KEYTAKEAWAYS

- The fourth Bitcoin halving bull market may have begun, supported by historical patterns, recent price movements, and the Fed's rate cut decision.

- Data indicators suggest the crypto market is in the early stages of a bull market, characterized by a mix of optimism and uncertainty.

- As the crypto market matures, investors should prepare for a "slow bull market" with gradual price increases and longer durations between cycles.

CONTENT

Analyze the potential start of Bitcoin’s fourth halving bull market, examining market sentiment post-Fed rate cuts. Explore current market stages and the concept of a slow bull market in maturing crypto markets.

Following the U.S. Federal Reserve’s rate cut in September, Bitcoin has led a strong crypto market rebound, surging from $52,590 to $65,718 (according to Bitget data), a 24.9% increase. Other cryptocurrencies followed suit, with many doubling in value. It seems the market is breaking out of a five-month continuous downtrend, shattering the historical trend of Bitcoin falling more than rising in September.

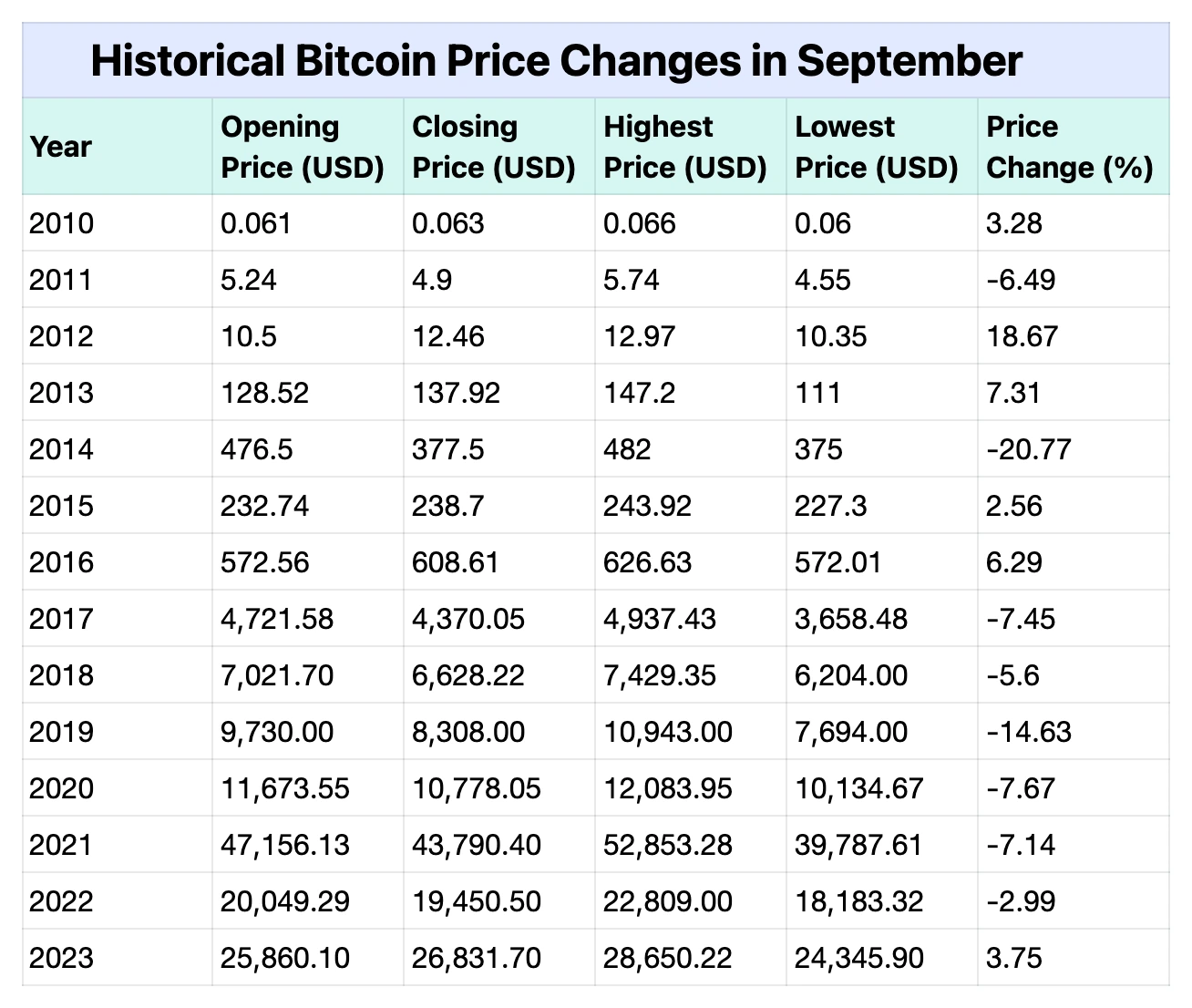

As shown in the chart below, I gathered data on Bitcoin’s price performance over the past 14 years in September, revealing a pattern of six gains and eight losses. In the last seven years, it has risen only once and fallen six times, making September one of the worst months for Bitcoin historically.

(Source: CoinRank)

However, the Federal Reserve’s 50-basis-point rate cut this time has injected a surge of optimism into the crypto market. Not only did it help the market reverse its downtrend, but it also changed many people’s expectations for the future. The Fear and Greed Index, which reflects market sentiment, rose from 22 (fear) on September 6th to 59 (neutral), approaching greed territory. Discussions of “bottom-fishing” and “the bull market is coming” have emerged in many crypto communities and industry media. It’s fair to say that the market has suddenly fallen into FOMO (Fear of Missing Out).

So, has the highly anticipated fourth halving bull market already started? What stage is the market currently in? What kind of bull market can we expect? This article will break it down for you.

RATIONAL ANALYSIS: HAS THE FOURTH HALVING BULL RUN REALLY ARRIVED?

Let’s first answer the most basic question in the crypto market: Has the fourth bull run begun? This question will determine most people’s investment strategies and profit expectations.

