KEYTAKEAWAYS

- Bitcoin's flash crash to $90,790 triggered $1.098 billion in liquidations, highlighting the importance of risk management in current market conditions.

- DEX leader UNI and storage pioneer FIL show strongest fundamentals, with potential market cap targets suggesting 192% and 477% upside respectively.

- ORDI and BOME require longer consolidation periods, but their unique positioning in Bitcoin and Solana ecosystems presents significant growth potential.

CONTENT

Comprehensive analysis of UNI’s DEX dominance, BOME’s meme evolution, ORDI’s BRC-20 leadership, and FIL’s storage infrastructure. Featuring technical analysis, investment thesis, and market predictions for Q1 2025.

*Ready to explore these opportunities? Trade on Bitget now. Remember: This content is informational only – always trade responsibly.

Welcome to the 6th edition of the Potential/Hot Cryptocurrency Research Report (CoinRank’s Market Watch), a joint publication by CoinRank and Agen. This edition analyzes four cryptocurrencies: UNI, BOME, ORDI, and FIL, examining their fundamentals, market dynamics, technical indicators, price targets, and investor suitability.

Market Overview: Bitcoin recently surpassed a significant milestone of $100,000, reaching $104,000 (Bitget data) before experiencing a flash crash to $90,790 in early trading hours today – a 14% retracement. Notably, altcoin volatility remained relatively contained during this correction.

