KEYTAKEAWAYS

- DeFAI merges DeFi and AI, enhancing financial services with smart trading, risk management, and user-friendly blockchain integration.

- AI Agents in DeFAI leverage real-time data, machine learning, and collaboration to optimize trading and manage risks in volatile markets.

- DeFAI’s future focuses on lowering barriers, IoT integration, and financial innovation, despite short-term market volatility risks.

CONTENT

Explore how DeFAI (Decentralized Finance + AI) is reshaping financial services with smart trading, risk management, and seamless blockchain integration. Learn its potential and challenges.

With the rapid advancement of blockchain and artificial intelligence (AI), decentralized finance (DeFi) has become a significant trend in the fintech sector. DeFAI (Decentralized Finance + Artificial Intelligence) combines these two technologies to redefine the structure and function of financial services.

This article will delve into the core concepts of DeFAI, its advantages, application scenarios, and how it operates.

CORE CONCEPTS OF DEFAI

Decentralized Finance (DeFi): Built on blockchain technology, DeFi aims to eliminate traditional financial intermediaries, enhancing transparency and accessibility, allowing users to conduct financial activities without the need to trust intermediaries.

Artificial Intelligence (AI): AI, through machine learning, natural language processing, and data analytics, provides intelligent support for financial decision-making, optimizing investment strategies, market analysis, and risk management.

Also Read:

AI Agents in Crypto 2024: Market Analysis Report

CoinRank’s Market Watch: From Oracles to DeFi Giants

ADVANTAGES OF DEFAI

1. Enhanced User Experience

DeFAI simplifies financial operations through AI technology, making it easier for ordinary users to enter the DeFi ecosystem. Users can manage their assets through smart contracts and AI assistants, similar to interacting with chatbots.

2. Smart Trading Strategies

AI-driven automated trading systems analyze market data in real-time, including price fluctuations, trading volumes, and social media sentiments, formulating efficient trading strategies to help investors seize opportunities in volatile markets.

3. Dynamic Risk Management

Machine learning algorithms monitor market dynamics in real-time, assess potential risks, and automatically adjust investment portfolios based on market changes, allowing users to maintain relatively stable returns amidst uncertainties.

HOW DEFAI WORKS

The core of the AI Agent in DeFi systems is the LLM (Large Language Model), operating through multiple layers of processes and technologies, from data collection to decision execution.

According to @3sigma’s research in IOSG, most models follow six specific workflows: data collection, model inference, decision-making, hosting and running, interoperability, and wallet management. Below is a summary:

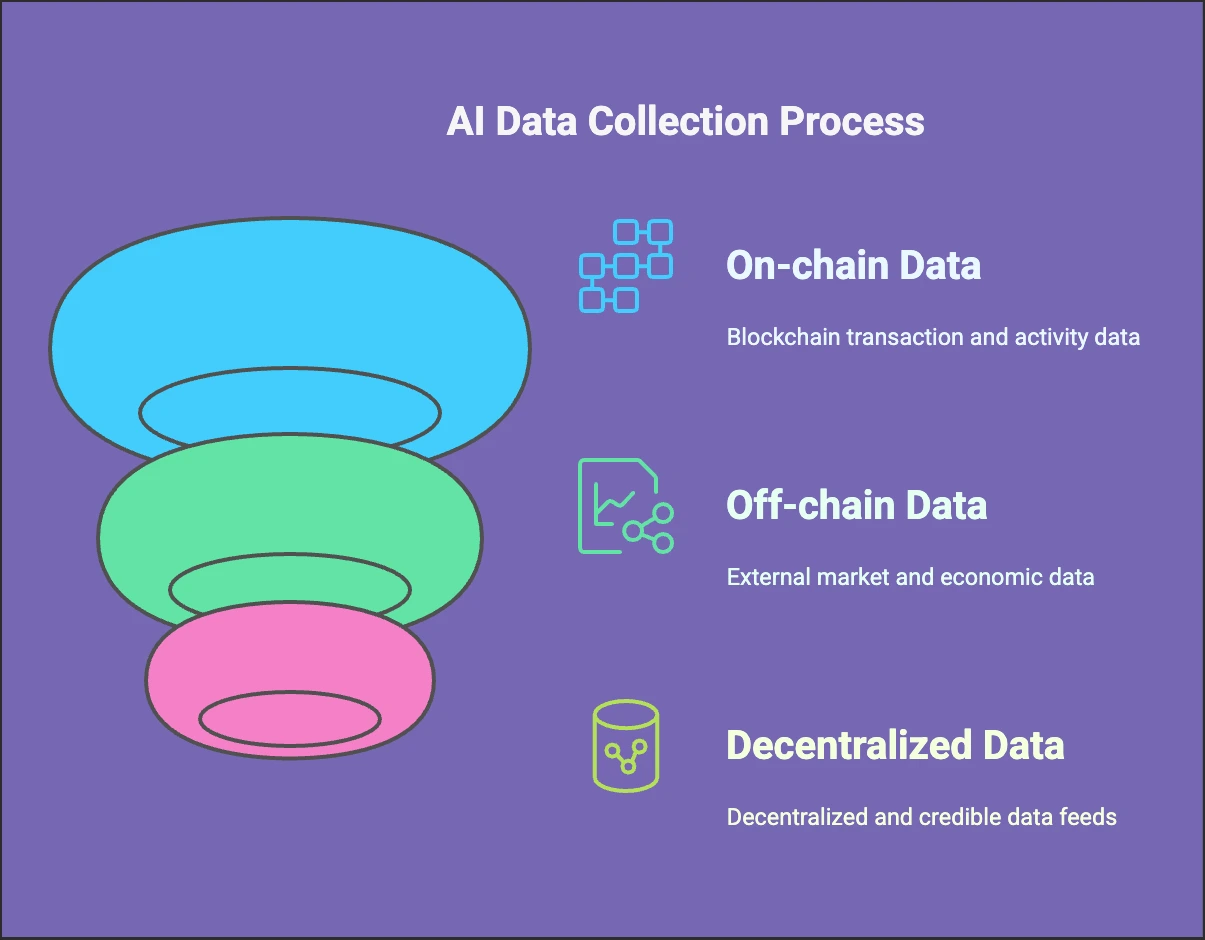

1. Data Collection

AI Agents comprehensively understand their operating environment by gathering real-time data from various sources:

-

-

On-chain Data: Through indexers and oracles, agents access blockchain data such as transaction records, smart contract states, and network activities.

-

Off-chain Data: Agents retrieve price information, market news, and macroeconomic indicators from external providers like CoinMarketCap and Coingecko via APIs.

-

Decentralized Data Sources: Some agents use decentralized data feed protocols to obtain oracle data, ensuring decentralization and credibility.

