KEYTAKEAWAYS

- Economic Optimism Drives Growth: A crypto bull market signals rising asset prices, buoyed by strong economic conditions and growing investor confidence.

- Investor Sentiment Initiates Bull Runs: The onset of a crypto bull market is marked by investor optimism, leading to increased buying and higher prices.

- Strategic Navigation Is Key: Recovery offers entry, belief fuels accumulation, optimism leads to consolidation, and euphoria signals profit-taking.

CONTENT

The Crypto Bull Market 2025 is here, unprecedentedly reshaping the financial landscape. Discover key signs, navigate through the four crucial phases, and master insider tips to optimally time your investments for maximum gains.

*The content of this article was updated in February 2025.

WHAT IS A CRYPTO BULL MARKET?

A bull market means the economy is doing well, with prices of assets, like stocks and cryptocurrencies, going up—signaling the onset of a crypto bull market. This positive trend is driven by a strong economy, robust employment levels, and investor optimism about the market’s upward trajectory.

Crypto bull runs—periods marked by a rapid 40% increase in prices over one or two days—are more pronounced, illustrating the dynamic nature of crypto bull markets due to their smaller size and higher volatility compared to traditional markets.

(Source from CoinMarketCap)

Historically, crypto bull markets have been marked by significant price surges. For instance, the 2017 bull run saw Bitcoin rise from around $1,000 to nearly $ 20,000, while the 2021 bull market pushed Bitcoin to over $60,000.

Now, in 2025, the market is experiencing another major surge, fueled by the maturation of blockchain technology and its integration into various industries.

Key Drivers of the Crypto Bull Market 2025

What triggers a crypto bull market? Just like in traditional markets, it starts with investors. When they believe prices will rise and keep rising, they begin purchasing stocks at low prices, hoping for a good return on investment (ROI). This optimism fuels further price increases.

Bitcoin Halving Aftermath

The Bitcoin halving event in 2024 set the stage for the current Crypto Bull Market 2025. Historically, Bitcoin halving events have been followed by substantial price increases due to reduced supply and steady demand. By February 2025, the effects of the halving are in full swing, driving Bitcoin and other cryptocurrencies to new heights.

Institutional Adoption

Institutional interest in cryptocurrencies has reached new levels in 2025. Major financial institutions, corporations, and even governments are now heavily invested in digital assets. This influx of institutional capital has created a strong foundation for the current bull market, with many institutions viewing cryptocurrencies as a legitimate asset class.

Technological Advancements

Blockchain technology has evolved significantly by 2025. Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-2 scaling solutions are now mainstream, enhancing the utility and adoption of cryptocurrencies. These advancements are attracting both retail and institutional investors, further fueling the bull market.

Regulatory Clarity

Regulatory frameworks for cryptocurrencies have become clearer in 2025, reducing uncertainty and boosting investor confidence. Governments worldwide are now providing guidelines that encourage innovation while protecting investors, creating a more stable environment for the crypto market to thrive.

A strong economy, indicated by robust gross domestic product (GDP) growth and low unemployment, also contributes to bull markets by boosting investor confidence. Cryptocurrency markets, though newer and distinct from traditional ones, respond to these broad economic indicators as well.

