KEYTAKEAWAYS

- Bitcoin's price surge signals renewed market optimism after a recent correction period.

- BlackRock's tokenized fund marks a significant step towards merging traditional finance and the cryptocurrency world.

- Hong Kong's potential for in-kind Bitcoin ETF redemptions could significantly increase capital flow into cryptocurrency markets.

- Bankman-Fried's sentencing highlights the severe consequences of fraud within the cryptocurrency industry.

- Bitcoin's upcoming halving may have less dramatic price impact due to institutional investment and the rise of Bitcoin ETFs.

- KEY TAKEAWAYS

- TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

- TOP 5 CRYPTO BY MARKET CAP

- 1. BITCOIN SURGES 7%, BREACHES $70,000 MARK

- 2. BLACKROCK BRIDGES TRADFI AND CRYPTO WITH NEW FUND

- 3. HONG KONG TO REVOLUTIONIZE BITCOIN ETF MARKET

- 4. FTX’S BANKMAN-FRIED GETS 25-YEAR SENTENCE

- 5. BITCOIN’S MARKET CYCLE: A NEW DAWN BEGINS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In the Crypto Weekly Snapshot, we present to you 5 carefully selected stories from the crypto market and the latest crypto market data so you won’t miss anything important!

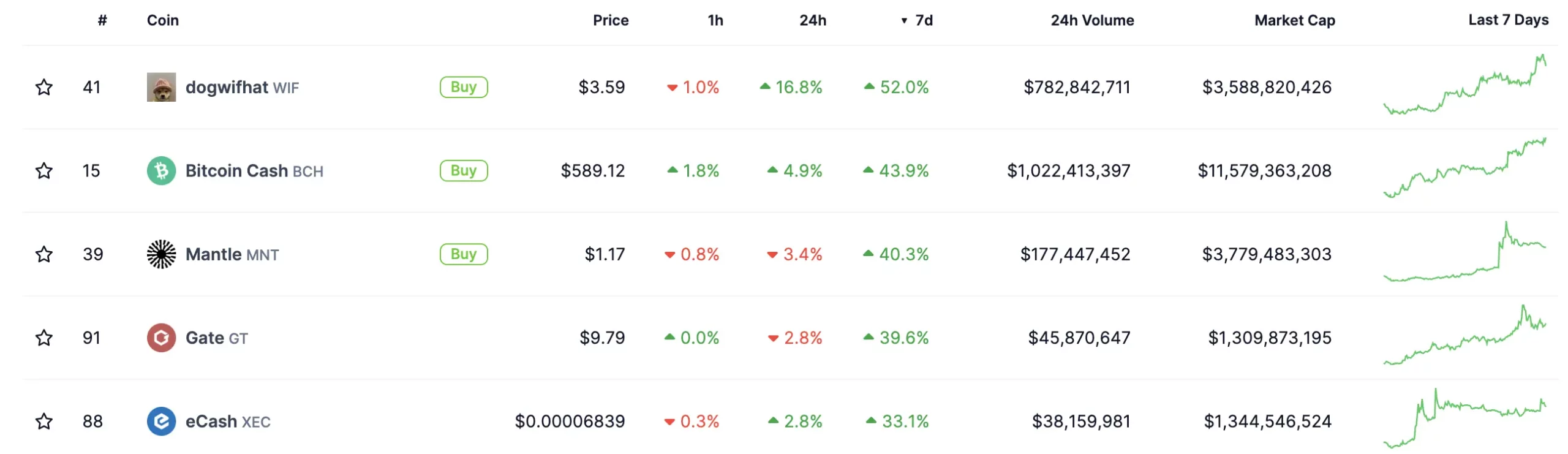

TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

(Source: CoinGecko)

