KEYTAKEAWAYS

- Fed signals only two rate cuts for 2025 and raises inflation forecasts, dampening market expectations for aggressive monetary easing and pressuring cryptocurrency prices.

- Powell's explicit denial of potential Fed Bitcoin holdings shatters market speculation about U.S. government strategic reserves, accelerating the crypto selloff.

- Massive liquidations hit crypto markets with $851M wiped out in 24 hours, while long-term investors eye the pullback as potential buying opportunity.

CONTENT

Federal Reserve’s conservative rate cut and Powell’s explicit rejection of Bitcoin holdings trigger crypto market selloff. Bitcoin drops 5% as traders face $851M in liquidations amid scaled-back rate cut expectations for 2025.

FED’S MESSAGE: DON’T COUNT ON AGGRESSIVE EASING

Bitcoin plunged below the psychological $100,000 mark after the Federal Reserve delivered what markets viewed as a hawkish rate cut, lowering its benchmark rate by 25 basis points to 4.25%-4.50%. While the cut itself matched expectations, the accompanying signals from Fed officials painted a far more conservative picture than crypto markets had priced in.

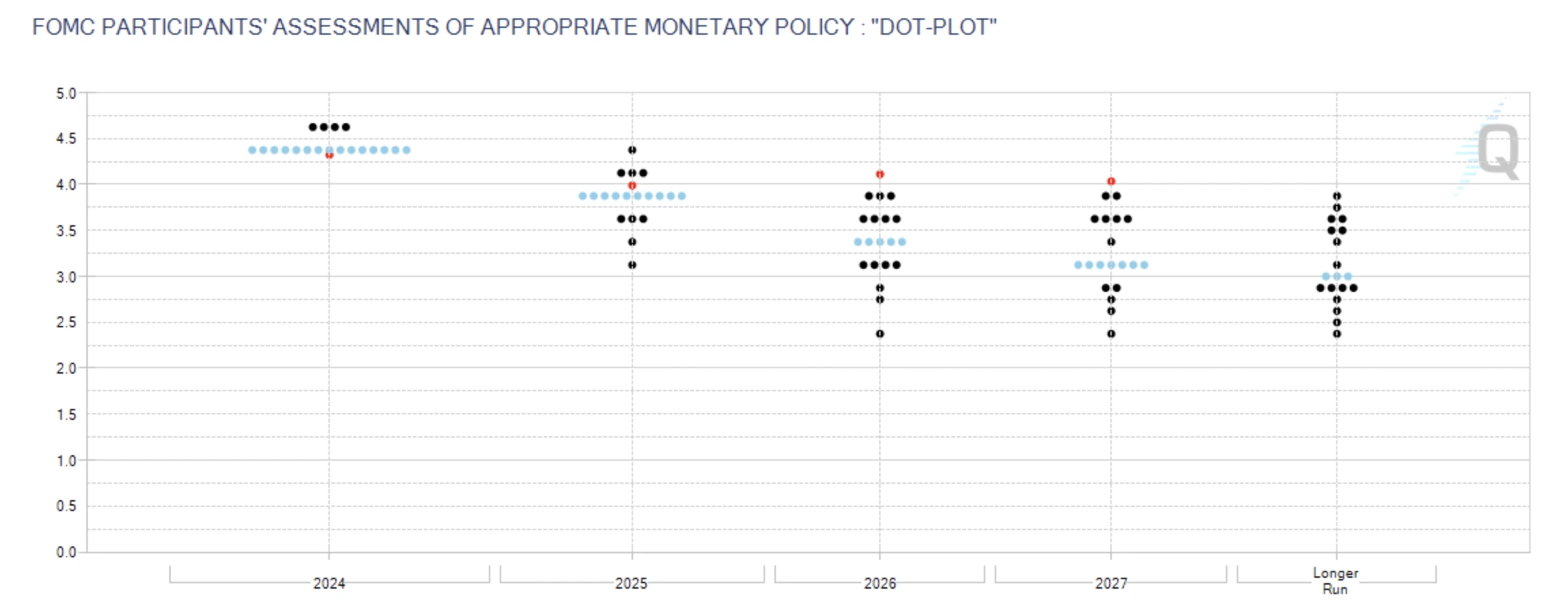

The central bank’s latest dot plot threw cold water on hopes for aggressive monetary easing, projecting just two rate cuts in 2025. Adding to the hawkish tilt, officials raised their 2025 inflation forecast to 2.5%, signaling continued vigilance against price pressures.

(Source: FedWatch)

Fed Chair Jerome Powell further rattled crypto markets by explicitly ruling out any Federal Reserve involvement in Bitcoin accumulation. “We are not allowed to hold Bitcoin, nor are we seeking to change the law,” Powell stated firmly, dashing speculation about potential U.S. government strategic reserves of the cryptocurrency.

Powell emphasized the data-dependent nature of future policy moves while highlighting fresh concerns about protectionist policies and expanding fiscal deficits. The measured tone suggested a Federal Reserve in no hurry to pivot toward substantial easing.

