KEYTAKEAWAYS

- Celebrity memecoins demonstrate crypto market's vulnerability, with LIBRA's rapid rise and 90% crash highlighting risks of unregulated celebrity-endorsed cryptocurrency projects.

- Regulatory frameworks struggle with decentralized markets, requiring global coordination and enhanced investor protection measures to prevent celebrity-driven market manipulation.

- Retail investors must prioritize early discovery, strict risk management, and emotional control while avoiding FOMO-driven decisions in celebrity memecoin investments.

CONTENT

Explore how celebrity memecoins like Argentine President’s LIBRA and CZ’s dog-inspired Broccoli are impacting the crypto market. Analysis of regulatory challenges, market effects, and strategies for retail investors in this evolving landscape.

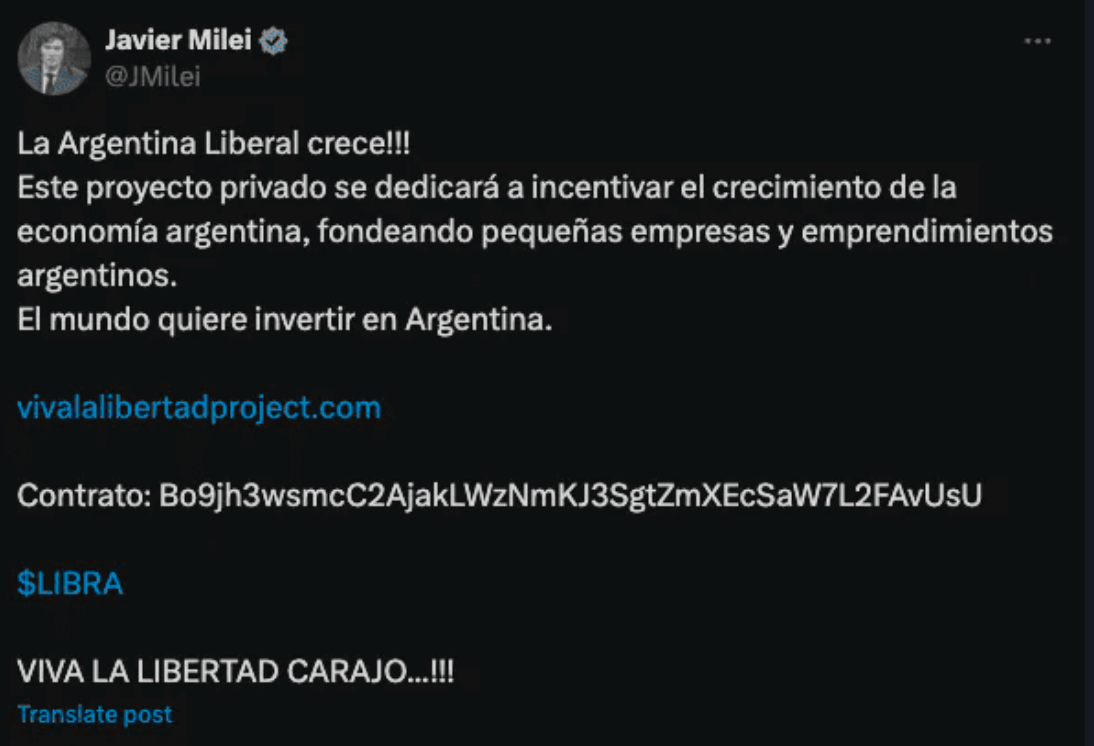

Last weekend, following Trump’s release of his namesake memecoin TRUMP, the market witnessed another “surprise”: Argentina’s President Milei prominently launched a memecoin called “LIBRA.” Meanwhile, Binance founder CZ revealed his pet dog’s name “Broccoli” on social media, leading to numerous similarly named memecoins appearing on the BNB Chain.

The market momentarily became “excited,” believing this was another opportunity for instant wealth. However, while Argentina’s President’s LIBRA briefly reached a market cap of $5 billion, it crashed by 90% within hours, leaving those who bought at the peak with nothing. Meanwhile, the LIBRA team cashed out over $100 million before departing. More ironically, the president later claimed he “wasn’t involved in the project’s development.” Similarly, CZ’s pet dog-inspired memecoin “Broccoli” not only caused transaction volumes on the BSC chain to surge and network congestion but also led many investors to suffer heavy losses overnight due to market chaos and speculative trading.

