KEYTAKEAWAYS

- Bitcoin ETFs provide a regulated, accessible way for institutions and retail investors to participate in the crypto market without directly holding cryptocurrencies.

- Institutional capital flows via ETFs are stabilizing Bitcoin’s market, promoting long-term strategies over short-term retail-driven speculation.

- The future of Bitcoin ETFs includes innovation like multi-asset crypto funds, further driving mainstream adoption but also introducing new regulatory and market challenges.

CONTENT

Explore how Bitcoin ETFs are attracting institutional capital, reshaping the market’s dynamics, and paving the way for broader adoption of cryptocurrencies. Learn about trends, risks, and future opportunities.

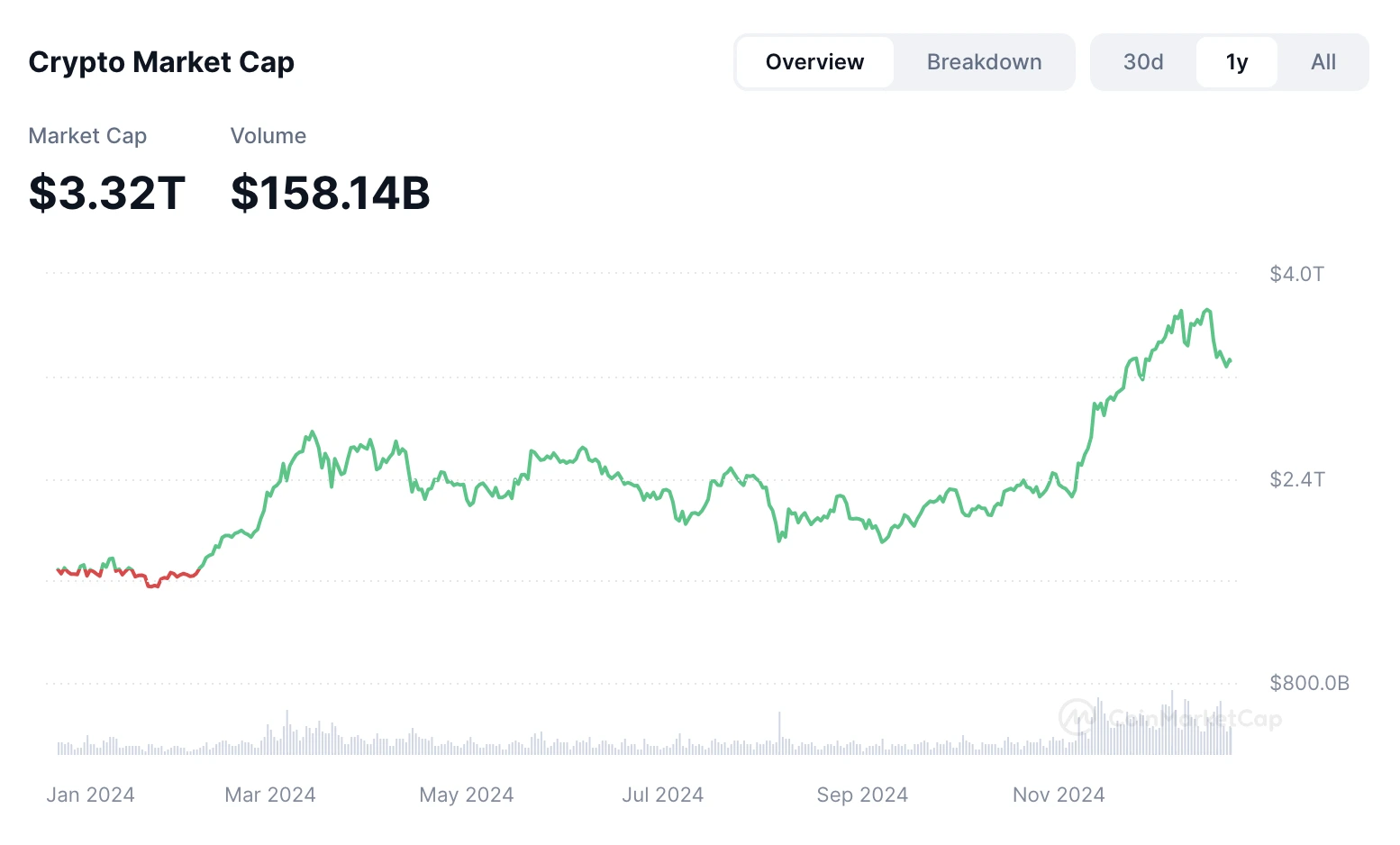

The Bitcoin market is experiencing a fundamental transformation. As Bitcoin ETFs (Exchange-Traded Funds) continue to attract significant capital inflows, investors are reassessing Bitcoin’s position as “digital gold” in the financial marketplace. What was once viewed primarily as a speculative asset is now being reshaped by institutional investors with substantial capital and long-term investment horizons.

(Source: CMC)

UNDERSTANDING ETF FUNDAMENTALS

An ETF functions as a tradable security that tracks Bitcoin’s value, allowing investors to gain exposure through traditional stock market exchanges. Bitcoin ETFs have gained considerable traction globally, with products like Grayscale’s GBTC, ProShares Bitcoin Strategy ETF (BITO), and iShares Bitcoin Trust ETF (IBIT) leading the way.

