KEYTAKEAWAYS

- Crypto lending allows earning interest by loaning crypto or borrowing funds using crypto as collateral, offering lucrative opportunities.

- Selecting reputable platforms with competitive interest rates and transparent fee structures is essential for maximizing earnings and minimizing risks.

- To boost profitability, diversify lending portfolios, seek high-interest opportunities, opt for longer loan terms, and conduct thorough risk assessments.

CONTENT

WHAT IS CRYPTO LENDING?

Crypto lending allows you to loan out your cryptocurrencies, such as Bitcoin or Ethereum, to others in exchange for interest payments, akin to earning interest from a bank.

This process is facilitated by platforms that can be centralized, like a traditional bank, or decentralized, offering a more direct peer-to-peer connection. These platforms often provide attractive interest rates for your loans, sometimes even exceeding 15%.

For those in need of funds but unwilling to sell their crypto assets, these platforms offer the option to borrow money by using their crypto as collateral. It’s an appealing scenario for both parties: as a lender, you generate earnings from your crypto holdings, and as a borrower, you receive the funds you need while retaining your crypto.

HOW CRYPTO LENDING WORKS

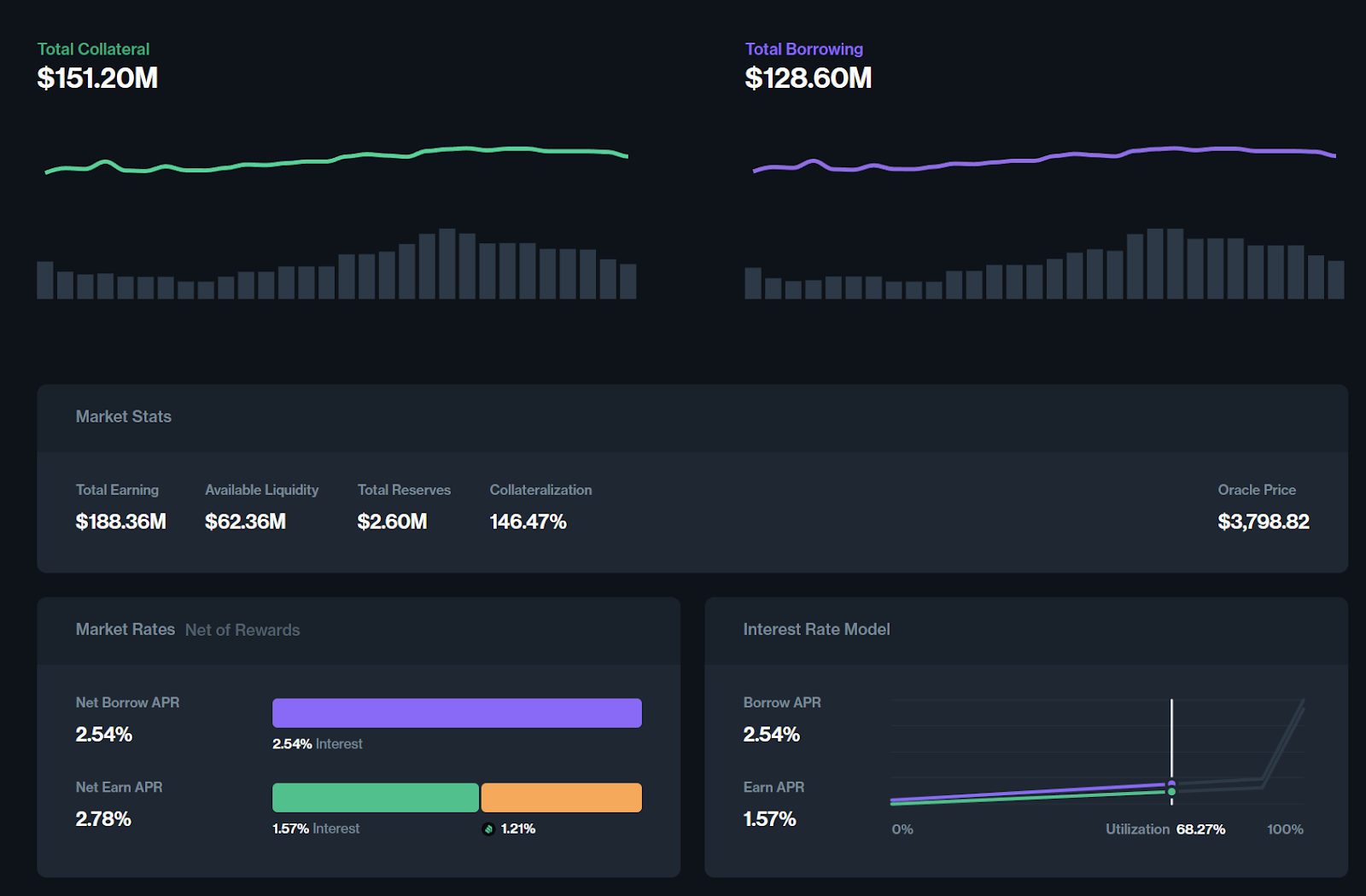

Crypto lending platforms serve as intermediaries. If you’re looking to earn interest, you deposit your crypto into the platform. Borrowers seeking loans provide their crypto as collateral to secure the loan. The platform manages the transaction, setting interest rates for lending and borrowing based on various factors, including market demand and the type of crypto.

Interest rates can vary widely among platforms and cryptocurrencies. Some platforms offer better rates if you agree to lock up your crypto for a specific period.

The process can be centralized, where a single company manages the lending and borrowing, requiring users to register and operate through their system. Alternatively, decentralized platforms allow for a more direct exchange between parties using smart contracts, eliminating the need for a central authority and potentially offering more autonomy and security to users.

CRYPTO LENDING: CHOOSING THE RIGHT PLATFORM

Selecting a suitable crypto lending platform is crucial for maximizing your earnings while minimizing risks. Here are key factors to guide your choice:

- Reputation and Reliability: Look for platforms with a proven track record and positive user testimonials. A reputable platform ensures your investments are in safe hands.

