KEYTAKEAWAYS

- Decentralized Autonomous Organizations revolutionized investment by enabling community-driven decision-making through smart contracts, though they still face challenges with true decentralization and participation barriers.

- VC DAOs like MetaCartel Ventures and BitDAO demonstrate the potential of decentralized investment, combining blockchain transparency with collective expertise for improved project selection.

- Synbo Protocol addresses DAO limitations through its Position-of-Proof mechanism and self-custodial model, offering solutions for efficient capital deployment and community participation.

CONTENT

Explore the evolution of decentralized capital through DAOs, from The DAO’s pioneering days to modern VC DAOs. Learn about success factors, limitations, and Synbo Protocol’s innovative solutions for the future of decentralized investment.

When discussing the evolution of decentralized capital, we must mention the rise of DAOs (Decentralized Autonomous Organizations). In the Web3 era, users are not only seeking financial returns but also deeply desire a sense of participation and resonance on a psychological level, which has given birth to DAOs. As the native domain of Web3 continues to expand, DAOs have shown potential to solve traditional organizational structure issues, with many traditional operational models gradually transitioning to fully decentralized autonomous organizations.

Ethereum founder Vitalik’s definition of DAOs provides three dimensions of understanding: autonomy as the core, human governance as a supplement, and internal capital ownership. A DAO is a unique self-governing organization, entirely operated by blockchain smart contracts, with its own charter and procedural rules, replacing day-to-day operational management with automatically executed code. Unlike traditional companies, blockchain technology provides DAOs with complete transparency.

REVIEWING THE DAO’S INSPIRATION FOR DECENTRALIZED CAPITAL

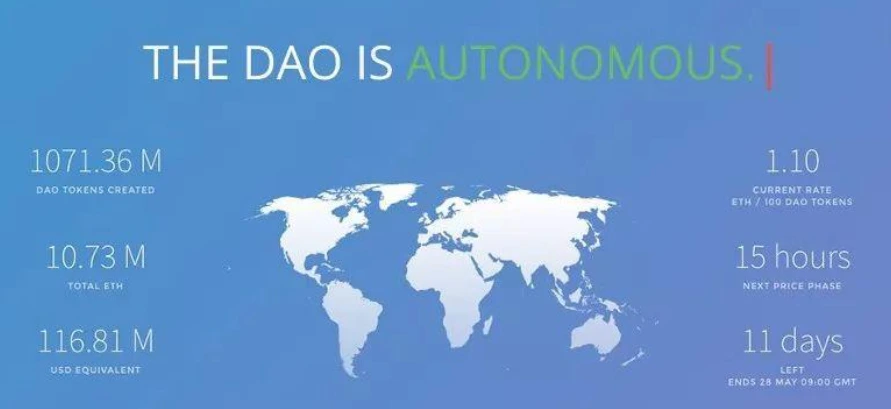

In this context, The DAO, as the first true DAO project, marked a significant milestone in the evolution of decentralized capital. Initiated by the Slock.it team, The DAO aimed to create a decentralized fund with the vision of achieving decentralized fund management through smart contracts. Most processes within The DAO were fully automated, and its concept and vision sparked strong reactions from blockchain enthusiasts.

The reasons why The DAO has caused such a huge impact in a short period of time are multiple and profound:

- Innovative Concept of Decentralized Autonomous Organization:

The core idea of The DAO was to allow investors to participate directly in decision-making, without the need for traditional centralized management institutions. Through smart contracts, all investment decisions and dividends could be executed in a transparent and trustless manner. This unprecedented concept of decentralized autonomy attracted a large group of people interested in blockchain technology and the decentralized vision.

- Successful Large-Scale ICO:

In April 2016, The DAO launched its crowdfunding campaign. In just 28 days, it raised over 12 million ETH, nearly 15% of the total ETH supply at the time, with a total value exceeding $150 million. This event not only showcased the potential of the DAO model but also highlighted the enormous impact of decentralized investment and the widespread participation of the community.

- Broad Community Participation and Support, Media Hype:

Due to the widespread popularity and support of The DAO project, it allowed anyone with a project idea to pitch to the community and potentially receive funding from The DAO. Any holder of DAO Tokens could vote on investment proposals, and if a project turned a profit, they would receive returns. This model attracted large numbers of community members to participate, and media hype further fueled the project’s popularity. Media coverage and enthusiastic investors accelerated the momentum of the project.

