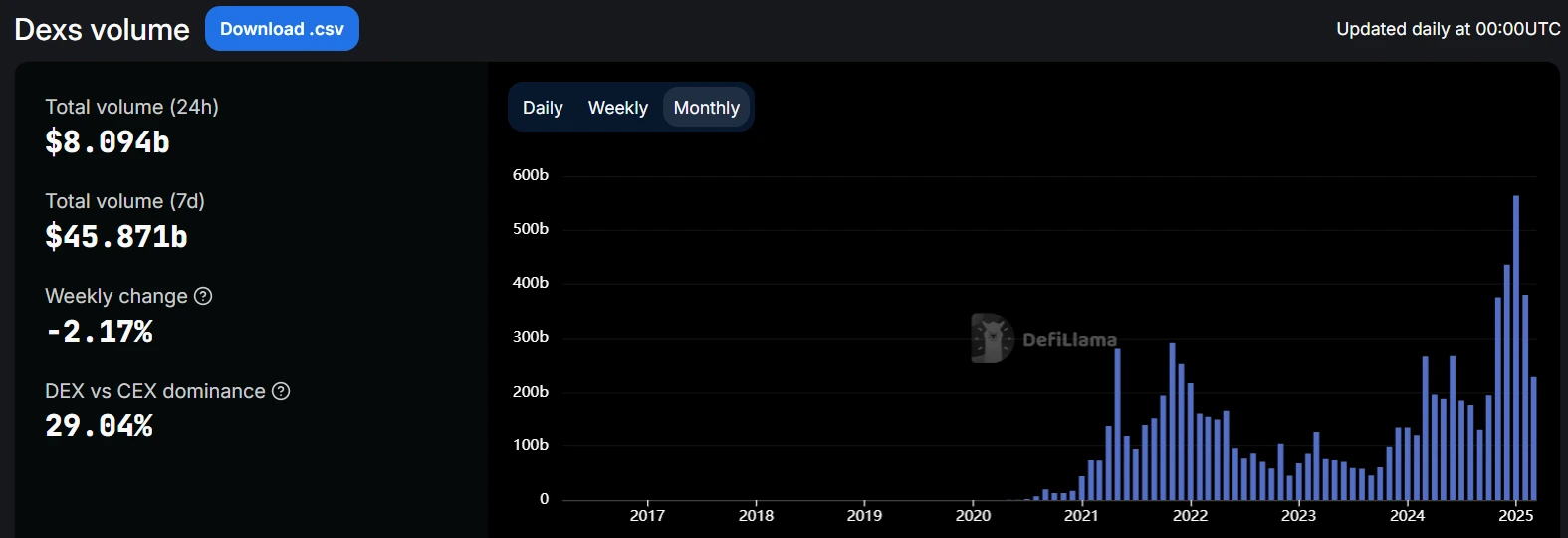

DEX Overall Trading Volume: $117.34 Billion

In the first quarter of 2025, the decentralized exchange (DEX) market showed clear seasonal fluctuation characteristics. According to the latest data from DeFiLlama, Q1 total trading volume reached $117.364 billion, including:

- January trading volume peaked for the quarter, reaching $56.401 billion

- February trading volume decreased by 32.6% month-over-month to $38.035 billion

- March trading volume continued to decline by 39.7% to $22.928 billion

The following factors mainly influenced this monthly decreasing trend: January saw market trading activity peak driven by the Solana ecosystem’s Meme coin boom; in February-March, as market enthusiasm waned and funds flowed back to traditional financial markets, trading volume gradually returned to normal; in late March, the significant adjustment in crypto market cap may have affected some funds temporarily withdrawing, with a considerable number of users adopting a wait-and-see attitude.

Blockchain Competition Landscape Evolution

In January 2025, Solana led with $25.849 billion (45.8% share) in absolute advantage, mainly benefiting from its low transaction fees (average $0.0001) and high throughput characteristics, successfully attracting a large number of retail traders.

Ethereum ($8.611 billion, 15.3%) and BSC ($7.871 billion, 14.0%) ranked second and third, while the emerging blockchain Base performed impressively with $5.287 billion (9.4%) in trading volume, surpassing established Layer 2 networks like Arbitrum.