LIBRA Token Price Trend

(Source: TradingView)

Since Trump launched TRUMP, setting a precedent for politicians and celebrities issuing memecoins, it seems to have opened Pandora’s box. Many political figures and governments have joined the token-issuing trend. The Central African Republic’s president personally oversaw the issuance of the national sovereign token CAR, while the Brazilian government launched the BRAZIL token. Similarly, Tanzania introduced the TANZANIA token, and Malaysia released the MALAYSIA token. The pattern is always the same: initially promising countless possibilities, when token prices rise, governments and related personnel heavily promote them, but once the tide turns, they quickly delete posts and erase all traces.

This phenomenon not only depletes the crypto market’s liquidity but also transforms the market into an unregulated casino through these blatant scamming behaviors. While the crypto sphere has achieved some level of “breakthrough” in terms of attention, it has done so through “negative publicity,” further tarnishing its reputation.

WHAT IMPACT WILL CELEBRITY SCAMS HAVE ON THE CRYPTO WORLD?

Although the market currently largely condemns such naked scamming behavior by political figures and celebrities, every situation has two sides, with both positive and negative impacts. From a positive perspective, in the short term, these events have brought increased attention and capital flow to the crypto market. The celebrity effect has generated high market attention for memecoins, and this short-term capital injection has added vitality to the crypto market. Regardless of the approach, these events have undoubtedly triggered widespread discussion and media attention, increasing general investor awareness and understanding of the crypto market. Despite potentially negative coverage, it has increased exposure and awareness.

These developments have also promoted market ecosystem diversification and innovation. Despite memecoins’ issues, their popularity drives ecosystem diversity. Additionally, they have attracted new users to enter the market, with the “celebrity effect” serving as a bridge for market entry. While the final results may be unfavorable for short-term investors, they still bring new user participation, building a user base for long-term crypto market development.

Looking at the long term, these events may promote industry maturity and self-regulation. Under chaotic market conditions, industry projects and platforms may feel greater pressure to act more responsibly. This could encourage stricter pre-issuance scrutiny and project transparency. Currently, many KOLs and institutional figures are discussing how to standardize token issuance, potentially accelerating the standardization of issuance and circulation processes. Short-term “bubble” phenomena may accelerate industry standardization, including introducing more robust regulations to protect investors and ensure the crypto market’s long-term healthy development.

