KEYTAKEAWAYS

- Industry experts share varied future scenarios for Bitcoin, ranging from mainstream adoption to regulatory challenges.

- Singapore's central bank mandates licensing for crypto custody and related services, enhancing regulatory oversight.

- Crypto ventures in the U.S. garner $1.16 billion, focusing on infrastructure and DeFi.

- Ripple introduces a USD-pegged stablecoin, entering the $150 billion market.

- Bitcoin climbs to $69K, diverging from the stock market's downturn after Fed comments.

- KEY TAKEAWAYS

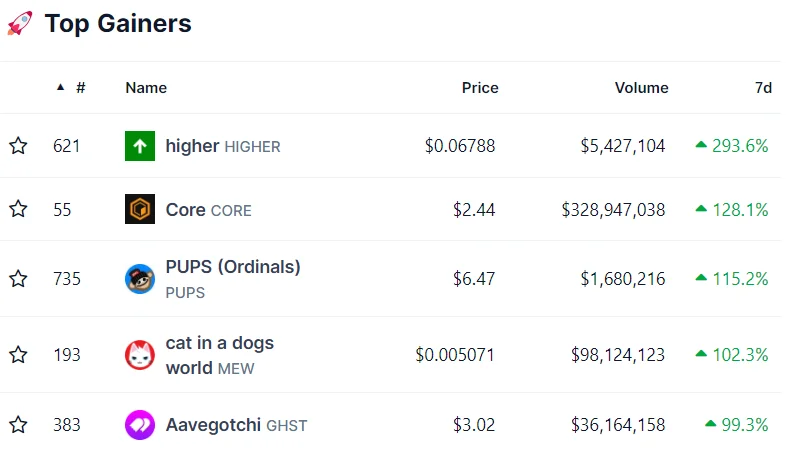

- TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

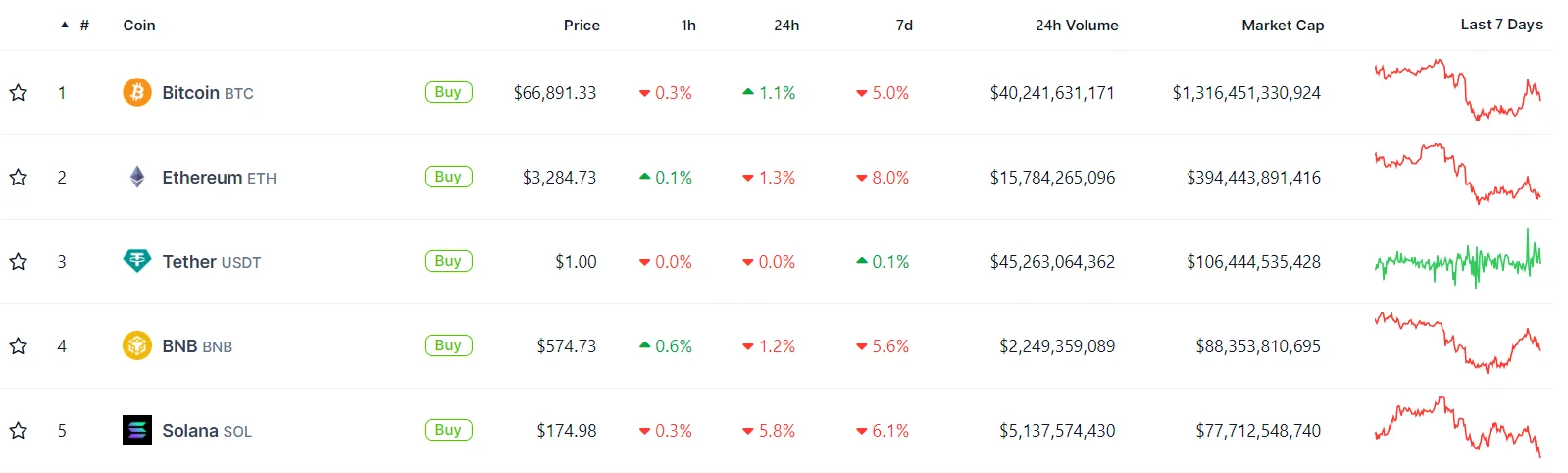

- TOP 5 CRYPTO BY MARKET CAP

- 1. BITCOIN’S FUTURE: 12 DIVERSE PREDICTIONS

- 2. SINGAPORE TIGHTENS CRYPTO REGULATION WITH NEW LICENSING

- 3. MARCH SEES A 52% BOOST IN CRYPTO VC FUNDING

- 4. RIPPLE ENTERS $150 BILLION STABLECOIN MARKET

- 5. BITCOIN SURGES 4.5% AMID HAWKISH FED SIGNALS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In the Crypto Weekly Snapshot, we present to you 5 carefully selected stories from the crypto market and the latest crypto market data so you won’t miss anything important!

TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

(Source: CoinGecko)

- HIGHER +293.6%

- CORE +128.1%

- PUPS +115.2%

- MEW +102.3%

- GHST +99.3%

TOP 5 CRYPTO BY MARKET CAP

(Source: CoinGecko)

- BTC $1,316,451,330,924

- ETH $394,443,891,416

- USDT $106,444,535,428

- BNB $88,353,810,695

- SOL $77,712,548,740

Apr 1, 2024

1. BITCOIN’S FUTURE: 12 DIVERSE PREDICTIONS

Mainstream Adoption and Everyday Use

Three years after assessing Bitcoin’s future prospects, a revisit to these predictions shows a transformed landscape, with Bitcoin’s value having soared and new technologies like Bitcoin Ordinals and ChatGPT entering the scene. Experts now envision a future where Bitcoin could become a common currency for everyday transactions, like buying coffee, enabled by advancements in technology and wider acceptance. This scenario suggests a world where Bitcoin and fiat currencies coexist, offering dual pricing models for goods and services.

Bitcoin in Gaming and Entertainment

With over 3 billion gamers worldwide, the integration of Bitcoin into the gaming industry represents a massive opportunity for widespread adoption. Through the speed of the Lightning Network, gamers could be rewarded in Bitcoin, making it the “native currency of the internet.” However, the realization of this future depends on the development and popularity of a viral game that incorporates Bitcoin, signaling a significant shift in how digital entertainment could intersect with cryptocurrency.

Traditional Finance (TradFi) and Bitcoin ETFs

The relationship between Bitcoin and traditional financial institutions (TradFi) has evolved, especially with the introduction of Bitcoin ETFs. While ETFs have brought new capital into the Bitcoin market, they also highlight a potential shift in control towards major financial firms. This dynamic could influence the direction of Bitcoin’s development and its original vision as a decentralized, peer-to-peer electronic cash system.

Advances in AI and Bitcoin’s Role

The intersection of Bitcoin with emerging technologies like artificial intelligence (AI) could redefine how we interact with financial tools and services. AI agents might soon be able to conduct transactions, access decentralized finance (DeFi) tools, and manage personal finances using Bitcoin, without the need for traditional banking services. This scenario suggests a future where Bitcoin becomes an integral part of a technologically advanced, decentralized financial ecosystem.

As Bitcoin continues to grow, regulatory scrutiny could shape its future. From taxation to potential bottlenecks in converting Bitcoin to fiat currencies, the regulatory environment remains uncertain. However, innovations within the Bitcoin ecosystem, such as ordinals and potential use cases in machine-to-machine transactions, offer a glimpse into a future where Bitcoin’s utility expands beyond its current scope.

Apr 2, 2024

2. SINGAPORE TIGHTENS CRYPTO REGULATION WITH NEW LICENSING

Regulatory Expansion in Crypto Services

Singapore’s Monetary Authority of Singapore (MAS) has initiated licensing requirements for crypto custody services among other activities, marking a significant shift in the city-state’s approach to cryptocurrency regulation. This regulatory change encompasses a broader spectrum of crypto-related activities, including cross-border money transfers and the facilitation of crypto transactions between accounts and exchanges. Initially passed in parliament in 2021, these adjustments to the Payment Services Act (PS Act) aim to align Singapore’s financial services with evolving global standards in the wake of the cryptocurrency sector’s volatility.

Implementing User Protection and Compliance

The recent amendments under the PS Act are designed to enforce user protection measures and uphold financial stability within the digital payment tokens (DPT) and cryptocurrency service sectors. Key requirements now include segregating customers’ assets, maintaining accurate records, and establishing robust systems for operational control. Service providers are granted a six-month period, starting April 4, 2024, to comply with these new regulations, signifying MAS’s commitment to fostering a secure and compliant digital finance ecosystem.

Transition and Licensing Process

Entities currently engaged in crypto-related services under the PS Act face a transition period requiring them to submit a license application within six months from April 4, 2024. This process includes providing an attestation report on compliance with anti-money laundering and counter-terrorism financing standards, validated by an external auditor. Non-compliance with these stringent requirements compels entities to discontinue their crypto service operations, underscoring MAS’s strict stance on regulatory adherence and the importance of operational integrity in the burgeoning crypto market.

Apr 3, 2024

3. MARCH SEES A 52% BOOST IN CRYPTO VC FUNDING

Record-Breaking Investment Flow

Venture capital interest in the crypto sector soared in March, witnessing a remarkable 52% increase in funding compared to the previous month. The momentum was largely driven by the United States, where crypto projects amassed more than $1.16 billion, marking it as the second-largest funding month within the last year. This surge in investments underscores a growing confidence among venture capitalists, especially towards initiatives focusing on crypto infrastructure and decentralized finance (DeFi).