- WIF +16.8%

- BCH +43.9%

- MNT +40.3%

- GT +39.6%

- XEC +33.1%

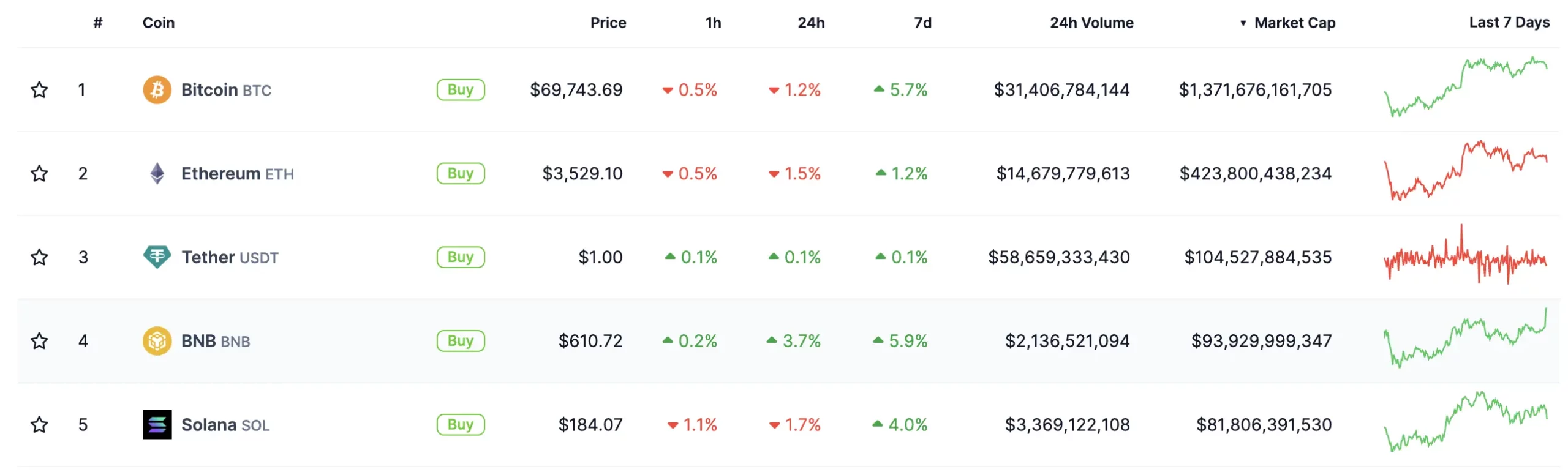

TOP 5 CRYPTO BY MARKET CAP

(Source: CoinGecko)

- BTC $1,371,676,161,705

- ETH $423,800,438,234

- USDT $104,527,884,535

- BNB $93,929,999,347

- SOL $81,806,391,530

Mar 25, 2024

1. BITCOIN SURGES 7%, BREACHES $70,000 MARK

Bitcoin Surpasses $70K

Bitcoin has made a remarkable recovery in the final week of March, surpassing the $70,000 threshold, a level not seen in recent times. The surge, quantified at a 7.8% increase, places Bitcoin’s value at $70,995.48, with a brief peak at $71,239.31. This upward trend was mirrored by Ethereum, which saw a 7.4% rise to $3,634.80, signaling a broad-based rally across the cryptocurrency spectrum.

Rally Boosts Crypto Sectors

This rally extended beyond Bitcoin and Ethereum, boosting related sectors such as cryptocurrency mining and trading platforms. Companies like MicroStrategy and Coinbase saw substantial gains of 21% and 9%, respectively. The mining sector, represented by Riot Platforms, CleanSpark, and Cipher Mining, also benefited significantly from Bitcoin’s performance. This rally comes after a correction phase where Bitcoin had dipped to around $60,800 from an all-time high of $73,797.68 earlier in the month.

Fed Signals Lift Bitcoin

The exact catalyst for this surge remains speculative, but the market’s response to the Federal Reserve’s recent signals suggests a strong influence. The Fed hinted at potential rate cuts and a slowdown in its quantitative tightening program, improving liquidity conditions and acting as a catalyst for asset prices. Bitcoin, often seen as a liquidity barometer, reacted positively to these indications, reflecting investor sentiment towards easier monetary policies in the near future.

Bitcoin’s Strong Q1 Performance

Despite recent pullbacks, Bitcoin’s performance in March points to a positive trend, with a 14% gain for the month and a 66% increase for the first quarter. This rebound suggests a robust investor sentiment and a speculative rally, driven by favorable liquidity conditions and market optimism towards cryptocurrency as an asset class.