- Technological Advancements:

Firstly, The DAO demonstrated the potential of smart contracts in fund management. It allowed decentralized management of funds via smart contracts, making fund management more transparent and efficient. This innovative approach to fund management was highly attractive.

Additionally, the Slock.it team, which combined blockchain technology with the Internet of Things (IoT), contributed to The DAO’s attention, as this integration of blockchain with IoT also played a role in the project’s appeal.

These factors collectively contributed to The DAO becoming a pivotal milestone in the evolution of decentralized capital. It not only demonstrated the potential of decentralized autonomous organizations and the power of community but also provided valuable insights and experiences for future DAO projects.

Although The DAO ultimately suffered an attack due to vulnerabilities in its smart contracts, leading to the failure of the project, which was regrettable, it also served as a catalyst for the entire decentralized investment field. The lessons from The DAO prompted the community and developers to place greater emphasis on smart contract security and the improvement of governance structures. This, in turn, drove the further development and refinement of later VC DAOs in the decentralized investment sector and directly led to the Ethereum hard fork event.

THE BOOMING DEVELOPMENT OF DECENTRALIZED CAPITAL

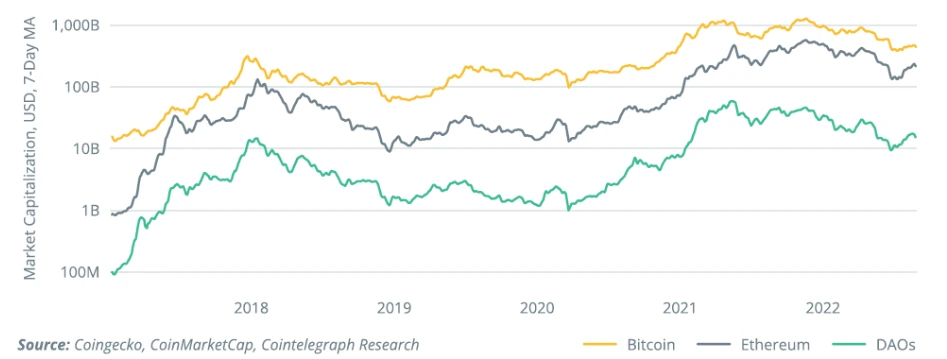

Since 2018, DAOs have gradually entered the public spotlight, initially focusing on smaller community governance and project coordination scenarios. By 2021, with the further popularization and expansion of blockchain technology applications, DAOs experienced explosive growth. According to data from Snapshot on active DAOs, the number of DAOs saw a meteoric rise from about 300 at the beginning of 2021 to over 4,000 by mid-2022, within just one and a half years. These DAOs spanned a wide range of fields, from art creation and social interactions to financial investments, attracting significant inflows of users and capital. At the same time, the overall market capitalization of DAOs surpassed the $10 billion mark during these two years.

In terms of capital scale, the total amount of funds in the DAO ecosystem exceeded 10 billion US dollars in 2022, growing several times compared to 2021. This growth was largely driven by the innovative models of fund management and resource allocation within DAOs, which attracted increasing participation from both investors and project initiators. For example, some well-known DAO platforms issued governance tokens, allowing community members to participate in decision-making and share in project profits. This model energized the community, accelerating the accumulation of funds.

With successful practices across various sectors, DAOs found their application in venture capital — giving birth to Investment DAOs. These Investment DAOs combine the decentralized principles of DAOs with venture capital, injecting new vitality and transformative opportunities into the traditional VC model. This combination not only broadens investment channels but also enhances the democratization and transparency of capital, enabling more individuals to participate in early-stage project investments. Several prominent VC DAOs have emerged in the investment sector, including:

- MetaCartel Ventures (MCV)

MCV is a decentralized venture capital DAO that operates as a fund investing in DApps with a profit-driven focus. Its founding members consist of 33 certified investors and builders, including experienced figures from the crypto community, such as Zapper and Rai. Essentially, it is a decentralized organization that uses MolochDAO’s v2 version to manage organizational funds, allocate shares, and manage voting among organizational members.

According to Crunchbase data, as of February 8, 2024, MCV has made 32 investments. The fund focuses on investing in DApps in the hackathon and pre-seed stages, with a particular emphasis on projects that use crypto assets. Its portfolio offers opportunities for advice from a community of experts, including contract security, legal counsel, business, and user experience.