CRYPTO MARKETS REEL FROM DOUBLE BLOW

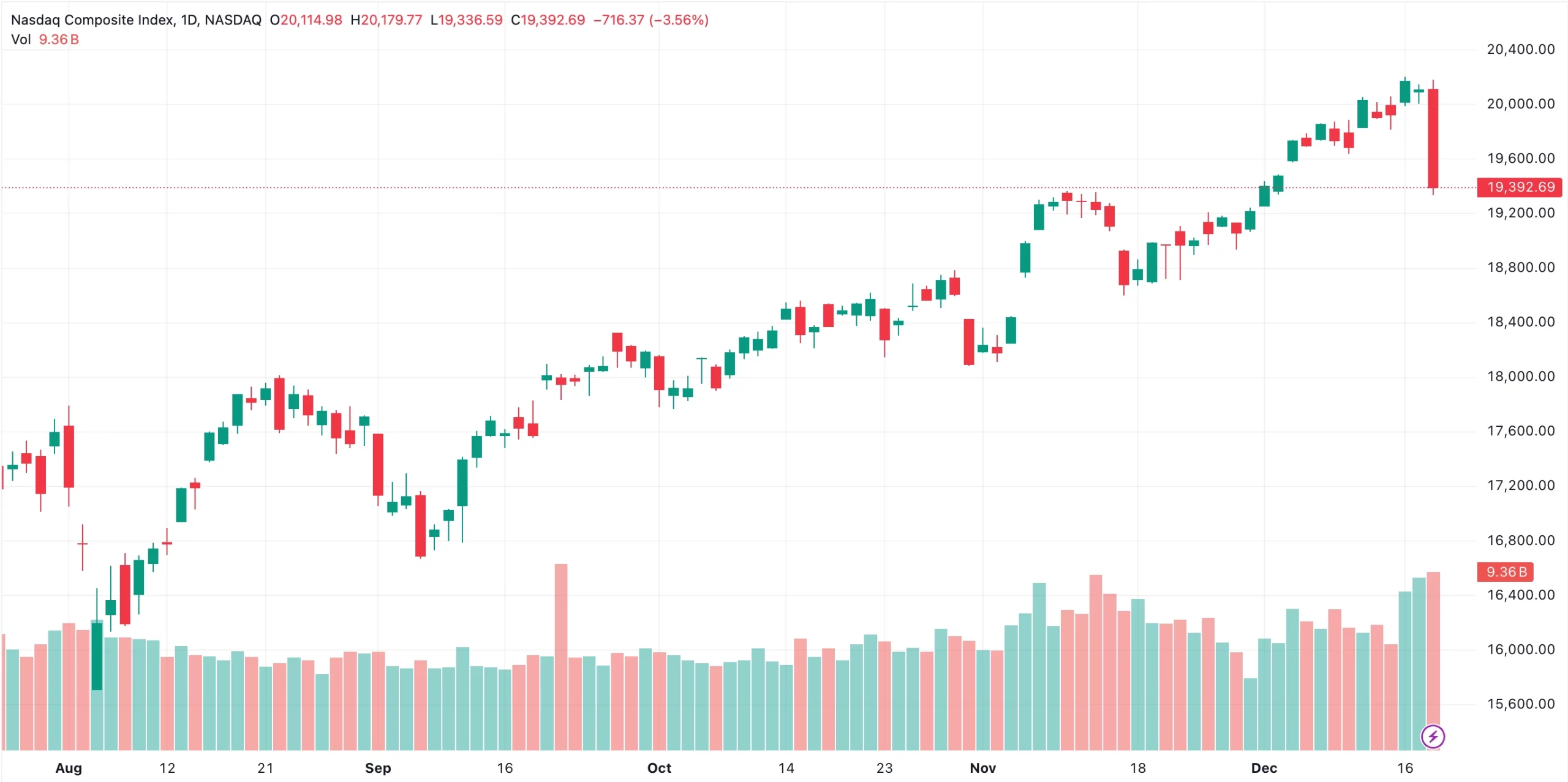

The hawkish surprise sent Bitcoin plummeting to $99,719.65 early Thursday, down more than 5% from recent highs of $108,000. The selling pressure rippled through the crypto ecosystem, hitting all major digital assets.

The decline marked a sharp reversal from the optimism that had propelled Bitcoin higher following Donald Trump’s November 5 presidential election victory.

Markets had been pricing in expectations of crypto-friendly policies, including speculation about a strategic Bitcoin reserve potentially incorporating 200,000 Bitcoins from criminal seizures. Powell’s explicit rejection of Fed involvement in such plans sparked a broad sell-off.

