KEYTAKEAWAYS

- Bitcoin historically shows strong February performance with a 10:2 positive-to-negative ratio, suggesting potential upside despite current market quietness and altcoin stagnation.

- Major economic events include BoE rate decision, US employment data, and FTX repayment, which could impact market sentiment and crypto liquidity.

- Recent positive developments like Trump's crypto initiatives lack immediate liquidity impact compared to catalysts like Fed rate cuts or spot ETF approvals.

CONTENT

Analysis of February’s crypto market outlook, featuring Bitcoin’s strong historical performance (10:2 positive ratio), key events including BoE rate decision, US economic data, and FTX repayment impact, amid potential Lunar New Year volatility.

Following January’s turbulence, February appears relatively quiet in terms of major financial events. However, Bitcoin has historically performed exceptionally well in February, with a strong tendency toward upward movement. Could this relatively quiet February present an opportunity for the market to build wealth under the radar?

While Bitcoin reached new all-time highs this January, altcoins remained relatively stagnant. Will February finally bring an altcoin season? With over 20 countries and regions, including major crypto markets like China, Japan, and South Korea, entering the Lunar New Year holiday period, could we see significant market movements?

The latest crypto financial calendar has just been released, providing comprehensive coverage of key events both within and outside the crypto sphere, along with detailed analysis of their potential market impact and underlying dynamics.

