KEYTAKEAWAYS

- Ethereum has seen significant ETF inflows, signaling growing investor confidence and optimism for a price surge in 2025.

- Institutional investors are increasingly bullish on Ethereum, with a rising number of stakers and growing trust in its DeFi ecosystem.

- Technical indicators show ETH is at a turning point, with its price potentially set to outperform Bitcoin, based on past market cycles.

CONTENT

Compared to the previous boom in DeFi and NFTs, ETH has faced more skepticism in this cycle. Many analysts point out that ETH is facing serious resistance to rising, and is heading towards inflation. Nearly all DeFi transactions are now happening on L2 networks, which have been dragging down ETH’s price.

However, since Trump’s election, things have started to change. Not only has the situation regarding ETH spot ETF inflows reversed by 180 degrees, but the market is also becoming increasingly bullish on ETH’s future… So, could 2025 be ETH’s year of revival?

HUGE INFLOWS INTO ETF

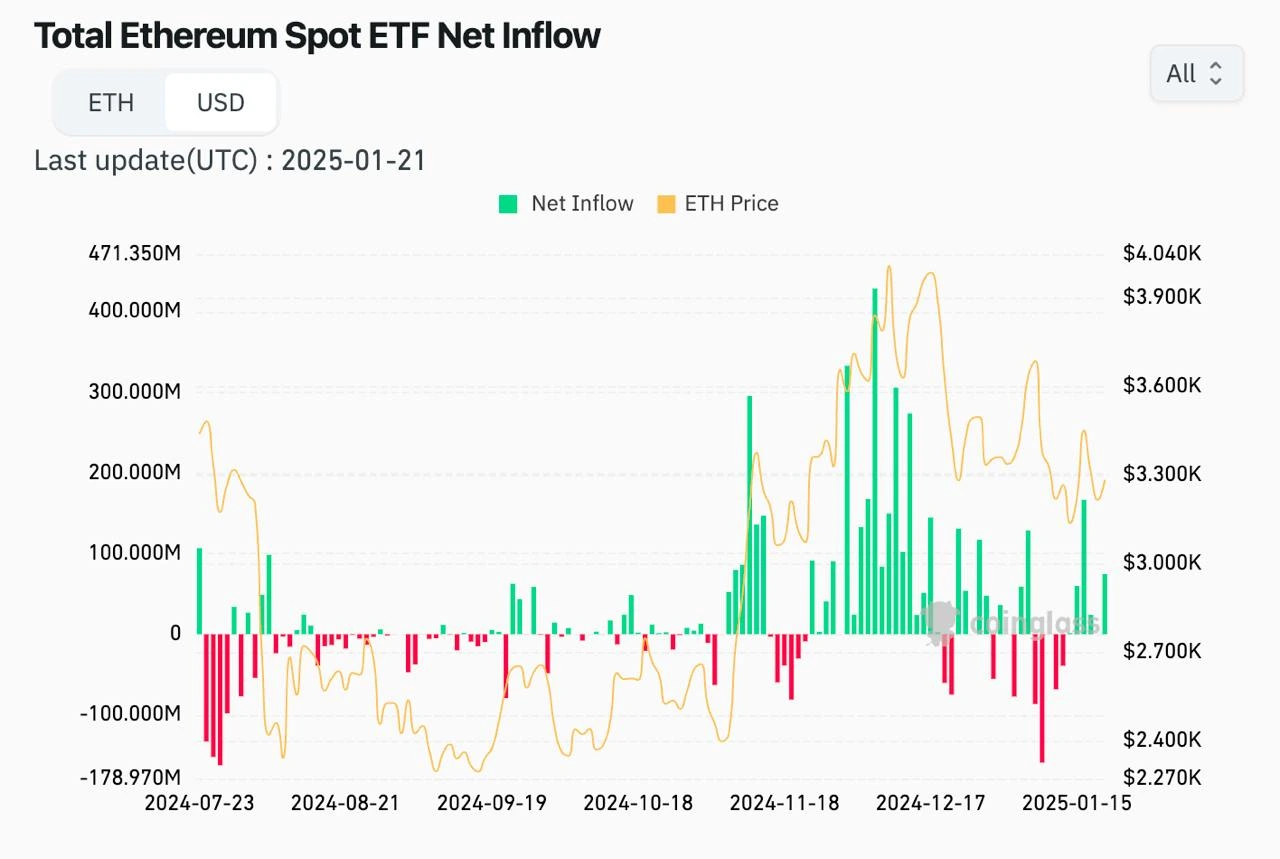

In mid-2024, the U.S. Ethereum spot ETF was approved. However, because the market was down at the time, investor response was lukewarm, and the fund inflows briefly turned negative. After about three months of silence, Ethereum saw a significant inflow of funds in early November, with net inflows consistently surpassing net outflows.