The answer: The bull market has started!

The following points support this conclusion:

Historically, Bitcoin’s bull market typically begins 3-5 months after a halving event. For example:

– The first halving was in November 2012, and the first bull market started in February 2013.

– The second halving was in July 2016, and the second bull market began in November 2016.

– The third halving was in May 2020, and the third bull market started in October 2020.

The underlying reason is easy to understand: halving changes the supply-demand dynamics, and it takes time for this change to transmit across the market, influencing miners’ behavior, investor expectations, media coverage, and the self-fulfilling effect of historical patterns. Additionally, monetary policies and macroeconomic environments often align with these halving cycles. Satoshi Nakamoto was not only a technical genius but also a financial mastermind.

For this halving, Bitcoin completed its fourth halving in April this year, and it has now been five months. Of course, history doesn’t simply repeat itself, and we can’t follow past patterns blindly. So, let’s analyze this halving based on specific market behaviors before and after:

Bitcoin bottomed out in June 2022, going through 16 months of consolidation, washing out weak hands and accumulating positions. Then, starting in September 2023, Bitcoin began rising, breaking through its all-time high of over $73,000 in March of this year—an impressive 3x increase from its $24,000 level just six months prior to the halving.

Following Bitcoin, many altcoins saw similar 3x or greater increases. However, this surge was largely due to the approval of Bitcoin spot ETFs, and the market lacked sufficient liquidity. Most of the price movement was driven by existing capital rather than new money entering. Therefore, when the crypto market participants finished their FOMO, the market quickly entered a five-month consolidation and downtrend due to a lack of new capital inflows.

It wasn’t until September 19th, when the Fed confirmed a 50-basis-point rate cut, that the market truly began to see liquidity inflows. This event fundamentally activated the market. After all, we know the basic logic of a bull market: continuous inflows of new money. The Fed acts as the largest liquidity provider in the global economy and financial markets.