- Security Measures: Your chosen platform should employ robust security protocols to safeguard your digital assets against cyber threats.

- Competitive Interest Rates: Investigate and compare interest rates across different platforms to find the most lucrative opportunities.

- Transparent Fee Structure: Understand all associated fees to avoid any unwelcome surprises that could eat into your profits.

CRYPTO LENDING: HOW TO GET STARTED

Starting your crypto lending journey is simple and easy. Follow these steps to get started:

- Select a Platform: Based on the criteria above, choose a platform that aligns with your needs and expectations.

- Deposit Your Cryptocurrency: Transfer your digital assets into the platform’s wallet. This action is akin to depositing money into a savings account.

- Set Your Lending Terms: Determine your preferred interest rate and loan duration. These terms will dictate the conditions under which your assets are lent out.

- Start Earning: With your cryptocurrencies loaned out, you’ll begin receiving regular interest payments, contributing to your passive income stream.

CRYPTO LENDING TIPS: BOOSTING YOUR PROFITABILITY

To enhance your lending experience and profitability, consider these strategies:

- Diversify Your Lending Portfolio: Spreading your investments across different platforms can mitigate risk and increase potential returns.

- Seek Out High-Interest Opportunities: Stay informed about the interest rates offered by various platforms and opt for those providing higher yields.

- Opt for Longer Loan Terms: Longer lending periods often attract higher interest rates, thereby boosting your overall earnings.

CRYPTO LENDING RISKS: WHAT YOU NEED TO KNOW

While crypto lending presents an attractive avenue for earning, it’s not without risks. Be aware of interest rate fluctuations, the potential for borrower default, and platform-specific risks such as security breaches or operational failures (exemplified by the bankruptcy of Celsius). A thorough risk assessment and ongoing monitoring are essential for safeguarding your investment.

CONCLUSION

Crypto lending offers a compelling opportunity for cryptocurrency enthusiasts to generate passive income and expand their investment horizon. By carefully selecting a lending platform, understanding the associated risks, and employing strategic measures to maximize profits, investors can successfully navigate the crypto lending landscape.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!