By the end of November, the Ethereum spot ETF recorded 18 consecutive days of net inflows, setting a rare record, with the highest daily net inflow exceeding $400 million. In terms of market cap, this is equivalent to nearly $1.2 billion in daily inflows into Bitcoin, considering that Ethereum’s market cap is only a quarter of Bitcoin’s.

(Source: Coinglass)

This capital movement may reflect a rebalancing of asset allocations or an expansion of investment scope, which coincides with the start of the new fiscal year for U.S. mutual funds on December 1. It also reflects the market’s optimistic expectations for 2025. If this demand for funds continues, ETH’s price could see a significant rise in 2025.

Also Read:

9 ETH Spot ETF Applications Under SEC Review

INSTITUTIONS BULLISH ON ETH’S FUTURE

In addition to the ETF activity, institutional investors have shown great confidence in ETH. Carlos Mercado, a data scientist at blockchain strategy company Flipside Crypto, pointed out that the number of Ethereum stakers has increased by over 30% in the past year.

According to a survey by New York-based blockchain intelligence firm Blockworks Research last October, 69.2% of respondents chose to stake Ethereum, with 78.8% of them coming from investment or asset management firms. Additionally, more than 52% of respondents participated in liquid staking, indicating that traditional financial players are increasingly understanding and engaging with Ethereum’s DeFi ecosystem.

(Source: defillama)

Bloomberg’s senior ETF analyst Eric Balchunas noted that since Trump’s victory, Ethereum ETFs have recovered from a phase of outflows and have seen net inflows. According to Bloomberg Intelligence, the cumulative fund flow for Ethereum ETFs has turned positive, further proving that institutional investors’ trust in Ethereum continues to grow.

TECHNICAL ANALYSIS BULLISH ON ETH

On the technical side, there are also signs that ETH might be poised for a breakout. The ETH/BTC price ratio is at a cyclical turning point, forming a bottom. Based on past experience, this suggests that Ethereum’s price might rise soon, potentially outpacing Bitcoin’s gains.

(Source: Tradingview)

Well-known commodities and forex trader Peter Brandt also posted a message, “A letter from the grave?” with a chart showing the ETH/BTC exchange rate. The chart illustrates how ETH surged when the ETH/BTC exchange rate was at a low point four years ago.

Also Read:

2024 Crypto Market Predictions Backed by Technical Analysis

TRUMP FAMILY SUPPORT

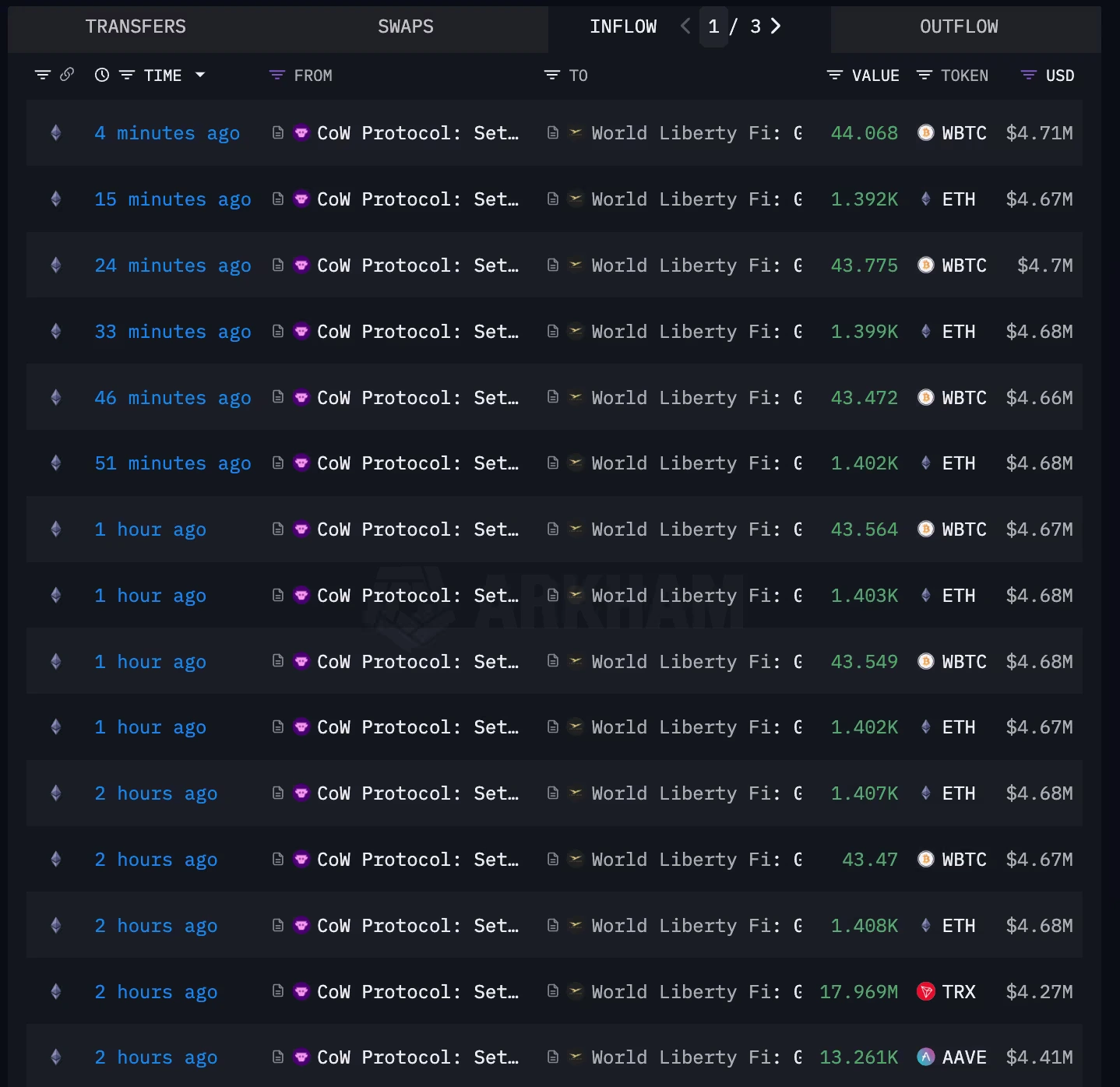

In addition to the fundamental factors, support from the Trump family has also become a potential price support point.The Trump family’s WLFI project has bought several Ethereum ecosystem tokens, including AAVE, LINK, ENA, and ONDO. However, ETH remains the largest holding in the project.

Just yesterday, WLFI posted on X, announcing strategic purchases to commemorate Trump’s inauguration as the 47th U.S. president, which included buying $47 million worth of ETH. With even the president’s family on board, why hesitate?

BULLISH PREDICTIONS INCREASING

As more favorable factors emerge, bullish predictions are becoming more frequent in the market.Crypto analyst Ali Martinez mentioned late last year that, by the end of this macro market cycle, ETH will outperform Bitcoin. In his optimistic forecast for the coming months, he predicted Ethereum would rise to $6,000 and might reach at least $4,000 during this cycle.

He stated, “Every market cycle has a phase where Ethereum outperforms Bitcoin, and while that hasn’t happened yet in this cycle, it’s definitely coming. Since ETH is still lagging, now is the time to buy before it beats the market.”

NDV co-founder Christian 2022.eth also posted that, since October, they have gradually built a position of over $8 million in BNB, believing that in the second half of the bull market, both BNB and ETH will play catch-up and lead the rally.

Historical data has supported similar optimistic predictions. According to Coinglass, ETH has performed the best in the first quarter following U.S. presidential elections and Bitcoin halving cycles, particularly in Q1 of 2017 and Q1 of 2021, when ETH rose by 518% and 161%, respectively, outperforming BTC in those quarters (BTC’s gains were 11.9% and 103.2%).

SOME BEARISH VIEWS REMAIN

Despite the growing optimism, not everyone is convinced that ETH will thrive in the near future.Markus Thielen, founder of 10x Research, is cautious about ETH, predicting it will continue to struggle and fail to reach new highs in 2025, especially in a “hawkish” macro environment. He believes, “We expect ETH to have a more conservative outlook in 2025. Unlike in previous years, the initial hawkish policies may face challenges from weakening liquidity.”

Additionally, Ethereum itself faces some tough challenges. Its ecosystem has been relatively quiet in 2024, with transaction volumes stagnating, while competitors like Solana and Sui are gaining strength. Moreover, Ethereum’s core narrative is increasingly being questioned, putting additional pressure on its future growth.

While the bullish outlook for ETH is gaining traction, it’s clear that the road ahead is not without obstacles. Whether Ethereum can truly make a comeback in 2025 will depend on how it navigates both internal challenges and external market conditions. Only time will tell if the optimism is well-placed or premature.

Also Read:

Memecoins: A New Financial Revolution or a Passing Trend?

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!