Looking back, the surge at the end of last year and the beginning of this year can be seen as a trial run, a prelude to the fourth halving bull market. It wasn’t the start of the bull market, but its dazzling performance, particularly the fact that it broke Bitcoin’s all-time high, gave many people the false impression that the bull market had begun early. When the subsequent sharp decline followed, it left many thinking the bull market was short-lived.

Now, considering the post-halving market sentiment, the time required for supply and demand to adjust, and the current monetary policy and macroeconomic environment, all signals point to the bull market being underway. With the Fed’s rate cut, all conditions are now in place.

DATA SPEAKS: THE CURRENT BULL MARKET IS IN ITS EARLY STAGE

A bull market is typically divided into three stages: early, middle, and late. These stages are also referred to as the preparation phase, full-blown phase, and bubble mania phase. Between each phase, there are transition periods, where the market often moves up and down in a range, gradually wearing out investors’ patience.

So, what stage is the market in now?

The conclusion: We are in the early stage of the bull market.

This phase often feels like a mix of optimism and uncertainty, with choppy market movements that leave investors puzzled. The market tends to have an almost equal number of bullish and bearish participants, and most coins show only limited gains. The overall market moves in fits and starts, slowly testing investors’ patience.

We can use some commonly tracked data indicators to support this view:

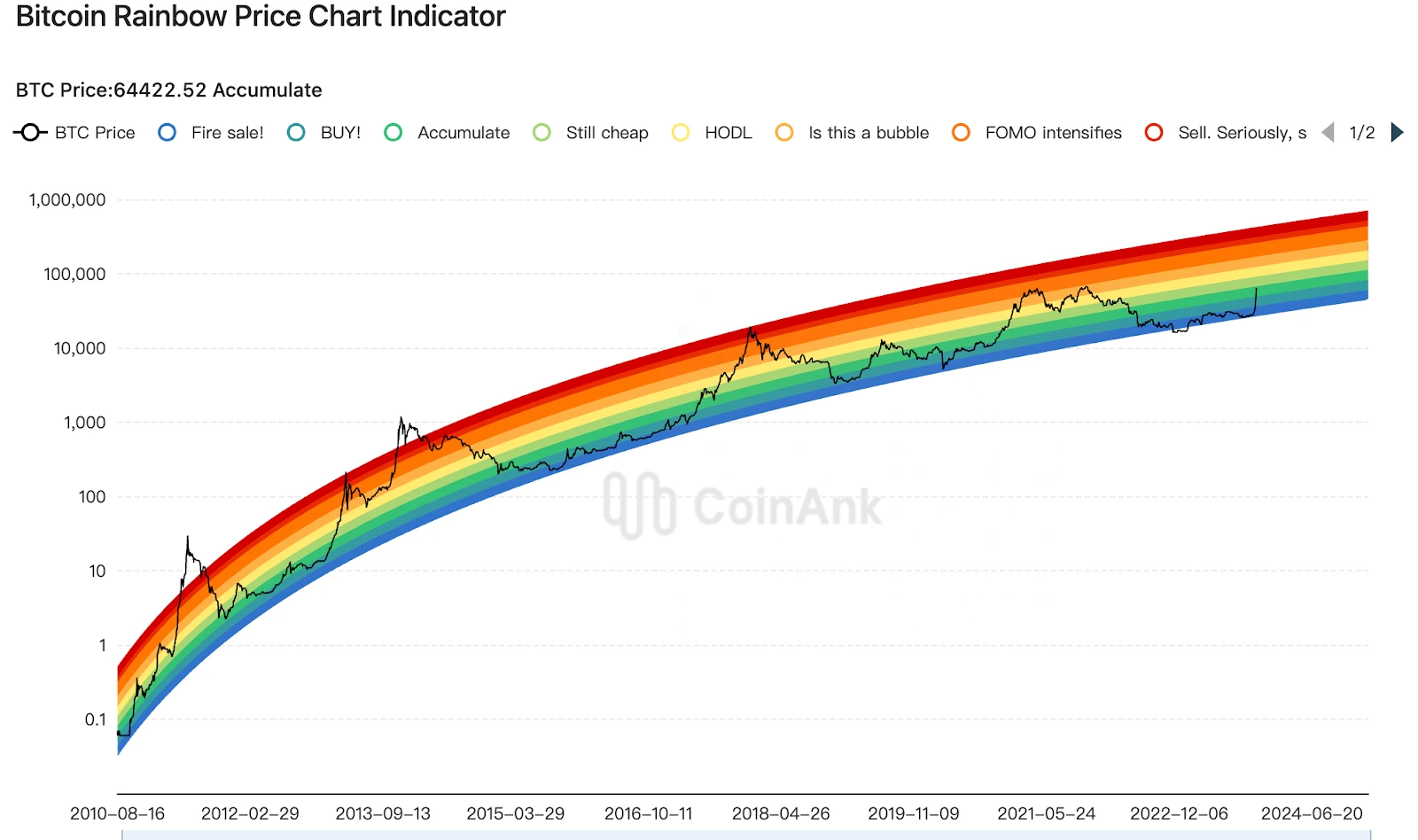

– Bitcoin Rainbow Chart: Currently, Bitcoin is in the “accumulate” zone, with the next zone being “cheap.” Historically, Bitcoin entering this zone after a halving indicates the bull market’s early stage.