HISTORICAL BITCOIN PERFORMANCE IN FEBRUARY

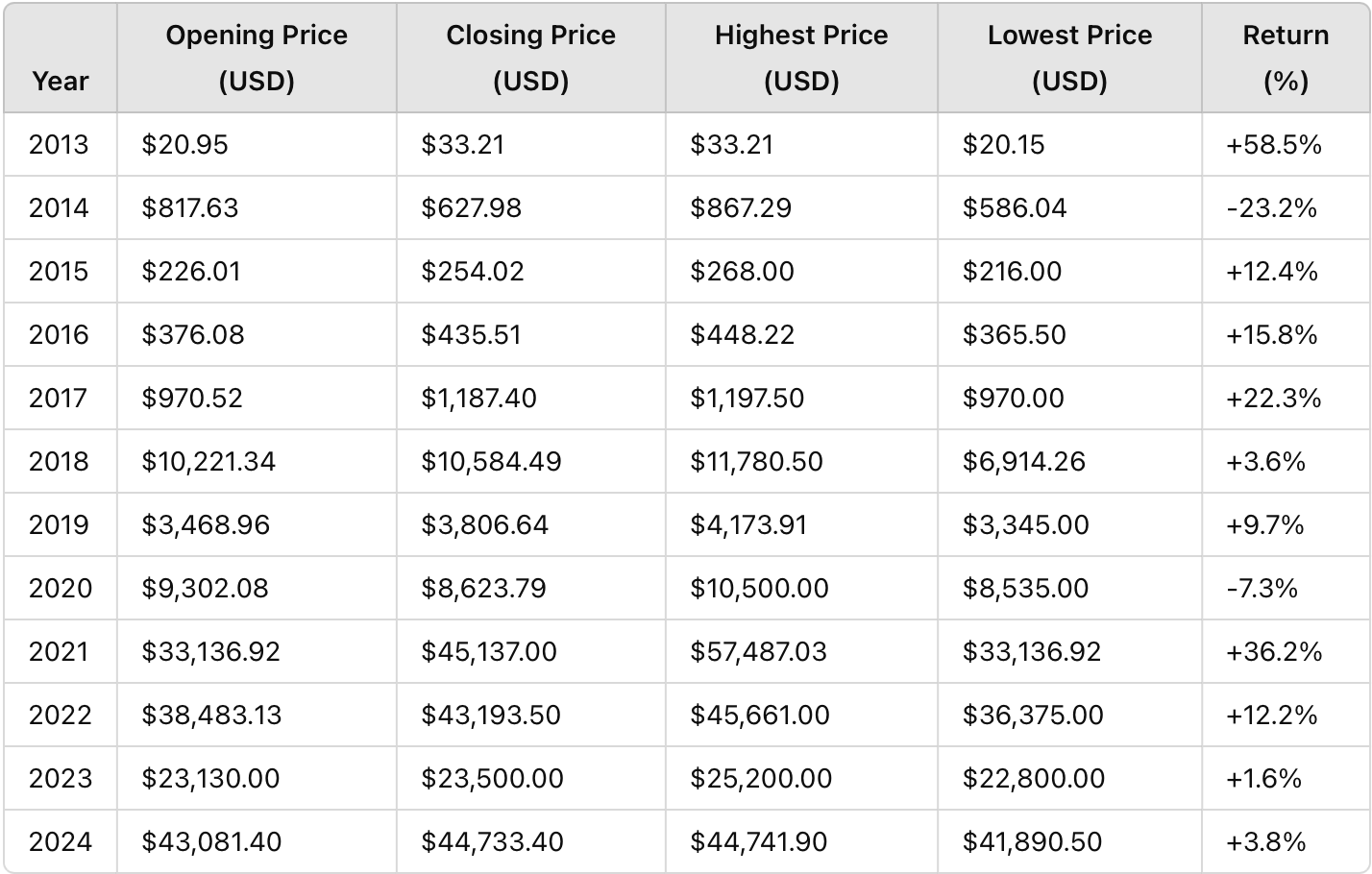

Before we dive in, let’s look at Bitcoin’s historical February performance as the crypto market’s leading indicator. According to data from TradingView and other third-party platforms:

Bitcoin Historical February Returns Chart

(Source: CoinRank)

The chart demonstrates Bitcoin’s strong historical performance in February, with positive returns dominating negative ones by a ratio of 10:2 over the past 12 years – a clear bullish trend.

KEY MARKET-MOVING EVENTS ANALYSIS

Note: All times listed are in New York Time (GMT-5)