CRYPTO BULL MARKET 2025: THE FOUR PHASES

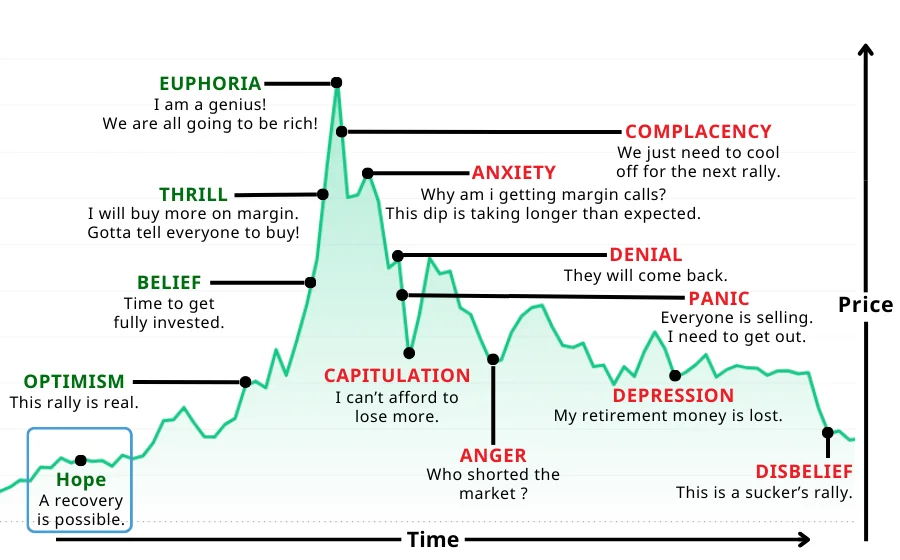

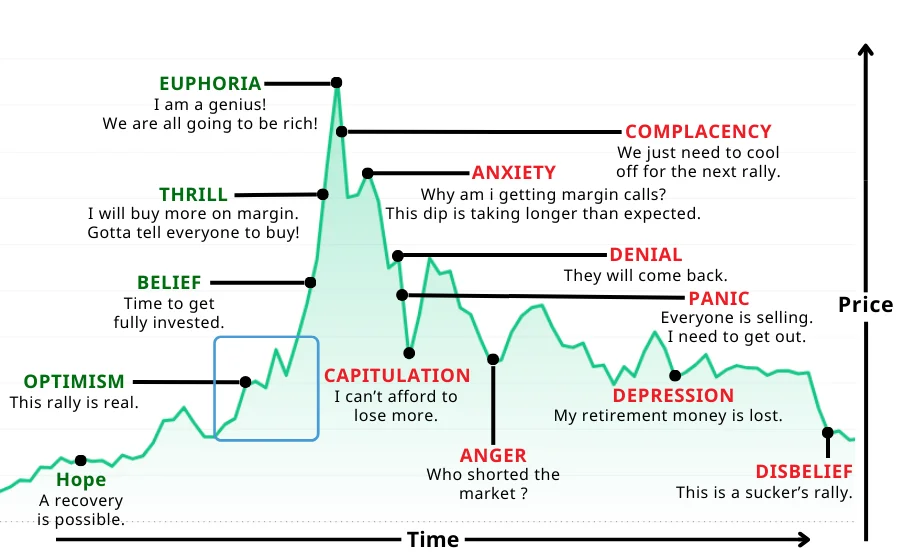

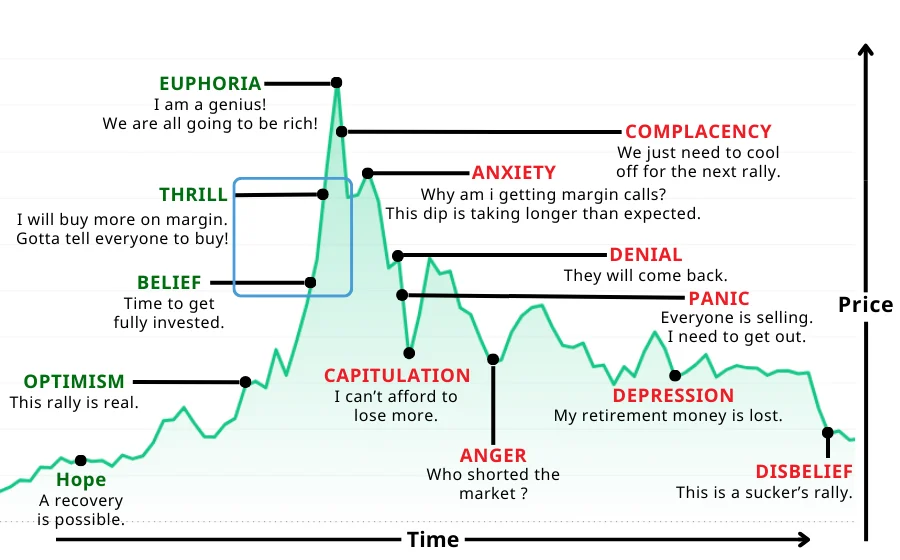

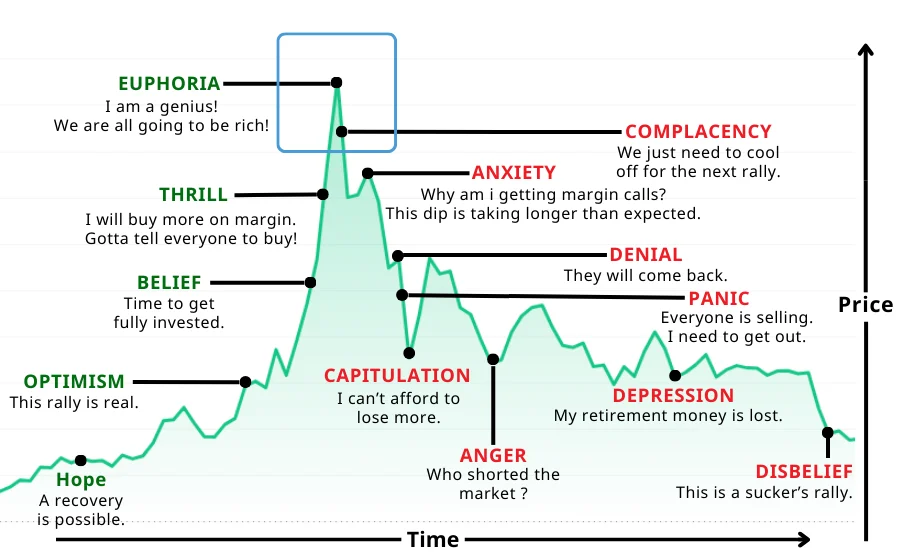

In this section, we’ll use Wall Street Cheat Sheet’s Psychology of the Market Cycle to analyze the market. Based on our analysis, there are four phases in a crypto bull market. As of February 2025, the market is transitioning from the second phase into the third, signaling a period of significant growth and opportunity.

Phase One: Disbelief and Recovery (Late 2023 – Mid 2024)

The accumulation phase occurred after the prolonged bear market of 2022-2023. Looking back, it was the best time to buy. This phase signifies the end of the bear market and the start of a slow recovery. We’re seeing some positive signs, but we’re still recovering from the bear market’s negative impact. Significant changes haven’t occurred yet, but these small improvements indicate progress. Many doubted the return of crypto, but those who believed in its future and invested during this phase are well-positioned for the upcoming crypto bull market. This phase laid the groundwork for the current bull run.

Additional trading tips:

- Identify Quality Projects: Seek projects with potential for the upcoming bull market, characterized by strong product/market fit, competitive advantage, active teams, clear roadmaps, and financial health.

- Conserve Funds: Many investors aim to buy dips from the previous bull market, where prices are 90% lower than their peaks. However, most top performers in the next cycle are not yet listed. It’s often better to invest early in new projects than to focus on past ones.

- Regulate Trading Frequency: Despite a dull market, resist trading out of boredom. Prioritize survival in the crypto market, then profit. Wait for favorable opportunities instead of making random trades.

- Monitor Liquidity: Keep an eye on centralized exchange (CEX) fund inflows, stablecoin minting and overall cryptocurrency market cap. Changes in these factors indicate shifts in market liquidity. More liquidity suggests improving market conditions.