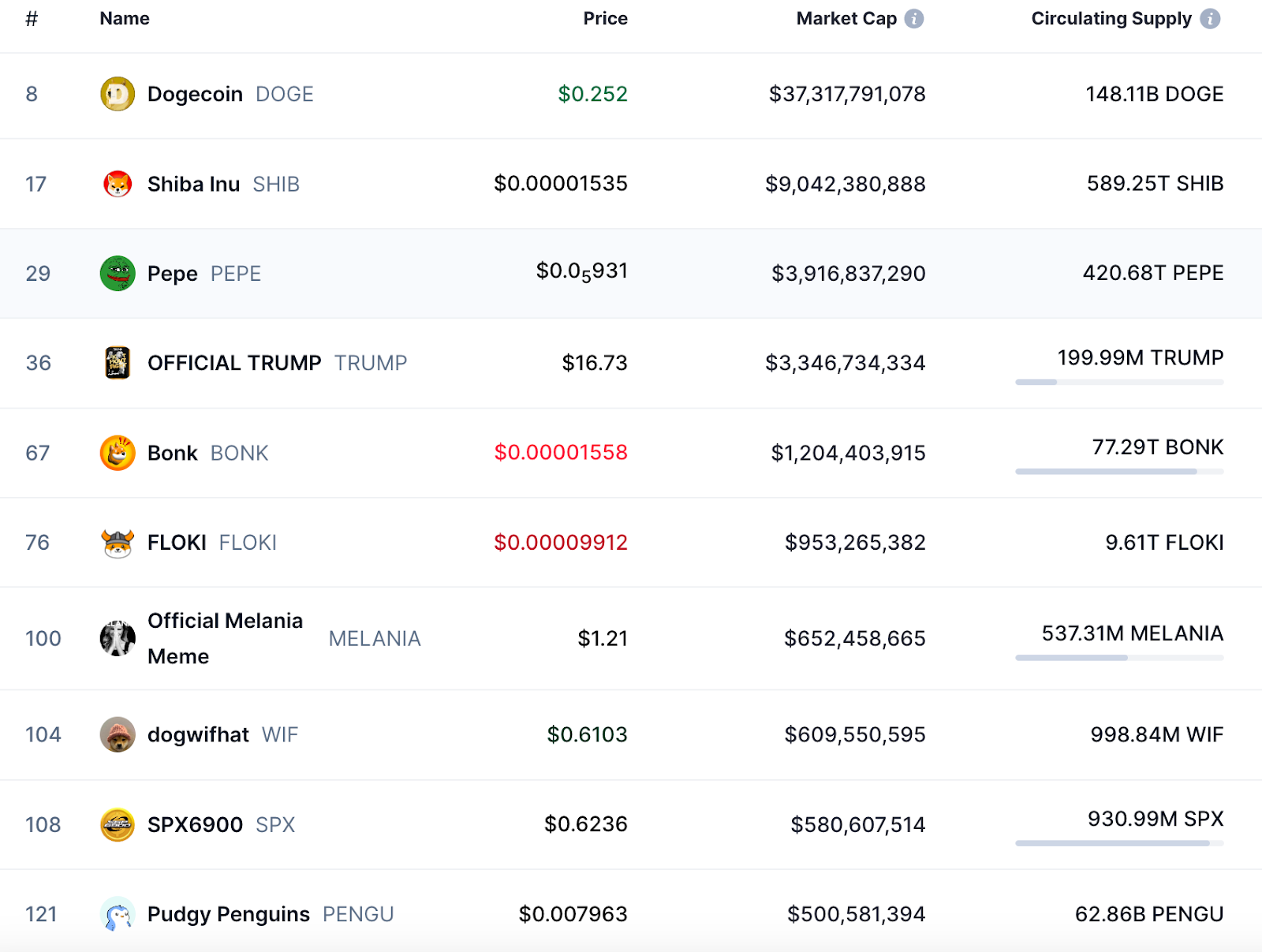

Current Top10 Memecoins by Market Cap

(Source: CoinMarketCap)

From a negative perspective, the most direct impact is retail investors’ blind following and losses. Memecoins’ rapid price increases have attracted many retail investors to chase high prices, resulting in severe losses. For example, after LIBRA tokens surged from a few cents to $5, they quickly returned to their starting point, leaving many investors with nothing.

In the short term, this has not only intensified market fluctuations but also weakened investor trust in the crypto market, reinforcing the impression of an “immature cryptocurrency market.” It has caused investors to doubt market transparency, especially when celebrity effects manipulate market prices, making people feel that the crypto market lacks long-term stable investment value. Rebuilding trust also takes time, which is undoubtedly unfavorable for current market conditions.

Repeated celebrity market manipulation increases regulatory pressure. Celebrity market manipulation cases will trigger more government and regulatory agency scrutiny and restrictions on cryptocurrencies, potentially leading to stricter regulations worldwide that limit market freedom.

REGULATORY CHALLENGES: ARE WE REALLY HELPLESS AGAINST CELEBRITY SCAMS?

Currently, the celebrity memecoin chaos exposes multiple vulnerabilities in crypto market regulation, technology, and institutional processes. While short-term solutions seem elusive, there are no systematic and effective methods for regulation and remediation.

The current regulatory difficulties are quite obvious. The crypto market’s decentralized nature makes regulation complex. Regulatory agencies struggle to effectively oversee decentralized projects or global markets, especially memecoin projects that rely solely on celebrity effects and often lack clear value propositions.

From an international coordination perspective, the challenges are enormous. The crypto market operates across borders, and project issuance and trading are not geographically limited. How to implement effective global regulation is a difficult problem, and inconsistent regulations across countries make regulatory work even more challenging.

From an investor protection standpoint, celebrity effect-driven memecoin projects often lack transparency, and information asymmetry is severe. Ordinary investors, especially retail investors, often lack sufficient professional knowledge and market judgment, easily following market trends blindly and ultimately suffering serious losses. In such cases, investor protection mechanisms appear particularly weak.