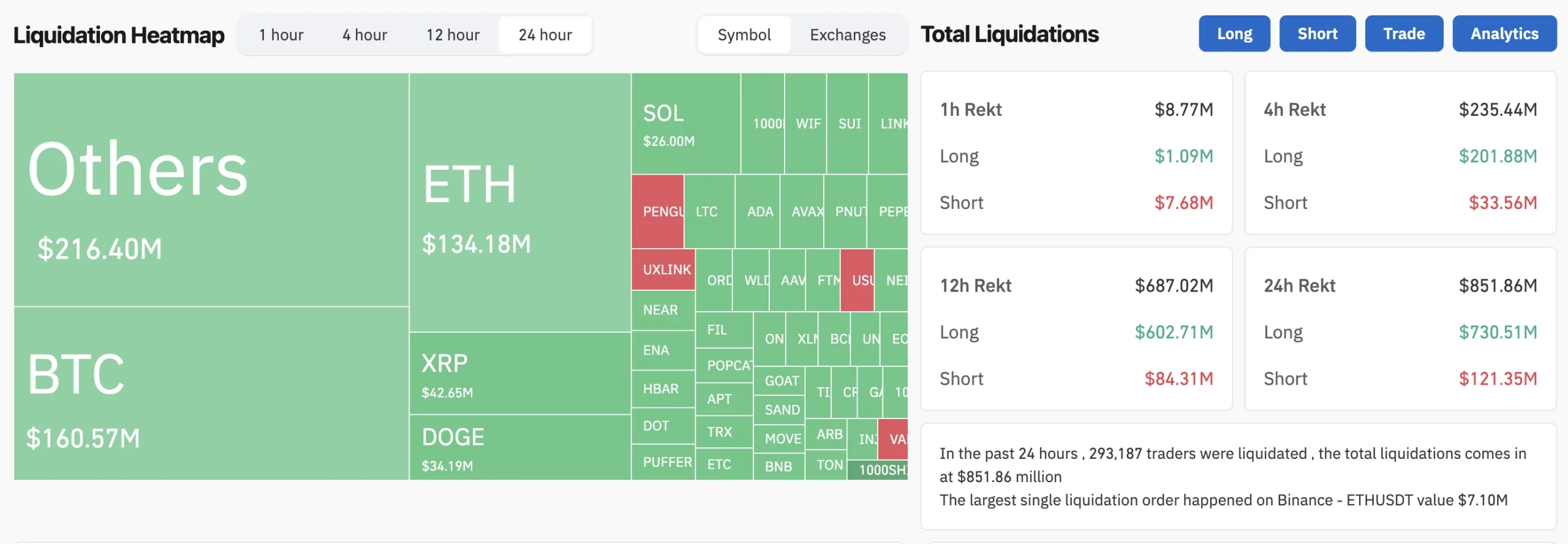

The carnage left a trail of liquidated positions in its wake. Data from Coinglass revealed 293,887 traders facing liquidation in just 24 hours, with total liquidation volume hitting $851 million.

(Source: SoSoValue)

Crypto event traders and market makers rushed to reduce risk exposure as expectations for 2025 rate cuts were scaled back.

“The market had gotten ahead of itself with rate cut expectations,” noted David Lawant, head of research at crypto prime broker FalconX. While Bitcoin’s correlation with major stock indices has declined, Lawant suggested the slower pace of anticipated rate cuts would continue pressuring risk assets in the near term.

(Source: Tradingview)

POLICY ENVIRONMENT WEIGHS ON CRYPTO SENTIMENT

The Fed’s cautious stance toward easing monetary conditions presents a particular challenge for crypto markets. Bitcoin has historically thrived in loose monetary environments but often struggles when liquidity conditions tighten.

Previous enthusiasm about the Trump administration potentially backing a strategic Bitcoin reserve had fueled bullish sentiment. However, Powell’s comments highlighted deeper uncertainties in the policy landscape, intensifying investor concerns about the path forward.

The situation also raises questions about Bitcoin’s reputation as “digital gold” and an inflation hedge. The Fed’s heightened focus on inflation risks could undermine this narrative, at least temporarily.

Related Reading:

How Options, ETFs, and Trump’s Policies are Accelerating the Future of Cryptocurrencies

Why Have Nations Been Reluctant to Include Bitcoin in National Reserves?

MARKETS EYE KEY SUPPORT LEVELS

Traders are now watching whether Bitcoin can hold critical support around $99,000. A decisive break below this level could trigger further technical selling. Other major cryptocurrencies face even greater volatility risks as the market digests the Fed’s message.

For longer-term investors, however, the current pullback may offer attractive entry points. Previous episodes of Fed-induced selling have often preceded strong recoveries, particularly in undervalued assets within the crypto ecosystem.

The key moving forward will be monitoring not just Fed policy and economic data, but also shifts in institutional sentiment, derivatives market positioning, and potential regulatory developments that could influence crypto market dynamics.

The Fed’s latest signals suggest crypto markets face a period of adjustment as expectations reset. While near-term pressure seems likely, Bitcoin and the broader digital asset space retain their long-term growth potential.

The current volatility serves as a reminder that crypto markets remain highly sensitive to monetary policy shifts. Successful navigation of this environment will require careful attention to both technical and fundamental factors as the market searches for a new equilibrium.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!