KEYTAKEAWAYS

- Ethereum surged 14.9% to $1,820, driven by ETF inflows, institutional buying, and Bitcoin’s breakout above $90,000.

- Strong fundamentals, including DeFi dominance and Layer 2 growth, support Ethereum’s long-term value.

- Despite bullish momentum, ETH faces short-term resistance and regulatory uncertainties in the evolving crypto landscape.

CONTENT

Ethereum (ETH) has made a strong comeback today, jumping above $1,800 and reaching a high of $1,820. In the past 24 hours, ETH has surged by 14.9%. Starting from a low of $1,537, the price quickly gained momentum, broke through the key resistance at $1,780, and is now holding above the 30-day moving average.

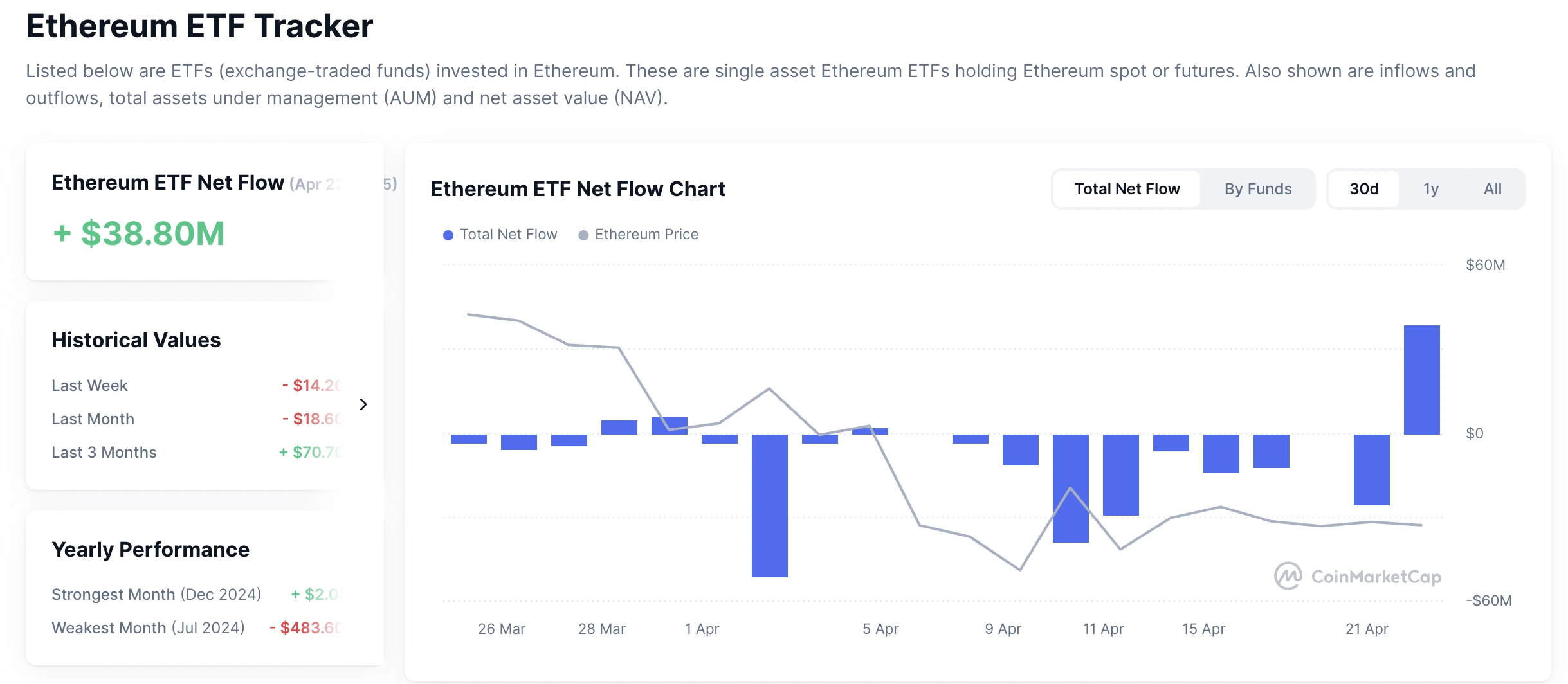

This rally is partly due to Bitcoin breaking above $90,000, which lifted the overall market. Other factors include a $38.8 million net inflow into spot ETFs, institutional buying (like from Fidelity Investments), and positive market sentiment around global macro news—such as a pause in US-Canada trade tariffs.

However, some analysts warn that ETH may face short-term pressure. The target price of $1,840 is near, and there’s a chance of a pullback. A second dip toward $1,400 cannot be ruled out.

This strong rally has sparked new interest in Ethereum’s long-term potential. Let’s take a deeper look at the fundamental side of ETH to understand its real value and future outlook.