Focus on Infrastructure and DeFi

The influx of capital primarily targeted projects dedicated to the development of crypto infrastructure and DeFi platforms, with a significant portion of funds directed towards projects on the Ethereum blockchain. Other blockchains like Polygon and BNB Chain also received notable attention from investors. This trend reflects a strategic interest in supporting the foundational aspects of the crypto ecosystem and in fueling the expansion of DeFi solutions that promise to redefine financial services.

Catalysts and Trends in Funding

The spike in venture capital funding coincides with bitcoin reaching a new all-time high of $73,798 in March, propelled by the successful launch of spot bitcoin exchange-traded funds (ETFs) by major issuers like BlackRock and Fidelity. These developments have not only rejuvenated market optimism but have also attracted traditional financial (TradFi) institutions back into the digital asset space. Investment strategies revealed a preference for early-stage seed funding, with more than half of the investments falling between $1 million and $5 million, highlighting the venture capital community’s commitment to nurturing emerging crypto projects.

Geographical Distribution of Investments

While the United States emerged as a significant beneficiary of March’s venture capital bonanza, capturing about a third of the total capital, the distribution of funds underscores the global appeal of crypto ventures. The concentration of funding in the U.S. may indicate the region’s strategic importance in the global crypto market, yet it also points to the widespread interest and investment in crypto innovations across different geographies, emphasizing the international scope of the burgeoning crypto industry.

Apr 4, 2024

4. RIPPLE ENTERS $150 BILLION STABLECOIN MARKET

Ripple Launches USD Stablecoin

Ripple has officially entered the stablecoin fray with its U.S. dollar-pegged digital currency, aiming to carve out a significant niche in the bustling $150 billion stablecoin market. This new offering is designed to be fully backed by a mix of U.S. dollar deposits, government bonds, and cash equivalents, ensuring a stable, one-to-one value correlation. In a move to promote transparency, Ripple will publish monthly attestation reports detailing its reserves, although the auditing partner remains unspecified.

Ripple vs. Market Giants

Setting its sights on the U.S. initially, Ripple does not discount the possibility of regional variants tailored to markets outside the U.S., such as Europe and Asia. This expansion pits Ripple directly against giants like Tether and Circle, creators of the USDT and USDC stablecoins, respectively. The market also includes other significant players like PayPal, which recently introduced its own stablecoin in partnership with Paxos. Despite the stiff competition, Ripple CEO Brad Garlinghouse expresses optimism about the evolving market dynamics and Ripple’s unique position within it.

Ripple’s Answer to Market Volatility

The catalyst behind Ripple’s decision to launch its stablecoin was the observed volatility in the stablecoin sector, notably the depegging incidents involving Tether’s USDT and Circle’s USDC. These events underscored the need for a stable and transparent digital currency option. Ripple seeks to meet this demand, leveraging its regulatory compliance across various jurisdictions as a key differentiator from competitors, some of whom have faced scrutiny over the transparency and adequacy of their reserves.

XRP Ecosystem and Legal Hurdles

While expanding its product line with the stablecoin, Ripple continues to support its XRP cryptocurrency, viewing the stablecoin as a complementary asset within the XRP ecosystem. This approach aligns with the desires of the XRP community and aims to enhance liquidity and growth for XRP. Despite this innovation, Ripple faces ongoing regulatory challenges, especially from the U.S. Securities and Exchange Commission (SEC) concerning the sale and classification of XRP as a security.

Apr 5, 2024

5. BITCOIN SURGES 4.5% AMID HAWKISH FED SIGNALS

Bitcoin’s Resilient Surge

In a striking deviation from the traditional market, Bitcoin demonstrated remarkable resilience by rallying to a significant 4.5% increase, touching the $69,000 mark, as stocks faced a downturn. This divergence came amid hawkish remarks from Minneapolis Fed President Neel Kashkari, suggesting a reconsideration of anticipated rate cuts if inflation persists. The crypto world watched as Bitcoin not only recovered from its weekly lows but also showcased a strong bullish sentiment in contrast to the wavering stock market.

Stock Market Reversal

The stock market experienced a notable reversal, with the S&P 500 and Nasdaq both dropping nearly 1% late in the U.S. trading session. This shift was directly attributed to Kashkari’s comments, highlighting the potential reconsideration of rate cuts—a sentiment that starkly contrasts with Fed Chairman Jerome Powell’s earlier, more dovish expectations. The market’s sensitivity to these comments underscores the ongoing uncertainty surrounding monetary policy and its implications for both traditional and digital asset classes.

Economic Indicators and Crypto Dynamics

As the financial community braces for the upcoming release of March’s employment data, the robustness of the job market remains a focal point, especially considering its potential to influence the Federal Reserve’s rate decision. Meanwhile, Bitcoin’s performance not only reflects its decoupling from traditional financial markets but also underscores the crypto market’s nuanced response to macroeconomic indicators. With Bitcoin surging and Ether seeing modest gains, the crypto market reflects a mix of optimism and uncertainty.