- The LAO

The LAO is a decentralized venture capital organization formed by a group of experienced blockchain industry investors, supporting startups and projects in the blockchain and DeFi fields. In 2022, the global LAO market reached $9.21 billion, with an expected CAGR of 3.21% from 2023 to 2029.

Its biggest advantage is that The LAO is a member-led venture capital fund, with investment decisions made collectively by its members, who are typically blockchain experts or experienced investors with strong screening capabilities. This allows The LAO to identify potential projects in their early stages.

- BitDAO

BitDAO is a decentralized venture capital organization that employs a decentralized governance model, enabling holders of $BIT tokens to participate in the decision-making process. BitDAO boasts a funding pool of over $2 billion, enabling it to make large-scale investments in Web3 projects, operating similarly to traditional venture capital. Such financial strength provides it with significant market competitiveness and investment capabilities.

To expand its industry influence, BitDAO has formed partnerships with well-known platforms like Bybit, which provide additional resources and market access points. As of 2024, BitDAO’s market size is approximately $2.4 billion, reflecting its strong position and active presence in the decentralized venture capital field.

- FlamingoDAO

FlamingoDAO is a venture capital DAO focused on NFTs, virtual art, and digital assets. It closely integrates investment with art and culture, becoming a community that combines art collection and investment, adding uniqueness to its projects.

The characteristic of FlamingoDAO is collective intelligence and a flat organizational structure. It has a network of 70 digital asset experts from diverse backgrounds, who have extensive experience in blockchain and the NFT ecosystem. This relatively tight-knit community leads to higher levels of participation. By 2022, the valuation of FlamingoDAO’s holdings had already reached $100 million.

ANALYSIS OF THE SUCCESS FACTORS AND LIMITATIONS OF VC DAOS

When analyzing the success factors and limitations of VC DAOs, we can see that these decentralized venture capital organizations are reshaping the investment landscape in new ways. Let’s first explore the reasons for the success of VC DAOs, especially when compared to traditional VCs:

1. Decentralized Fund Pool: One of the key success factors of VC DAOs is their decentralized fund pool, collectively owned by DAO members. The investment decision-making process is transparent and executed via smart contracts. This disintermediation enhances trust and attracts investors who are dissatisfied with traditional venture capital models, which often lack transparency and have concentrated control.

2. Flexible Decision-Making Mechanism: Another significant advantage of VC DAOs is their flexible decision-making mechanism. Unlike traditional VC firms, VC DAOs usually make investment decisions through decentralized voting systems. This allows more investors to participate in project screening and decision-making, increasing both democracy and transparency. It gives the community a sense of ownership and involvement, which is typically absent in centralized VC structures.

3. Blockchain Technology Advantage, Transparency and Immutability: Blockchain technology provides VC DAOs with two key benefits: transparency and immutability. These features ensure that all investment actions and fund flows are public and immutable, which enhances the credibility of projects. This level of transparency, along with decentralized governance, also reduces the risk of fraud or mismanagement, as every transaction is verifiable on the blockchain.

4. Broader Network and Lower Investment Risks: VC DAOs benefit from a broader network of investors, industry experts, and advisors, creating diversified sources of knowledge and capital. This lowers investment risk and provides valuable insights for decision-making. Additionally, the decentralized nature of these organizations allows for more democratic participation in decision-making, fostering a diverse range of perspectives and reducing the concentration of decision-making power.

At the same time, let’s analyze their limitations dialectically:

1. Fundamental Issue of True Decentralization: Despite the aim of VC DAOs to achieve decentralized governance, there can often be an issue of governance centralization. For instance, while MetaCartel Ventures emphasizes community and member participation, investment decisions and control are typically concentrated in the hands of a few core members. This reduces the effectiveness of decentralization, as the decision-making process may not be as democratic or distributed as initially intended. In practice, the governance structure can sometimes resemble the centralized structures VC DAOs were meant to replace.

2. High Participation Barriers: Another limitation of VC DAOs is the high entry threshold for participation. For example, The LAO restricts membership to “accredited investors” as defined by U.S. law, which limits participation to a smaller, more elite group. Many VC DAOs have similar membership requirements, meaning that only a select few are allowed to participate in decision-making. This exclusionary practice reduces the diversity of members and may limit the inclusivity and broad perspectives in investment decisions. While the decentralized nature of VC DAOs theoretically promotes inclusivity, in practice, this exclusivity can hinder the potential for a truly diverse community.

