KEYTAKEAWAYS

- dYdX Reaches $1.46 Trillion in Cumulative Trading Volume

- $DYDX token holders have increased to 53,000

- Users collectively staked 241 million $DYDX tokens

- dYdX will optimize its token structure and strengthen decentralization

CONTENT

dYdX Reaches $1.46 Trillion in Cumulative Trading Volume. $DYDX token holders have increased to 53,000. Users collectively staked 241 million $DYDX tokens. dYdX will optimize its token structure and strengthen decentralization.

DYDX REACHES $1.46 TRILLION IN CUMULATIVE TRADING VOLUM

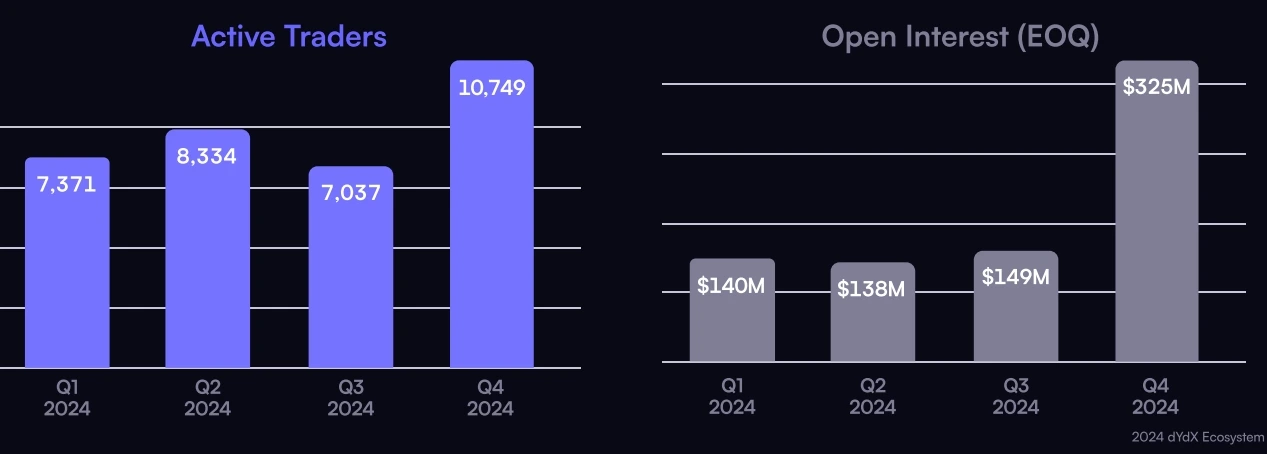

According to its “2024 Ecosystem Report,” decentralized trading platform dYdX has achieved remarkable results in 2024. The platform’s annual trading volume reached $270 billion, with cumulative trading volume surpassing $1.46 trillion since 2021. The report shows that the community distributed $63 million in trading rewards throughout the year, while MegaVault deposits totaled $79 million, and over 150 new markets were successfully launched.

Source: dYdX

2024 marked a significant milestone in the development of the dYdX ecosystem. Over the past year, the platform has significantly enhanced its influence in the decentralized derivatives trading space through continuous product innovation and community governance. Notably, the dYdX Unlimited feature launched in November last year not only supports instant market launches but also substantially improved the platform’s liquidity and trading efficiency.

The platform’s growth is also reflected in key user metrics. As of January 2025, DYDX token holders have increased to 53,000, representing a 292% year-over-year growth, with 17,700 users participating in token staking and a total of 241 million DYDX tokens staked. The median annual staking yield is 14.93%, providing stable passive income for community members.

CONTINUOUS OPTIMIZATION OF LIQUIDITY AND USER INCENTIVES

MegaVault, as the core of dYdX’s liquidity strategy, performed exceptionally well in 2024. Within just six weeks, MegaVault’s Total Value Locked (TVL) exceeded $79 million, with the highest annual yield rate temporarily surpassing 40%. The launch of this liquidity pool not only enhanced the platform’s market depth but also provided users with more earning opportunities.

