- Liquidation risks primarily exist in leveraged trading (such as futures and contracts), whereas spot and ETF trading won’t trigger forced sell-offs.

- Air coins, which lack real value, are highly volatile and risky. Investing in mainstream assets like Bitcoin and Ethereum not only provides better liquidity and market acceptance but also helps reduce investment risk.

- “Liquidation” news often exaggerates risks, as it mostly reflects losses of a small group of leveraged traders and has minimal impact on the long-term trend of the spot market.

TABLE OF CONTENTS

Cryptocurrency investment is not as excessively risky as “liquidation” news often portrays. By avoiding leveraged trading, steering clear of air coins, and taking a rational approach to market fluctuations, investors can effectively reduce risks and achieve steady growth. The article aims to help readers overcome misunderstandings about the crypto market and find a safer investment strategy that suits them.

Bitcoin Surges Past $90K, Then Drops—How Should Retail Investors View “Liquidation” News?

On November 12, Bitcoin briefly surged above $90,000 before plunging to around $85,500. At the time of writing, it has rebounded to above $86,000. Other cryptocurrencies also experienced sharp drops: Ethereum, for instance, hit $3,449 but quickly fell by nearly $300.

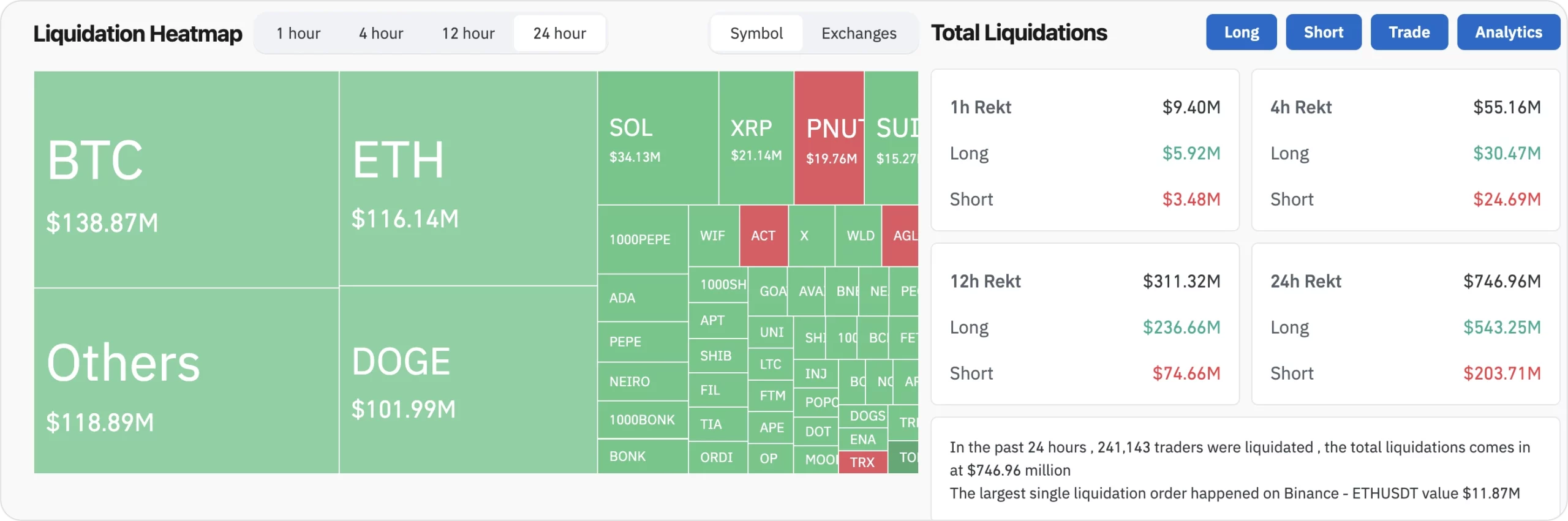

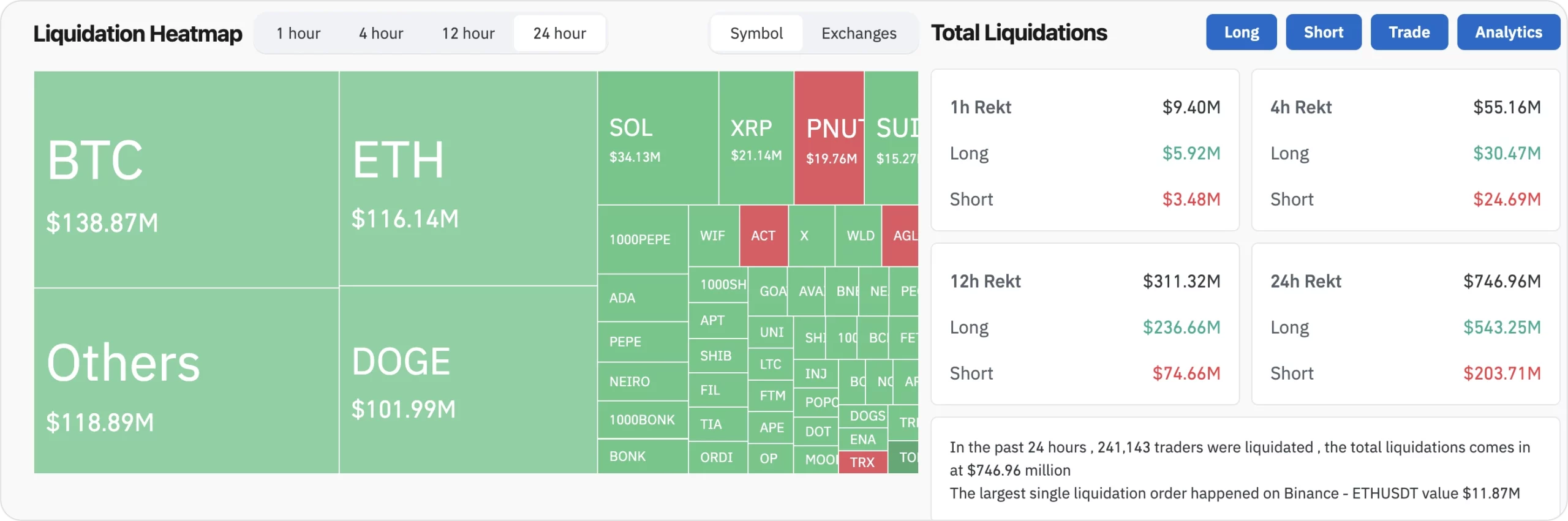

According to Coinglass, in the past 24 hours alone, 241,005 crypto traders were liquidated, with total liquidations reaching $745 million.

(Source:Coinglass)

Every time the crypto market experiences volatility, headlines like “Hundreds of Thousands of Traders Liquidated” flood the internet, creating an impression that crypto investment is inherently risky. However, such news lacks real value and often misleads regular investors, fostering misunderstandings about crypto. Terms like “liquidation” can provoke fear, leading many to believe that investing in cryptocurrency is a high-stakes gamble. But if crypto is really that risky, how could Bitcoin’s value increase over the long term?

Here are three key tips for investors to avoid excessive fear stirred by “liquidation” news:

1. AVOID DERIVATIVES TO STEER CLEAR OF LIQUIDATION RISKS

Trading Bitcoin spot or ETFs does not carry liquidation risk. Liquidations mainly occur in leveraged trading, such as Bitcoin futures or contracts. Leveraged trading involves borrowing; if the asset’s price falls below the loan amount, brokers may force-sell the position, resulting in significant losses for investors.

Media often highlight “liquidations” in the derivatives market, creating a sense of alarm. In reality, the spot market does not involve leverage, so price fluctuations do not trigger forced sell-offs. Holding spot Bitcoin can yield long-term growth potential regardless of short-term price drops. While derivatives volatility may impact spot market sentiment in the short run, it does not alter Bitcoin’s long-term trajectory. Focusing on spot over derivatives can effectively help you avoid liquidation risks.

2. STEER CLEAR OF “AIR COINS” TO AVOID FLASH CRASHES

Many people avoid crypto altogether due to the frequent news of air coins. Air coins refer to assets with no real-world applications, unrecognized technology, or even outright scams, also known as “junk coins.” Flash crashes often occur in air coins; while these may not trigger liquidations, they carry extreme volatility and high risks.

The best way to avoid this risk is to stay away from air coins and avoid being enticed by their occasional surges or grand promises. Such coins may already be controlled by large players, who manipulate them to exploit investors’ greed. When investing in crypto, prioritize major assets like Bitcoin and Ethereum, which have better liquidity, high market recognition, and have been tested over time.

3. TAKE A RATIONAL APPROACH TO CRYPTO MARKET FLUCTUATIONS; DON’T BE MISLED BY “LIQUIDATION” NEWS

Liquidation news reflects the losses of a small segment of leveraged traders and has little to do with the long-term performance of the spot market. Bitcoin and Ethereum, for example, have withstood multiple bull and bear cycles and still hold strong market value. Rather than focusing on “liquidation” headlines, investors should pay attention to market trends and fundamental shifts in the crypto landscape.

By adopting reasonable investment methods and selecting stable asset types, you can achieve relatively stable returns in the crypto market.

Investing in cryptocurrency is not gambling; it requires rational analysis and a long-term approach. By avoiding leveraged trading, steering clear of air coins, and taking a balanced view on market fluctuations, investors can minimize risks and enjoy the potential growth of crypto assets. Don’t let liquidation headlines mislead you—take a rational path and explore the true value of crypto.

Read More:

MicroStrategy: The Biggest Winner Behind Bitcoin’s Soaring Surge

Why Some Tech Giants Have Not Entered the Cryptocurrency Market

CoinRank x Bitget – Sign up & Trade to get $20!