In February, against the backdrop of overall market correction, various blockchains’ market shares showed significant changes:

- Solana’s trading volume sharply decreased by 59.1% to $10.586 billion, but remained the single chain with the highest trading volume

- BSC ($8.431 billion) grew against the trend by 7.1%, surpassing Ethereum ($8.223 billion) to become the second-largest DEX blockchain

- Base maintained stable performance, holding the fourth position with $3.139 billion

In March, Ethereum ($6.053 billion) reclaimed the top position, mainly benefiting from institutional investors’ preference for large-scale transactions.

Solana ($5.001 billion) and BSC ($4.164 billion) ranked second and third. Notably, Berachain ($2.1744 billion), whose mainnet launched less than 2 months ago, ranked 8th, entering the top ten list for the first time, demonstrating its ecosystem’s rapid expansion.

Emerging Force Performance

The Base chain performed impressively throughout the quarter, with cumulative Q1 trading volume reaching $10.08 billion, including: January $5.287 billion (9.4% share); February $3.139 billion (8.3%); March $1.654 billion (7.2%).

Despite the decline in trading volume affected by the overall market, its market share remained relatively stable, proving its continuous development potential under Coinbase ecosystem support.

Sui, as a representative of emerging blockchains, had a cumulative Q1 trading volume of $2.483 billion, including: January $1.242 billion; February $0.722 billion; March $0.519 billion. Although the absolute figures are not high, it has steadily positioned itself in the second tier, demonstrating the unique attractiveness of the Move language ecosystem.

The derivatives-specialized chain Hyperliquid L1 completed $1.571 billion in trading volume in Q1, including: January $0.663 billion; February $0.514 billion; March $0.394 billion. Despite its smaller scale, its focus on derivatives trading has maintained its competitiveness in this niche area.

Q1 2025 DEX market showed three major characteristics:

- Solana-dominated retail market: Despite large fluctuations in trading volume, it remains the most active blockchain for retail users

- Ethereum’s institutional preference: Showing stronger resilience during market downturns

- The rise of new blockchains like Base: Proving the effectiveness of vertical, specialized development paths