Mar 26, 2024

2. BLACKROCK BRIDGES TRADFI AND CRYPTO WITH NEW FUND

BlackRock’s Tokenized Initiative

BlackRock, the world’s largest asset manager, has introduced its inaugural tokenized fund on a public blockchain, marking a pivotal moment in the convergence of traditional finance (TradFi) and the crypto industry. This innovative step not only underscores BlackRock’s commitment to embracing blockchain technology but also signals a broader industry trend towards digitization. The fund, named the BlackRock USD Institutional Liquidity Fund (BUIDL), is designed to foster interoperability between TradFi and crypto, offering a seamless transition for traditional investors towards on-chain funds.

Ecosystem Collaboration

The success of BlackRock’s tokenized fund hinges on its strategic collaboration with key players from both the TradFi and crypto worlds. The involvement of institutions like Securitize, BNY Mellon, Anchorage Digital Bank, BitGo, Coinbase, and Fireblocks in the fund’s ecosystem exemplifies a comprehensive approach to ensure smooth operation and wide acceptance. This coalition aims to address and eliminate the friction points traditionally associated with adopting blockchain technology in finance, paving the way for a new era of investment strategies.

Benefits of On-Chain Funds

The adoption of the Ethereum blockchain for the fund highlights a deliberate choice to leverage the benefits of public over private blockchains. This approach allows for greater interoperability, programmability, and, importantly, the possibility of on-chain fund redemptions with stablecoin integration. For institutional holders, this experiment with blockchain technology promises 24/7 instant settlements, enhanced transparency, and improved capital efficiency, all at a reduced cost compared to traditional methods.

Future of Asset Management

The introduction of on-chain funds like BUIDL could herald a new growth category for asset managers. The evolution from simple crypto accumulation strategies, such as those offered by exchange-traded fund (ETF) products, towards the creation of on-chain multi-asset products, represents a significant shift in asset management. This shift not only diversifies the range of investment products available but also introduces new unit economics and distribution models in the crypto asset management space.

Mar 27, 2024

3. HONG KONG TO REVOLUTIONIZE BITCOIN ETF MARKET

Hong Kong’s Crypto Market Evolution

Hong Kong’s Securities and Futures Commission (SFC) is on the verge of a pivotal decision that could transform the landscape of cryptocurrency investment in Asia. The regulator’s potential approval of in-kind creations and redemptions for spot Bitcoin ETFs signals a major shift, potentially opening the gates for a vast pool of Chinese investors to enter the crypto market. This move, expected in the second quarter of the year, marks a significant departure from the traditional cash-only redemptions seen in U.S. spot-based ETF products, offering a more cost-effective, tax-efficient, and liquid investment option.

ETF Innovations Spark Investor Interest

The anticipation around spot Bitcoin ETFs in Hong Kong has been building, with notable firms like Harvest Global and Venture Smart Financial Holdings lining up to launch their offerings on the Hong Kong Stock Exchange. The introduction of in-kind redemptions, allowing investors to exchange ETF shares directly for the underlying asset rather than cash, is heralded as a game-changer. This method is favored for its efficiency and lower costs, setting the stage for a broader adoption of cryptocurrency investments among traditional investors.

Asia’s Rising Crypto Investment Tide

The implications of Hong Kong’s move toward in-kind redemptions for spot Bitcoin ETFs are profound. According to Noelle Acheson, a seasoned industry analyst, this development could significantly amplify the flow of funds into the cryptocurrency market from Asia, given the region’s larger crypto trading volumes compared to the U.S. The integration of such ETFs into approved investment portfolios could channel substantial capital into the crypto ecosystem, leveraging the deeper familiarity with crypto assets prevalent in the Asian market.

Hong Kong: A New Crypto Finance Hub

The strategic importance of Hong Kong’s potential regulatory pivot cannot be overstated. By facilitating legal and regulated investment avenues for Bitcoin and other cryptocurrencies, Hong Kong is poised to become a key player in the global crypto finance arena. The move could catalyze a significant influx of new money into the market, highlighting the region’s role in shaping the future of cryptocurrency investment. This initiative, closely observed internationally, could lead to wider cryptocurrency adoption in financial centers, strengthening the market’s position within the global financial system.

