KEYTAKEAWAYS

- Ethereum ETF approvals loom as Bitcoin finds support at $55,000. Short-term rally expected, but medium-term technical damage limits bullish outlook.

- Futures traders remain long despite price declines. Grayscale Ethereum Trust's NAV discount narrows, but potential ETF conversion could increase selling pressure.

- Bitcoin ETF inflows continue, but at a slower pace. Upcoming CPI data, FTX creditor payouts, and other factors create a complex trading environment.

CONTENT

Check the latest crypto market update: Ethereum ETF developments, Bitcoin trends, and future influences. Also find the analysis of market dynamics, including ETF inflows, CPI data impact, and potential rallies amid selling pressures.

1. ETHEREUM ETF DEVELOPMENTS

All six applicants for spot Ethereum ETFs have filed updated S-1 forms, signaling potential imminent SEC approval. This development coincides with expectations of a crypto price rebound, driven by anticipation of a weaker US CPI report.

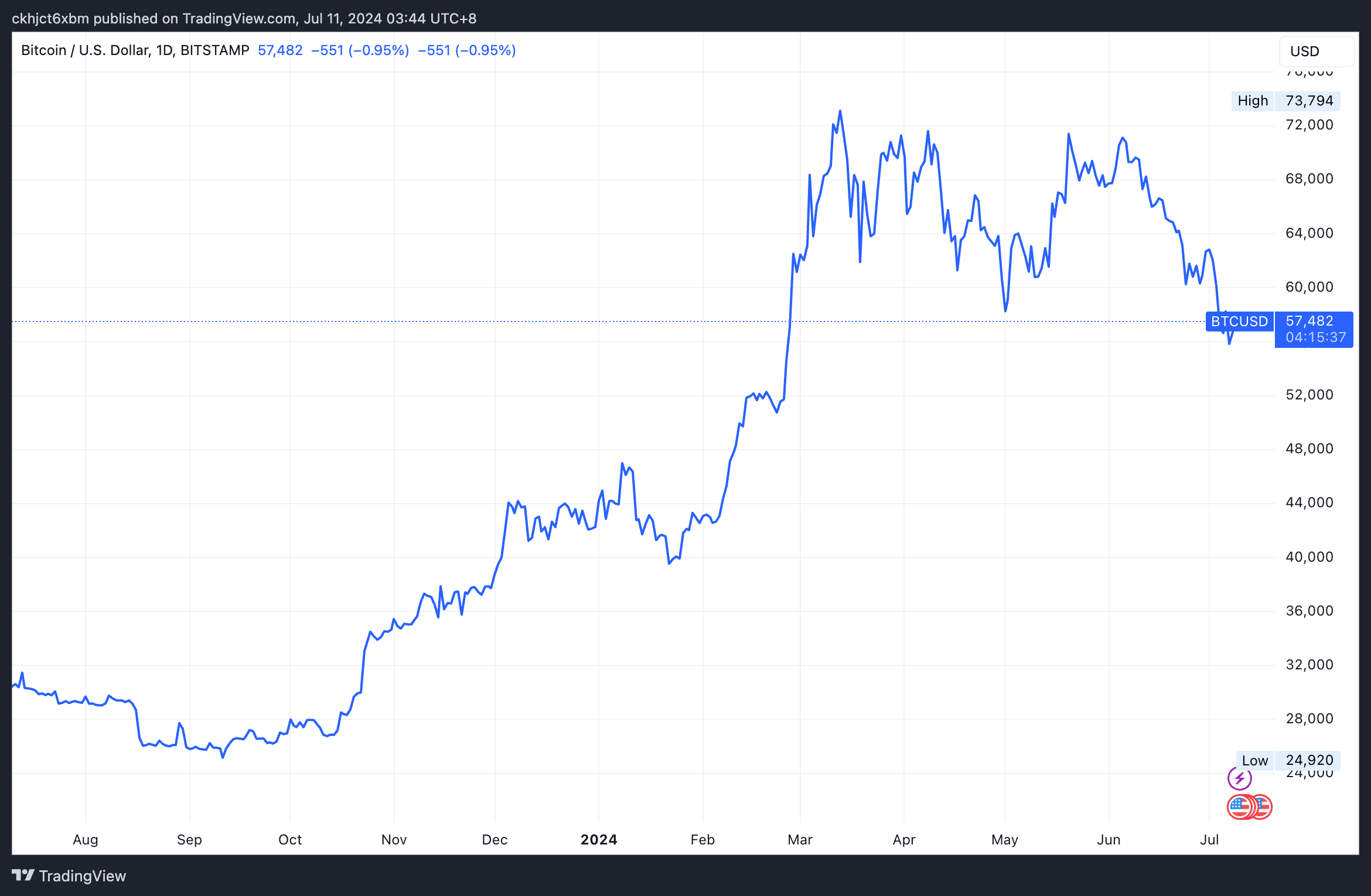

2. BITCOIN’S CURRENT MARKET SITUATION

Bitcoin has found support near $55,000, with oversold indicators suggesting a possible short-term reversal. Two out of three reversal indicators have turned bullish, and with an RSI reading of 38%, even short sellers may need to pause. The $55,000-$56,000 range appears to be forming a base from a technical analysis perspective. However, given medium-term technical damage, any bullish movement is expected to be a short-term tactical countertrend rally.

(Source: TradingView)

