KEYTAKEAWAYS

- Bitcoin and Ethereum led the crypto market trend with over 50% gains, while TON emerged as the top performer with a 211% increase.

- The crypto market trend showed an elevated primary market, making secondary market profits more challenging for small investors.

- Key crypto market trend factors for the second half include US interest rates, Ethereum ETF approval, and the US Presidential election's impact on regulations.

CONTENT

An in-depth exploration of crypto market trends in early 2024, examining performance, narratives, and strategic outlooks for investors in the latter half of the year.

On July 5, 2024, Bitcoin hit a new low in this bull cycle, dropping from $71,000 to $54,000 in a month, a decline of over 20%. During such turbulent times, it is always wiser to take a step back and look at the market more comprehensively. CoinRank will review the overall crypto market trend in the first half of the year, examine the market performance, key data, strong cryptocurrencies, and narratives, and provide an outlook for key events worth noting in the second half.

CRYPTO MARKET TREND: PERFORMANCE OF TOP CRYPTOCURRENCIES

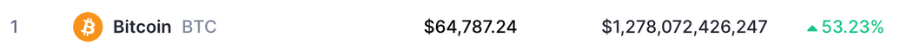

Market Focus in the First Half: Bitcoin – Up 53% This Year

(source: CoinMarketCap)

Despite recent declines, Bitcoin (BTC) has still risen by 53% so far in 2024.

Two key events in the first half of 2024:

- Bitcoin Spot ETF Approval in Early January

- Bitcoin’s Fourth Halving at the End of April

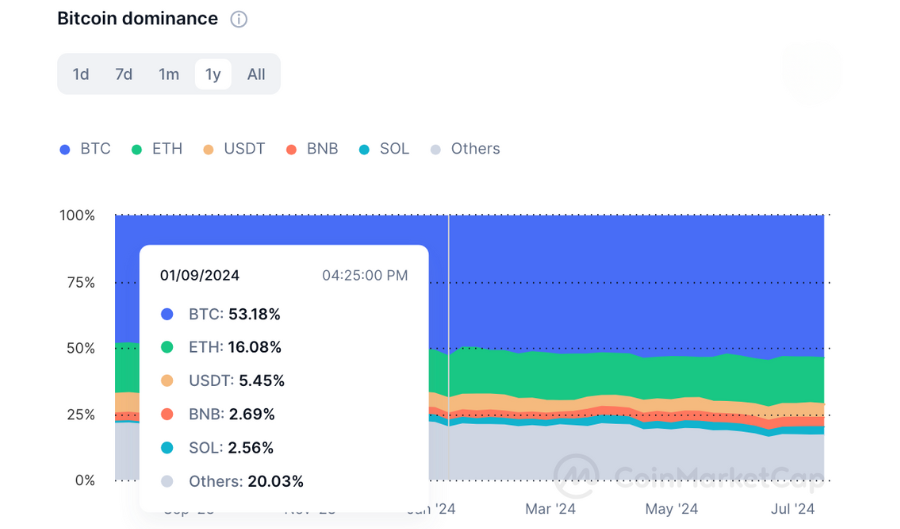

(source: CoinMarketCap)

Throughout 2024, Bitcoin’s market dominance has remained above 50%, making it the market’s focal point.

(source: CoinMarketCap)

The price increase of Bitcoin has been driven by the anticipation and subsequent approval of the Exchange-Traded Fund (ETF).

Prior to the ETF approval, the market anticipated the approval, which led to price increases. Following the approval, there was some profit-taking, but new highs were reached thereafter.

Given the significant impact of ETFs on Bitcoin, it’s crucial to continuously track ETF fund flows. Platforms like The Block provide clear statistics on ETF fund flows, with the primary focus being on whether the trend of fund inflows changes.

If there are continuous net inflows, it indicates that institutions and investors are still entering the crypto market, maintaining the overall trend. However, if the fund flow shifts to net outflows or becomes neutral, the crypto market trend may change. Without continuous external capital entering the crypto market, internal competition will become more intense, making the selection of high-quality projects more critical.

>>> Read more:

-

Bitcoin Halving 2024: Will It Be Different From the Previous Three?

- Crypto Bull Market 2024: What It is and When to Buy

Possible Market Focus in the Second Half: Ethereum – Up 50% This Year

![]()

(source: CoinMarketCap)

Historically, in previous bull markets, Ethereum has outperformed Bitcoin in terms of price increases. However, so far this year, Ethereum’s increase has been less than Bitcoin’s.

Since the first half of the year was focused on Bitcoin, the crypto market trend in the second half may shift focus. The Securities and Exchange Commission (SEC) has already approved the Ethereum Spot ETF, pending the approval of the S-1 filing, which is expected this month or, as stated by the SEC chairman, by this summer.