Q1 2025 END-OF-QUARTER DEX PLATFORM COMPETITION LANDSCAPE ANALYSIS

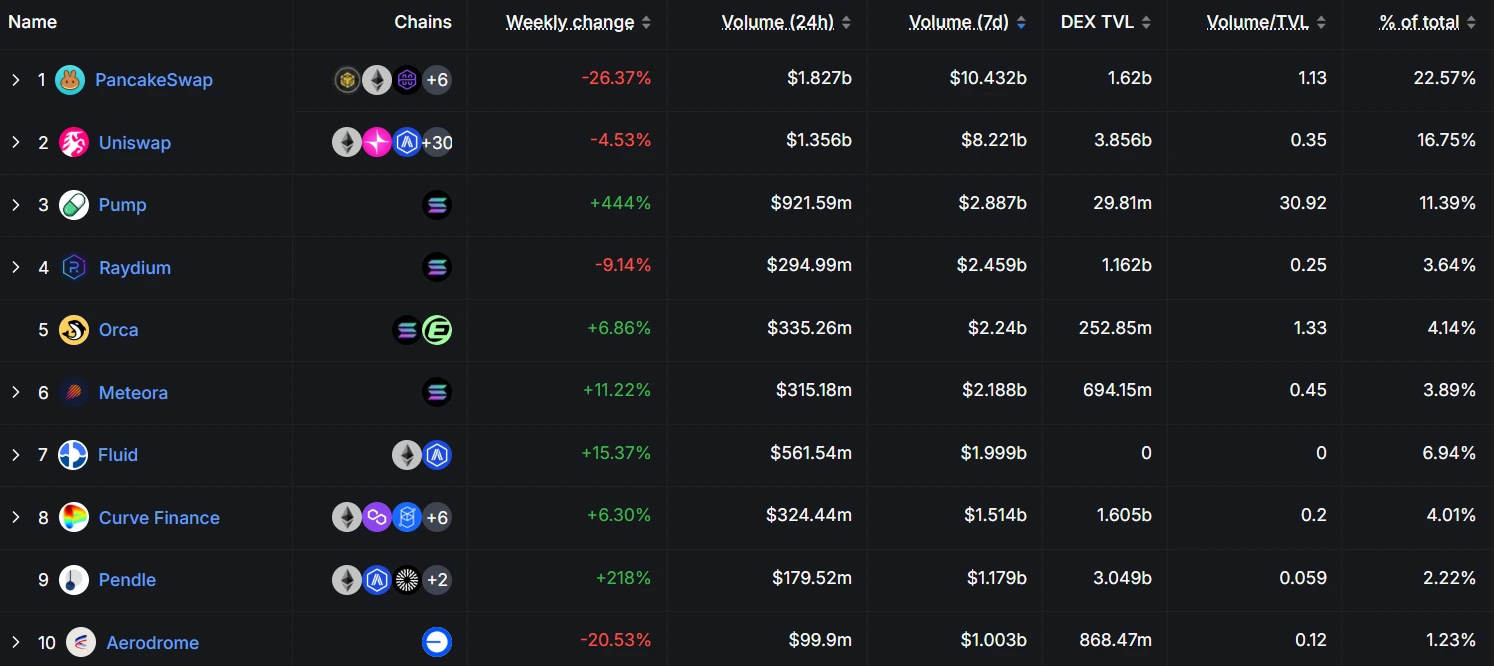

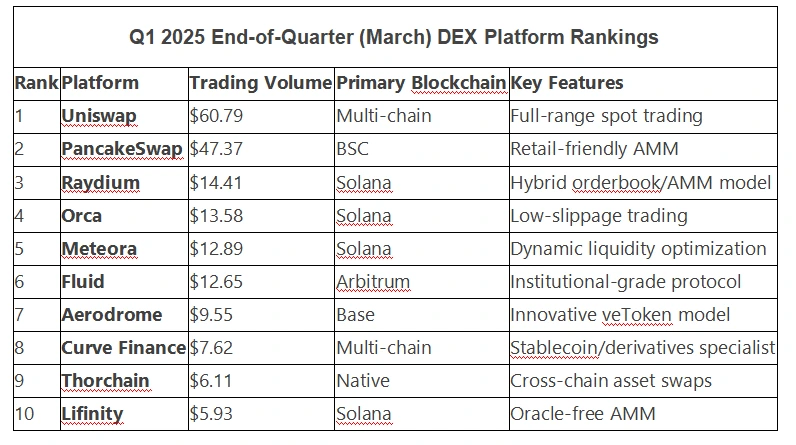

In March 2025, DEX market total trading volume reached $22.928 billion, with platform competition showing the following characteristics:

- Top two dominance remains solid: Uniswap ($6.079 billion) and PancakeSwap ($4.737 billion) together account for 47.2% market share

- Rise of Solana ecosystem: Raydium ($1.441 billion), Orca ($1.358 billion), and Meteora ($1.289 billion) have a combined trading volume of $4.088 billion, accounting for 81.7% of Solana chain’s total trading volume

- Emerging platforms perform impressively: Fluid ($1.265 billion) and Aerodrome ($0.955 billion) respectively represent the growth potential of Arbitrum chain and the derivatives track.

