KEYTAKEAWAYS

- December features major central bank decisions (Fed, ECB, BOE) and critical economic data releases (NFP, CPI) that could significantly impact Bitcoin's momentum after its November surge to near $100,000.

- Historical December Bitcoin performance shows an even split between positive and negative returns over the past decade, with holiday period volatility typically increasing due to reduced market participation.

- Several significant token unlocks are scheduled (including DYDX, SUI, ADA, APT, and OP), which could create additional market pressure alongside traditional financial events and geopolitical developments.

CONTENT

Comprehensive analysis of December’s crucial financial events affecting Bitcoin, including Fed decisions, economic data releases, and token unlocks. Learn how these catalysts could impact crypto markets in the final month of 2024.

*Ready to explore these opportunities? Trade on Bitget now. Remember: This content is informational only – always trade responsibly.

In November, Bitcoin rose from $70,310 to a high of $99,518 (Bitget data), marking a 37% monthly gain – the second-largest increase this year, bringing it within touching distance of $100,000.

Entering December, Bitcoin continues to exhibit volatility at high levels while alternative cryptocurrencies begin their rally, fueling speculation about an upcoming “altcoin season.” As the final month of the year, will Bitcoin maintain its upward momentum and lead the digital asset market to new heights?

While future market movements remain uncertain, we can prepare by monitoring key market-moving financial events. This article compiles December’s major events: monetary policy decisions from the three major central banks (European Central Bank (ECB), Bank of England (BOE), Federal Reserve); traditional year-end market volatility; holiday market closures; U.S. employment and Consumer Price Index (CPI) data; and potential unexpected market-moving events related to geopolitical developments in Ukraine-Russia and Middle East conflicts.

Understanding these events and their underlying market dynamics can help identify potential investment opportunities.

HOW HAS BITCOIN PERFORMED HISTORICALLY IN DECEMBER?

Examining data from TradingView and other third-party sources:

(Source: CoinRank)

Historical data shows December performance has been mixed, with a 5:5 ratio of positive to negative returns over 10 years, primarily influenced by market cycles and macroeconomic conditions.

MAJOR MARKET-MOVING EVENTS CALENDAR

Note: All times listed are in Eastern Standard Time (UTC-5, EST)

Financial Events

Crypto Events

Key Focus Events:

- Federal Reserve monetary policy decision

- European Central Bank monetary policy decision

- Bank of England monetary policy decision

- U.S. Non-Farm Payrolls Report

- U.S. Consumer Price Index

- Holiday Period Market Activity

December 4, 13:45, Federal Reserve Chair Powell Speech

During his last public speech, Powell stated he was “in no hurry to cut rates.” After last night’s sudden martial law in Korea, unexpected surge in job openings, and Fed officials calling for caution, will Powell provide any hints about rate cut expectations tonight? Could this trigger market movement?

As Federal Reserve Chairman, his speeches serve as indicators for future monetary policy, carrying more influence than any other figure. His remarks often contain clues about future monetary policy, serving not only as crucial input for future investment strategies but potentially causing short-term market fluctuations.

December 6, 08:30, Non-Farm Payrolls Report

U.S. October non-farm payroll additions were just 12,000, the smallest increase since December 2020 and well below the expected 113,000, cementing the case for a November rate cut.

This month’s NFP release comes just before the Fed’s monetary policy meeting. Last month’s performance was affected by Hurricanes Milton and Helene, as well as the Boeing strike. Some institutions predict 195,000 new jobs this month – if accurate, this could diminish December rate cut prospects, while lower numbers would increase the likelihood.

Historically, each NFP release day causes tremors in global financial markets, earning the nickname “Non-Farm Night.” There have been instances where abnormal NFP data triggered crypto market crashes, so investors should manage risks accordingly.

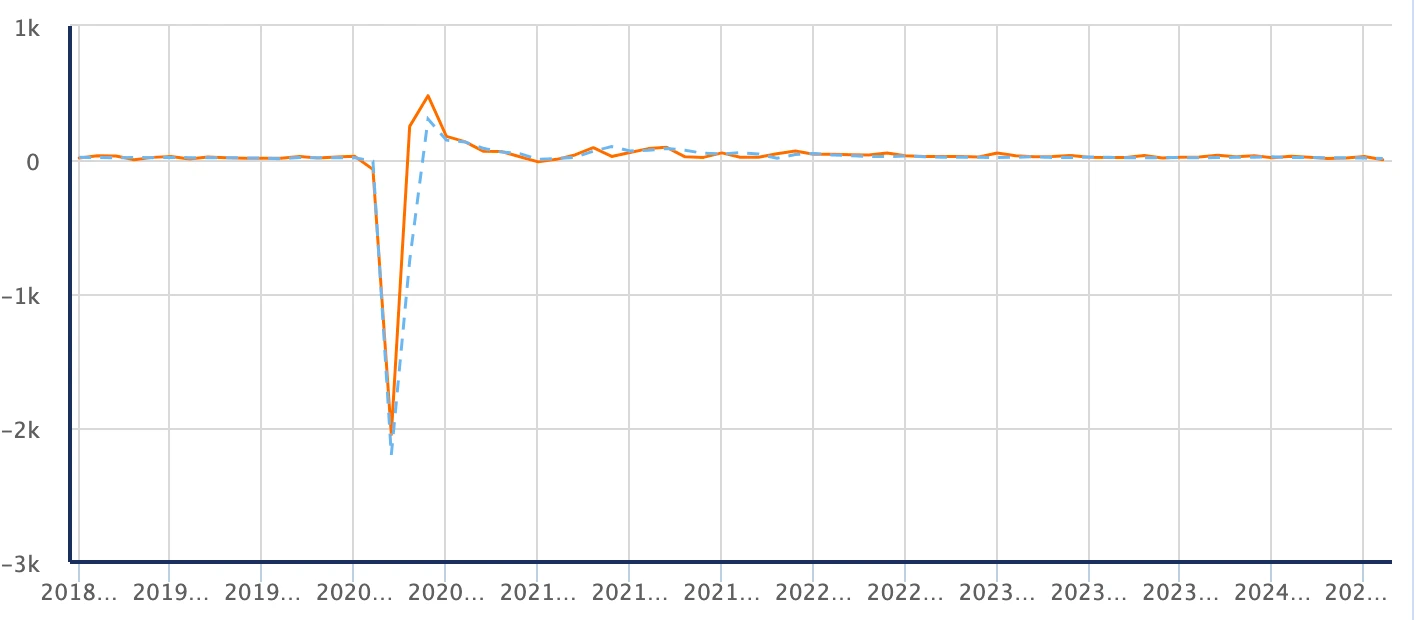

U.S. Non-Farm Payrolls- Forecast vs. Actual Comparison

(Source: fx678)