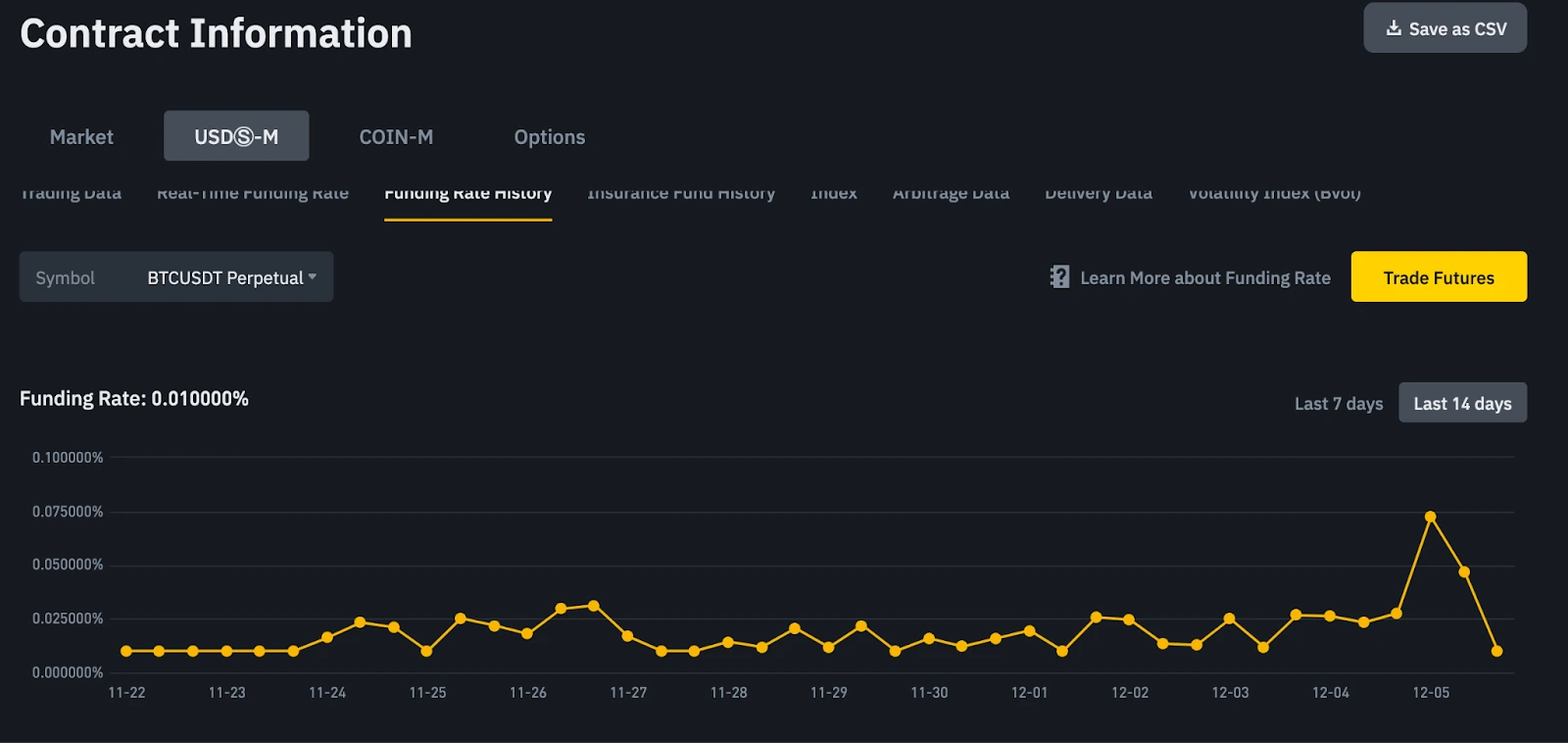

The correction appears primarily driven by leveraged position liquidation mechanics. The elevated funding rate for Bitcoin perpetual contracts on Binance, which reached 0.072, contributed to substantial liquidations totaling $1.098 billion across platforms in the past 24 hours, with long positions accounting for $816 million (Coinglass data).

BTC Perpetual Contract Funding Rate

(Source: Binance)

The current market dynamics reflect typical bull market behavior, where price discovery is accompanied by periodic corrections to maintain healthy market structure. Several major macroeconomic events in December may influence market sentiment and price action (Refer to: Crypto Market December Outlook: Key Events and Market Catalysts for Year-End 2024).

Data Sources: All metrics and analytics referenced are derived from Tradingview, CoinMarketCap, Feixiaohao, and Bitget.

For comprehensive market analysis, refer to our previous reports:

- CoinRank’s Market Watch: From Top 10 to Top 200 – Investment Analysis of DOGE, SUI and PIXEL

- CoinRank’s Market Watch: Rising Stars Analysis – PNUT, TIA, XRP, and DOGS

- CoinRank’s Market Watch: From Meme Kings to Tech Giants – Analyzing PEPE, ATOM, ACT and TON

UNI: ETHEREUM’S CORNERSTONE DEX PROTOCOL

Token Fundamentals

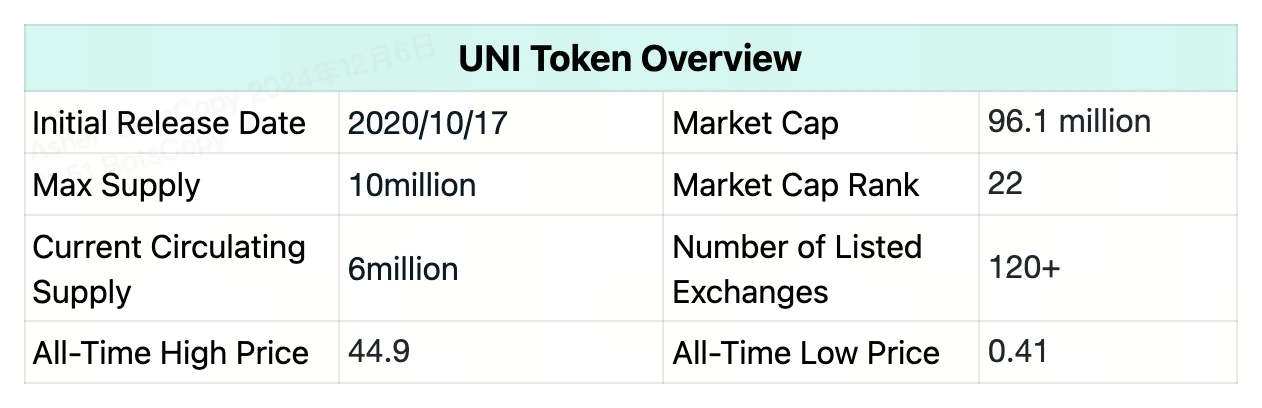

Uniswap, launched at DevCon 4 in November 2018, stands as the pioneering decentralized trading protocol on Ethereum. Current metrics below:

Investment Thesis

As the dominant player in the DEX sector, Uniswap serves as the primary liquidity venue for emerging tokens prior to centralized exchange listings. This positioning naturally drives protocol value appreciation. The platform’s on-chain TVL has demonstrated robust growth, increasing 36% over the past quarter.

Institutional conviction remains strong, evidenced by Grayscale’s DeFi fund allocation, where UNI comprises 58.07% of the portfolio. This institutional backing underscores the fundamental strength of decentralized exchange infrastructure.

Technical Analysis

Price action shows sustained momentum over five consecutive weeks, with UNI appreciating from $6.6 to $16.6, approaching March resistance levels. Current price levels suggest consolidation may be needed between $17-19 before continued upward movement.

Price Target

UNI’s historical position among top 10 cryptocurrencies suggests potential reversion to previous market cap levels. Using TRX’s current market cap ($28.13B) as a benchmark indicates potential appreciation of 192% in the near term (2-3 months). Given broader bull market conditions, this represents a conservative estimate.

Investor Profile

Suitable for investors with assets in the $100,000-$1,000,000 range seeking balanced risk-adjusted returns.

