KEYTAKEAWAYS

- The Fed is slowing balance sheet reduction, easing liquidity pressures, which may benefit risk assets like Bitcoin and Ethereum.

- Rate cut expectations are rising, with markets pricing in three cuts in 2024, potentially fueling institutional demand for crypto.

- Regulatory risks remain a challenge, as SEC actions could offset positive momentum from improving macroeconomic conditions.

CONTENT

On March 19, the Federal Reserve kept its benchmark interest rate unchanged at 4.25%-4.50%, which was in line with market expectations. However, this meeting brought some subtle changes in tone. While the Fed did not cut rates, it hinted at concerns about economic uncertainty and announced that it would slow down the reduction of its balance sheet starting in April.

For the crypto market, the Fed’s policies play a major role. Whether it’s Bitcoin, Ethereum, or the broader Web3 and DeFi ecosystem, changes in monetary policy can affect liquidity and investor sentiment. So, what does this latest decision mean for crypto? Let’s break it down.

THE FED’S MESSAGE: NO RATE CUTS YET, BUT A SOFTER STANCE

Here are the key takeaways from the Fed’s announcement:

The economy and labor market remain strong, but growth is uncertain

- The Fed acknowledged that the job market is still solid and close to its maximum employment goal.

- However, it also noted that economic uncertainty is rising, which was not a focus in previous statements.

- This shift suggests that the Fed is becoming more cautious about economic growth.

Inflation is still above the 2% target, so rate cuts are not urgent

- Inflation has come down from its peak, but it remains too high for the Fed to feel comfortable cutting rates.

- The Fed still aims to bring inflation down to 2% but is willing to be patient.

Balance sheet reduction will slow down, easing liquidity pressures

- Starting in April, the Fed will reduce its monthly Treasury bond runoff from $25 billion to $5 billion.

- This means that the pace at which the Fed removes liquidity from the financial system will slow down.

- Some investors view this as a mild form of easing, even though interest rates remain unchanged.

One key difference from previous meetings is that not all Fed members agreed on this decision. Christopher J. Waller opposed slowing down the balance sheet reduction, while in January, all members had supported the previous policy. This internal disagreement suggests that the Fed is reaching a turning point in its policy stance.

WILL THE FED CUT RATES?