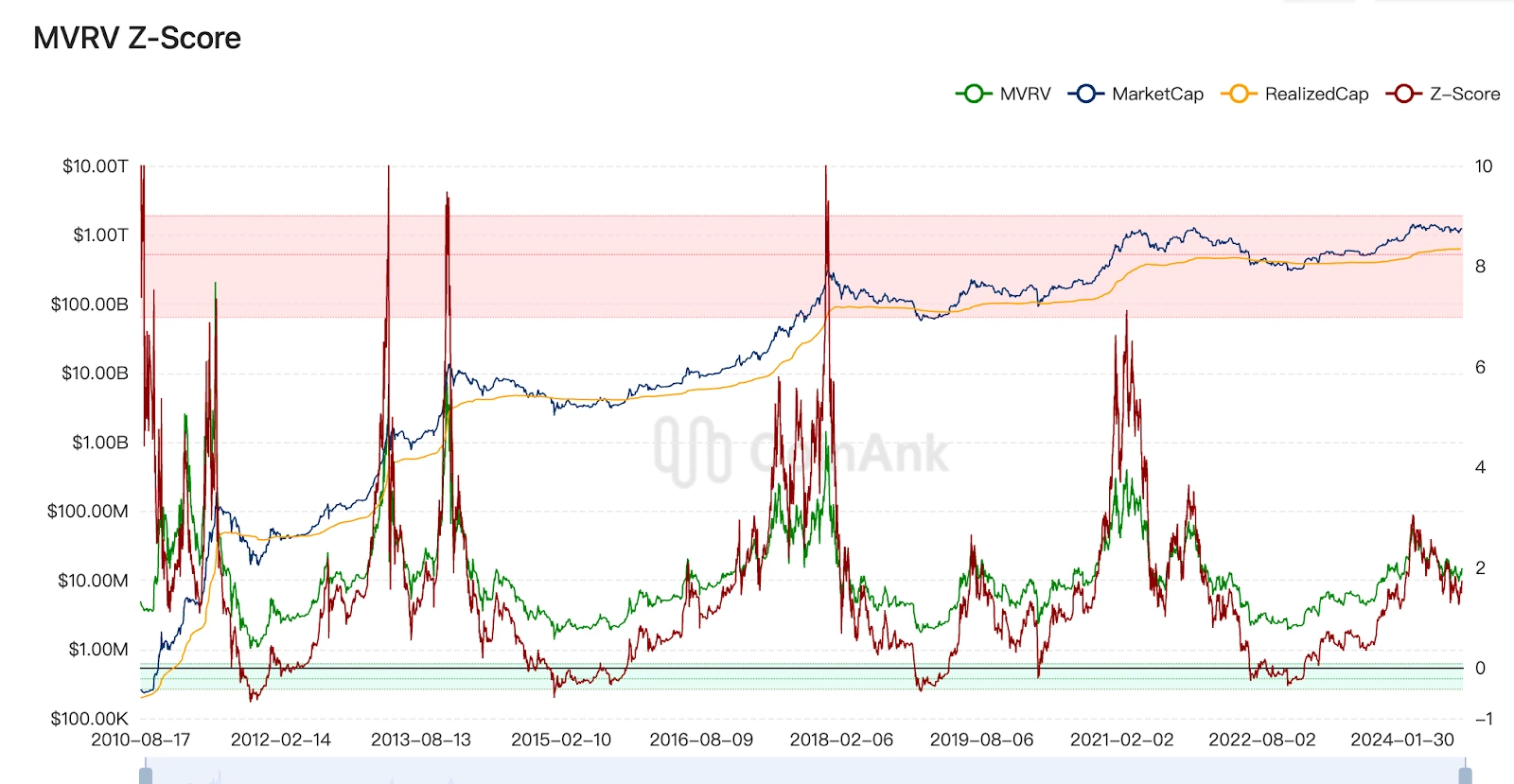

– MVRV Ratio: Currently at 1.94, indicating that the market is in a low-risk zone. The higher the ratio, the more overvalued the market, with a ratio above 3.5 indicating a bubble.

