KEYTAKEAWAYS

- Sui TVL Breaks $2 Billion, Setting New All-Time High

- Ethereum Stablecoins (USDT&USDC) Increase by $1.11 Billion Weekly

- Gaming DApps Have 40% More Active Wallet Addresses Than DEX DApps

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

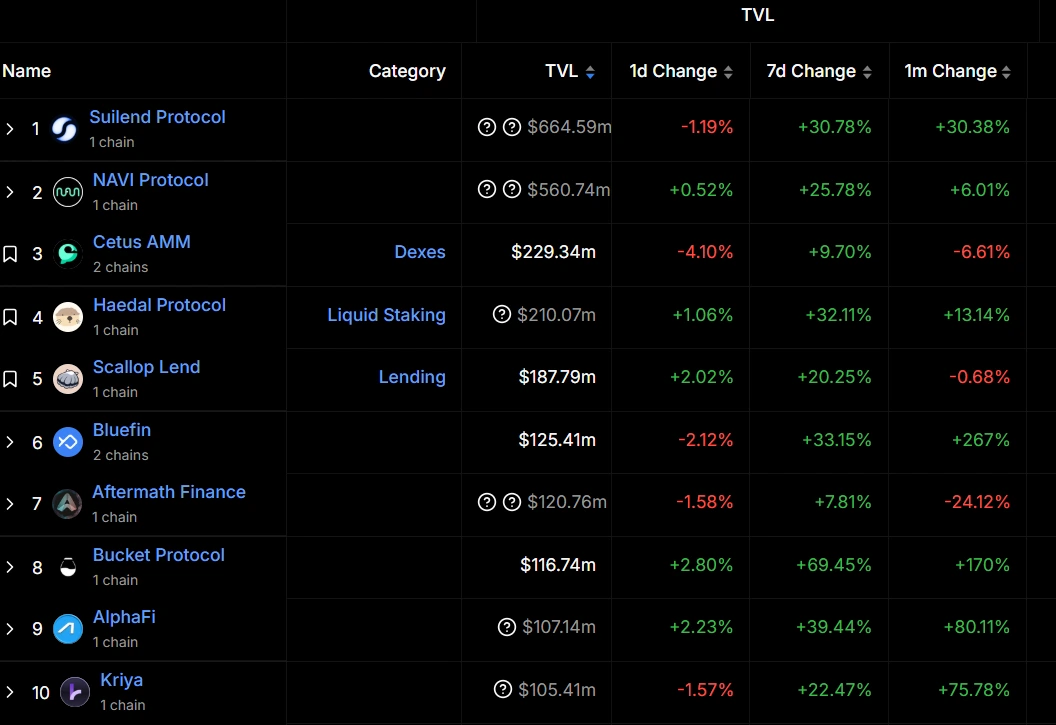

SUI TVL BREAKS $2 BILLION, SETTING NEW ALL-TIME HIGH

On January 7th, the Total Value Locked (TVL) of public chain Sui exceeded $2 billion, setting a historic high, reaching the $1 billion milestone in just three months. DApps including Suilend Protocol, NAVI Protocol, Haedal Protocol, and Scallop Lend all achieved weekly TVL growth of over 20%.

Source: DefiLlama

Analysis:

Sui states that recently announced and launched stablecoins, wallets, and lending protocols have driven Sui’s growth. Industry giants like Grayscale, VanEck, and FranklinTempleton have also provided momentum for Sui.

What makes SUI attract so much investor attention as we approach 2025? Factors may include: combination of stability and market trust, technical strength and market opportunities, market momentum and investor enthusiasm.

In a frequently volatile market environment, SUI has shown strong vitality with its unique characteristics and market credibility. Its technical advantages of high throughput and low latency, combined with quick market stabilization, have secured SUI’s position among cryptocurrencies. For 2025’s outlook, SUI remains full of possibilities, with its future depending on continued optimization of market strategy and user experience.