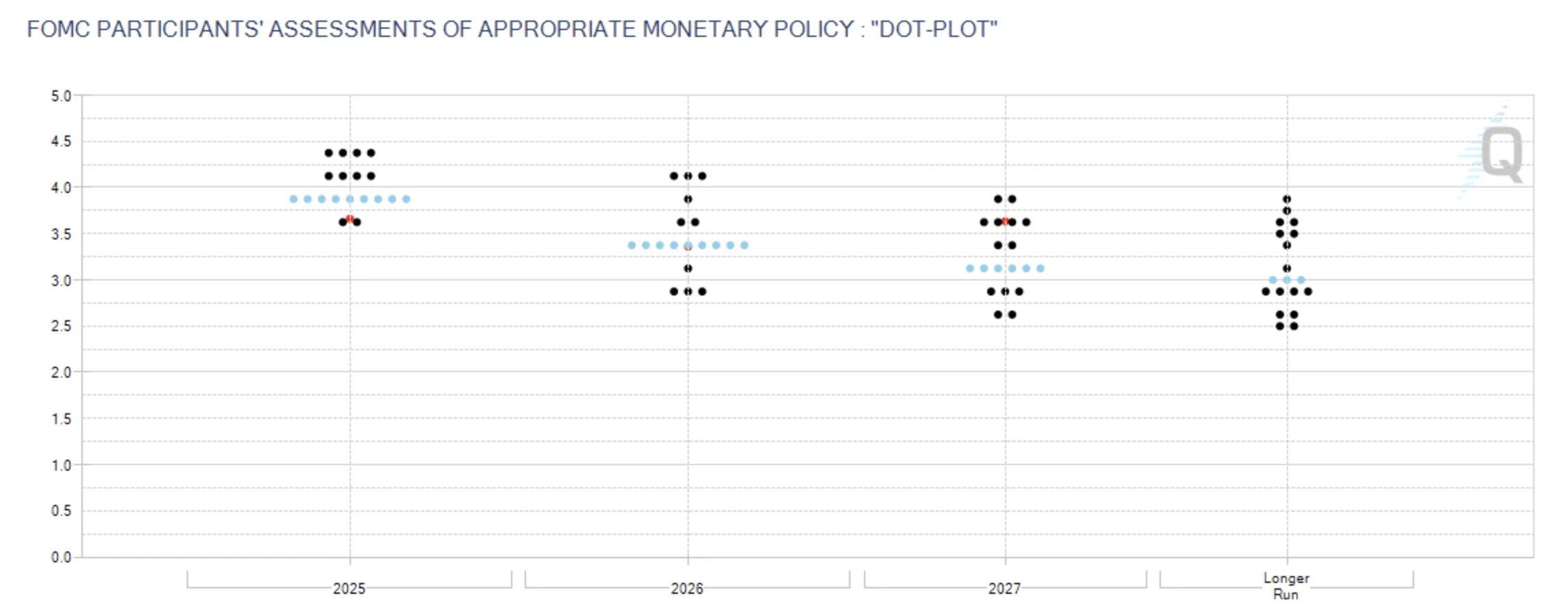

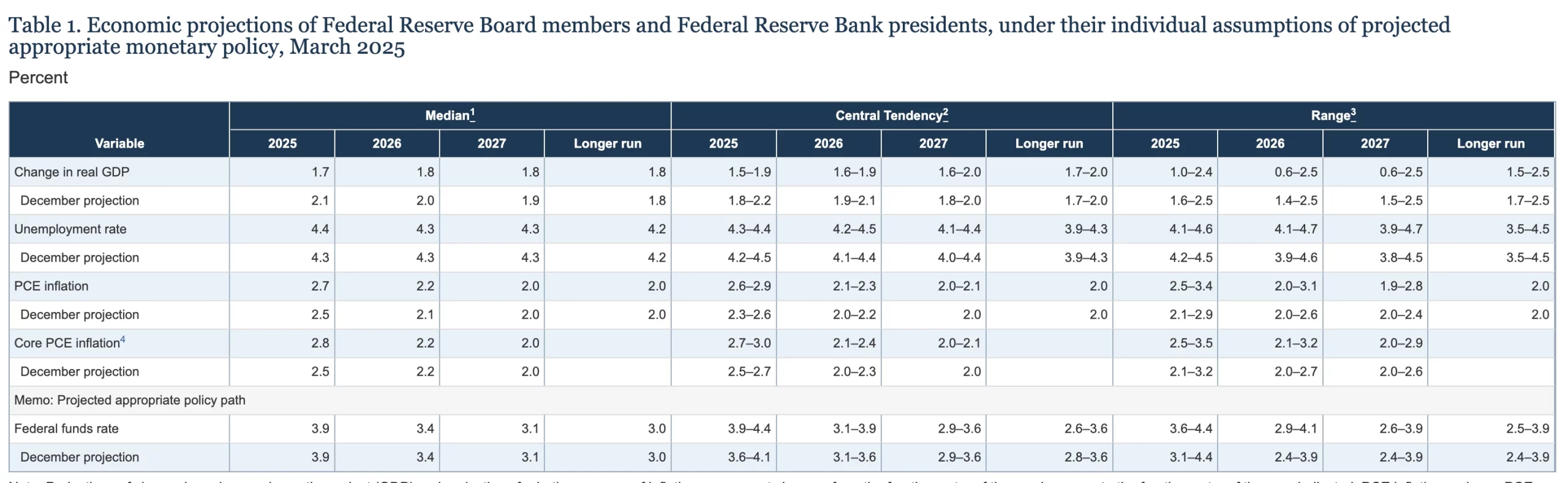

Every three months, the Fed releases a “dot plot” showing where officials expect interest rates to go. The March dot plot showed no major changes compared to December:

- The Fed still expects two rate cuts in 2025, totaling 50 basis points.

However, the Fed’s economic outlook has become slightly more cautious:

- Growth expectations were lowered: 2025 GDP growth was revised down from 2.1% to 1.7%, signaling a weaker economy.

- Unemployment is expected to rise slightly: The 2025 forecast increased from 4.3% to 4.4%.

- Inflation forecasts increased slightly: Core PCE inflation for 2025 is now expected to be 2.8%, up from 2.5%.