Mar 28, 2024

4. FTX’S BANKMAN-FRIED GETS 25-YEAR SENTENCE

Sentencing Shakes Crypto World

Sam Bankman-Fried, the former CEO of FTX, faced the consequences of his actions in a landmark sentencing on Thursday, receiving a 25-year prison term. Convicted on seven counts of fraud and conspiracy, Bankman-Fried’s downfall marks a significant moment in the cryptocurrency sector’s history. The dramatic collapse of FTX in 2022, leading to an $8 to $11 billion loss for its customers, underlined the devastating impact of fraudulent practices in the rapidly evolving crypto market.

A Lack of Remorse

Throughout the sentencing process, the presiding Judge Lewis Kaplan criticized Bankman-Fried for his apparent lack of remorse and his attempts to maintain a positive public persona amidst the scandal. This attitude, coupled with his significant role in the fraudulent activities at FTX and Alameda, played a crucial part in the judge’s decision to impose a lengthy sentence. The court also imposed an $11 billion fine on Bankman-Fried, encompassing forfeiture agreements to liquidate assets, including a private jet.

Defense and Prosecution Perspectives

The courtroom saw an array of arguments from both sides. The prosecution, emphasizing the need for a stern message against financial crimes, highlighted the extensive harm Bankman-Fried caused to FTX’s victims. Conversely, Bankman-Fried’s defense pointed to his non-malicious nature and his past efforts towards altruism, pleading for a more lenient sentence that would not “destroy the prime of his client’s life.”

Bankman-Fried’s Reflection

In a poignant moment, Bankman-Fried addressed the court, expressing concern for the FTX customers awaiting the return of their funds over his own future. Despite his conviction, he maintained that FTX could have survived its liquidity crisis, a belief that contrasts starkly with the victims’ harrowing loss of savings. His remarks offered a glimpse into the complex character behind one of the most notorious collapses in crypto history.

Mar 29, 2024

5. BITCOIN’S MARKET CYCLE: A NEW DAWN BEGINS

Halving’s New Horizon

As Bitcoin approaches another halving event, the crypto community stands on the brink of a potentially transformative shift. Traditionally, halvings have precipitated significant price surges and heightened market activity. However, this cycle might break from past patterns due to an influx of institutional investors and the advent of spot bitcoin exchange-traded funds (ETFs). This newfound interest from the traditional financial sector, coupled with Bitcoin’s record-breaking rally to over $73,000, suggests we might be witnessing the end of the volatile four-year market cycles that have characterized Bitcoin’s history.

Institutional Impact and ETFs

The entrance of heavyweights like BlackRock into the cryptocurrency space signals a broadening acceptance of Bitcoin as a legitimate asset class. This shift is underscored by the success of Bitcoin ETFs, which offer investors a more accessible and regulated avenue to cryptocurrency investment. Such developments not only enhance Bitcoin’s liquidity and stability but also promise to attract a wider audience to the crypto market. This could fundamentally alter Bitcoin’s market dynamics, potentially smoothing out the sharp peaks and troughs that have defined its trading history.

Economic Challenges and Mining Dynamics

Despite the bullish outlook, the crypto market faces potential headwinds from global economic factors, such as inflation and slower growth, which could dampen investor enthusiasm for high-risk assets like Bitcoin. Moreover, the halving event is expected to place pressure on Bitcoin miners, potentially leading to consolidation within the industry. These factors, combined with regulatory uncertainties, might pose challenges to Bitcoin’s price momentum in the short term.

Beyond Boom and Bust

The interplay of ETF inflows and institutional engagement could diminish the halving event’s role as a primary market catalyst, ushering in an era of more stable growth for Bitcoin. This shift away from pronounced bull and bear cycles may result in a more predictable market, aligning more closely with traditional asset classes. While this could mean fewer opportunities for speculative gains, it also promises a reduction in the dramatic losses that have plagued many retail investors.