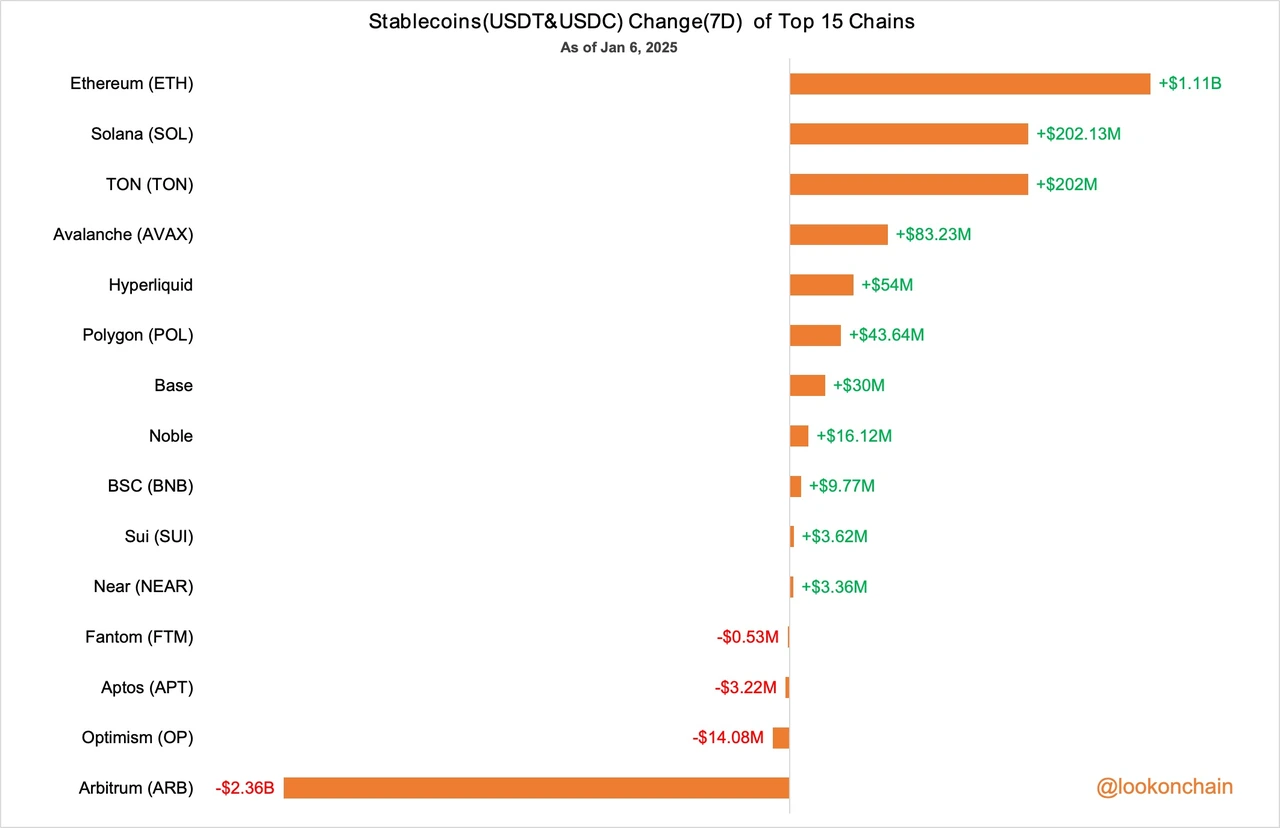

ETHEREUM STABLECOINS (USDT&USDC) INCREASE BY $1.11 BILLION WEEKLY

According to lookonchain data, over the past 7 days, stablecoins (USDT&USDC) on Ethereum increased by $1.11 billion, while those on Solana increased by $202.13 million. TON followed closely behind with stablecoins reaching $202 million, and stablecoins on Avalanche increased by $83 million.