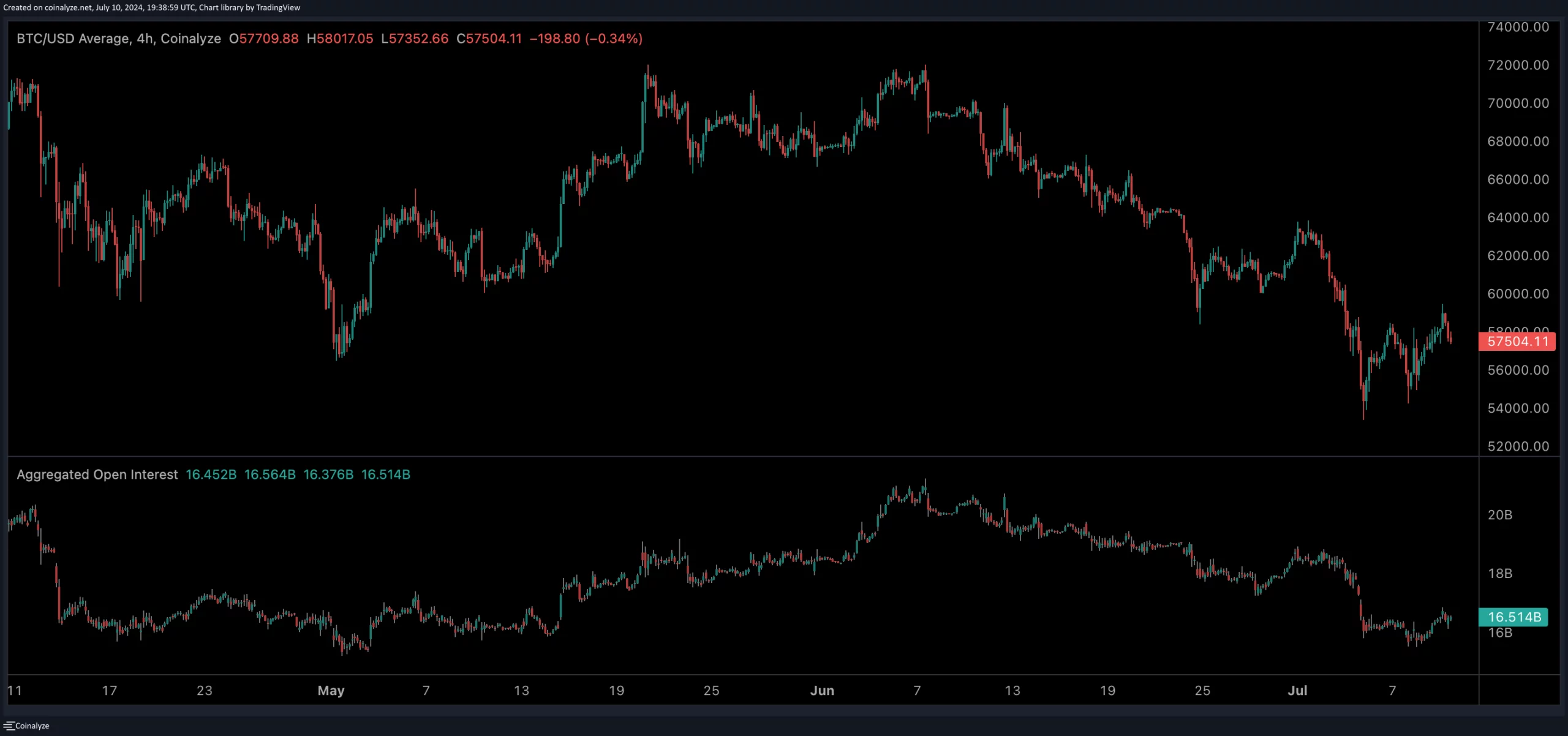

3. FUTURES MARKET TRENDS

Despite a 20% decline in Bitcoin’s price over 30 days, futures traders have remained relatively long since May 20. Bitcoin’s open interest increased from 260,000 BTC to a peak of 305,000 BTC, currently standing at 277,000 BTC. Ethereum’s position similarly grew from 2.6 million to 3.1 million, despite ETH trading at nearly the same price level.

(Source: Coinalyze)

(Source: Coinalyze)

4. GRAYSCALE ETHEREUM TRUST AND POTENTIAL IMPACTS

The Grayscale Ethereum Trust has nearly closed its net asset value (NAV) discount to just -1.5%, driven by expectations of imminent ETF approval. This is a significant improvement from the -60% discount observed in December 2022. However, converting this $9 billion ETN into an ETF could lead to significant selling pressure once trading begins, similar to the impact seen from Grayscale’s Bitcoin Trust (GBTC) in January 2024.

5. BITCOIN ETF INFLOWS AND UPCOMING CPI DATA

Recent data shows $295 million in Bitcoin ETF inflows on a single day, building upon $143 million from the previous trading day. While significant, this is less than the $4 billion and 20 consecutive days of inflows observed between May and June CPI data releases. The upcoming July 11 CPI data release is expected to show a decline to 3.1%, with potential for further impact if the month-on-month drop in Core CPI falls below 0.2%.

6. FUTURE MARKET INFLUENCES

Several factors could influence the crypto market in the near future:

- Continued selling pressure from the German state of Saxony, which still has 25,000 BTC to sell.

- Potential Mt. Gox selling pressure as payouts begin by July 24.

- FTX creditor payouts, estimated at $16 billion, with $3.2 billion to $5 billion potentially returning to crypto assets.

- The deadline for FTX customers to vote on bankruptcy wind-down payments is August 16, with a hearing on October 7.

MARKET OUTLOOK

Given these factors, Bitcoin could potentially rally back to nearly $60,000 before experiencing another decline to the low $50,000 range. This creates a complex trading environment. Once the market mentally digests the selling pressure from Saxony and Mt. Gox, more bullish narratives may resurface, such as FTX creditor payout expectations in mid-August and the potential impact of the upcoming US election on Bitcoin.

IN SUMMARY

The anticipation of Ethereum ETF approvals is driving market sentiment, with expectations of a short-term Bitcoin rally. However, significant selling pressure from various sources could limit the upside. The potential impact of FTX creditor payouts and the upcoming CPI data release will also play a crucial role in shaping the market’s direction. While bullish narratives exist, they are likely to resurface only after the market absorbs the current selling pressure.