(Source:CMC)

ETHEREUM FUNDAMENTALS

Fundamental analysis focuses on an asset’s real value. It considers factors like the economy, technology, supply and demand, and market sentiment to understand long-term potential. Here are the key points for Ethereum:

TECH ECOSYSTEM AND USE CASES

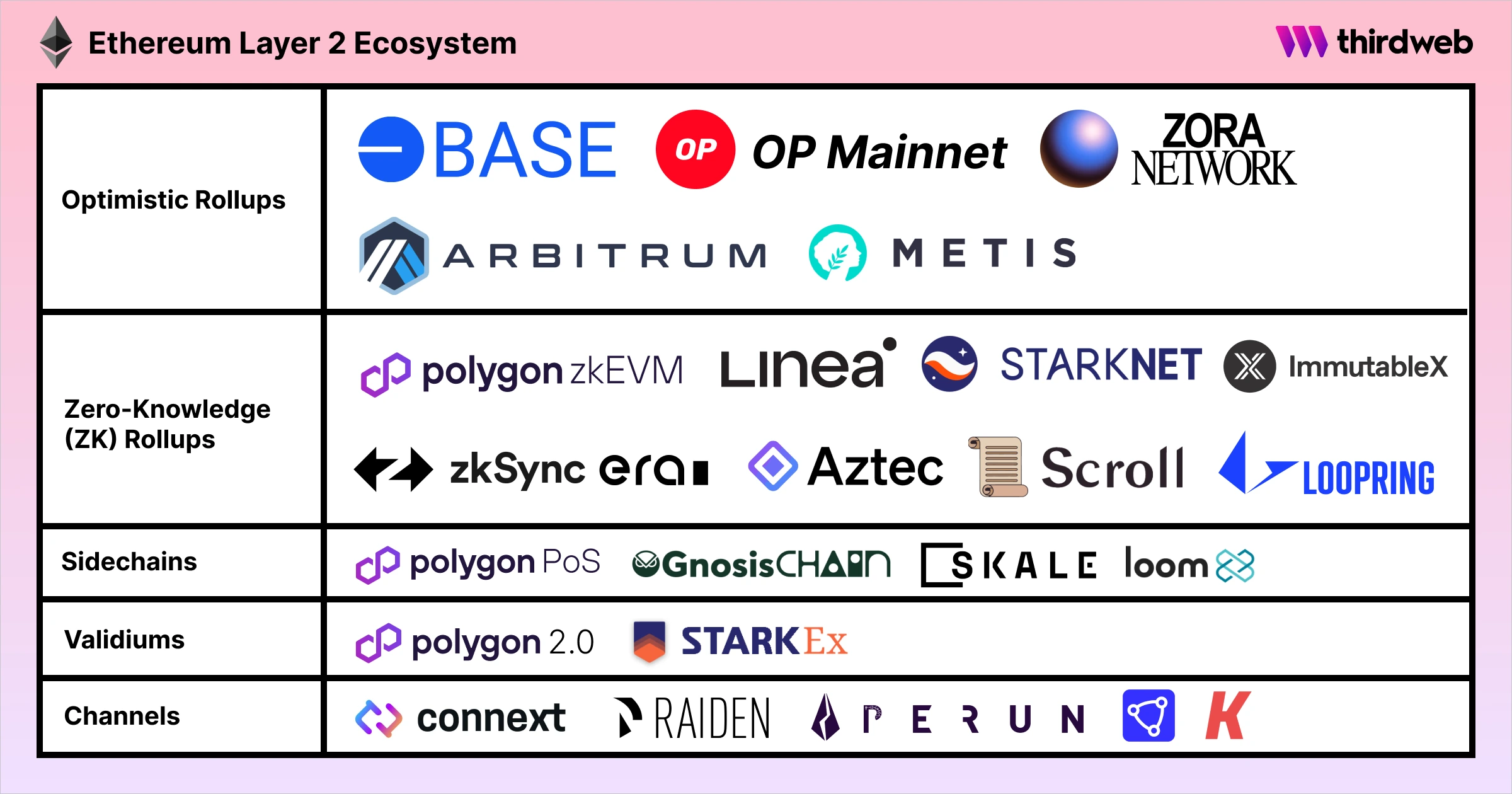

Ethereum is the leading smart contract platform in the world. Its ecosystem is a major strength. In 2025, Ethereum and its Layer 2 networks (such as Arbitrum and Optimism) support many areas: DeFi (decentralized finance), NFTs (non-fungible tokens), and DAOs (decentralized autonomous organizations).

According to DappRadar, Ethereum still holds around 55% of the total value locked (TVL) in DeFi. While other networks like Solana and TON are growing fast—especially in meme coins and blockchain gaming—Ethereum still stands at the center of the crypto ecosystem thanks to its large developer community and wide use cases.

COMPETITION AND RISKS

Despite its strong position, Ethereum faces increasing competition. Solana offers high speed and low fees, making it popular for NFTs and meme coins. TON is strong in gaming, and TRON leads in stablecoin transactions.

Some users believe Ethereum’s growth in areas like DeFi and NFTs has slowed compared to previous cycles. That could limit price breakout potential.

Regulation is another risk. In 2025, global rules on crypto are tightening. The US SEC is reviewing many DeFi protocols, which could affect innovation within Ethereum’s ecosystem. Investors need to watch regulatory changes closely.

FUTURE OUTLOOK

For long-term investors, Ethereum still looks promising. Its deflationary model and growing ecosystem can increase value over time. But short-term traders should be cautious about volatility and focus on key support and resistance levels.

Macroeconomic factors like inflation data and interest rate decisions will also affect price trends. Staying updated on these will help in making better investment choices.

Today’s strong rebound shows the market still has confidence in Ethereum. Even with challenges like L2 competition, regulation, and shifting user trends, ETH remains one of the most attractive assets in the crypto space.

As blockchain tech grows in areas like finance, gaming, and the metaverse, Ethereum is likely to continue its role as the “world computer” and offer lasting value for investors.

(Note: Crypto markets are highly volatile. This article is for informational purposes only and does not constitute investment advice.)

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!