KEYTAKEAWAYS

- The court-approved compensation plan sets a January 2025 start date, prioritizing customer deposits and implementing a structured 9-step claims process for affected investors.

- FTX's downfall stemmed from complex financial entanglements with Alameda Research, triggered by Binance's FTT token selloff and mismanaged customer funds.

- The crypto industry faces renewed scrutiny of exchange practices, with regulators worldwide reconsidering their approach to cryptocurrency market oversight.

CONTENT

After its dramatic collapse in 2022, FTX’s newly approved compensation plan offers hope to over 100,000 affected investors. Learn about the January 2025 rollout, claim process, and how this watershed moment is reshaping crypto’s future.

For thousands of investors affected by the sudden collapse of FTX in late 2022, October 2024 finally brought a glimmer of hope. The U.S. court’s approval of the FTX bankruptcy compensation plan, set to take effect in early January 2025, marks a turning point in this saga that has reshaped the cryptocurrency landscape. As the dust begins to settle, this development offers a chance for healing in a market that was deeply shaken by one of its biggest failures.

THE COMPENSATION PLAN: A LIGHT AT THE END OF THE TUNNEL

After months of anticipation, FTX Trading Ltd. and its affiliated debtors have announced that their restructuring plan is entering its final phase. This hard-won progress sets the stage for what many hope will be the beginning of recovery for affected customers and creditors. According to recent updates, FTX aims to begin compensation payments in early January 2025.

(Source: X)

The road ahead is carefully mapped out. In early December, FTX will partner with professional distribution agents to ensure compensation funds can reach investors worldwide. During this time, customers will have the opportunity to set up verified accounts through an existing portal.

By late December, following the court’s approval of reserve amounts for disputed claims, the debtors will announce the official effective date of the plan. This crucial step paves the way for the distribution process.

When January 2025 arrives, the bankruptcy restructuring plan is expected to come into full effect. Within 60 days of the effective date, the first wave of distributions will begin, with priority given to those holding approved claims in the convenience class.

The scale of this compensation effort is staggering. Initial bankruptcy proceedings revealed that FTX’s total liabilities exceeded $8 billion, encompassing funds from customers and investors across the globe. When FTX filed for bankruptcy protection, it left behind more than 100,000 creditors and investors, ranging from everyday retail customers to major institutional players.

The plan prioritizes the repayment of customer deposits, followed by shareholders and other creditors. Given the complexity involved, the complete process may stretch over several years.