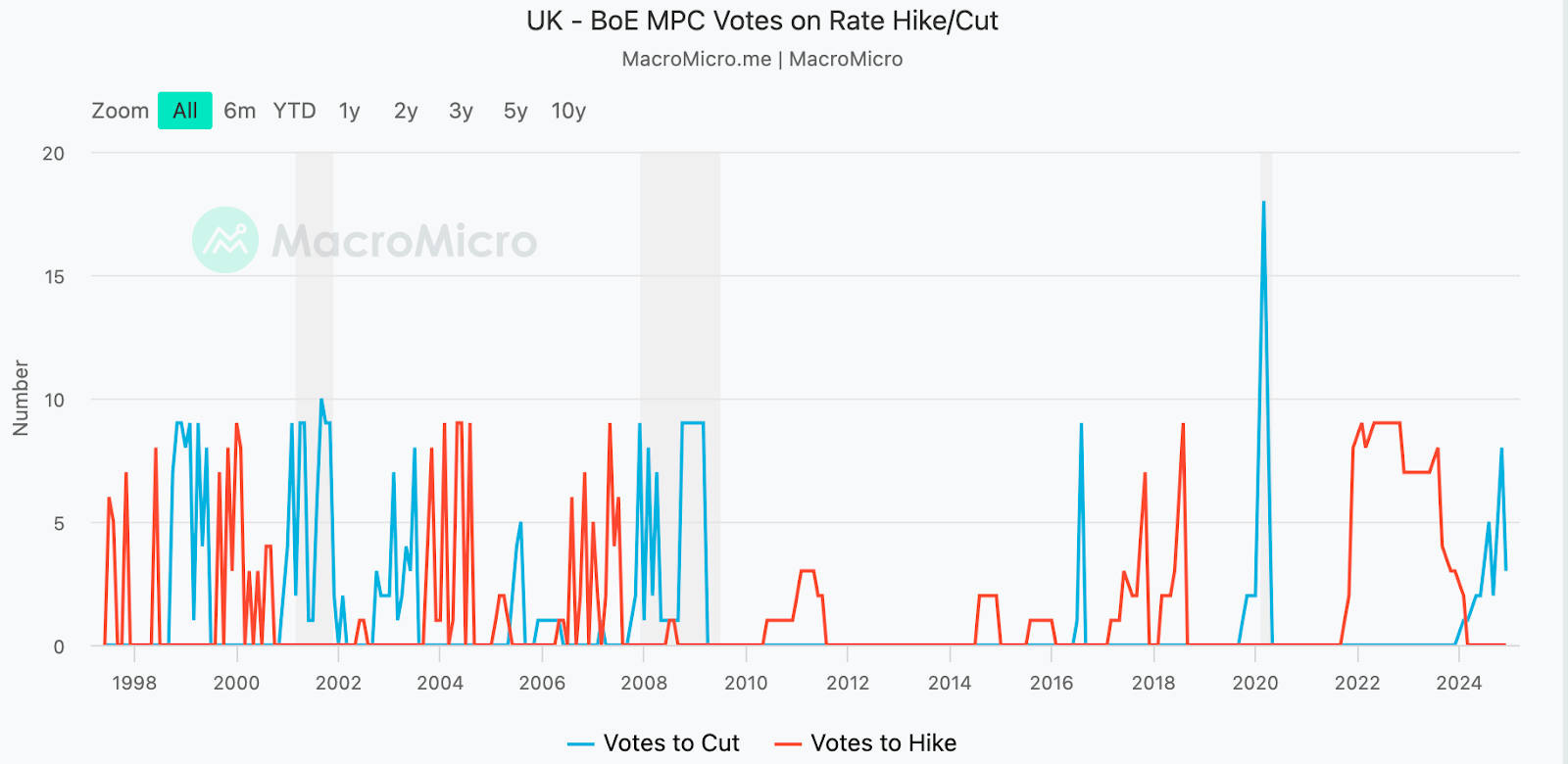

February 6: Bank of England Interest Rate Decision

The Bank of England’s current rate stands at 4.75%, which mainstream analysts consider overly restrictive. The Monetary Policy Committee (MPC) may need to accelerate its rate-cutting cycle to prevent prolonged economic stagnation. Market consensus expects a 25 basis point cut at this meeting.

Further rate reductions are anticipated in subsequent meetings, with projections showing the terminal rate dropping to 3.25% by mid-2026, given the UK’s economic weakness and easing inflationary pressures.

BoE Monetary Policy Committee Voting Distribution Chart

(Source: MacroMicro)

February 7: U.S. January Non-Farm Payroll Report

December’s NFP data showed 256,000 new jobs, significantly exceeding the consensus forecast of 160,000. The unemployment rate unexpectedly declined to 4.1%, below the anticipated 4.2%, potentially complicating the 2025 rate cut outlook.

However, with the next Fed meeting not scheduled until March 18 and another NFP report due in between, market impact should be limited barring any major surprises, likely resulting in only short-term volatility.