End-of-Quarter (March) TOP10 Platform Data Perspective

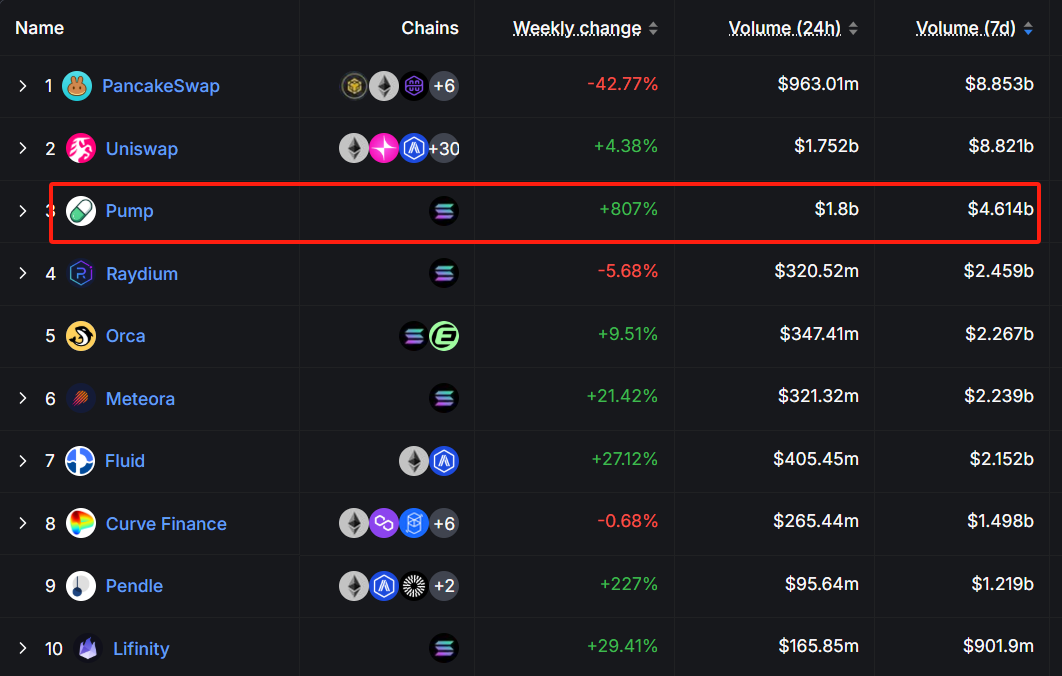

Last Week of Quarter (Last Week of March) Dynamic Observation

- Trading volume contraction trend: Top platforms’ weekly trading volumes have declined, reflecting the cyclical decrease in market activity. PancakeSwap weekly trading $8.853 billion (weekly decrease 42.77%). Uniswap weekly trading $8.821 billion, with lower than monthly average share this month.

- Meme trading boom continues: pump.fun ranked TOP3 with $4.614 billion weekly trading volume, showing continued active trading of Solana ecosystem Meme coins.

- Breakthrough of derivatives platforms: Pendle ($1.219 billion) entered the weekly TOP10 for the first time, reflecting growing demand for interest rate derivatives

Key Trend Interpretation

Solana ecosystem’s deep development, with 5 Solana-based platforms entering TOP10, accounting for a combined 23.1%, forming a complete trading ecosystem. Base chain and Arbitrum validate the effectiveness of Coinbase ecosystem support.

Uniswap/PancakeSwap are becoming comprehensive traffic gateways; niche market leaders Curve and Thorchain maintain differentiated competitiveness.

Short-term fluctuation characteristics, end-of-week data shows increased market sensitivity, platforms need to strengthen liquidity risk management.

DEX DERIVATIVES TRACK MARKET LANDSCAPE

In the first quarter of 2025, the DEX derivatives market presented a “one giant, many strong” competitive landscape. Hyperliquid dominated the market with absolute advantage, its 24-hour trading volume reaching $4.036 billion, market share as high as 73.08%, becoming the undisputed leader in the derivatives track.

This performance mainly benefits from its innovative fully on-chain order book model and ultimate trading experience, controlling funding rate deviation within 0.01%, approaching centralized exchange levels.

Vertex Protocol ranked second with $329 million (5.96% share), demonstrating stable market competitiveness. dYdX v4 ($134 million, 2.43%) and Drift Protocol ($93 million, 1.69%) ranked third and fourth, forming the second tier together. Notably, RabbitX emerged rapidly with $106 million (1.92%) trading volume, showing the development potential of emerging platforms.

In terms of leading platform mechanism innovation, Hyperliquid achieved breakthroughs through intent-based trading architecture, where users only need to declare trading goals for professional market makers to bid for execution. Its pioneering “dynamic funding rate insurance pool” effectively alleviates long-short imbalances during extreme market conditions, and its fully on-chain liquidation engine has improved liquidation efficiency by 300% compared to 2024.

Vertex Protocol adopts a hybrid model combining CLOB and AMM, with an innovative “liquidity tiering” system providing differentiated slippage protection for different transaction sizes, and cross-margin account support for 50+ collateral assets significantly improves capital efficiency.

dYdX v4 has made progress in compliance, balancing privacy protection and regulatory requirements through fully decentralized order books and zk-proofs technology, and introducing isolated account models to meet institutional needs.

Niche track development shows diversified trends. Perpetual contracts dominate the market with 89% share, with average leverage stable in the 10-20x range, but mainstream BTC and ETH contracts’ share has decreased to 65%, with altcoin contract demand growing significantly.

In the options and structured products sector, GMX focuses on volatility derivatives, Astherus order book options protocol has reached daily trading volume of $13 million, and structured products like Snowball have seen 120% TVL growth this quarter.

