KEYTAKEAWAYS

CONTENT

Explore how Trump’s presidency impacts the crypto market, from the explosive TRUMP token to potential political memecoins. Learn about key investment opportunities and market strategies in this new era of digital assets.

On January 20th last month, the highly anticipated Trump presidential inauguration took place as scheduled, marking the official entry of the crypto market into the “Trump Era.”

Prior to this, a single tweet from Trump caused the memecoin named after him, “TRUMP,” to surge from $0.182 to a peak of $77.6 (according to Bitget data) in a short period – a gain of over 400x. While this created numerous wealth success stories, it also sparked considerable controversy.

Trump’s tweet about TRUMP

(Source: X account)

At the height of TRUMP’s success and extreme FOMO, Trump’s wife Melania seized the opportunity to launch her own cryptocurrency, MELANIA, on the Solana blockchain, sending the market into another frenzy.

As a president getting involved in cryptocurrency issuance, some argue that Trump is abusing his power and blurring the lines between government roles and commercial interests. Others contend that Trump issued the token as a private individual before taking office, seeing no issues with it. Regardless, as the upcoming U.S. president for the next four years, Trump’s move could have far greater implications than people imagine.

TRUMP’S 400X SURGE: IS THE POLITICAL MEMECOIN MARKET EXPLODING?

With just one tweet on January 18th last month, Trump caused TRUMP to surge over 400x. Though the approach was straightforward and sparked controversy due to legal and regulatory concerns, as well as differing opinions, the results were undeniably impressive.