3. Imbalance of Funding and Resources: VC DAOs also face challenges in terms of an imbalance in funding and resources. For example, FlamingoDAO, despite its “collective intelligence” and flat organizational structure, relies heavily on funding from a few major investors or influential figures in the tech and digital asset sectors. These leading figures pool their capital to bid on high-priced NFT artworks, which leads to a concentration of power and resources. As a result, investment decisions become more centralized, even within a decentralized organization. This imbalance in funding and resource allocation may limit the democratic nature of decision-making and result in decisions that favor wealthier or more influential members.

4. Complexity in Governance and Coordination: While decentralized governance is a strength, it can also present significant challenges. As VC DAOs often involve numerous members across different geographies and backgrounds, coordinating decision-making can be slow and cumbersome. Disputes may arise regarding investment choices, and reaching consensus through a decentralized voting system can take time. This can lead to delays in making timely investment decisions, potentially missing market opportunities that a more centralized VC might be able to act on faster.

5. Legal and Regulatory Uncertainty: Another limitation of VC DAOs is the legal and regulatory uncertainty surrounding them. Given the decentralized and borderless nature of DAOs, their operations may be subject to various legal frameworks depending on jurisdiction. This can create complications in terms of compliance with securities laws, tax regulations, and intellectual property rights. As DAOs continue to grow in prominence, legal clarity will be necessary to ensure their long-term viability and legitimacy in the investment landscape.

EXPLORING REAL DECENTRALIZED INVESTMENT SOLUTIONS

Through analysis, we can see that while VC DAOs have significant potential in advancing decentralized investment and community participation, their limitations—such as governance centralization, high participation thresholds, and imbalances in funding and resources—cannot be ignored. These limitations require continuous innovation and optimization of two key aspects: decentralized community capital operation and capital efficiency, in order to achieve a more democratic, transparent, and decentralized investment environment. Synbo Protocol, which aims to utilize blockchain technology to establish an efficient, boundaryless, and permissionless decentralized capital protocol, proposes corresponding solutions.

How to Achieve Decentralized Community Capital Operations?