In prediction markets, RabbitX’s “political event contracts” performed impressively, while innovative products like weather derivatives and NFT hedging tools are beginning to emerge.

Q1 2025 DEX MECHANISM EVOLUTION AND INNOVATION

In the first quarter of 2025, decentralized exchanges (DEX) achieved breakthrough progress in liquidity management, trading efficiency, and risk control.

As market trading volume fluctuated (Q1 total of $117.364 billion) and blockchain competition intensified, DEX protocols continuously reshaped industry paradigms through technological innovation.

Deep optimization of liquidity mechanisms became the core issue this quarter. The innovative model represented by CoW AMM achieved internalization of MEV (Miner Extractable Value) by restructuring arbitrage value distribution mechanisms.

This mechanism introduces off-chain batch auctions and Solver bidding systems, allowing liquidity providers (LPs) to capture profits traditionally taken by arbitrage bots. Data shows that protocols adopting CoW AMM increased LP annualized returns by an average of 18%, while completely eliminating liquidity rebalancing losses (LVR).

Uniswap V4’s Hooks functionality further released capital efficiency potential, while Bunni V2 protocol automatically deploys idle funds to lending protocols through dynamic liquidity allocation algorithms, creating compound returns for LPs. This innovation increased the TVL utilization rate of Base chain’s leading DEX Aerodrome to 73%, far exceeding the industry average.

Cross-chain trading infrastructure received key upgrades. Thorchain improved atomic swap protocols to reduce cross-chain transaction confirmation time to 15 seconds, supporting seamless asset transfers between 12 heterogeneous chains.

Its liquidity network adopts a dynamic fee model, automatically adjusting rates based on inter-chain congestion, controlling slippage for large transactions within 0.8%.

Notably, the Sui ecosystem leveraged Move language’s security features to launch the first non-oracle AMM protocol Lifinity, replacing traditional price oracles with on-chain volatility prediction algorithms, achieving $593 million in Q1 trading volume and validating the feasibility of new pricing mechanisms.

The co-evolution of security and compliance architectures became an industry focus. Large-scale application of ZK-Rollup technology reduced transaction costs on Layer 2 networks like StarkNet to below $0.01, while ensuring fund security through validity proofs.

In regulatory adaptability, Polygon ID’s zero-knowledge proof KYC solution has served 3 million users, achieving a balance between anonymous identity verification and AML compliance.

The SEC’s stricter regulation of governance tokens prompted leading platforms to establish transparent market maker disclosure systems, with Uniswap V4 specifically developing governance token holder revenue isolation pools to ensure protocol revenue distribution complies with securities law requirements.

Three major trends in future mechanism evolution have emerged:

First, AI-driven liquidity management, with 20% of DEXs beginning to deploy reinforcement learning algorithms to optimize market-making strategies; second, the popularization of hybrid architectures, with Gate.io’s innovative verification zone CEX-DEX hybrid model reducing transaction costs by 80%; third, the institutionalization of risk hedging tools, with insurance protocols like Nexus Mutual covering assets worth $8.5 billion and launching real-time dynamic premium models targeting smart contract vulnerabilities.

These innovations mark DEXs’ transition from trading execution venues to comprehensive risk management platforms, laying the foundation for the maturity of Web3 financial infrastructure.

DEX ECOSYSTEM TRANSFORMATION AND OPPORTUNITIES

In the first quarter of 2025, the DEX market exhibited three core characteristics:

- Multi-chain landscape deepening: Solana led the retail market with a peak share of 45.8%, Ethereum showed institutional preference resilience, and new blockchains like Base and Berachain rapidly emerged, validating the vertical development path.

- Derivatives specialization: Hyperliquid occupied 73% market share with innovative architecture, perpetual contracts dominated but altcoin demand grew, and innovative products continued to emerge.

- Mechanism innovation breakthroughs: MEV internalization, capital efficiency improvements, and cross-chain enhancements drove DEXs toward sustainable economic models, while technologies like ZK-Rollup reduced transaction costs.

Looking ahead, AI integration, hybrid architectures, and insurance mechanisms will be key development directions. With technological breakthroughs and regulatory improvements, DEXs are accelerating their evolution into comprehensive financial infrastructure, entering a new stage of differentiated competition. The current period represents a strategic opportunity to position in core tracks.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!