KEYTAKEAWAYS

- Crypto liquidations exceed $1 billion, with 85% from long positions.

- Bitcoin and Ethereum account for $367 million and $349.9 million in liquidations, respectively.

CONTENT

Bitcoin and Ethereum lead liquidations as global crypto market cap plunges 13.4%. Analysts point to geopolitical tensions as a potential trigger for the market-wide downturn, with long positions bearing the brunt of the losses.

The cryptocurrency market has experienced a significant downturn, resulting in over $1 billion in liquidations within a 24-hour period. This market turbulence has affected traders across various exchanges and cryptocurrencies, with long positions suffering the most substantial losses.

> Also read: Crypto Market in Turmoil: Bitcoin and Ethereum Lead Massive Selloff

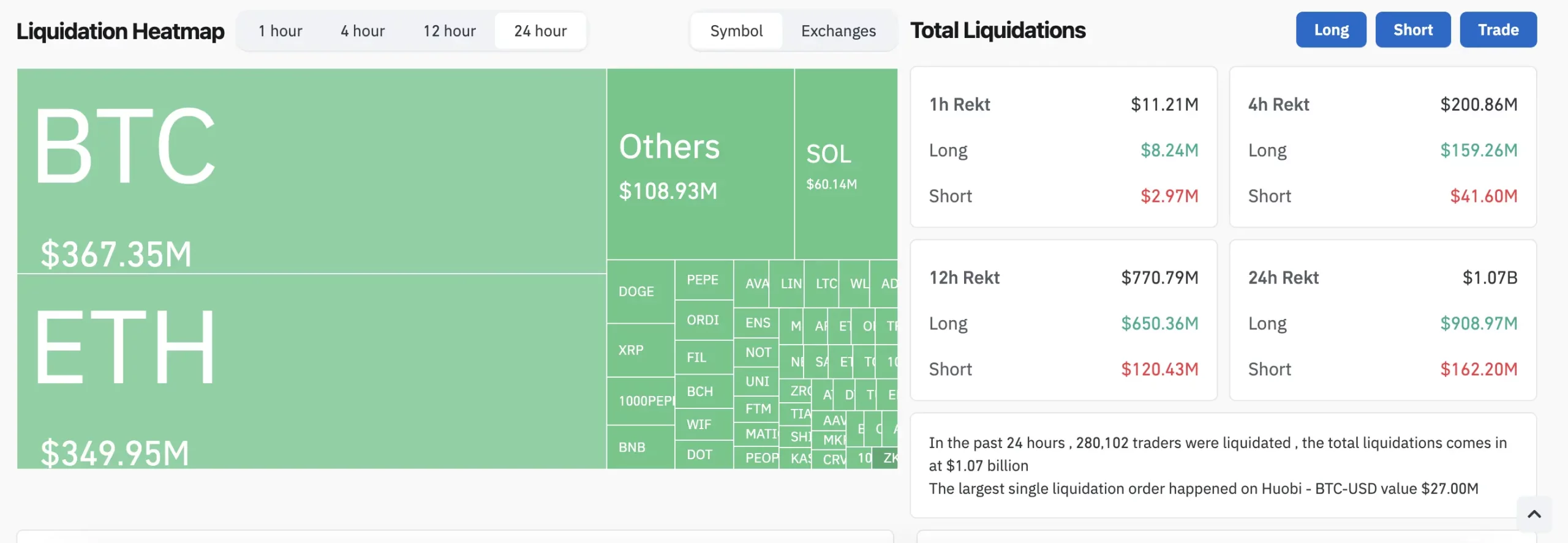

Crypto Liquidation in 24 hours | Source: Coinglass

According to data from Coinglass, total crypto liquidations have reached $1.07 billion, marking a staggering 454% increase over the past day. Long trading positions, which represent bets on price increases, account for approximately 85% of these liquidations, amounting to $900.6 million.

The liquidation wave has impacted over 278,000 traders, with the largest single liquidation occurring on the Huobi exchange, valued at $27 million. Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, have been at the forefront of these liquidations. Bitcoin accounts for $367.3 million in liquidations, while Ethereum closely follows with $349.9 million.

Among cryptocurrency exchanges, Binance leads in liquidation volume with $412 million, followed by OKX with $319.4 million. These figures underscore the widespread nature of the market downturn across multiple trading platforms.

The increased liquidations have coincided with a broader bearish trend in the cryptocurrency market. CoinGecko data shows that the global crypto market capitalization has plummeted by 13.4% in the past 24 hours, currently standing at $1.94 trillion. Paradoxically, the total daily trading volume has surged by 155%, reaching $220 billion, indicating heightened market activity amid the turbulence.

Bitcoin, the leading cryptocurrency, has experienced a 12% decline in the past day, trading at $52,880 at the time of writing. The asset briefly dipped below $50,000, causing its market capitalization to temporarily fall under the $1 trillion mark.

Some analysts suggest that the escalation of geopolitical tensions, particularly the Iran-Israel conflict, may have contributed to the market-wide downturn. This highlights the interconnectedness of global markets and the potential impact of geopolitical events on cryptocurrency valuations.

As the crypto market navigates through this period of volatility, investors and traders are advised to exercise caution and stay informed about both market trends and global events that could influence digital asset prices.