KEYTAKEAWAYS

- Cryptocurrency market cap is a key metric indicating the overall size and value of digital assets, used by investors to evaluate investment potential.

- Bitcoin and Ethereum, despite both being top cryptocurrencies, have different technological focuses and roles, leading to significant differences in their market caps.

- Market cap is a valuable reference for investors, but it's essential to consider other factors like project progress, team background, and token distribution for a comprehensive investment decision.

CONTENT

Learn about market cap comparisons between major cryptocurrencies like Bitcoin and Ethereum, and understand how this crucial metric influences investment decisions in the crypto market.

CRYPTO MARKET CAP COMPARISON: WHAT IS CRYPTO MARKET CAP?

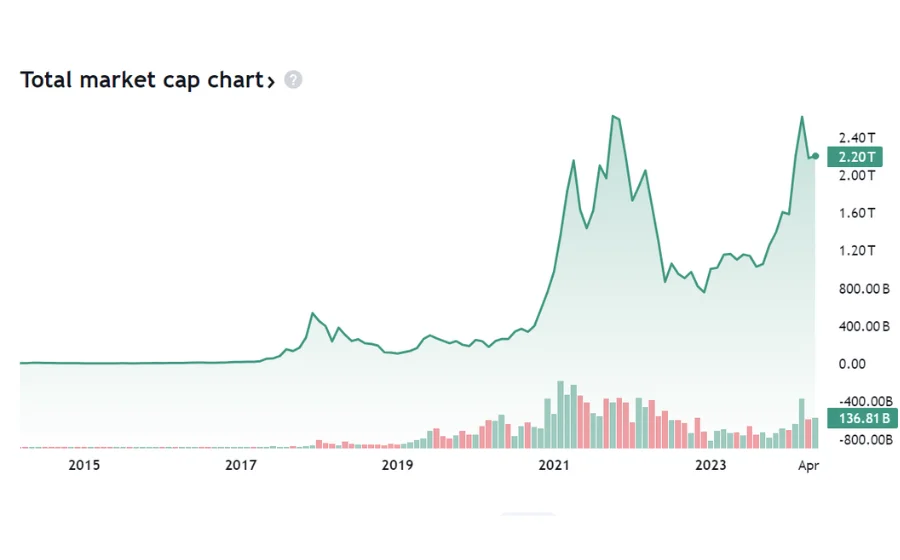

Cryptocurrency market capitalization (CMC) is the total value of all digital assets circulating in the market. It is calculated by multiplying the current price of a cryptocurrency by its total circulating supply.

(source: tradingview)

This metric serves as a key indicator of the overall size and health of the cryptocurrency market, and it is often used by investors to assess the relative value and potential of different cryptocurrencies. Due to the volatile nature of the market, CMC can fluctuate significantly over time. Several websites, such as CoinMarketCap, track and display CMC data, along with crypto rankings, allowing investors to monitor market trends and make informed investment decisions.

-

Crypto Market Cap Comparison With Traditional Financial Markets

The rapid growth of the CMC in recent years has led to comparisons with traditional financial assets. By making crypto market cap comparisons with traditional financial assets and fintech companies, we can gain a deeper understanding of the role and potential of digital currencies in the global economy. For example, Bitcoin’s market cap is now comparable to that of many well-known global financial institutions and tech giants, highlighting its significance as an emerging asset class.

-

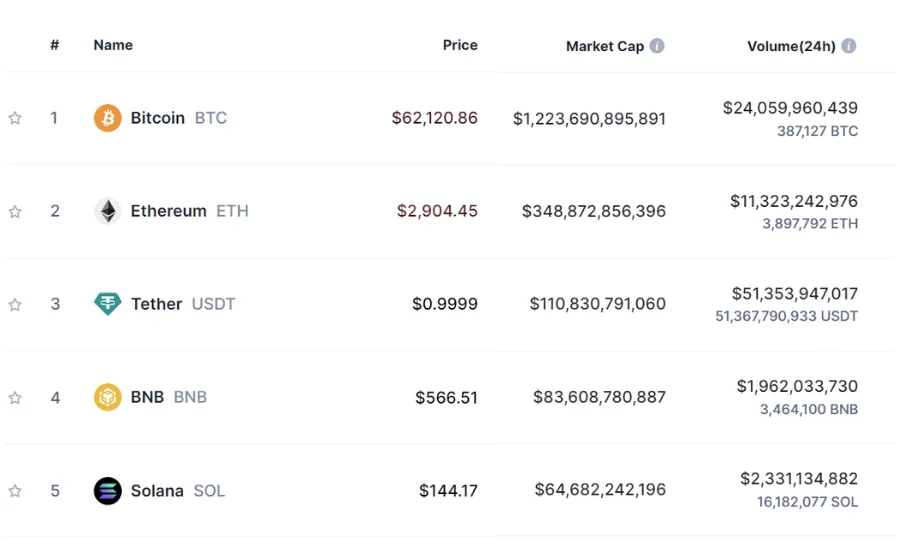

Crypto Market Cap Comparison With Crypto Rankings

Investors often look at crypto market cap comparisons to understand crypto rankings. Below is a chart of the top 5 cryptocurrencies by market capitalization.

(source: coinmarketcap)

>>>Learn more:

Crypto by Market Cap Ranking 2024 – Top 5 Cryptos You Should Know

4 Recommended Crypto Market Live Trackers

CRYPTO MARKET CAP COMPARISON: BTC VS ETH

Bitcoin and Ethereum, while both leading cryptocurrencies, have distinct technological approaches and serve different purposes.

Bitcoin, established earlier, primarily functions as a store of value and medium of exchange, utilizing the Proof of Work consensus algorithm.

Ethereum, on the other hand, introduced smart contracts, enabling the creation of diverse decentralized applications (DApps) beyond simple transactions. This has led to a thriving ecosystem encompassing DeFi, supply chain management, and gaming.

As of May 14, 2024, Bitcoin’s price hovers around $61,000, with a market cap of $1.2T. Ethereum’s price remains around $2,900, with a market cap of $347B. The difference in market cap is significant, with Bitcoin’s market cap nearly three times that of Ethereum.

Why is there such a large gap between Ethereum and Bitcoin’s market caps? This can be analyzed from the following perspectives:

- Positioning and Functionality: Blockchain technology finds its most prominent application in the financial sector, addressing issues like fiat currency devaluation. Bitcoin, often dubbed “digital gold,” is primarily designed to hold value over time, prioritizing this function over additional features like smart contracts. Ethereum, in contrast, focuses on building a broader blockchain ecosystem, with the preservation of value being a less central concern.

- Supply Dynamics: Bitcoin has a fixed supply of 21 million coins, reinforcing its appeal as a store of value. Ethereum’s supply, while currently around 120 million, continues to grow, potentially impacting its long-term value proposition.

- Market Perception and Consensus: The success of a blockchain project hinges on three interdependent factors: technology, ecosystem, and consensus, with consensus being the most critical. This involves building recognition and trust, demanding considerable technological and time investment. Bitcoin, launched on January 3, 2009, has a substantial lead over Ethereum, which started on July 30, 2015. This early advantage allowed Bitcoin to develop extensively, survive multiple crises, and build strong recognition and trust.

>>>More to read :

CRYPTO MARKET CAP COMPARISON: IMPACT ON INVESTORS

Market cap serves as a fundamental metric to gauge the influence and significance of a currency, often surpassing the importance of its price.

Given the nascent and volatile nature of the crypto market, which is susceptible to black swan events, a crypto market cap comparison provides investors with a crucial reference point for assessing investment value and risk.

A cryptocurrency’s market cap not only reflects its market position but also indicates its relative stability and liquidity. Typically, cryptocurrencies with a higher market cap attract more interest from investors due to their perceived stability and higher liquidity.

However, the limitations of market cap cannot be overlooked. CMCs can be subject to manipulation, especially in cases where the market cap of certain projects is artificially inflated.

Therefore, besides considering the market cap, investors should also evaluate other factors such as the progress of the project, the background of the team members, and the distribution of tokens to make a more comprehensive investment decision.

FAQS

- What is Cryptocurrency Market Cap?

It represents the total market value of a cryptocurrency, calculated by current price multiplied by circulating supply.

- Why is Crypto Market Cap Compared to Traditional Markets?

Comparisons help gauge crypto’s significance against established financial assets and its impact on the global economy.

- How are Bitcoin and Ethereum Different?

Bitcoin acts primarily as digital gold, while Ethereum facilitates decentralized applications with its smart contract technology.

- Why Does Bitcoin Have a Higher Market Cap Than Ethereum?

Bitcoin’s fixed supply and established trust contribute to its higher market cap compared to Ethereum’s growing supply.

- What Role Does Market Cap Play for Crypto Investors?

Market cap helps investors assess the relative size, stability, and liquidity of different cryptocurrencies.