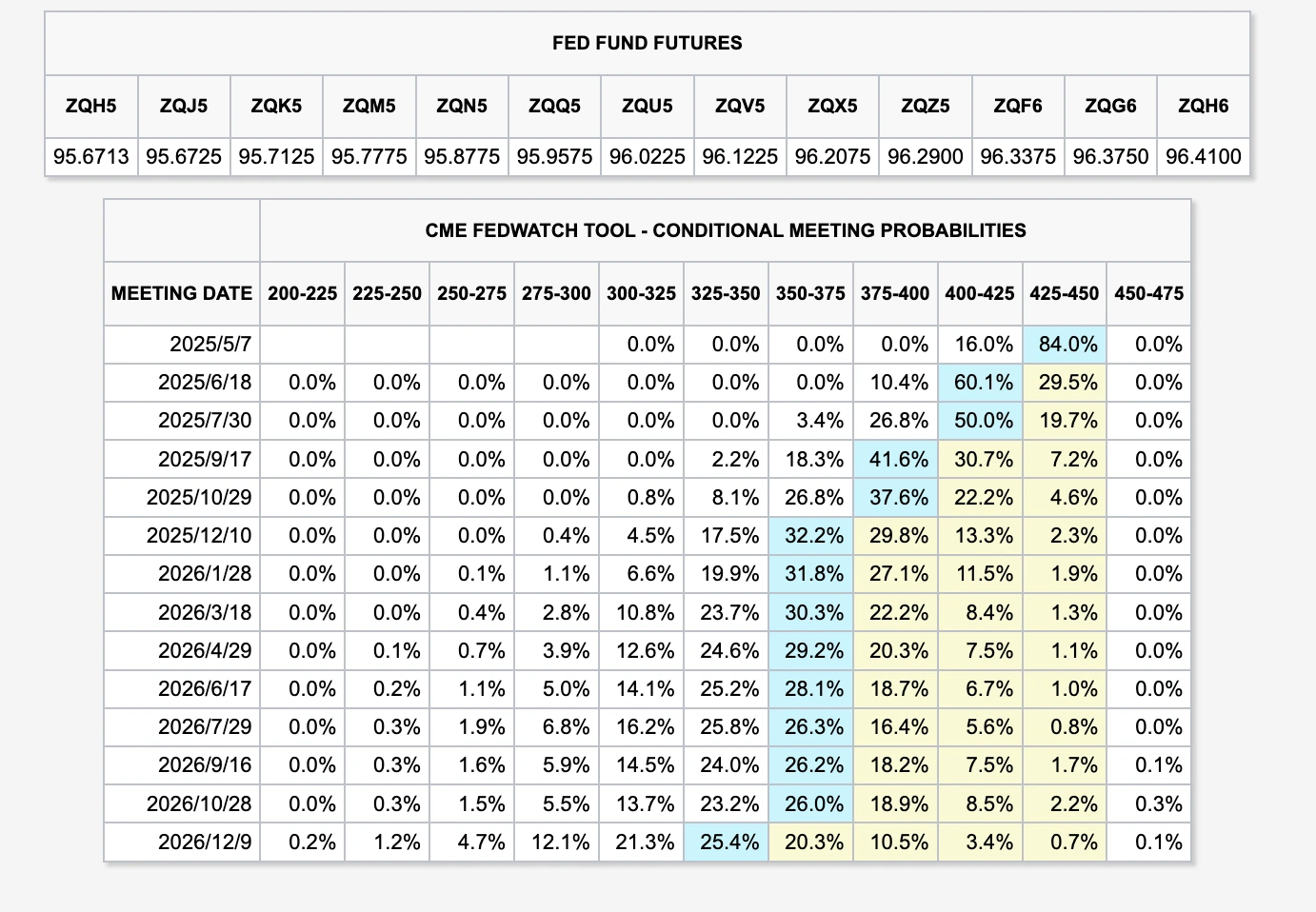

While the Fed still signals only two rate cuts, the market thinks otherwise. Futures traders now expect three rate cuts in 2024, with the first likely in June.

HOW WILL CRYPTO MARKETS REACT?

The Fed’s policy decisions have a direct impact on liquidity and risk assets, including cryptocurrencies. Even though rates were not cut this time, the decision to slow balance sheet reduction and growing rate cut expectations are already influencing investor sentiment.

Improved liquidity could benefit crypto

- The Fed’s high interest rates and tight liquidity conditions have been a challenge for Bitcoin and other digital assets.

- Now, by slowing the pace of balance sheet reduction, the Fed is reducing liquidity pressures.

- More liquidity in the financial system generally supports risk assets like crypto, as investors feel more comfortable deploying capital.

Growing rate cut expectations could drive institutional adoption

- Markets are now pricing in the first Fed rate cut in June and expect at least two or three cuts by year-end.

- Historically, crypto markets have performed well when the Fed starts cutting rates because:

- Weaker U.S. dollar – Lower interest rates could push the dollar lower, making Bitcoin more attractive as an alternative asset.

- Institutional investment – With Bitcoin ETFs now available, rate cuts could encourage more institutional capital inflows into crypto.

- Higher risk appetite – Rate cuts typically boost interest in growth and speculative assets, including crypto.

Bitcoin and gold moving in sync

- Recently, both gold and Bitcoin have seen price increases following shifts in Fed policy expectations.

- This suggests that Bitcoin is being treated more like a store of value, similar to gold, rather than just a speculative asset.

- If economic uncertainty continues to rise, Bitcoin could attract more capital from investors looking for safe-haven assets.

Regulation remains a key uncertainty

- While the Fed’s policy direction is shifting in a more favorable way for crypto, regulatory risk is still a major factor.

- The U.S. SEC has recently increased its enforcement actions against crypto firms.

- Even if liquidity improves, tighter regulation could offset some of the positive effects on the market.

WHAT’S NEXT FOR CRYPTO?

This Fed meeting suggests that the tightening cycle may be nearing its end, which is a positive signal for risk assets, including crypto. However, the full impact depends on how soon the Fed actually begins cutting rates.

Investors should keep an eye on:

- U.S. economic data – If growth continues to slow, the Fed may cut rates sooner than expected, boosting crypto sentiment.

- Inflation trends – If inflation remains sticky, the Fed may delay rate cuts, putting pressure on markets.

- Institutional buying – Bitcoin ETF flows have been rising. If rate cuts materialize, institutional demand could accelerate.

At this stage, the Fed hasn’t fully pivoted, but the market is already positioning for easier monetary policy. If rate cuts begin in mid-2025, crypto could see a stronger bull run, but regulatory risks remain a wildcard.

For now, investors should stay patient and watch how the Fed’s next moves unfold. The turning point may be near, but we’re not there just yet.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!