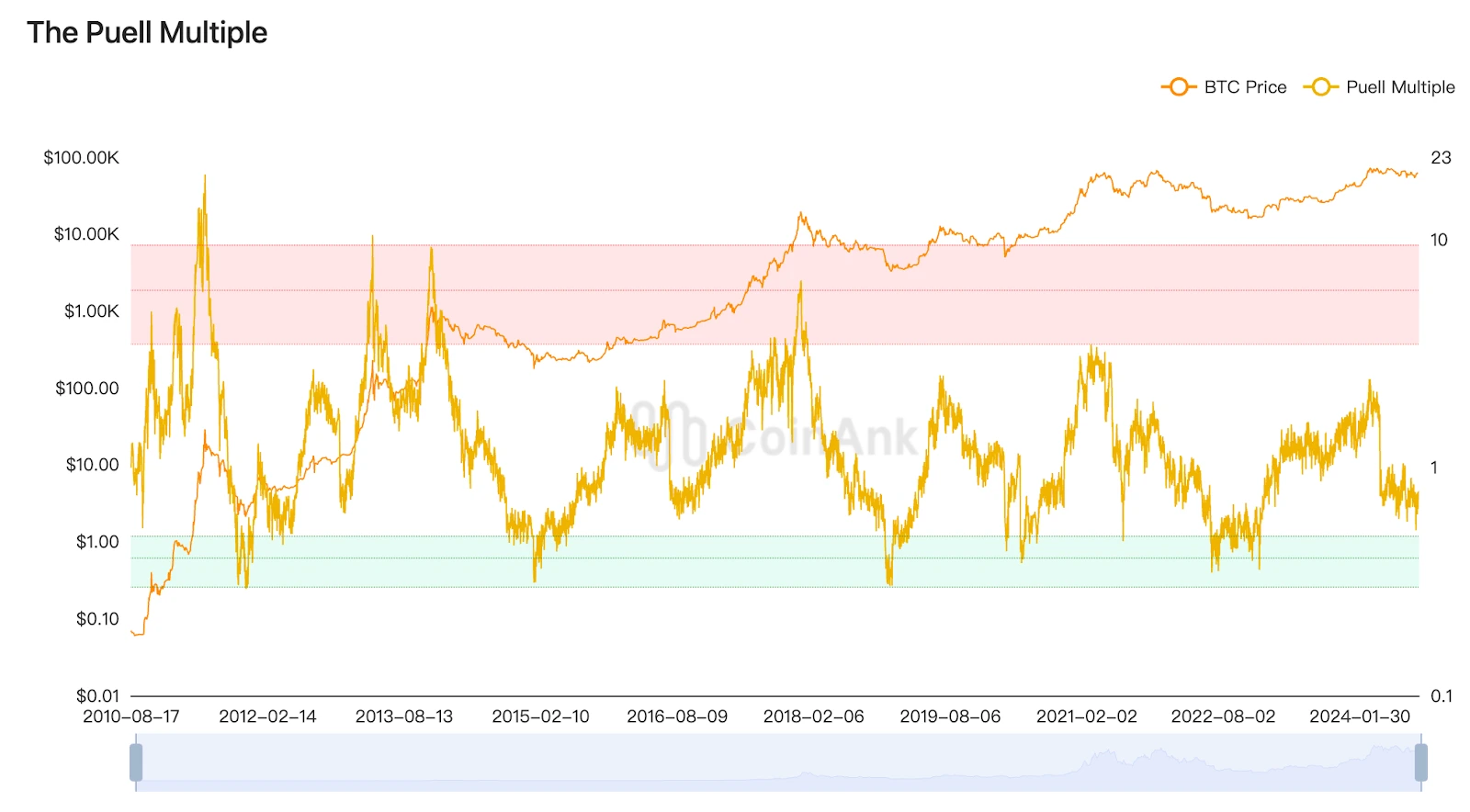

– Puell Multiple: Currently at 0.73, indicating that the market is in a low-risk zone. This metric explores market cycles from the perspective of mining revenues. When the value falls within the range of 4-10.5, the market may be entering a late-stage bull market.

In conclusion, based on the data, the crypto market is currently in a low-risk price area. Comparing these metrics to past halving cycles, the data suggests we are in the early stages of a bull market.

SLOW BULL MARKET: THE CRYPTO MARKET IS GRADUALLY MATURING

A slow bull market refers to a gradual upward trend in prices. As Bitcoin’s market capitalization grows and institutional participation increases, the market is less likely to experience extreme price volatility. Instead, we’re likely to witness gradual upward movements and consolidation periods. This lengthening of the bull market means investors will need more patience and may have to lower their return expectations.

Let’s look at some data to explain why a slow bull market is likely:

– Volatility Reduction: Over each halving cycle, Bitcoin’s daily price swings of more than 15% have decreased:

– In the first halving cycle, there were 76 days with price movements greater than 15%.

– In the second halving cycle, there were 68 days.

– In the third halving cycle, this dropped to just 20 days.

As Bitcoin becomes more mainstream and the market matures, volatility has significantly decreased. While this helps attract more participants, especially institutional investors, it also means fewer opportunities for the average investor.

– Longer Bull Market Durations: Each bull market has lasted longer than the previous one:

– The first halving cycle saw Bitcoin rise from $11 to over $1,169, a 105x increase, lasting about one year.

– The second halving cycle saw Bitcoin rise from $650 to $19,800, a 30x increase, lasting about 1.5 years.

– The third halving cycle saw Bitcoin rise from $3,800 to $69,000, a 17x increase, lasting about 1 year and 8 months.

In summary, as Bitcoin’s ecosystem grows and institutional participation deepens, bull markets are becoming longer and more gradual. This means that investors must adjust their strategies and expectations. The days of 10x or 100x returns may be over, and patience will be key to success in this maturing market.

*Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile and risky. Readers should conduct their own research and consult with financial professionals before making investment decisions.