Rating

4/5 ⭐️

BOME: SOLANA’S MEME CULTURE ARCHIVE PROTOCOL

Token Fundamentals

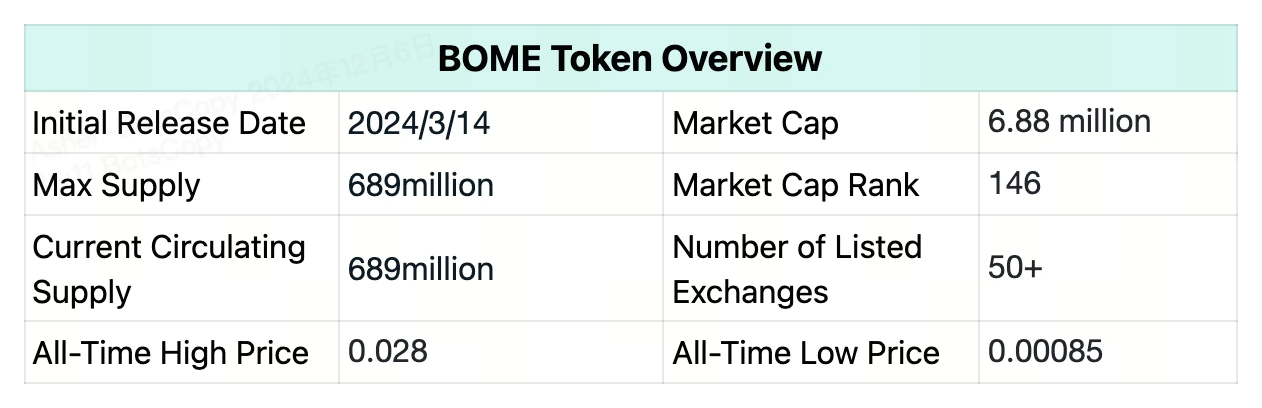

BOOK OF MEME represents an experimental protocol on the Solana network, combining memecoin mechanics with web3 cultural infrastructure. The project aims to establish a digital framework for evolving meme culture preservation. Current metrics below:

Investment Thesis

BOME’s value proposition centers on synthesizing decentralized social infrastructure with meme culture dynamics. The protocol leverages blockchain technology to create permanent archives of internet cultural artifacts. While this comprehensive approach may appear ambitious, it aligns with grassroots meme tokenomics and benefits from both PEPE and SOL ecosystem network effects.

Technical Analysis

Since its major exchange listings in March, price action has displayed prolonged consolidation with downward bias. Despite broader market recovery, BOME continues to trade near support levels. While this price action has frustrated market participants, the fully diluted token distribution necessitates extended accumulation periods for strategic positions.

Price Target

Within the memecoin sector, BOME currently ranks ninth by market capitalization. While reaching DOGE, SHIB, or PEPE‘s valuation appears ambitious, achieving parity with BONK’s $3.38B market cap presents a realistic target, suggesting potential upside of 391%.

Investor Profile

Suited for $1,000-$100,000 tier portfolios comfortable with high-risk, high-reward positions.

Rating

3/5 ⭐️

ORDI: BITCOIN’S FIRST BRC-20 STANDARD BEARER

Token Fundamentals

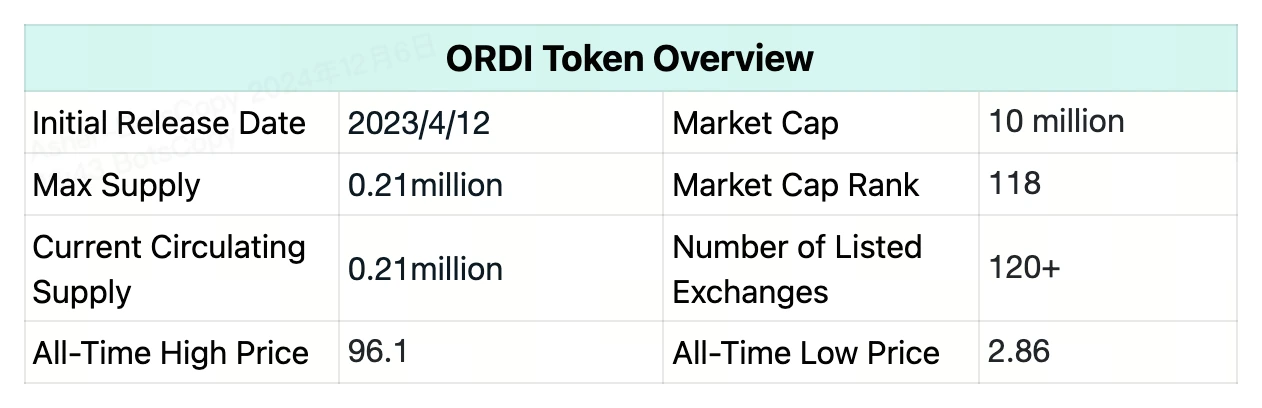

ORDI represents the genesis token implementing the BRC-20 fungible token standard on Bitcoin. Current metrics below:

Investment Thesis

As a catalyst of early 2023’s market momentum, ORDI maintains significant market attention. The token’s positioning within Bitcoin’s ecosystem suggests potential renewed interest during the fourth halving cycle, potentially emerging as a dominant narrative.