These investment vehicles offer both retail and institutional investors regulated access to Bitcoin exposure without the complexities of direct cryptocurrency ownership.

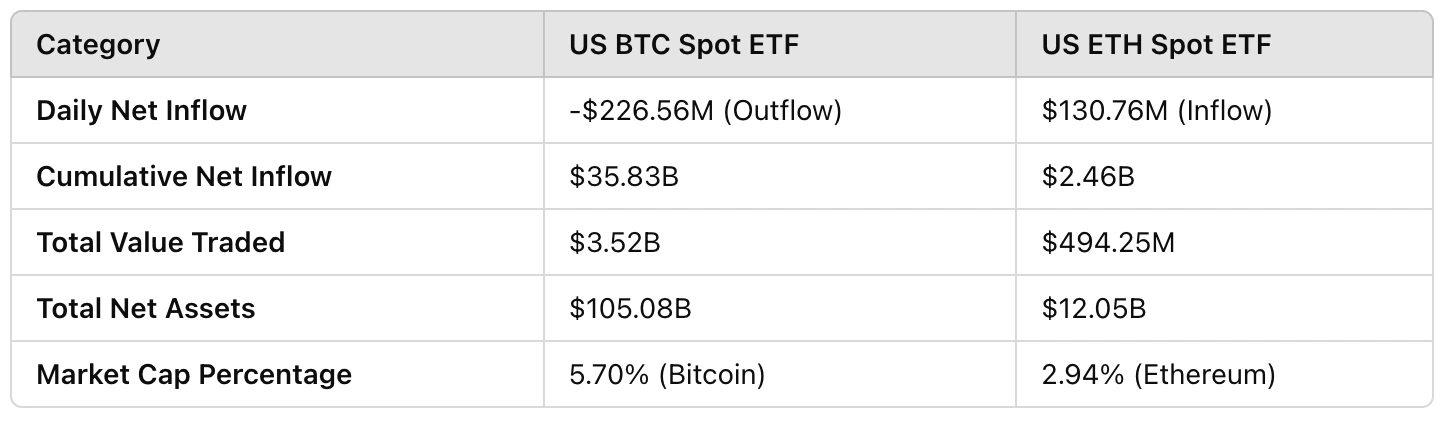

(Source: SoSoValue)

The launch of BlackRock’s IBIT marks a significant milestone in this evolution. Unlike ProShares’ futures-based approach, IBIT directly tracks Bitcoin’s price. Since its inception, IBIT has accumulated over $37 billion in assets under management, demonstrating robust institutional demand for direct Bitcoin exposure through regulated channels.

As of December 23, the latest data on U.S. BTC Spot ETF and ETH Spot ETF highlights the pivotal role of ETFs in advancing the cryptocurrency market. The BTC Spot ETF, with cumulative inflows of $35.83 billion and total net assets of $105.08 billion, accounting for 5.70% of Bitcoin’s market cap, demonstrates the market’s strong confidence in Bitcoin.

Meanwhile, the ETH Spot ETF is gradually attracting capital with daily inflows of $130.76 million and total net assets of $12.05 billion, representing 2.94% of Ethereum’s market cap. Although its scale is smaller, the consistent net inflows reflect a growing market interest in Ethereum.

These figures not only showcase the positive impact of cryptocurrency ETFs in drawing traditional capital and enhancing market liquidity but also signal that crypto assets are increasingly becoming an integral part of the mainstream financial system, fostering greater confidence in the market’s future growth.

Also Read:

Grayscale’s GBTC: The Potential Spot Bitcoin ETF – Pros, Cons, and What to Watch Next

INSTITUTIONAL INTEREST: TIMING AND STRATEGY

The surge in institutional participation can be attributed to several factors. Global economic uncertainties and inflationary pressures have prompted investors to explore alternative stores of value.

As traditional safe-haven assets like gold face scrutiny, Bitcoin has emerged as a compelling digital alternative. ETFs provide institutions with a compliant and operationally efficient pathway for Bitcoin investment.

The regulatory environment has also evolved favorably. Major markets, particularly the United States, have adopted a more accommodating stance toward Bitcoin ETFs, providing the regulatory clarity that institutional investors require. This shift has encouraged broader participation from traditional financial institutions.

Some institutions appear to be taking strategic positions in Bitcoin, viewing it as a technological paradigm shift comparable to early-stage investments in transformative companies like Apple or Amazon.

MARKET IMPACT OF ETF INVESTMENT

The influx of institutional capital through ETFs is contributing to market maturation. Trading patterns are increasingly influenced by long-term investment strategies rather than short-term speculation. ETF inflows tend to create more stable market dynamics, though this may reduce opportunities for short-term traders.

(Source: CMC)

This transformation introduces new market dynamics. While institutional participation can enhance market stability, it also concentrates influence among larger players. The potential impact of institutional portfolio rebalancing or strategic exits presents a risk factor that market participants must consider.

Also Read:

Why Have Nations Been Reluctant to Include Bitcoin in National Reserves?

FUTURE DEVELOPMENTS AND CONSIDERATIONS

The Bitcoin ETF market continues to evolve. Industry observers anticipate further innovation, including potential Ethereum-based ETFs and diversified crypto-asset ETF products. These developments could accelerate mainstream cryptocurrency adoption.

However, several challenges remain. The market must address ongoing technological infrastructure needs, navigate evolving regulatory requirements, and develop educational resources to help investors understand these complex products.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!