-

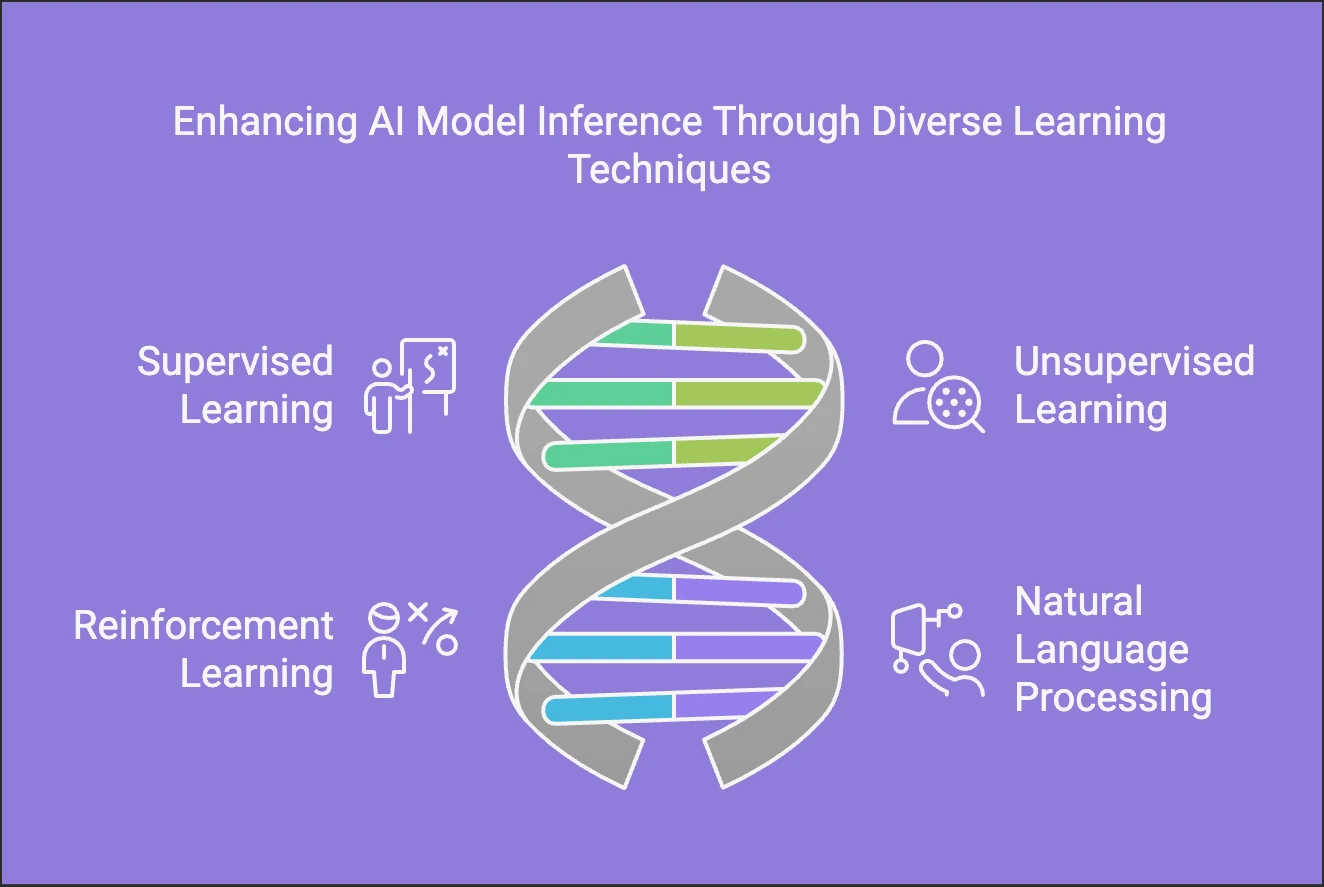

2. Model Inference

After data collection, AI Agents enter the inference and computation phase, utilizing multiple AI models for complex reasoning and predictions:

-

-

Supervised and Unsupervised Learning: Training on labeled or unlabeled data allows models to analyze market behavior and governance forums.

-

Reinforcement Learning: Through trial and feedback, agents can autonomously optimize strategies, such as determining the best buy or sell timing in token trading.

-

Natural Language Processing (NLP): Understanding and processing user input enables agents to extract key information from governance proposals or market discussions.