NAVIGATING THE CLAIMS PROCESS: A GUIDE FOR INVESTORS

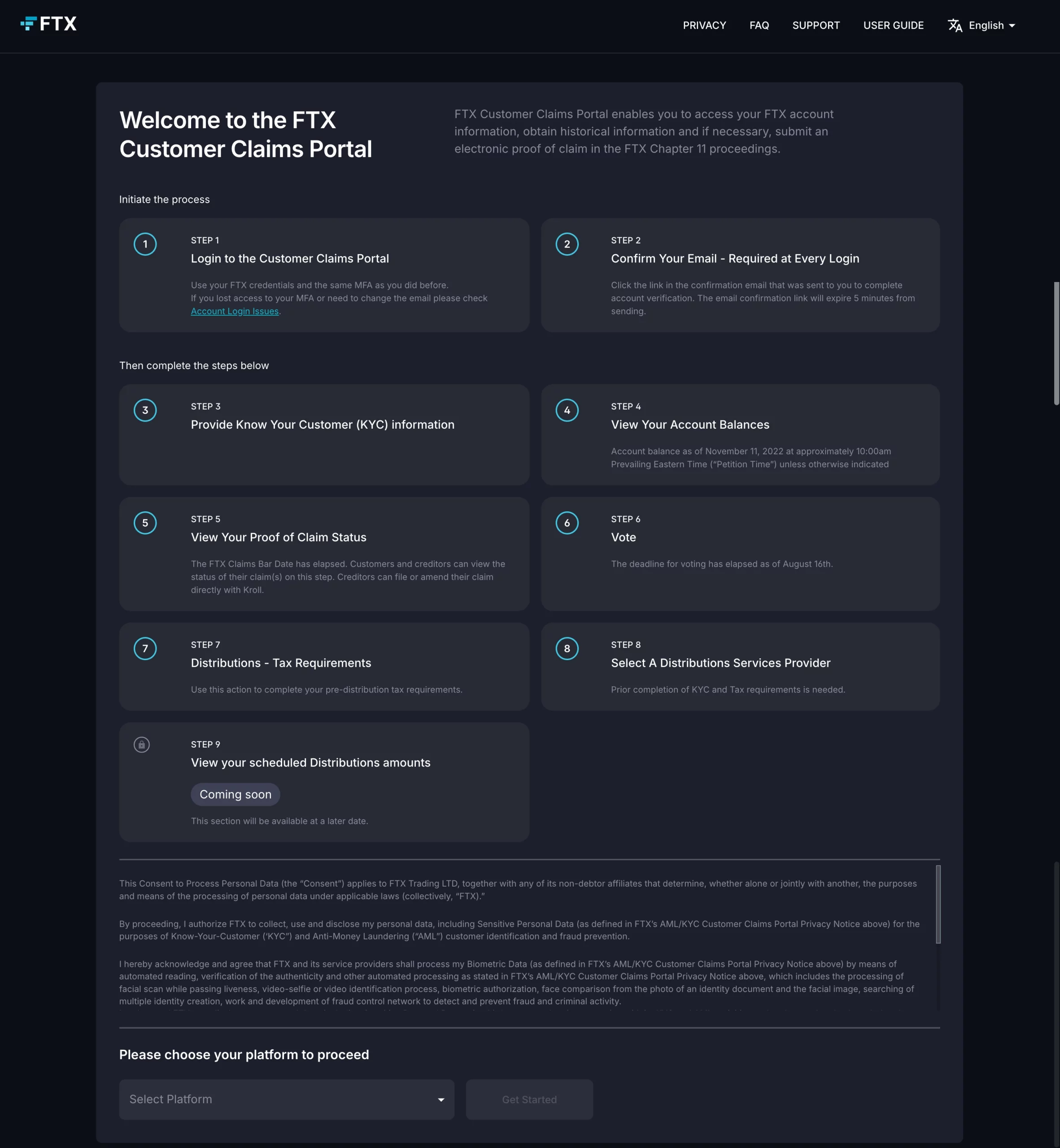

For those anxiously awaiting compensation, understanding how to secure their rightful claims is paramount. FTX has launched a dedicated claims portal, implementing a thoughtful 9-step process that includes account login, email verification, KYC information submission, and account balance review.

(Source: FTX)

To help ensure a smooth claims process, here are some key considerations:

- Use your original FTX platform login credentials

- Provide thorough and accurate personal information

- Take time to carefully verify your account balance details

- Follow each step of the website instructions with attention to detail

Remember that the authenticity and accuracy of your submitted information are crucial to the success of your claim. Taking the time to review all materials before submission not only helps expedite the process but also helps protect your legal rights.

THE RISE AND FALL OF FTX: A CAUTIONARY TALE

When Sam Bankman-Fried founded FTX in 2017, few could have predicted its meteoric rise to become the world’s second-largest cryptocurrency exchange. The story of FTX’s ascent reads like a Silicon Valley fairy tale. Beyond cryptocurrency trading, the platform ventured into derivative trading and other financial services.

Meanwhile, its sister company, Alameda Research, focused on cryptocurrency investment and trading. Yet it was the intricate financial relationship between FTX and Alameda Research that would ultimately spell disaster.

November 2022 brought a sudden and devastating liquidity crisis, leaving FTX unable to meet a surge of withdrawal requests. This crisis emerged from a perfect storm of factors:

The first crack appeared in the form of financial opacity. The complex web of transactions between FTX and Alameda Research harbored serious issues, particularly because a significant portion of Alameda’s assets were collateralized with FTX’s own token (FTT). This made FTX’s stability dangerously dependent on FTT’s market value.

(Source: Tradingview)

Then came the catalyst: Binance, the world’s largest cryptocurrency exchange, announced its intention to liquidate its FTT holdings. This move triggered a wave of panic, leading to a devastating bank run on FTX.

Most troubling were the revelations of financial mismanagement and fraud. FTX had failed to properly safeguard customer funds, with some assets being redirected to Alameda Research for high-risk investments, ultimately resulting in catastrophic losses.

LESSONS FROM THE FTX COLLAPSE

The consequences of FTX’s collapse rippled widely through the cryptocurrency landscape. Trust, the delicate foundation of any financial market, took a severe hit. Cryptocurrency prices fell across the board, with the FTT token leading the way in shaking market confidence.

The incident sparked widespread discussions about how crypto exchanges operate. Questions that had been whispered in industry circles suddenly became front-page news: How can we really know our funds are safe? What happens behind the scenes at these exchanges?

Regulators worldwide began paying close attention, with many beginning to reconsider their approach to overseeing the crypto space.

As the dust continues to settle, the crypto world finds itself at a crossroads. The FTX story has become more than just another company bankruptcy – it has forced everyone, from casual investors to industry veterans, to rethink the future of cryptocurrency trading.

The collapse of FTX marked a turning point in cryptocurrency regulation. Regulatory bodies worldwide took action to strengthen oversight of the crypto industry.

Globally, many countries began implementing exchange licensing systems, requiring trading platforms to obtain appropriate licenses before operating. Additionally, “firewall” policies became widespread, mandating strict separation between customer assets and platform operational funds.

While these regulatory changes may present short-term challenges for the industry, they are expected to rebuild investor confidence and guide the cryptocurrency market toward a more mature and regulated future. The FTX incident may well become a crucial milestone in the cryptocurrency industry’s transition toward responsible development.

Also Read:

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!