Phase Two: Belief and Accumulation (Mid 2024 – Early 2025)

The phase began in mid-2024, as prices started to rise steadily. This phase is characterized by recovery and a growing belief in a new cycle, as demonstrated by notable price movements: $BTC surging to $73k, $ETH jumping to $4k, and $SOL massively pumping to $200. On-chain indicators and technical analysis charts further support the start of a major cycle. While it’s not as ideal a time to enter as phase one, it’s still an opportune moment to take risks and deploy capital. This is the phase to actively farm airdrops, stake coins, and aggressively build your portfolio in preparation for the upcoming parabolic price movements.

Additional trading tips:

- Cut Losses, Boost Winners: Act swiftly to cut losses and increase holdings in profitable coins. A 5x return doesn’t rule out a 10x return, but it’s crucial to monitor market indicators and sentiment. Timely reduction of losing investments is key.

- Secure Profits: It’s impossible to sell at the peak. Establish and stick to a profit-taking strategy.

- Manage Altcoin Positions: Avoid using significant personal funds to invest heavily in altcoins. While it’s okay to invest in altcoins and meme coins, avoid going all-in or using high leverage.

- Invest Wisely: Coins with rapid price spikes often have average fundamentals. Remember, prices rise with market enthusiasm. Focus on areas with market consensus for potential price increases.

- Beware of Ponzi Schemes: Be cautious of Ponzi-like projects in bull markets. While you can profit from them, ensure you exit before a downturn. Alternatively, avoid them altogether.

- Diverse Insights: Broaden your scope beyond institutional insights; engage with retail investors on platforms like Reddit and YouTube for unique, complementary market perspectives.

Phase Three: Optimism and Consolidation(Early 2025 – Mid 2025)

As of February 2025, the market is entering the euphoria phase. Prices are skyrocketing, and retail investors are flooding the market, driven by fear of missing out (FOMO).

During this phase, people who didn’t own any coins before join the market, and things get wild. The value of your holdings keeps hitting new highs, and there’s news every day. Tokens with shaky fundamentals reach very high prices. Everyone starts to believe that the market will keep going up forever, adding to the excitement of phase three.

Additional trading tips:

- Shift Your Mindset for Risk Management: Adjust risk management to reflect the lower risk-reward ratio at new market highs. Tighten stop-loss orders and consider a conservative portfolio approach.

- Take Profits Strategically: Begin securing profits on assets with significant gains to mitigate exposure during market corrections. Focus on balance rather than exiting all positions.

- Use New Cash Carefully: Approach new investments with caution, prioritizing opportunities with a solid risk-reward balance. Opt for undervalued sectors or assets less influenced by speculation.

- Be Wary of New Entrants and High Volatility: Increased participation and volatility may lead to price instability. Exercise caution with assets that have experienced unjustified rapid growth.

Phase Four: Euphoria and Exit (Could start from mid-2025)

Phase four is the riskiest time to put new money into the market, but strangely, it’s when most people decide to buy. This is your chance to sell and protect your profits. Look out for signs of too much excitement in the market, like the Coinbase app being the top download or a lot of news coverage. Start unstaking your coins, exit any leverage positions, and mostly turn your investments into cash. This phase often precedes a market correction or the beginning of a bear market, signaling the end of the Crypto Bull Market. The aim is to sell before the expected bear market starts, to make sure you keep your financial freedom.

TOP 10 NARRATIVES SHAPING THE CRYPTO BULL MARKET 2025

The Crypto Bull Market 2025 is being driven by several key narratives that are redefining the cryptocurrency landscape. Here are the top 10 narratives to watch:

1. Artificial Intelligence (AI) in Blockchain

AI-powered blockchain projects are revolutionizing the industry by enabling decentralized tools for data analysis, risk management, and contract automation. These innovations are enhancing efficiency and adoption, making AI a key driver of the current bull market.

2. Memecoins

Memecoins like Dogecoin and Shiba Inu continue to capture the imagination of retail investors. Their viral nature and community-driven growth are contributing to the hype and activity in the Crypto Bull Market 2025.

3. Real World Assets (RWA)

The tokenization of tangible assets such as real estate and art is bringing liquidity and accessibility to traditional markets. RWAs are enabling global investments and diversifying portfolios, making them a critical narrative in the current bull market.