Source: Lookonchain

Analysis:

Stablecoin issuance differs from other tokens as it doesn’t dilute value due to its dollar-pegged nature backed by collateral. This increase represents growing market demand for stablecoins and is theoretically viewed as hot money entering the market, a bullish signal.

As blockchain technology expands across various fields, demand for stablecoins increases. Stablecoins aim to address cryptocurrency’s inherent volatility, making them more suitable for daily transactions, smart contracts, and value storage.

GAMING DAPPS HAVE 40% MORE ACTIVE WALLET ADDRESSES THAN DEX DAPPS

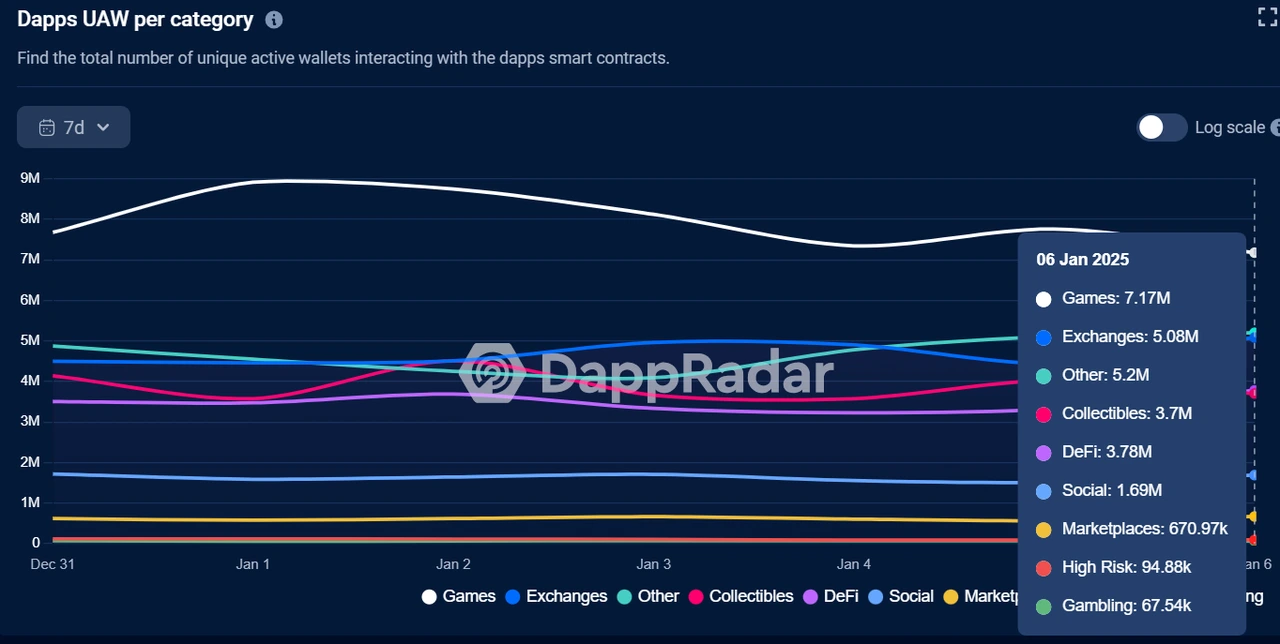

DappRadar data shows that on January 7th, wallet addresses interacting with gaming DApp smart contracts reached 7.17M, while those interacting with DEX DApps were 5.08M. Additionally, Social DApp smart contract interactions have grown rapidly, reaching 1.69M addresses.

Source: DappRadar

Analysis:

UAW data reflects the popularity of various on-chain DApps, with most users preferring CEX trading for efficiency and convenience. GameFi integrates blockchain technology and cryptocurrency into games, allowing players to enjoy entertainment while earning economic returns (like NFTs and tokens). This combination attracts both gamers and cryptocurrency enthusiasts.

Many GameFi projects attract players through innovative gameplay and novel economic models, such as virtual land, cross-chain gaming, and crypto rewards. These fresh experiences enhance player interest and participation.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!