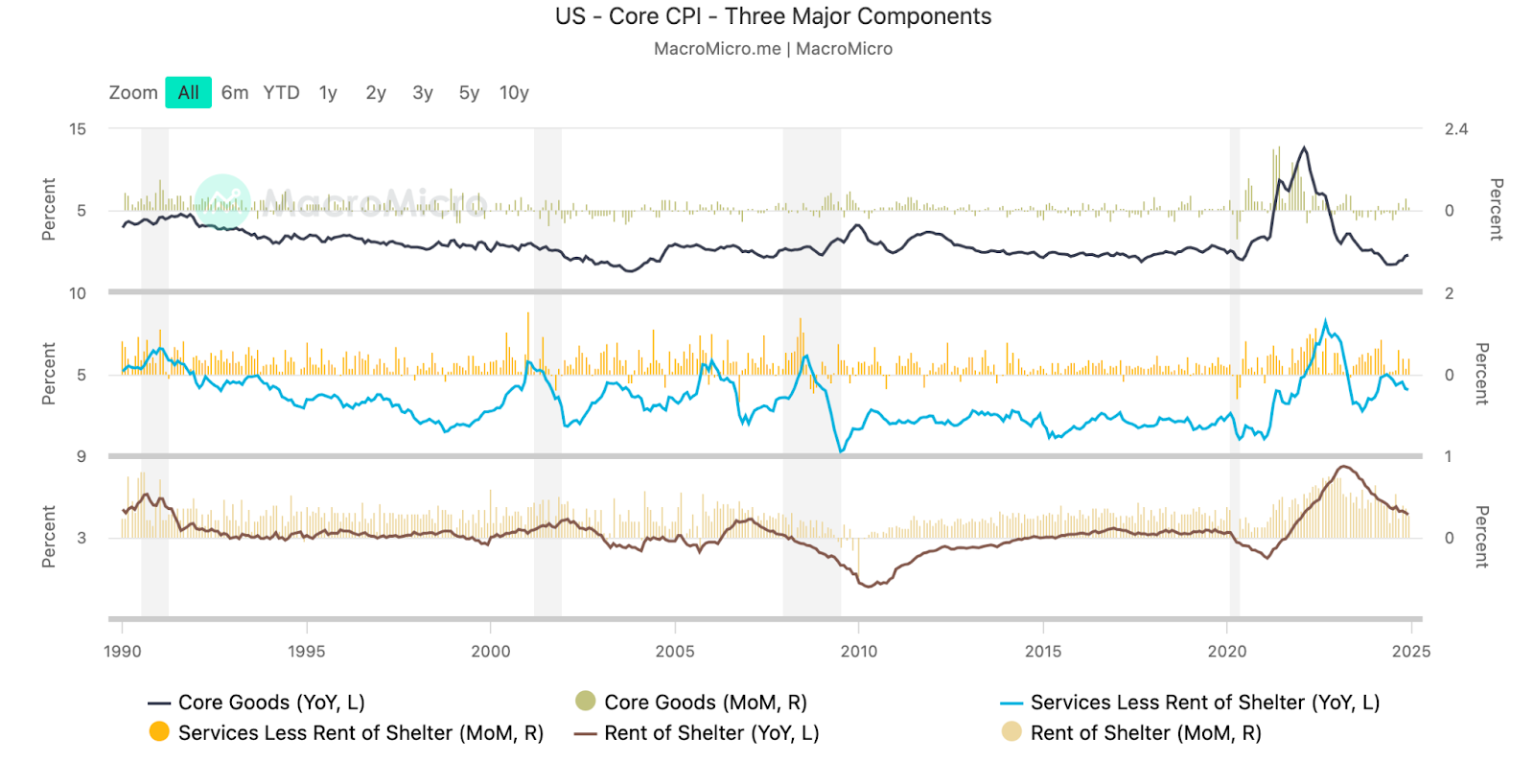

February 12: U.S. January CPI Release

Last month’s December CPI showed a 2.9% year-over-year increase, matching expectations and up from 2.7% previously. Despite the less-than-ideal data, markets rallied on Trump’s inauguration optimism. This month’s CPI release, like the NFP data, comes well before the March Fed meeting and may have limited market impact unless significantly off expectations.

U.S. Core CPI Components Breakdown

(Source: MacroMicro)