>>> Read more: 9 ETH Spot ETF Applications Under SEC Review

Top Gaining Cryptocurrency: TON – Up 211% This Year

![]()

(source: CoinMarketCap)

According to CoinMarketCap, among the top ten cryptocurrencies excluding stablecoins, TON has seen the highest increase. At the beginning of the year, TON was outside the top ten but managed to break into the top ten in the first half of 2024, marking it as one of the strong cryptocurrencies, with its ecosystem still in an explosive growth phase.

>>> Read more:

-

Ton, Its Potential Projects and Airdrops 2024 – What Can We Expect From This Growing Ecosystem?

- Toncoin: Telegram’s Cryptocurrency

CRYPTO MARKET TREND: PERFORMANCE OF POPULAR NARRATIVES

Narratives refer to the focus and discussion on specific themes, such as Layer 2, DePIN (Decentralized Physical Infrastructure Networks), RWA (Real World Assets), ZK (Zero-Knowledge Proofs), and parallel EVM (Ethereum Virtual Machine). Narratives represent the topics people discuss, while sectors represent specific technologies or applications.

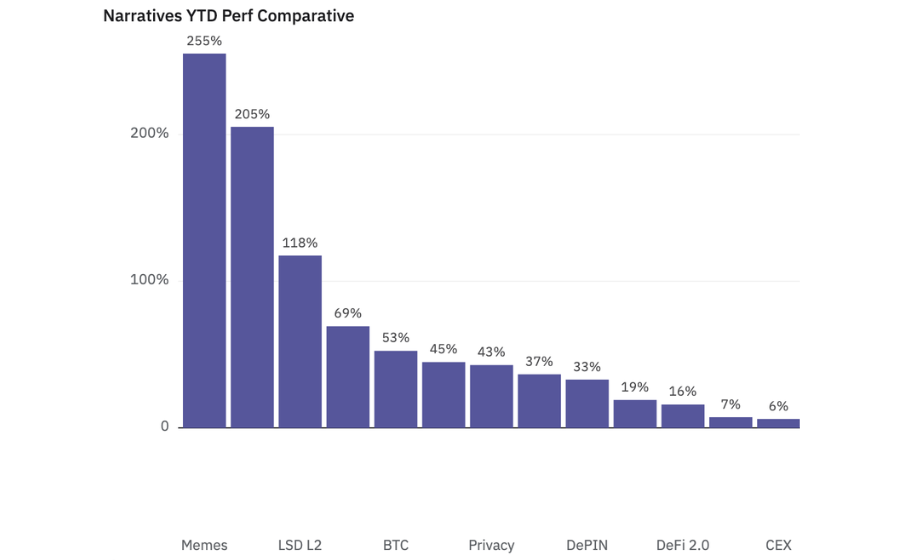

Top 10 Narratives in the First Half

(source: Dune)

1. Memecoins

Top Memecoins 2024- What You Need to Know

3 Memecoins to Make You a MILLIONAIRE in July 2024!!

2. RWA

Ondo: The Leading Protocol in the RWA Sector

Real-world Assets (RWA): Bridging Traditional And Defi Markets

3. LSD (Liquid Staking Derivatives) L2

4. Identity

5. BTC

A Ten-Year Review of Bitcoin’s Performance: Why Has Bitcoin Surged Over 10,000%?

Bitcoin ETF Investors Capitalize on Market Dip: Daily Inflows Surge to $295M

6. Bitcoin Narrative

What Is Bitcoin Cash (BCH): Role and Future

Runes, the New Protocol on Bitcoin Blockchain You Should Know About

7. Privacy

8. AI

Is AI the Answer to Crypto Mining Companies?

9. DePIN

DePIN Made Simple | Top 3 DePIN Projects

10. Account Abstractions

Unique Crypto Market Trend of This Bull Market

- Bitcoin remains a relatively stable and high-yield investment, even compared to other altcoins.

- Memecoins becoming mainstream.

The possible reasons are that the ETF has brought in many new participants, including institutions and traditional investors. For these new external participants, Bitcoin might be the only widely known cryptocurrency, followed by Ethereum. As new participants flood in, the market becomes more complex and influenced by more factors, making memecoin narratives the only native crypto narrative, thus receiving more attention from the existing crypto community.

>>> Read more: Bitcoin Set to Take Center Stage After the U.S. Election

Observations from the Top Narratives Crypto Market Trend

In addition to the two unique aspects mentioned above, another key observation is the increased focus on applications related to the real world. Narratives such as RWA, Identity, AI, DePIN, and account abstraction reflect blockchain’s practical applications in the real world. As cryptocurrencies gradually extend beyond the crypto space, blockchain and crypto technologies are increasingly integrating with real-world applications, making narratives with real-world applications more promising.