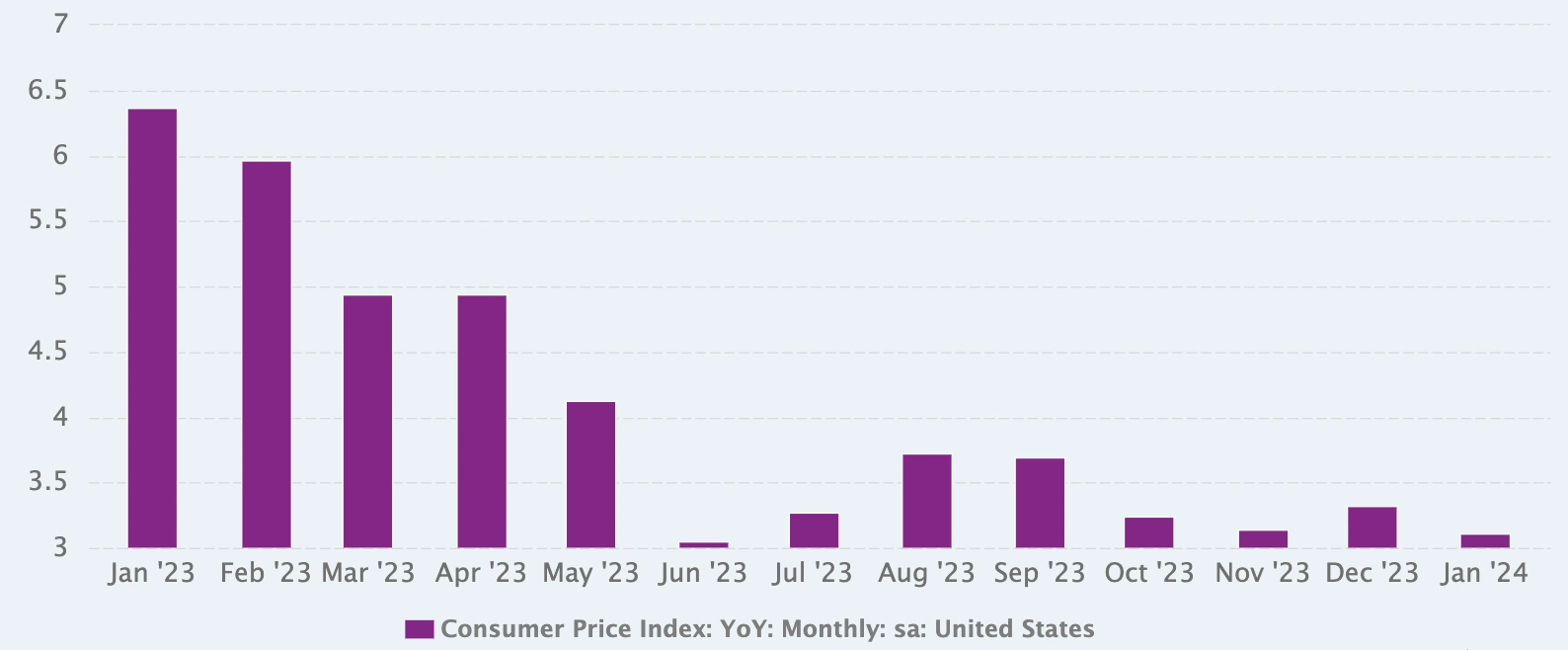

December 11, 08:30, U.S. November Consumer Price Index Release

Last month’s data showed U.S. core CPI holding steady, with monthly year-over-year growth rising to 2.6%, up 0.2 percentage points from the previous month. However, core CPI year-over-year growth remained stable at 3.3%. Overall, U.S. inflation is easing, which set the foundation for last month’s rate cut.

Bringing inflation back to 2% is the Fed’s long-term monetary policy goal, making CPI one of the most important factors in rate decisions. This month’s CPI release comes just one week before the Fed meeting. If CPI data aligns with expectations and remains stable, markets should remain relatively calm. Better-than-expected figures would support rate cuts and potentially drive markets higher, while worse figures could trigger declines.

U.S. CPI Data Changes Over the Past Year

(Source: CEIC Data)

December 12, 08:15, European Central Bank Monetary Policy Decision

ECB Governing Council member Holzmann recently suggested the ECB might cut rates by 25 basis points in December, but ruled out larger cuts.

The market consensus expects the ECB to cut rates at every meeting before June next year, with rates projected to fall to 1.75% by the end of 2025 to stimulate economic growth. However, Trump’s inauguration on January 20th next year could bring comprehensive import tariffs, potentially creating upward inflation pressure in Europe and affecting the ECB’s rate cut timing.

As one of the world’s three major central banks, the ECB’s monetary policy influence on global economics and financial markets is second only to the Fed. If this meeting delivers the expected 25 basis point cut, it should generally benefit crypto markets, though short-term market movements may be limited.

December 18-19: Major Central Bank Decisions

Federal Reserve (14:00, Dec 18) Bank of England (07:00, Dec 19) Bank of Japan (22:00, Dec 18)