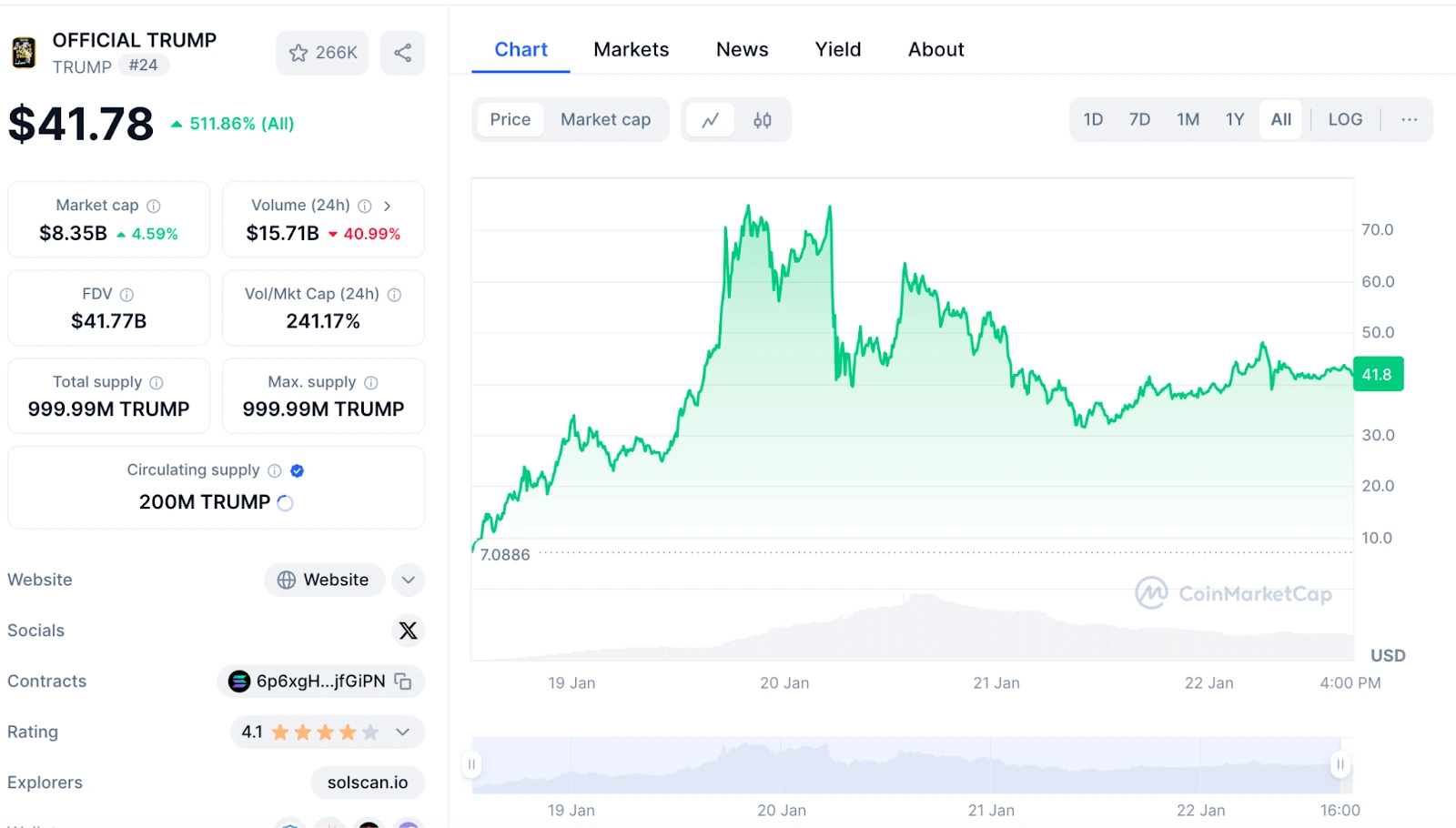

TRUMP reached a fully diluted valuation (FDV) of $80 billion and an actual market cap of $16 billion. Even after corrections, it still maintains a market cap of over $8 billion. In comparison, the Trump family built their wealth over three generations to reach $4 billion. In essence, during the final two days before U.S. constitutional salary provisions took effect, the Trump family extracted tens of billions of dollars from the crypto sphere through memecoins.

TRUMP token price information

(Source: CoinMarketCap)

Such explosive wealth creation is bound to attract attention. TRUMP’s issuance might set a precedent, potentially spawning a political memecoin market concept and triggering a “blockchain spring.”

Trump himself is a highly controversial and influential political figure, and now as U.S. president, he naturally attracts attention and interest, easily drawing investors and market focus. His launch of the TRUMP memecoin might inspire imitation from political leaders in countries with weaker currencies, particularly in regions like Africa, Central America, South America, Southeast Asia, and the Middle East.

Why would these regions be the first to imitate? These countries with weaker currencies have relatively fragile economic foundations and often face high inflation, currency devaluation, and insufficient foreign exchange reserves. Issuing memecoins could attract capital inflow through international markets and improve domestic economic conditions. For example, Venezuela previously attempted to issue Petro, a digital currency backed by oil.

Moreover, these regions have relatively weak legal systems, making it convenient for political figures to use memecoin funding to pursue influence and consolidate power. Issuing digital currencies can help these countries’ leaders generate buzz in international markets, attract more attention, and enhance personal or national influence. For instance, when El Salvador made Bitcoin legal tender, it instantly drew attention from the global crypto market.

From a practical standpoint, these regions’ lack of infrastructure and financial facilities actually makes them more receptive to blockchain and digital currencies. Issuing digital currencies can directly leverage blockchain technology to fill gaps in traditional financial systems while increasing public participation in local economies.

Memecoins have low technical barriers and high potential returns. After seeing TRUMP’s surge, leaders in these regions might hope to achieve similar short-term gains while attracting economic attention to their countries.

Regarding user demographics, memecoins’ core user base consists of young people who are highly receptive to digital currencies and pay close attention to political figures’ brands. Political leaders issuing memecoins can spark enthusiasm among youth groups and even use it as a new tool for political mobilization.

If other political figures or related events follow suit, it could trigger more politically-related memecoin issuances, forming a new concept sector: political memecoins, which could present decent speculative/investment opportunities for investors.

So, how can one capture these opportunities?

From the above analysis, it’s clear that investors looking to capitalize on politically-related memecoins need to closely monitor media and information sources that can quickly spread and drive market sentiment.