-

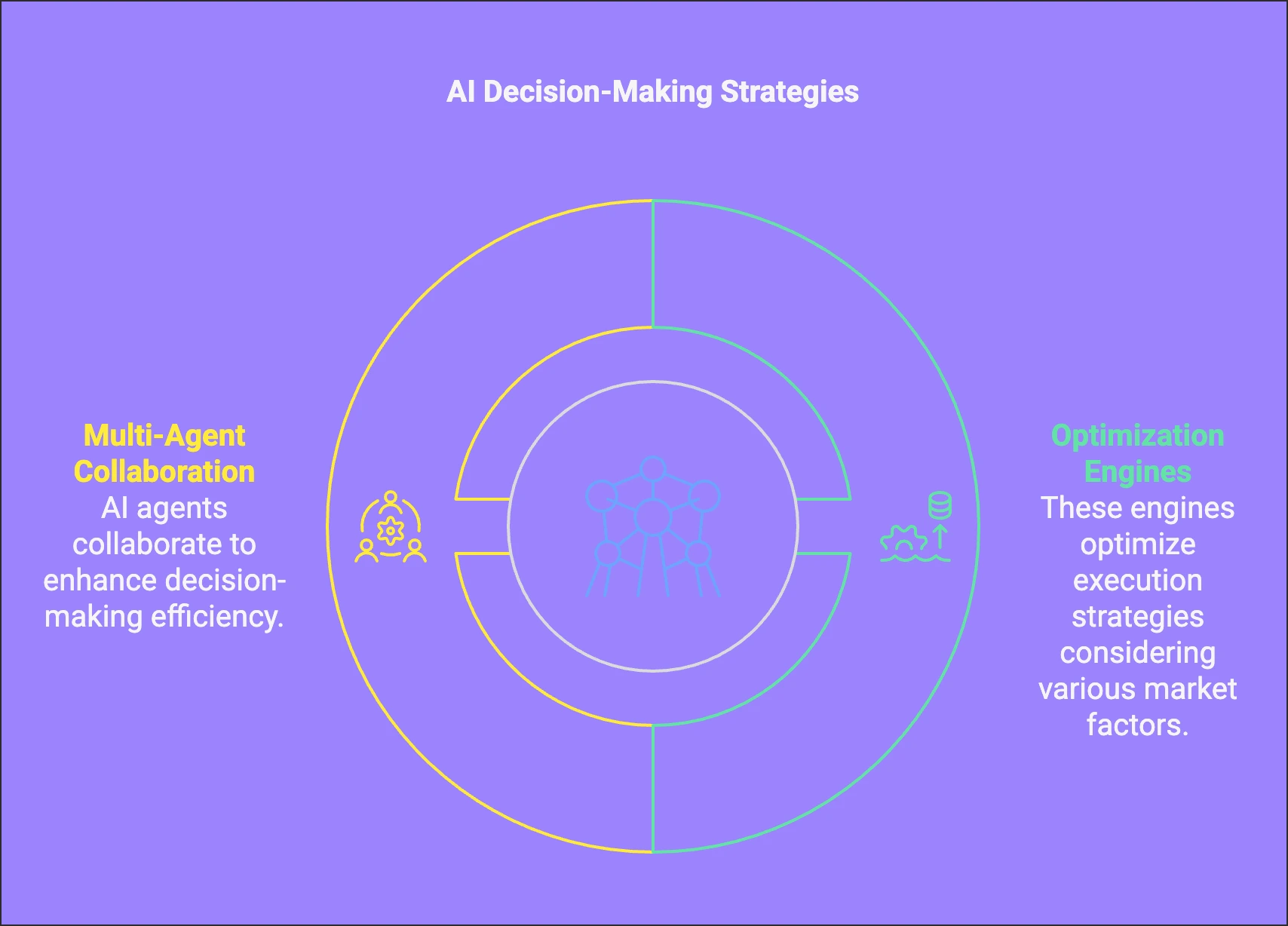

3. Decision-Making

Based on the collected data and inference results, AI Agents analyze the current market and weigh multiple variables to make optimal decisions:

-

-

Optimization Engines: These engines find the best execution strategies under various conditions, considering factors like slippage, transaction fees, network delays, and capital size.

-

Multi-Agent System Collaboration: Multiple AI Agents may collaborate, each focusing on different task areas to enhance overall system decision efficiency.

-

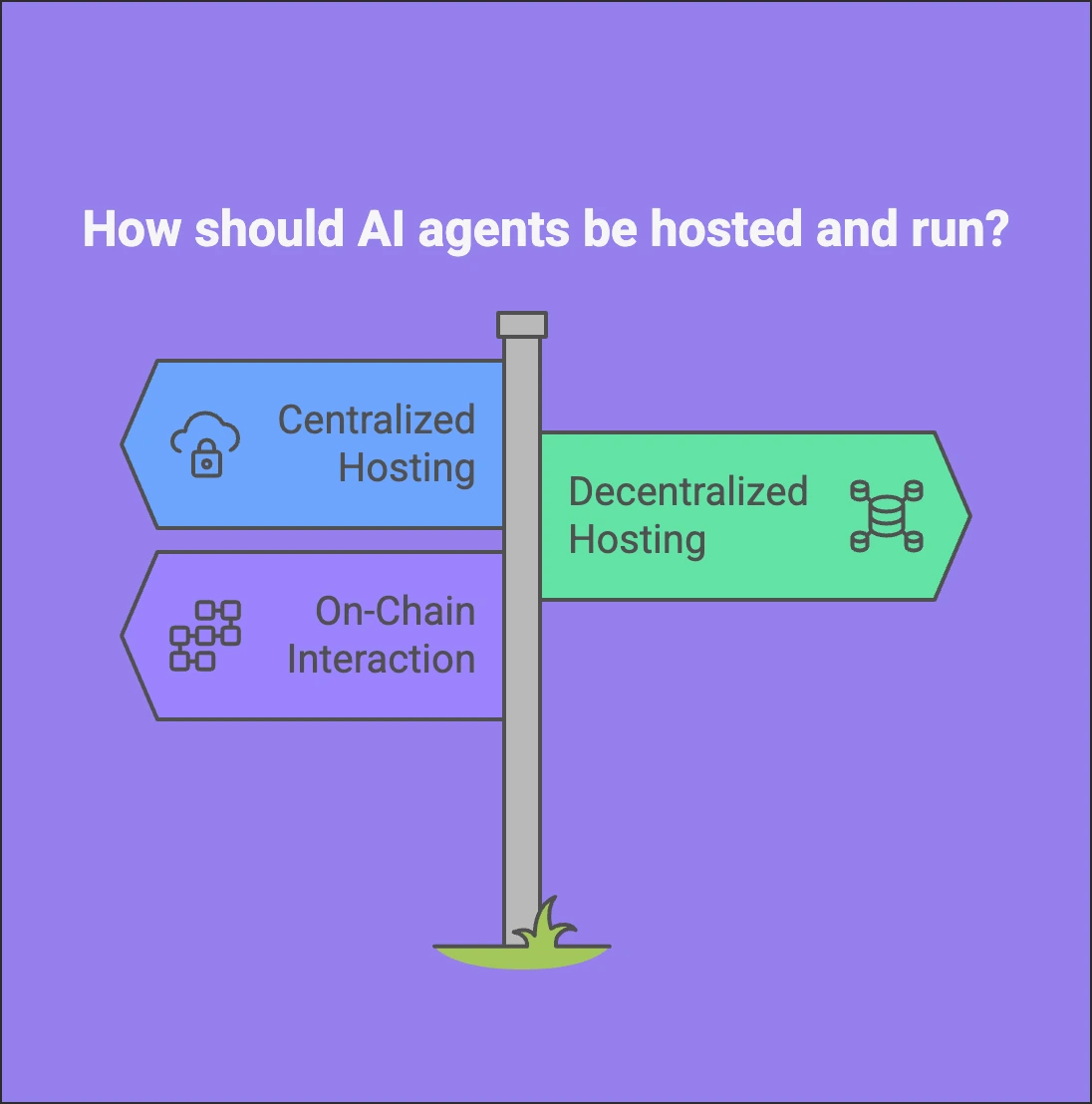

4. Hosting and Running

AI Agents handle significant computations, often hosting models on off-chain servers or distributed networks:

-

-

Centralized Hosting: Some agents use centralized cloud services like AWS for computation and storage, ensuring efficiency but posing centralization risks.

-

Decentralized Hosting: To reduce centralization risks, agents use decentralized computing networks like Akash and storage solutions like Arweave.

-

On-Chain Interaction: Agents interact with on-chain protocols for executing smart contracts and managing assets, requiring secure key management and transaction signing.

-

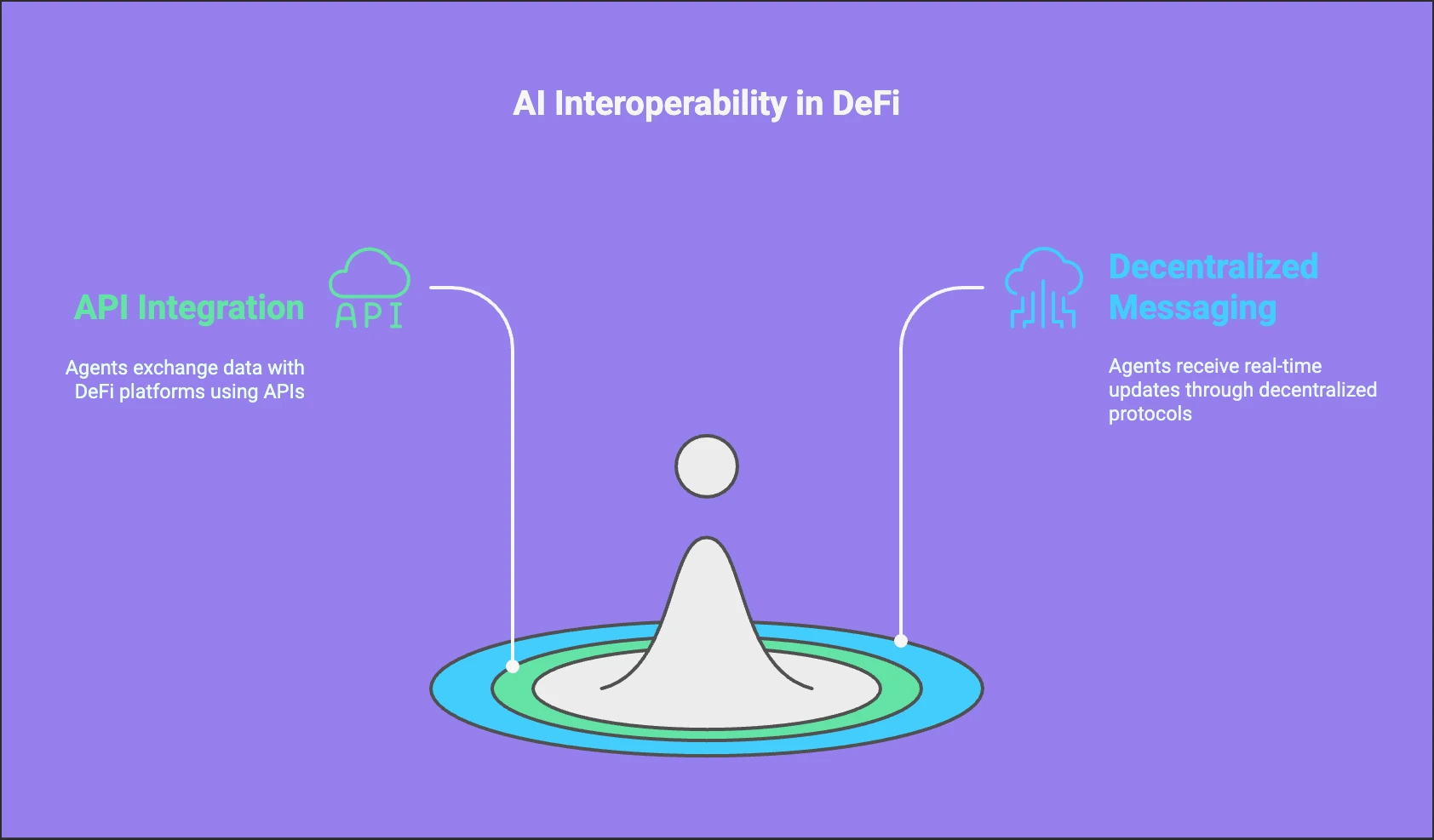

5. Interoperability

A critical role of AI Agents in the DeFi ecosystem is seamless interaction with various DeFi protocols and platforms:

-

-

API Integration: Agents exchange data and perform operations with decentralized exchanges, liquidity pools, and lending protocols via APIs.

-

Decentralized Messaging: Agents receive updates through decentralized messaging protocols like IPFS or Webhooks, enabling real-time strategy adjustments.