Source: dYdX

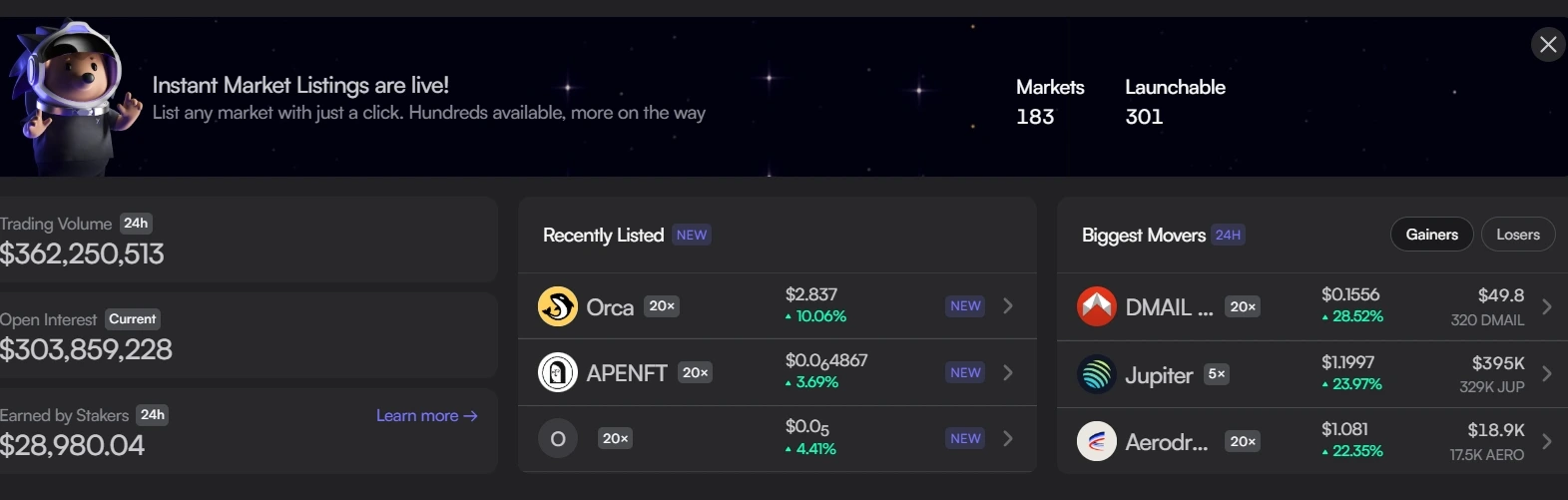

MegaVault’s growth is closely tied to dYdX’s vision of “Trade Anything.” In 2024, the dYdX community launched new perpetual contracts including forex markets (such as Turkish Lira and Euro) and prediction markets (like the Trump election market), providing users with a broader range of trading options. The rapid launch of these new markets was made possible by the platform’s “instant listing” feature, allowing any user to easily create and trade new assets.

Furthermore, dYdX further incentivized active users through innovative trading reward programs. Data shows that in 2024, the platform distributed $63 million in trading rewards, including protocol-automated instant rewards and monthly incentive programs. This mechanism not only increased user loyalty but also drove growth in trading volume.

FUTURE OUTLOOK: ADVANCING TOWARDS STRONGER DECENTRALIZATION

In the report, dYdX emphasizes that 2025 will be a crucial year for further expanding the influence of decentralized trading. The platform plans to optimize its tokenomics structure and further drive ecosystem decentralization through enhanced incentives and community governance.

Looking ahead, dYdX’s Q1 2025 roadmap includes the following key points:

- User Experience Upgrade: Optimizing the platform’s mobile user experience, launching a more seamless mobile application and instant deposit functionality.

- Liquidity Enhancement: Improving MegaVault’s performance to provide robust support for more markets while delivering higher liquidity for users.

- Market Expansion: Through further simplification of the market listing process, the platform expects to add hundreds of new trading pairs by 2025, laying a solid foundation for the “Trade Anything” vision.

On January 28, the DYDX platform showed a daily trading volume of $360,990,803, with open interest at $304,553,399

Source: dYdX

Finally, as decentralized derivatives trading becomes more widespread, the dYdX platform is providing users with a broader selection of markets and a more flexible trading environment. In this report, dYdX demonstrates the immense potential of decentralized finance through its outstanding innovation capabilities and community-driven ecosystem development.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!