CRYPTO MARKET TREND: WHAT’S DIFFERENT?

A widely observed crypto market trend is that the primary market is becoming more elevated, while the secondary market is seeing less enthusiasm. More institutions are participating in cryptocurrencies, and project financing amounts are increasing, which raises the valuation in the primary market. When tokens enter the secondary market, they are already at a high valuation, compressing investors’ profit margins and reducing participation in the secondary market, leading to some initial public offerings being priced lower than expected.

For small investors who cannot participate in private sales, this means that profits are harder to come by as token listing prices are already high, increasing the difficulty of trading. However, it also means that participating more actively in the primary market can offer more profit opportunities.

Airdrops are a low-cost way for small investors to participate in the primary market, and their importance has increased compared to the past.

>>> Read more: The Impact of Airdrops in the Cryptocurrency Market: A Data-Driven Analysis

Another observation is the absence of an altcoin season this time around. In previous bull markets, Bitcoin would lead the rally, followed by altcoins, resulting in a widespread altcoin rally known as the “altcoin season.” However, this time, altcoin season has yet to appear. While various popular sectors have experienced brief rallies, there hasn’t been a broad-based increase. This might be because the cycle rhythms differ each time, making it unclear whether there will be no altcoin season or if it just hasn’t occurred yet.

Overall, this market cycle has shown increased trading difficulty, no widespread rally, and a higher importance on selecting quality projects.

(source: SoSoValue)

Although there hasn’t been a broad-based rally, strong altcoins in each sector have still seen increases of several tens of times over the year. With the number of tokens multiplying several times over, if there isn’t an influx of excess capital into the market, it will be difficult to convert the stock market into a growth market.

CRYPTO MARKET TREND: OUTLOOK FOR THE SECOND HALF OF 2024

Key Points from the First Half

Top Performing Narratives:

- Bitcoin Ecosystem

- Memecoins

- Real-World Applications (RWA, DePIN, AI)

Market Changes:

- Elevated primary market

- Reduced space in the secondary market

- Faster sector rotations, no widespread rallies

Key Focus Areas for the Second Half

Capital:

- US interest rate cuts

- Ethereum ETF

Key Events:

- US Presidential Election

Capital remains the most critical factor in a bull market, significantly influencing the overall trend. Key crypto market trends to watch in the second half include whether the US will cut interest rates, when the Ethereum ETF will be listed, and how much capital it will attract once listed.

The US currently has the most significant impact on cryptocurrencies, with a considerable difference in attitudes between the Democratic and Republican parties towards crypto. The ruling Democratic Party has a more stringent stance on cryptocurrencies, while the Republican Party is more open. The outcome of the next US Presidential election will be a major catalyst.

Trading Strategies for the Second Half

Seeking Primary Market Participation Opportunities:

- Airdrops, Launchpads, Initial Coin Offerings (ICOs)

Asset Allocation:

- Balancing investments in mainstream coins, altcoins, and memecoins

Joining Communities for Information:

- Gaining market insights and understanding market dynamics

Based on the overall crypto market trend in the first half, several strategic directions can be summarized:

1. Participate in low-cost primary market opportunities such as airdrops and launchpads.

2. With fast sector rotations and no widespread rallies, unless you have exceptional market insight, using a diversified portfolio approach can yield more stable profits in such a market.

3. It’s also important to pay attention to the allocation ratio between mainstream coins, altcoins, and memecoins.

For those who feel uncertain about market timing, considering a dollar-cost averaging strategy might be the simplest approach.

Overall, with the increased trading difficulty, information becomes even more critical. Joining communities for discussion can help establish faster and more reliable information sources.

FAQS

- What was the dominant crypto market trend in the first half of 2024?

Bitcoin’s performance, driven by spot ETF approval and halving, with a 53% increase despite recent declines.

- How did the crypto market trend affect small investors?

The elevated primary market made secondary market profits harder, increasing the importance of airdrops and primary market participation.

- Which top crypto showed the highest gains in 2024 so far?

TON (Telegram Open Network) saw a 211% increase, breaking into the top ten cryptocurrencies.

- What are the key events shaping the crypto market trend in the second half of 2024?

US interest rate decisions, Ethereum ETF approval, and the US Presidential election.

- How has the narrative focus changed in the current crypto market trend?

Increased focus on real-world applications like RWA, DePIN, and AI, alongside memecoins becoming mainstream.

>>> Read more: