KEYTAKEAWAYS

- DFSA Approves USDC, EURC as First Recognized Stablecoins

- Dubai's Focus on Stablecoin Compliance

- Multiple Countries or Economies Experimenting with Stablecoins

CONTENT

DFSA APPROVES USDC, EURC AS FIRST RECOGNIZED STABLECOINS

Recently, the Dubai Financial Services Authority (DFSA) officially approved Circle’s stablecoins USD Coin (USDC) and EURC (EURC) as the first recognized stablecoins under its regulatory framework. This decision marks that businesses within the Dubai International Financial Centre (DIFC) can use these two stablecoins in multiple digital asset applications such as payments and fund management. As a financial hub in the Middle East, Dubai’s pioneering recognition of stablecoins demonstrates an open and forward-thinking financial policy, opening a new chapter for the global application of stablecoins.

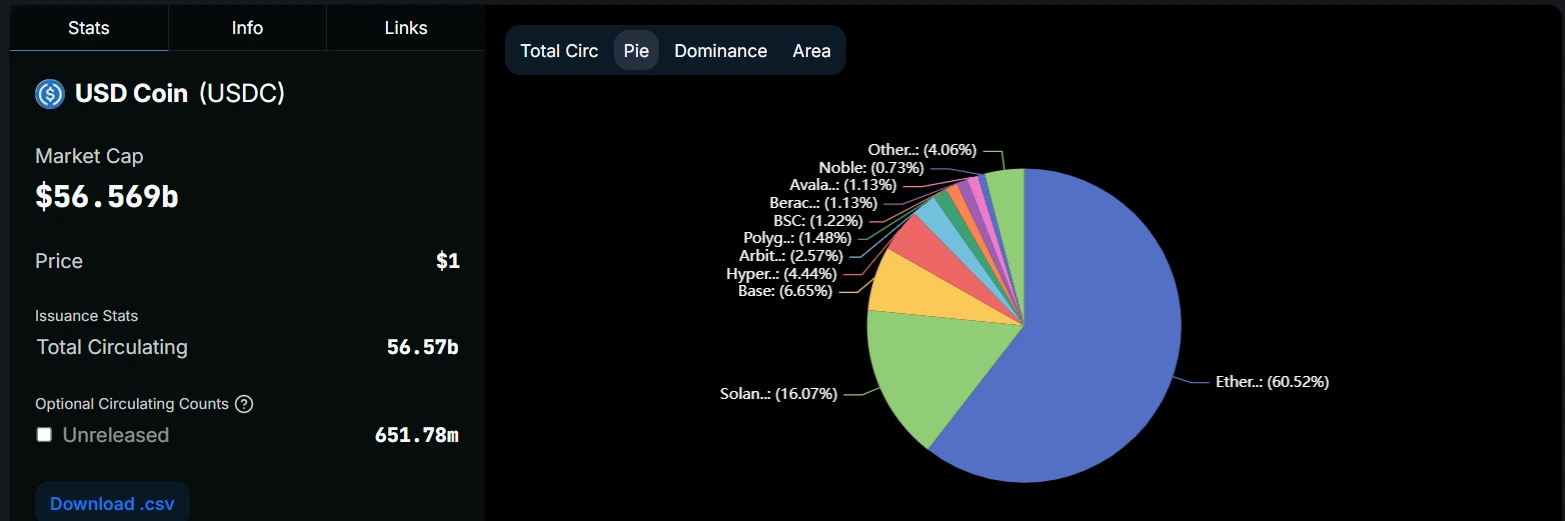

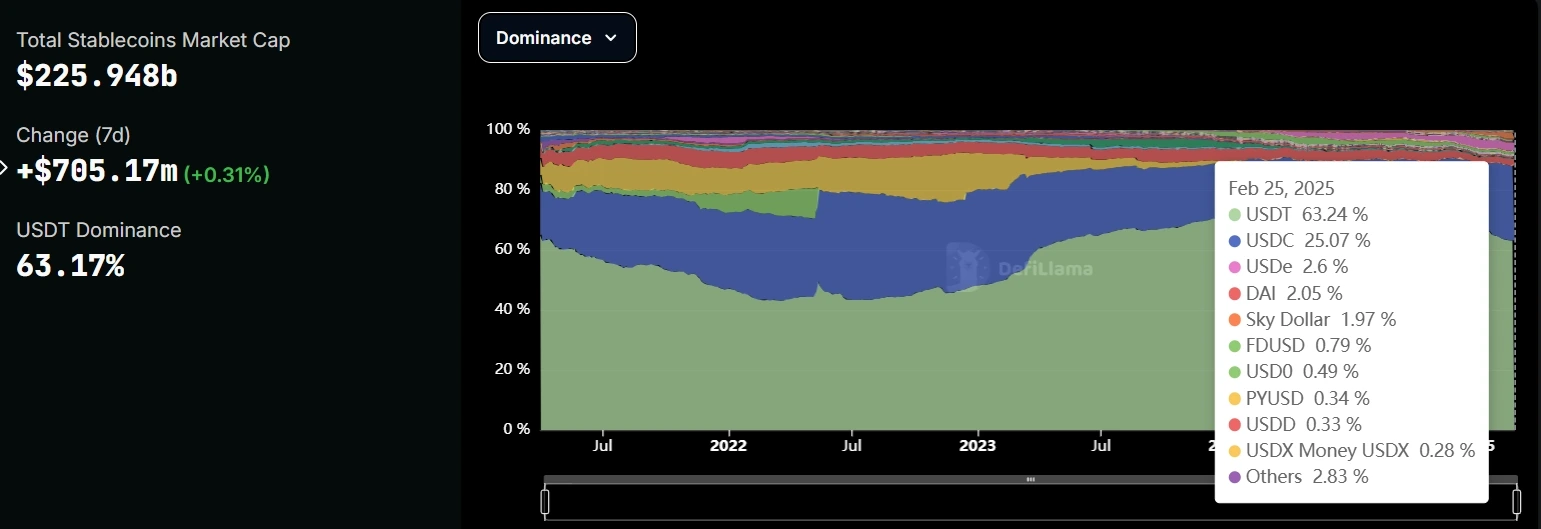

Source: DefiLlama

USDC and EURC are dollar-pegged and euro-pegged stablecoins issued by Circle. USDC is the world’s second-largest stablecoin with a market cap exceeding $57 billion, second only to Tether (USDT). EURC is Circle’s euro-pegged stablecoin aimed at providing more convenient digital currency solutions for the European market. The issuance and circulation of both stablecoins rely on blockchain technology, ensuring transaction transparency and security.

The approval by the Dubai Financial Services Authority means that businesses within the DIFC can legally use USDC and EURC for payments, fund management, and cross-border settlements. Since its establishment in 2004, the DIFC has attracted nearly 7,000 active businesses, becoming an important financial center for the Middle East, Africa, and South Asia regions. This approval not only provides more financial tools for businesses within the DIFC but also sets an example for other global financial centers.

REASONS FOR STABLECOIN POPULARITY

The rise of stablecoins is no coincidence; it’s backed by profound global financial transformation. First, stablecoins provide a relatively stable store of value, especially against increasing global economic uncertainty. Unlike highly volatile cryptocurrencies such as Bitcoin, stablecoins maintain relatively stable value by pegging to fiat currencies (like USD, EUR), making them hedging tools for investors and businesses in the crypto market.

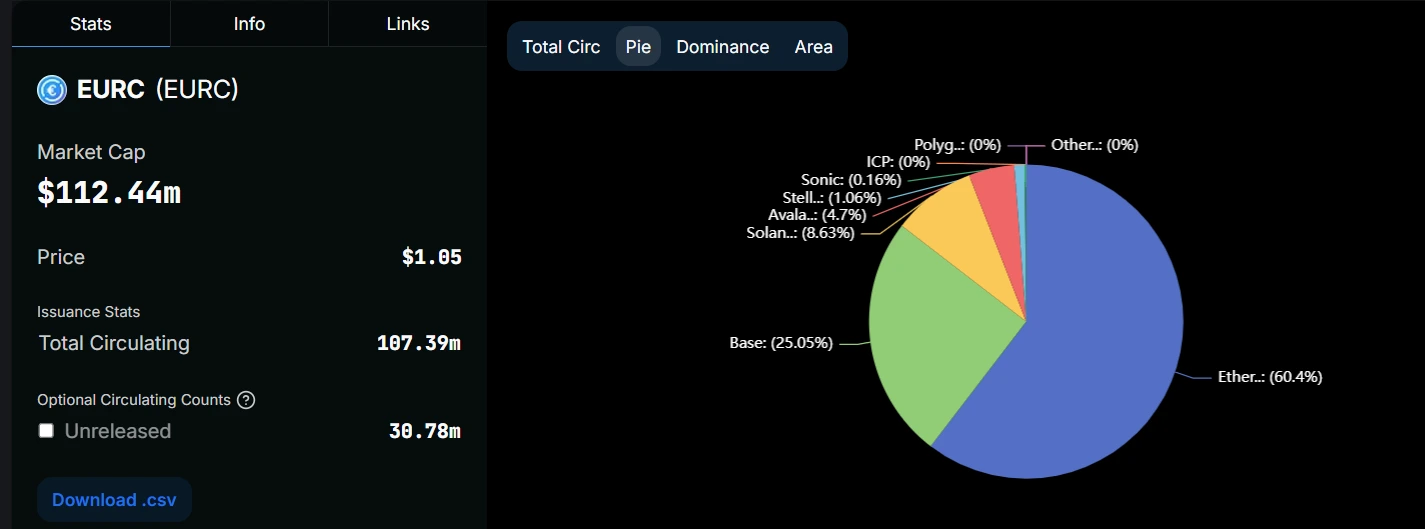

Source: DefiLlama

Second, stablecoins demonstrate enormous potential in cross-border payments and remittances. Traditional cross-border payment systems typically take days to complete transactions with high fees. Stablecoins, using blockchain technology, can complete global fund transfers in minutes at a fraction of traditional bank transfer costs. This efficient, low-cost payment method has gained widespread adoption, particularly in emerging markets.

Additionally, stablecoins offer new solutions for financial inclusion. In many developing countries, people lack access to traditional financial services due to limited banking infrastructure or unstable local currencies. Stablecoins provide these populations with means for storage, transfer, and payment through decentralized methods, enabling their participation in the global economy.

DUBAI’S FOCUS ON STABLECOIN COMPLIANCE

Although there are many stablecoin projects globally, USDC and EURC gained Dubai’s recognition primarily due to their transparency and compliance. Circle, as the issuer of USDC and EURC, has consistently worked to improve transparency for its stablecoins and regularly publishes audit reports proving that its stablecoins are indeed fully backed by fiat assets. This enhanced transparency not only strengthens user trust but also makes these stablecoins more competitive in the global regulatory environment.

In contrast, other stablecoins like Tether (USDT), despite having a larger market share (63.13%), have faced ongoing questions about their transparency and compliance. Although Tether has been working to improve its transparency, it still faces significant regulatory pressure in multiple jurisdictions. USDC and EURC, through collaboration with global regulatory authorities, offer greater standardization for traditional financial institutions, leading to their widespread recognition in financial centers like Dubai.

Source: DefiLlama

MULTIPLE COUNTRIES OR ECONOMIES EXPERIMENTING WITH STABLECOINS

Stablecoins, as an emerging form of digital currency, are rapidly rising globally, showing enormous potential particularly in cross-border payments and remittances. Their efficient, low-cost characteristics make them an important complement to traditional financial systems, especially in emerging markets where stablecoin applications are changing the financial services landscape. Beyond payments and remittances, stablecoin use cases have expanded to multiple areas including salary payments, goods purchases, savings, and investments, further enhancing their importance in the global financial system.

Whether through central bank digital currencies (CBDCs) to strengthen monetary sovereignty or private stablecoins to drive financial innovation, countries are actively exploring future applications of digital currencies. Here are attempts and developments in stablecoins and CBDCs across multiple countries or economies:

- United States: The Federal Reserve is researching the feasibility of a Digital Dollar, focusing on its impact on financial stability and monetary policy. Private stablecoins like USDC and USDT already dominate the US market and are closely monitored by regulatory agencies.

- European Union: The European Central Bank (ECB) is developing a digital euro aimed at providing a secure digital currency for the eurozone. The digital euro will complement cash, primarily for retail payments.

- Japan: The Bank of Japan (BOJ) has launched a digital yen pilot project to test its technical feasibility and practical applications.

- India: The Reserve Bank of India (RBI) has initiated a digital rupee pilot project in both retail and wholesale versions.

- Nigeria: Nigeria is the first African country to launch a CBDC, with eNaira officially going live in 2021. eNaira aims to enhance financial inclusion, reduce cash usage, and lower cross-border payment costs.

- China: Launched a central bank digital currency (CBDC)—the digital yuan (e-CNY).

- Switzerland: The Swiss National Bank (SNB) is testing a wholesale CBDC for interbank settlements.

The Dubai Financial Services Authority’s approval of USDC and EURC as the first recognized stablecoins signals a profound transformation in the global financial system. As more countries and regions join, stablecoin applications and market landscape will further expand, bringing a more diversified and efficient development to the global financial system.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!