Currently, crypto technology updates rapidly, especially with emerging DeFi, NFT, and other projects constantly appearing. Regulatory agencies often struggle to issue timely adaptive regulations. The relative slowness of regulatory lag leads to regulatory frameworks being unable to respond to emerging risks promptly, such as bubble risks brought by celebrity manipulation or token issuance.

Facing these regulatory challenges, there are many potential solutions, but currently, they may all need time to clarify thinking and truly implement. For example, regarding regulatory response measures, legal definitions and responsibility subjects can be clarified. From a legal perspective, celebrity tokens can be incorporated into existing financial regulatory frameworks, such as classifying them based on their functional attributes (like securities, commodities, or payment tools). The U.S. SEC has attempted to regulate some tokens as securities, but clearer standards are needed.

For subsequent accountability, strict accountability should be applied to celebrities or project teams who use their influence to manipulate markets. For example, if Argentina’s President Milei’s tweets boosting LIBRA coins before their crash involved insider trading or market manipulation, the “false statement” clauses in traditional securities law should apply.

Argentine President Supporting LIBRA

From within the industry, token issuance should strengthen information disclosure and transparency requirements. For example, token distribution should be public, and project teams should be required to disclose token distribution ratios, lock-up periods, and purposes. Additionally, interest relationships must be disclosed – if celebrities participate in token issuance, they need to publicly disclose their financial relationships with the projects to avoid misleading investors through fan economics.

The crypto market’s global nature requires cooperation between regulatory agencies in different countries, such as establishing unified rules through FATF (Financial Action Task Force). Currently, the EU’s MiCA regulation has attempted to establish a cross-border regulatory framework covering the entire process of token issuance and trading.

Regarding technological innovation and constraints, relevant platforms should provide on-chain monitoring and risk warnings, or educate users to use blockchain data analysis tools (like Bubblemaps) to track token flows and identify abnormal transactions. For example, Trump coin insider traders were exposed through on-chain data; such technology can be routinely applied.

Decentralized governance and transparency improvements can also be achieved by promoting DAO (Decentralized Autonomous Organization) models, requiring celebrity tokens’ governance rights to be distributed to the community to reduce centralized control risks. As places where token value circulates, exchanges’ technical compliance auditing is also important. Exchanges need to establish automated audit systems to monitor listed projects’ on-chain data and public sentiment.

In optimizing and executing institutional processes, exchanges should establish standardized processes for listing audits, set strict listing thresholds including project background investigation, token economic model review, and liquidity commitments. They should also focus more on investor protection and education mechanisms, requiring exchanges to provide risk warnings and limit high-leverage trading. For example, Singapore prohibits credit card purchases of cryptocurrencies to reduce retail investors’ irrational investment risks.

Additionally, establishing industry self-discipline and community supervision mechanisms, forming industry alliances to set token issuance ethical guidelines, such as requiring celebrities not to directly control token supply or liquidity. Encourage community reporting of suspicious projects and use on-chain governance for delisting votes on non-compliant tokens.

RETAIL INVESTOR STRATEGY: THE FINE LINE BETWEEN WEALTH AND LOSS

From a retail investor’s perspective, how should one capture opportunities or avoid risks when facing these celebrity effect-driven memecoin phenomena?

If you’re a Degen player more inclined to capture these fleeting wealth opportunities, you need to follow three “early” principles: early discovery, early purchase, and early profit-taking.

As we mentioned in our previous article “Ultimate Guide: How to Find and Invest in High-Potential Memecoins (2024),” you can discover early opportunities through social media platforms like Twitter, Reddit, Telegram, and Discord.