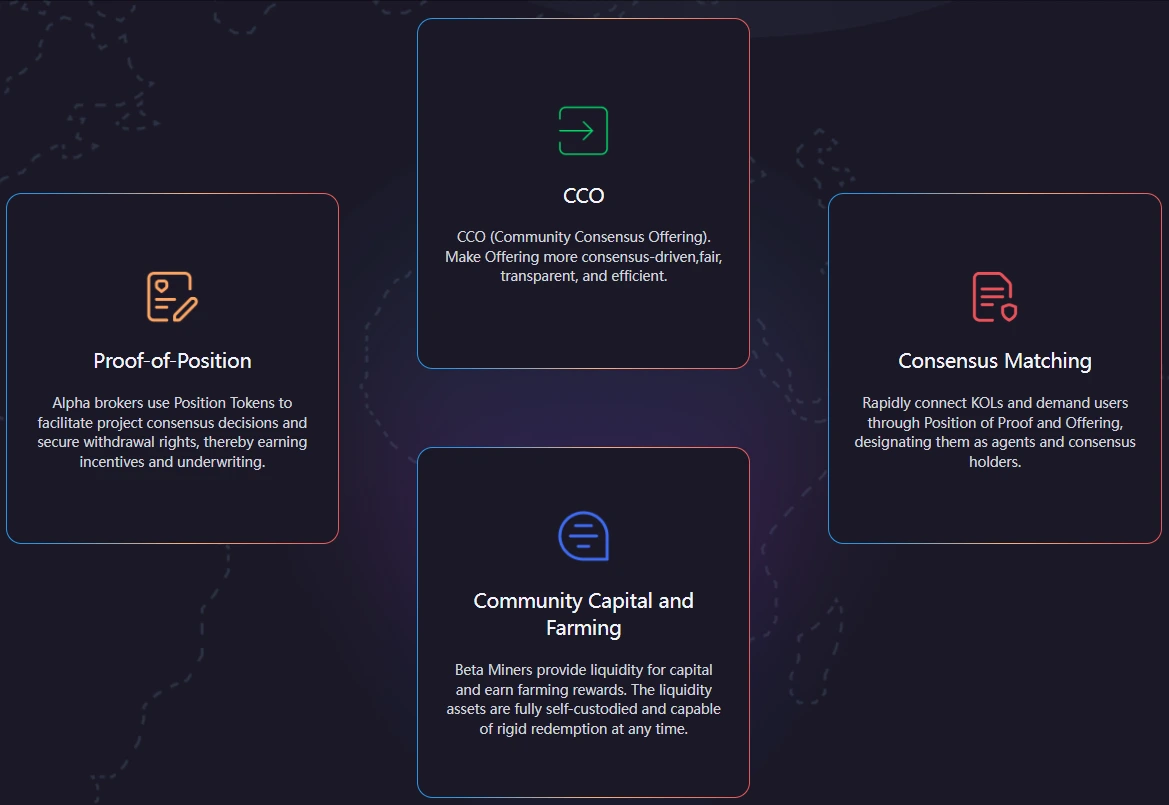

Synbo Protocol adopts a “Consensus – Self – Custody” model. In its community capital pool, assets provided by Beta Miners remain fully self-custodial, allowing for rigid redemptions at any time. This design not only ensures the safety of funds but also gives community members more voice in investment decisions. Through a dynamically adjusted reward mechanism, the community capital pool can flexibly adapt to market demands, attracting more community members to actively participate, thereby achieving fair capital flow and effective utilization.

How to Improve Capital Efficiency and Increase Returns for All Parties?

Synbo Protocol utilizes a Position-of-Proof (PoP) mechanism. Within a 72-hour consensus cycle, Alpha Brokers participate in decision-making by staking Position Tokens. Their interests are directly tied to the outcomes of these decisions, ensuring prudence and efficiency in decision-making. This mechanism can quickly identify and match quality projects with suitable investors, creating a dynamic consensus market, allowing capital to flow precisely to the most needed areas, significantly improving capital efficiency.

Innovative Features of Synbo Protocol:

Synbo Protocol not only leverages innovative technology and mechanisms to break through the development bottlenecks of VC DAOs, but also offers several key advantages:

- PoP Mechanism: Enhances both decision-making efficiency and fairness.

- CCO Model: Achieves deep integration of interests and long-term alignment.

- Dual Token Economic Model: The Position Tokens (equity tokens) and Yield Tokens (reward tokens) form a dual-engine system to create ecosystem balance and efficient capital operation.

Building a New Paradigm for Community Capital:

Synbo Protocol is committed to creating a new paradigm for community capital, focusing on sustainable and long-term development, and aiming to build a multi-party win-win blueprint:

- For Project Creators:

Through Synbo Protocol’s innovative mechanism, project creators can achieve accurate valuation through dynamic pricing, avoiding valuation biases and ensuring reasonable financing.

Community members actively participate in various stages of the project’s development, providing comprehensive support from technology to market promotion, helping the project succeed.

- For Investors:

Synbo Protocol ensures transparency in investment decisions. Investors can access sufficient information and make decisions based on rational analysis, reducing risks.

Investors can share project profits by staking Position Tokens and earn stable liquidity returns through Yield Tokens, achieving diversified returns.

- For Community Members:

Community members participate in consensus-building, with their opinions being valued in project decision-making, enabling co-creation of value.

Under the incentive mechanism, community members share both risks and rewards with project creators and investors. They engage deeply in the project, enhance their own value, and actively promote the project, driving ecosystem development.

SUMMARY

In the current wave of financial innovation, fueled by rapid technological advancements and the ongoing evolution of market demands, decentralized investment models have emerged as a shining star, capturing widespread attention.

Traditional investment models, over time, have revealed numerous flaws—such as complex decision-making processes, lack of transparency, low community participation, and inefficient capital flow—that no longer meet the needs of the modern era.

In contrast, Synbo Protocol has broken free from the constraints of traditional investment models with its unique and innovative solutions. By creating a new paradigm for community capital and establishing a long-term mechanism for decentralized capital flow, Synbo Protocol has introduced a revolutionary approach to decentralized investment.

Synbo Protocol brings fresh perspectives and opportunities to the entire industry, inspiring continuous innovation and guiding the sector toward a more mature and efficient new phase. In the ongoing transformation of the financial landscape, Synbo Protocol plays a pivotal role, contributing to the evolution of decentralized finance and shaping the future of investment systems.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!