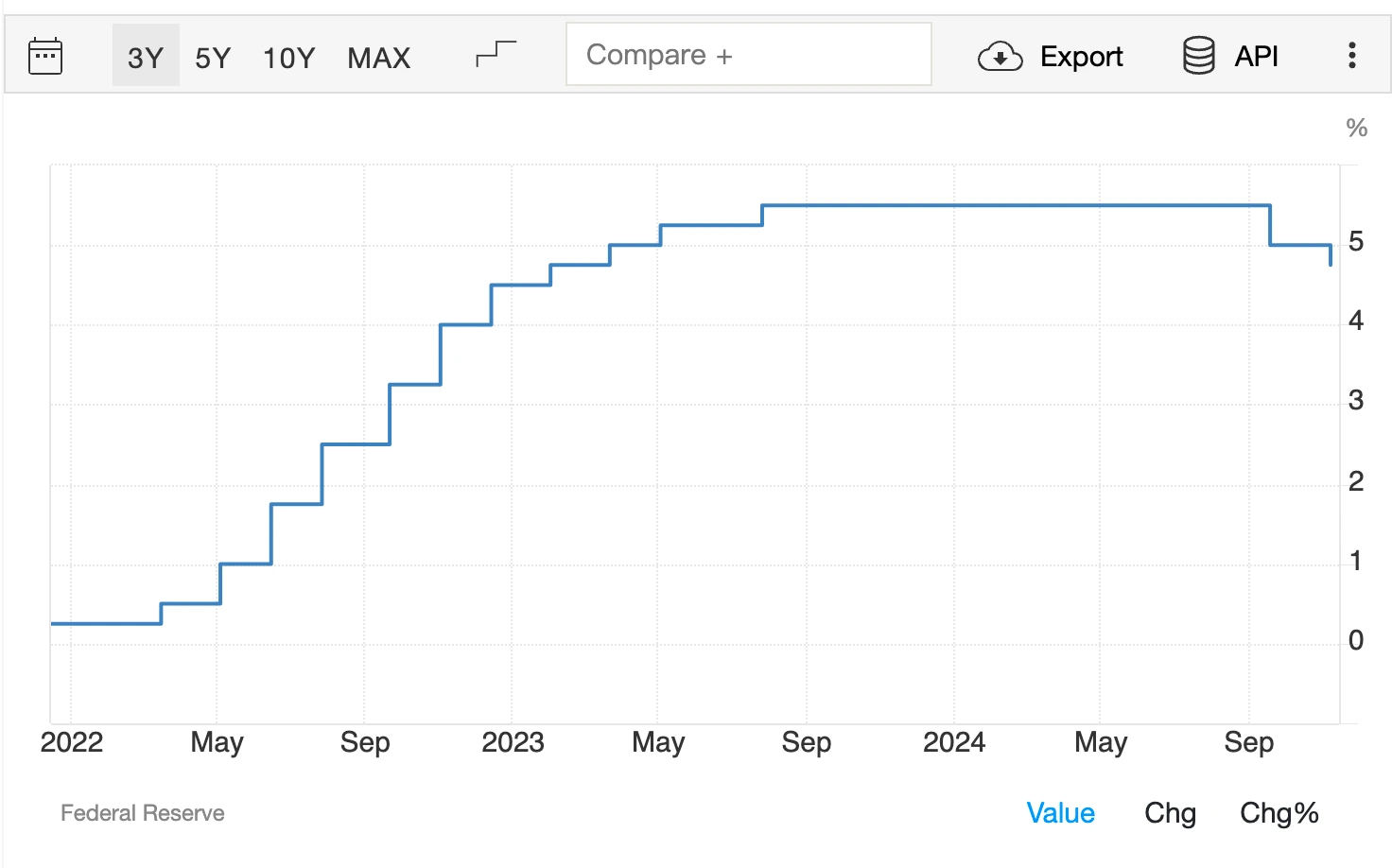

For the Fed’s final battle this year, the market mainstream still expects a 25 basis point cut, with CME’s FedWatch Tool showing a 72.9% probability.

However, recent Fed officials have been “diplomatic,” saying they still believe inflation will reach the 2% target and hinting at support for future rate cuts, while carefully avoiding specific comments about December’s decision. The upcoming U.S. NFP and CPI data will be crucial – if they meet expectations, a 25 basis point cut is virtually certain and should receive positive market feedback.

The Bank of England cut rates by 25 basis points in November and may follow the Fed’s lead this month, while the Bank of Japan is expected to raise rates by 25 basis points. However, the Fed’s influence is undoubtedly greater, and market performance that day will primarily follow the Fed’s actions.

U.S. Interest Rate Changes Over the Past 3 Years

(Source: Trading Economics)

December 24-25, Holiday Period

Historically, the crypto market often experiences major price drops or volatile movements around Christmas, leading to the term “Christmas robbery.” For example, Bitcoin saw a significant correction around Christmas 2017, falling from nearly $20,000 to around $13,000. Similar volatile movements occurred in 2019 and 2021.

The main reasons likely include tax-related factors, such as year-end tax-loss harvesting or profit-taking, reduced participation during holidays, and financial institution closures. Investors should manage risks and prepare accordingly.

December 31, Market Closures

Early Close:

- Hong Kong Exchange (HKEX): 12:00

- Singapore Exchange (SGX): 12:00

- London Stock Exchange (LSE): 12:30

- Euronext Paris: 09:05: 14:05

ADDITIONAL FINANCIAL EVENTS

Other Central Bank Decisions:

- Reserve Bank of Australia (December 9)

- Bank of Canada (December 11)

- Swiss National Bank (December 12)

Token Unlocks Schedule:

- DYDX: December 1, 8.33M tokens ($15.25M)

- SUI: December 3, approximately 34.62 million tokens

- ADA: December 6, approximately 18.53M tokens

- APT: December 12, 11.31M tokens ($155.17M)

- OP: December 31, approximately 31.34M tokens

Specific unlock dates and quantities may adjust based on actual conditions. Token unlocks typically influence price action and require comprehensive analysis of market conditions, risk metrics, and token fundamentals for informed investment decisions.

STRATEGIC OUTLOOK

The cryptocurrency market’s global nature and increasing integration with traditional finance amplify its sensitivity to various market influences. December presents multiple scheduled events and potential unexpected developments, including geopolitical factors and regional security situations, which could trigger significant market movements.

While this analysis highlights major events, market dynamics involve numerous variables. Individual events may have varying impact scales, potentially representing either significant risks or opportunities for individual investors.

This information serves educational purposes only and does not constitute investment advice. Comprehensive research and analysis remain essential for informed investment decisions.

▶ Buy Crypto at Bitget