KEYTAKEAWAYS

- Trump's Crypto Layout: From Meme Coins to National Cryptocurrency Strategy

- White House "Crypto Dream Team" Holdings Map: BTC Remains Hard Currency

- USD1 Stablecoin Has Been Questioned by Outsiders as Tool for Trump Family to Expand Financial Influence

- KEY TAKEAWAYS

- TRUMP’S CRYPTO LAYOUT: FROM MEME COINS TO NATIONAL CRYPTOCURRENCY STRATEGY

- WHITE HOUSE “CRYPTO DREAM TEAM” HOLDINGS MAP: BTC REMAINS HARD CURRENCY

- THE RISE OF 29-YEAR-OLD CRYPTO STRATEGIST BO HINES: FROM FOOTBALL FIELD TO POLICY MAKING

- WHEN POLITICS MEETS CRYPTO ANARCHISM

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In April 2025, the most notable focus in American political and business circles is undoubtedly the Trump family and administration team’s comprehensive advance into the cryptocurrency sector. From the upcoming blockchain version of “Monopoly,” to the exposure of White House officials’ crypto asset holdings, to a 29-year-old football player becoming the crypto policy helmsman—this “crypto revolution” led by Trump is reshaping the boundaries between American finance and politics.

TRUMP’S CRYPTO LAYOUT: FROM MEME COINS TO NATIONAL CRYPTOCURRENCY STRATEGY

On April 15, Fortune magazine revealed that Trump’s latest crypto project will be a real estate-themed blockchain game inspired by his beloved “Monopoly.” According to insiders, players can earn cryptocurrency by building virtual properties on a digital board. The project is spearheaded by Trump’s longtime ally Bill Zanker and is planned for release at the end of April.

This is just the tip of the iceberg for Trump’s crypto empire. Currently, crypto projects or major events associated with Trump are growing. In the cryptocurrency field, Trump’s name is no longer just a political symbol but has become a business brand.

In January 2025, $TRUMP (Trump Coin) was launched on the Solana chain, officially positioned as the “only Meme coin recognized by the Trump team.” With a total supply of 1 billion tokens, 20% was publicly sold through ICO, while the remaining 80% is held by Trump’s company. Although the team emphasized that the token is “not an investment tool and is unrelated to politics,” its market value once surpassed $27 billion after listing, followed by violent fluctuations, raising market concerns about speculative risks.

In the same year, the Trump family made a high-profile entry into decentralized finance (DeFi), launching the World Liberty Financial platform. The core team of this project could be described as a “family business”—Trump himself serves as the Chief Crypto Advocate, his youngest son Barron Trump as the “DeFi Vision Officer,” while Eric and Donald Jr. act as “Web3 Ambassadors” active on the promotion frontline. The platform issued the $WLFI token, focusing on crypto lending services, and plans to launch a payment system called “TruthFi.”

As a derivative of World Liberty Financial, the USD1 stablecoin was also introduced. This stablecoin, pegged 1:1 to the US dollar, has been questioned by outsiders as a tool for the Trump family to expand their financial influence, possibly involving the intersection of political and business interests.

In the NFT realm, Trump has already tasted success. Since 2022, the Trump NFT series authorized by NFT International LLC has released four versions, including static portraits, animated effects, and rare digital collectible cards, each priced at $99. To date, the series has sold more than 200,000 pieces, generating over $22 million in revenue, becoming one of the most successful celebrity NFT cases.

In March 2025, Trump went a step further, proposing the US National Cryptocurrency Reserve plan, suggesting that the federal government include mainstream cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) in reserve assets, aiming to make the US the “global center for crypto finance.” Although this proposal has not yet been implemented, it has already sparked extensive discussions about national digital currency strategies.

From Meme coins to DeFi, from NFTs to national-level crypto policies, Trump’s crypto map is expanding at an astonishing speed—both a business monetization ambition and a contest for discourse power in emerging finance.

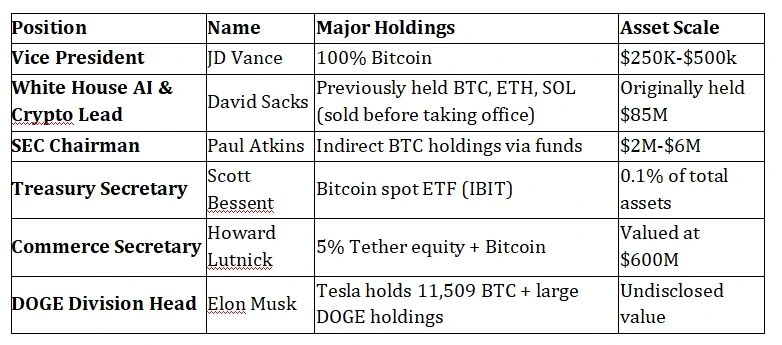

WHITE HOUSE “CRYPTO DREAM TEAM” HOLDINGS MAP: BTC REMAINS HARD CURRENCY

With the appointment of SEC Chairman Paul Atkins finalized, Trump administration’s core crypto policy team is now fully in place. These officials’ crypto holding styles differ significantly:

Notably, Vice President Vance stands out in the team as a “Bitcoin purist,” while Musk continues his “meme coin enthusiast” persona. This diversified portfolio is interpreted by the industry as a signal of policy balance: “Vance represents the conservative regulatory stance, while Musk symbolizes innovative experimentation.” (Wall Street Journal commentary)

THE RISE OF 29-YEAR-OLD CRYPTO STRATEGIST BO HINES: FROM FOOTBALL FIELD TO POLICY MAKING

In this crypto revolution, the most surprising key figure is 29-year-old former professional football player Bo Hines. As Executive Director of the “Presidential Digital Assets Advisory Committee,” he met with over 50 industry leaders within his first 30 days in office, including a16z founder Marc Andreessen and Ripple CEO Brad Garlinghouse.

“He’s like drinking from a fire hose,” commented an anonymous crypto executive, “Despite lacking experience, his learning speed is astonishing.” Three major policies spearheaded by Hines have already shown initial results:

- Pushing the SEC to withdraw lawsuits against Coinbase and Ripple;

- Pardoning “Silk Road” founder Ross Ulbricht;

- Preparing to pass the “Stablecoin Regulation Act” before August.

However, challenges remain: Trump’s tariff policy caused BTC prices to plummet 10% in a single day, exposing the fragile connection between policy and markets. “We need to find a balance between innovation and stability,” Hines candidly stated in an interview.

WHEN POLITICS MEETS CRYPTO ANARCHISM

The Trump team’s crypto ambitions have also sparked sharp criticism. Left-wing think tank Better Markets pointed out: “A national cryptocurrency reserve could become a tool for manipulating specific asset prices.” The Guardian questioned the Trump family’s conflicts of interest in DeFi projects.

But supporters believe this is an inevitable process of financial democratization. “Washington has finally understood the language of blockchain,” said Bitcoin mining company CEO Matt Schultz, “Even if the motives aren’t pure, the results could rewrite history.”

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!