For instance, social media platforms are where political memecoin trends often explode. Follow Trump himself and related political figures’ official Twitter (X) accounts, as well as crypto KOLs like Elon Musk, CZ, Vitalik, etc. Also follow memecoin-focused communities or accounts like @ShibaToken, @DogeCoin, and official exchange accounts such as Binance, Gate.io, and Bitget.

Beyond Twitter (X), pay attention to Reddit, where many memecoin discussions and promotions first appear in relevant subreddits: r/cryptocurrency, r/MEMEcoins, r/Bitcoin, etc.

Reddit MEMEcoin section

Other crypto market-related platforms like Telegram, Discord, YouTube, and TikTok are worth monitoring based on personal preferences.

For news sources, regularly check crypto news and information websites like CoinDesk, CoinTelegraph, The Block, and Decrypt. Also monitor cryptocurrency market and tool platforms like CoinMarketCap, CoinGecko, Nansen, and DEXTools for real-time trading data.

In essence, capturing political memecoin opportunities requires multi-channel information gathering, timely trend tracking, and sharp judgment to quickly obtain information and participate in trades, while setting proper profit-taking and stop-loss points to avoid blind chasing.

WHICH COINS SHOULD BE PRIORITIZED DURING THE “TRUMP ERA”?

Over the next four years, Trump as U.S. president will significantly impact the crypto market. Besides the potential political memecoins mentioned above, which existing coins or projects in the market are worth watching?

First are U.S.-based blockchain projects. Beyond riding Trump’s slogan of “making America the crypto capital,” Trump’s “America First” policy might indirectly benefit blockchain projects developed by U.S. teams, especially platforms supporting enterprise applications and large-scale transactions.

Examples include:

- Solana (SOL): Headquartered in the U.S. with deep integration into the domestic tech ecosystem. If the U.S. government or enterprises support domestic technology, Solana could be a primary platform choice.

- Avalanche (AVAX): Team based in the U.S. with strong performance in legal and compliance aspects, potentially standing out in a regulation-friendly environment.

- Polygon (MATIC): Actively collaborating with traditional enterprises (like Disney, Starbucks) to provide blockchain-based solutions.

- Stellar (XLM): Designed for U.S. regulatory compatibility, potentially benefiting if the U.S. advances cross-border payment innovation.

- Filecoin (FIL): Developed by U.S. technical teams with synergy potential with domestic cloud service markets.

Other projects and coins that might benefit from Trump’s presidency include Cosmos (ATOM), Algorand (ALGO), Hedera (HBAR), Arbitrum (ARB), Optimism (OP), Ripple (XRP), and Celo (CELO).

The second potentially profitable concept coins are decentralized payment and asset protection coins, such as Bitcoin (BTC), Monero (XMR), Dash (DASH), Litecoin (LTC), Ethereum (ETH), and Cardano (ADA). This is mainly because the Trump administration might continue right-wing policies advocating less government intervention.

The third potentially profitable concept coins are those purchased by Trump’s crypto funds, such as ETH (largest holding, exceeding 600 million USDT), WBTC, ENA, TRX, AAVE, LINK, ONDO, etc., for obvious reasons.

MARKET OUTLOOK UNDER TRUMP’S PRESIDENCY

Since Bitcoin broke $100,000 on December 5th, there have been four major 10,000-point drops in a month and a half, making for difficult but thorough market corrections, especially harsh on altcoins! Now, after a month of consolidation, Bitcoin is choosing to break upward and won’t likely stop at $110,000.

Currently, with Trump officially becoming U.S. president, most investors see this as a long-term positive, and TRUMP’s explosion could be said to carry too many expectations from the crypto market. Coming from the U.S. president’s hand, who wouldn’t speculate this is the beginning of the new U.S. administration further embracing cryptocurrencies?

Although Trump’s inauguration speech didn’t mention digital currency, causing some anxiety, there’s no need to rush. With Musk by his side and the Trump family fund continuously buying ETH and other digital currencies, while also issuing coins, the market won’t see just one wave.

Overall, Bitcoin will continue its upward trend, with these negative factors causing short-term volatility but not changing the main direction. Trump is now U.S. president! The fourth halving bull market will enter the fast lane!

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!