4. Decentralized Physical Infrastructure Networks (DePIN)

DePINs are decentralizing essential services like telecommunications and energy through blockchain. These projects are creating efficient systems by merging the physical and digital worlds, reducing costs, and increasing transparency.

5. Solana Ecosystem

Solana’s high-speed, low-cost blockchain continues to innovate in DeFi, NFTs, and gaming. Its scalability and growing institutional interest have positioned Solana as a leader in the Crypto Bull Market 2025.

6. Web3 Gaming

Web3 gaming is introducing blockchain-based economies where players can own and trade in-game assets. This sector is driving adoption by combining entertainment with cryptocurrency, laying the foundation for sustained growth.

7. Liquid Restaking Tokens

Liquid restaking is optimizing staking rewards by unlocking additional yield opportunities. This innovation is increasing network participation and liquidity, aligning perfectly with yield-focused investment strategies.

8. Layer 2 Solutions

Layer 2 solutions like Optimism and Polygon are addressing blockchain scalability challenges by reducing fees and alleviating congestion. These technologies are critical enablers of mass adoption in the Crypto Bull Market 2025.

9. Decentralized Finance (DeFi)

DeFi continues to disrupt traditional financial systems by offering decentralized lending, borrowing, and trading platforms. As DeFi protocols become more user-friendly and secure, they are attracting significant investment.

10.SocialFi: The Rise of Decentralized Social Networks

SocialFi, or decentralized social networks, are gaining traction in 2025. Platforms like Kaia on Line and TON on Telegram are leading the charge, integrating blockchain technology with social media to empower users with ownership of their data and content. These platforms are creating new economic models where users can monetize their social interactions, making SocialFi a key narrative in the current bull market.

HOW TO NAVIGATE THE CRYPTO BULL MARKET 2025

1. Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps mitigate the risk of buying at a market peak during the Crypto Bull Market and allows you to accumulate assets over time, reducing the impact of short-term price fluctuations.

2. Monitor Market Indicators

Keep an eye on key market indicators such as trading volume, market sentiment, and on-chain data. These metrics can provide valuable insights into trends within the Bull Market and help you make informed decisions.

3. Set Clear Goals

Define your financial goals and risk tolerance before investing. Are you looking for short-term gains or long-term growth? Having a clear plan can help you stay focused and avoid impulsive decisions during periods of heightened excitement in the Crypto Bull Market.

THRIVING IN THE CRYPTO BULL MARKET 2025

The Crypto Bull Market 2025 offers immense opportunities for investors, but success requires careful planning and a solid understanding of the market. By staying informed, adopting sound investment strategies, and managing risks, you can position yourself to take full advantage of this exciting period. Remember, the key to thriving in a Crypto Bull Market is to stay disciplined and avoid getting caught up in the hype.

Read more about:

- Bitcoin Halving 2024 Introduction- How Can We Profit from It?

-

Crypto Bear Market – What Causes It and Investment Advice During Recessions

FAQS

- What is a crypto bull market?

A crypto bull market is a period when cryptocurrency prices consistently rise, driven by strong economic conditions and investor optimism.

- What are the phases of a crypto bull market?

The phases of a crypto bull market are Disbelief and Recovery, Belief and Accumulation, Optimism and Consolidation, and Euphoria and Exit.

- Are we in a crypto bull market now?

Currently, we are in the second phase, Belief and Accumulation, of a crypto bull market, with growing confidence in a new cycle.

More articles about the crypto market:

- Why Is Crypto Market Down? 3 Factors You Should Keep an Eye On

- 5 Indicators for Crypto Market Analysis and Where to Find Them

- Crypto by Market Cap Ranking 2024 – Top 10 Cryptos You Should Know – CoinRank

- 4 Best Low Market Cap Crypto to Consider if You’re Bored With Bitcoin

- 2024 Top 5 Crypto Market News Websites

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!