Technical Analysis

Following its initial 100x price appreciation in early 2023, the token entered an extended consolidation phase. Weekly charts indicate emergence from base formation, though immediate resistance levels and distribution patterns suggest methodical price discovery. Historical holders from previous price levels create natural selling pressure, indicating a more measured appreciation trajectory compared to initial price discovery.

Price Target

While replicating early 2023’s performance appears unlikely, ORDI’s position as the BRC-20 pioneer coupled with Bitcoin’s momentum suggests significant upside potential post-consolidation. Conservative targets align with top 50 market cap placement (current #50 WIF at $3.53B = 253% upside). Aggressive targets suggest top 30 potential (current #30 RENDER at $5.41B = 441% upside).

Investor Profile

Appropriate for $10,000-$1,000,000 tier portfolios seeking balanced risk-reward exposure to Bitcoin ecosystem narratives.

Rating

3.5/5 ⭐️

FIL: WEB3’S DECENTRALIZED STORAGE LEADER

Token Fundamentals

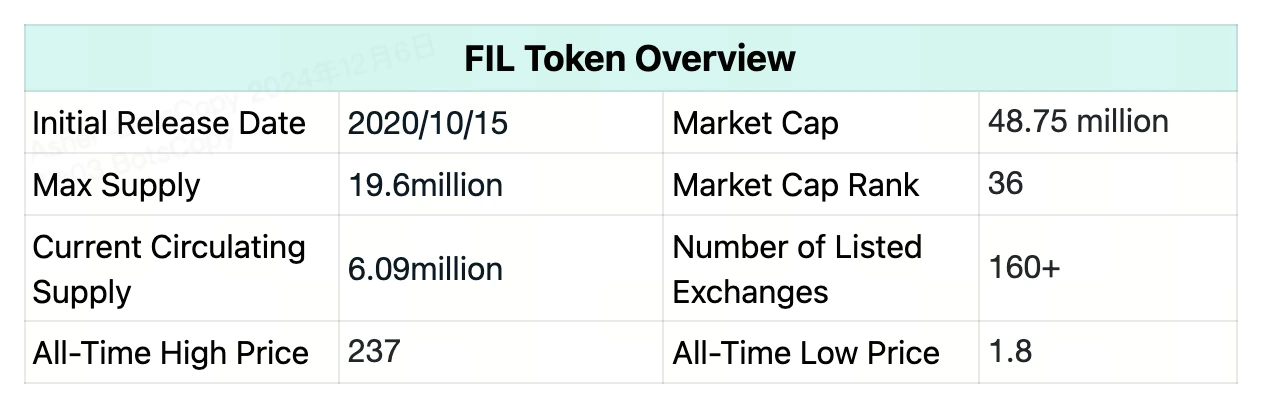

Filecoin operates as a decentralized storage network, providing incentive layers above IPFS infrastructure. The protocol enables permissionless participation in storage markets, allowing bandwidth and storage capacity monetization. Current metrics below:

Investment Thesis

As the market leader in decentralized storage infrastructure, FIL experienced significant volatility during the previous cycle, transitioning from prolonged underperformance to explosive price appreciation. Following three years of base building and accumulation, price action suggests renewed institutional interest in blockchain infrastructure plays.

Technical Analysis

Five consecutive weeks of positive price action accompanied by increasing volume metrics indicate robust trend formation. While daily and weekly readings suggest overbought conditions relative to Bollinger Bands, Bitcoin’s recent volatility introduces near-term uncertainty. However, the underlying momentum remains constructive with substantial upside potential.

Price Target

Top 10 market capitalization represents appropriate valuation for dominant infrastructure protocols. Using TRX’s current market cap ($28.13B) as benchmark suggests 477% upside potential in the near term (2-3 months).

Investor Profile

Suited for $100,000-$10,000,000 tier portfolios seeking exposure to fundamental blockchain infrastructure.

Rating

4/5 ⭐️

COMPARATIVE ANALYSIS

- Risk-Adjusted Return Stability: UNI > FIL > ORDI > BOME

- Absolute Return Potential: ORDI > BOME > FIL > UNI

- Current Market Momentum: UNI > FIL > ORDI > BOME

▶ Buy Crypto at Bitget