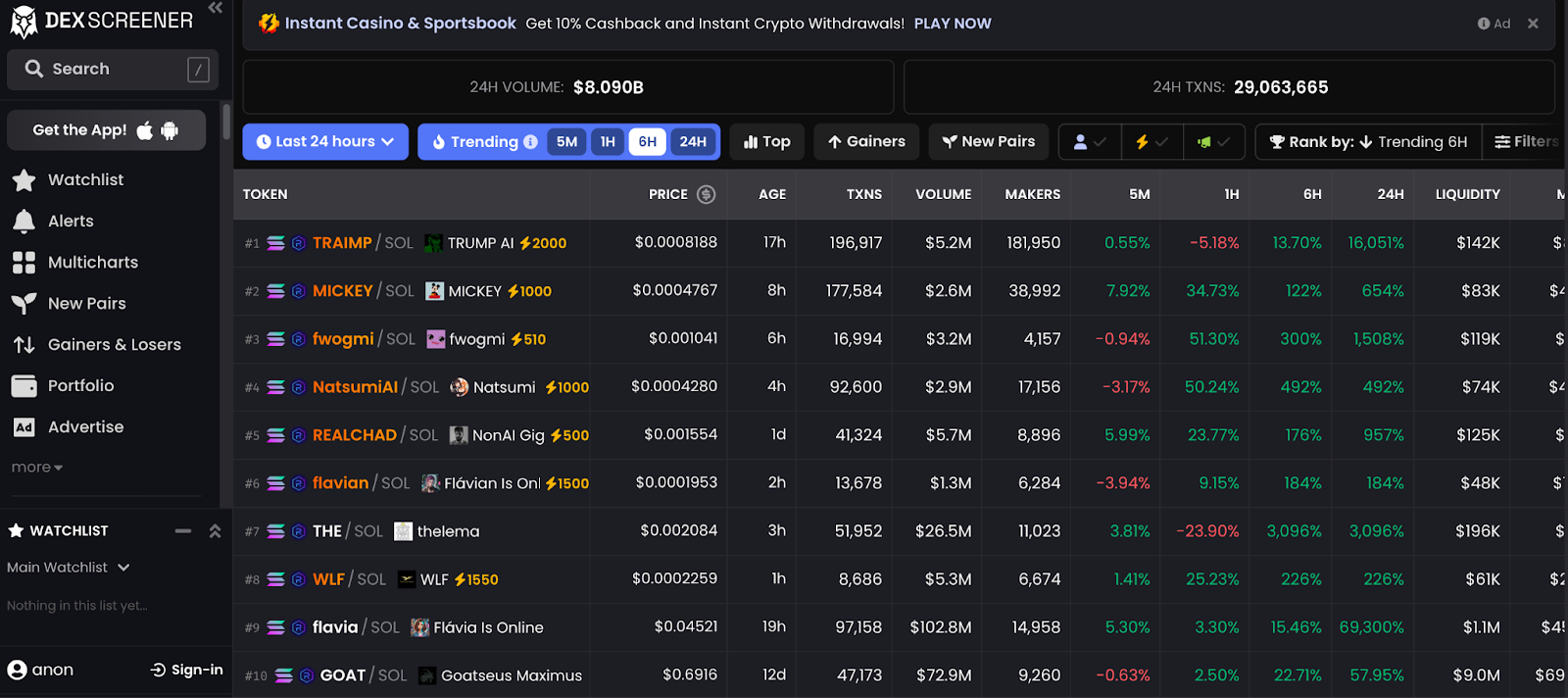

For Twitter, you can follow well-known cryptocurrency KOLs, crypto celebrities, various countries’ politicians, and memecoin-related accounts. Additionally, you can use tools like Nansen to track these KOLs and whale wallet movements to discover quality memecoins. You can also use specialized crypto market platforms and related tools to discover memecoins more quickly. For example, the “New Coins” sections on CoinMarketCap and CoinGecko; you can also use on-chain data monitoring to discover new memecoins more quickly, such as DEX Screener, a tool platform specifically for analyzing token trading on DEXs; and the blockchain explorers of the two largest memecoin-concentrated public chains: ETH and BSC.

Memecoins Situation on Different Blockchains

(Source: DEX Screener)

By extensively utilizing social media, communities, on-chain data monitoring tools, and DEX trading platforms, collecting and screening information through multiple channels to verify authenticity, you can quickly and effectively discover new memecoins.

After buying, you need to establish a profit-taking strategy and secure profits early. Once the coin price shows a surge and the market begins to show signs of instability or trading volume changes dramatically, retail investors should decisively consider taking profits. You can set profit-taking points (such as selling when prices rise by 30%, 50%, or higher) rather than waiting for prices to reach their peak. Since memecoins often fluctuate significantly in the short term and are highly speculative, securing profits early is very important.

If you understand market volatility, consider selling holdings in batches rather than all at once. For example, sell 30% to 50% of positions to lock in partial profits, with the remaining portion adjustable as market prices continue to rise. This way, even if the market reverses, some profits are already secured.