-

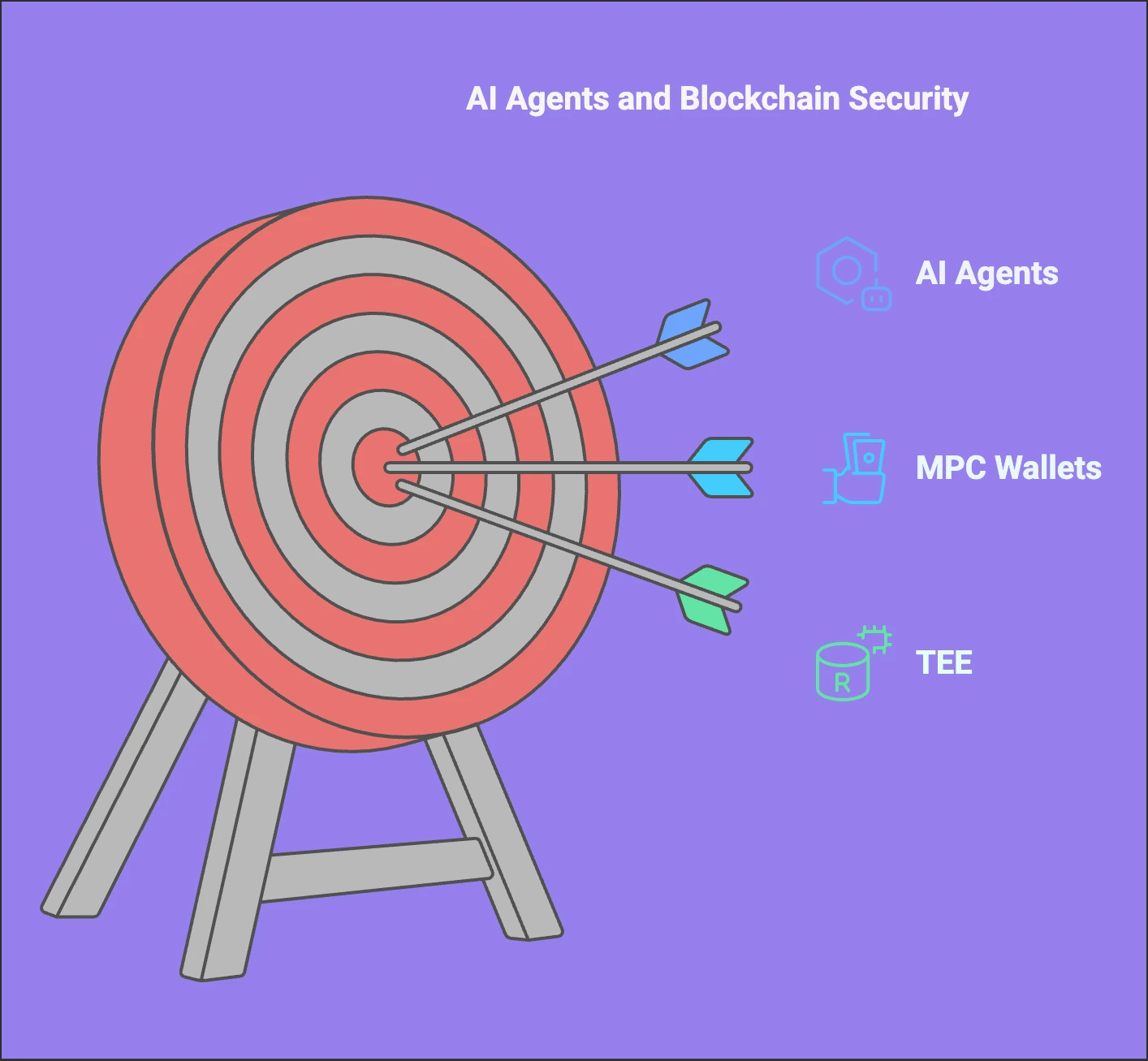

6. Wallet Management

AI Agents execute blockchain operations through wallet and key management mechanisms:

-

-

MPC Wallets: Multi-party computation wallets split private keys among participants, allowing secure transactions without single-point key risks.

-

TEE (Trusted Execution Environment): This method stores private keys in protected hardware enclaves, enabling autonomous transactions and decisions in a secure environment.

-

DEVELOPMENT TRENDS AND FUTURE PROSPECTS

DeFAI is rapidly evolving, with projects like Almanak, Cod3x, and Mode actively advancing. These projects, focusing on different areas such as quantitative trading and AI-driven decentralized applications, attract substantial investments and user participation, boosting the ecosystem’s vitality.

Looking ahead, DeFAI has the potential to drive innovation in financial services. By lowering entry barriers and offering personalized services, DeFAI will provide financial services to more users, especially those marginalized in traditional financial systems.

With technological advancements, DeFAI will deeply integrate with other fields such as IoT and supply chain management, offering comprehensive intelligent services. The continuous change in market demand will drive the emergence of new innovative solutions in the DeFAI sector to address future challenges and opportunities.

Although DeFAI demonstrates immense potential, investors need to be cautious of the pullback risks associated with short-term speculation. The cryptocurrency market is highly volatile, and significant price fluctuations may occur in the short term.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!