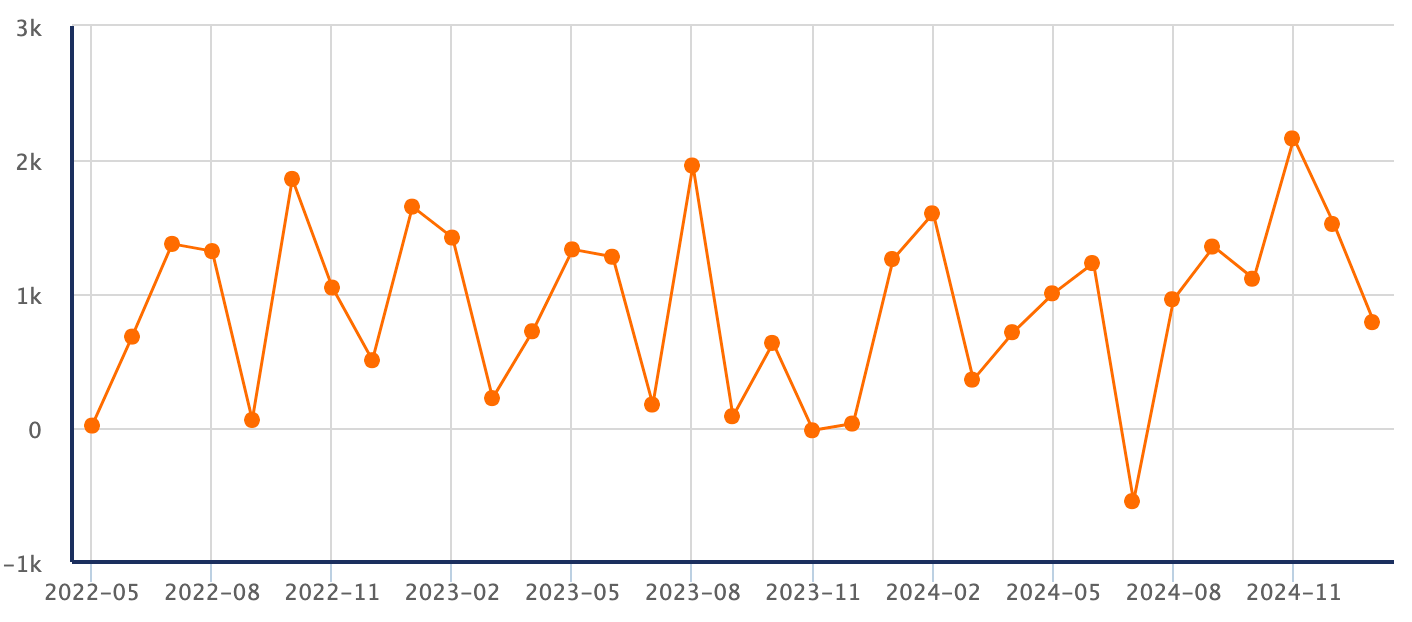

February 18: U.S. December Net Foreign Securities Purchases

This metric tracks foreign investment in U.S. long-term securities (Treasury bonds, corporate bonds, and equities) and serves as a key indicator of international confidence in U.S. markets. These transactions, typically USD-denominated, influence global dollar demand and the currency’s reserve status.

For crypto markets, while increased foreign capital flows can strengthen the dollar and potentially pressure risk assets short-term, the current downtrend in foreign purchases suggests rising risk appetite. This shift away from low-risk securities could benefit crypto markets, particularly as assets like Bitcoin gain recognition as digital safe havens.

U.S. Foreign Securities Purchase Trends

(Source: FX678)

February 25: FTX Initial Repayment Date (Through March 4)

The FTX repayment milestone will significantly impact market sentiment, liquidity, and regulatory outlook. Successful execution could boost market confidence and drive prices higher, while complications could trigger temporary volatility. Investors should monitor developments closely during this period.

Additional Financial Events:

- February 5: ADP Employment Report

- February 10: Eurozone Sentix Investor Confidence

- February 13: U.S. Producer Price Index

- February 18: NY Fed Manufacturing Index

- February 20: Philadelphia Fed Manufacturing Index

- February 25: Implementation of Turkey’s new crypto regulations

MARKET OUTLOOK: LONG-TERM CATALYSTS VS IMMEDIATE LIQUIDITY NEEDS

Late January brought a wave of positive catalysts: Trump’s presidency and crypto initiatives, Cynthia Lummis’s appointment to chair the Senate Banking Digital Assets Subcommittee, progress on the U.S. Bitcoin Reserve, and Trump’s first crypto executive order.

Why hasn’t Bitcoin rallied on these developments? The key metric for evaluating news remains its potential to generate actual market liquidity. While these developments are fundamentally bullish long-term, they lack the immediate liquidity impact of catalysts like Fed rate cuts or spot ETF approvals. Even with presidential backing, implementing initiatives like the Bitcoin Strategic Reserve requires extensive regulatory coordination and cannot be expedited.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!