Meanwhile, setting stop-losses is also important. Once the price falls to a preset stop-loss point (such as a 20% drop), automatically close the position. This prevents emotional decision-making and avoids situations of “holding to death.”

If you didn’t participate early, should you still participate?

If you decide to continue participating, you need to be able to judge market sentiment and must understand current market emotions and the true demand for these coins. For example, is there still enough heat to support continued price increases? Is it just a bubble phase? If it’s rising only due to social media heat, the risk of chasing high prices is extreme.

Additionally, you need to diversify investments and not put all funds into a single memecoin, especially these high-risk projects. You can test the waters with small amounts and maintain strict stop-losses. If deciding to participate later, it’s recommended to test with small amounts and set strict stop-loss points. For example, control investment amounts to within 5% of total funds and set stop-loss points at 10% of the purchase price.

Researching fundamentals and market trends is also very important. If you want to enter this type of market, try to find memecoin projects with actual applications or technical support, rather than relying solely on celebrity effects. You can pay attention to community activity, project team background, and transparency to ensure the project has potential rather than just short-term speculation.

Most importantly, you need to avoid emotional decision-making and maintain calm judgment. The biggest problem for retail investors is being easily affected by emotional fluctuations and making impulsive decisions. Therefore, establishing good trading plans and strictly following profit-taking and stop-loss strategies is key to reducing emotional decision-making.

From the perspective of risk control and establishing long-term strategies, maintaining rationality and independent thinking is important. The foundation is to study seriously and improve investment abilities. The cryptocurrency market changes rapidly, and investors should continuously learn relevant knowledge to improve investment capabilities. For example, they can learn technical analysis, fundamental analysis, and other methods to better judge market trends.

Celebrity-issued memecoins provide short-term profit opportunities for retail investors but come with extremely high risks. Early participants should set clear profit targets and sell in batches, while later participants need to carefully evaluate risk-reward ratios. Regardless of when they enter, investors should maintain rationality, avoid emotional trading, and enhance investment capabilities through learning and risk control. Ultimately, only rational investment and long-term planning can establish an undefeated position in the crypto market.

SUMMARY

Based on this article’s analysis of celebrity-driven memecoin events, we have summarized the key points regarding market impacts (both positive and negative), regulatory analysis, and investment strategies for readers’ reference. These takeaways aim to provide a comprehensive overview of how to understand and navigate the current market situation while maintaining a balanced perspective on both opportunities and risks.

1. Positive Market Impacts

- Short-term Market Vitality

-Brings immediate heat and capital inflow to the crypto market

-Celebrity effects generate high market attention

-Short-term capital injection adds market vitality

- Increased Market Exposure

-Triggers widespread discussion and media attention

-Increases general investor awareness and understanding

-Expands market visibility despite negative coverage

- Ecosystem Development

-Promotes market ecosystem diversification

-Drives innovation in the crypto space

-Attracts new users and builds long-term user base

- Market Maturation

-Encourages industry self-regulation

-Promotes stricter pre-issuance scrutiny

-Accelerates standardization processes

-

Negative Market Impacts

- Investor Risks

-Causes retail investor losses through blind following

-Creates extreme market volatility

-Leads to trust erosion in the crypto market

- Market Stability Issues

-Intensifies short-term market fluctuations

-Weakens long-term investment confidence

-Reinforces market immaturity perceptions

- Regulatory Concerns

-Increases government scrutiny

-May lead to stricter global regulations

-Could restrict market development freedom

-

Regulatory Solutions

- Legal Framework

-Clear legal definitions needed

-Enhanced accountability measures

-Stronger information disclosure requirements

- Technical Solutions

-On-chain monitoring systems

-Risk warning mechanisms

-Blockchain analysis tools implementation

- Process Improvements

-Standardized listing procedures

-Strict entry requirements

-Enhanced investor protection mechanisms

-

Investment Strategies

- Early Stage Investment

-Focus on early discovery

-Implement timely entry strategies

-Plan clear exit points

- Risk Management

-Diversify investments

-Use small testing positions

-Set strict stop-loss points

- Research Requirements

-Study project fundamentals

-Analyze market trends

-Verify team backgrounds

- Emotional Control

-Maintain rational decision-making

-Follow predetermined trading plans

-Adhere to risk management strategies

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!