KEYTAKEAWAYS

- The US has pivoted from strict regulation to strategic crypto support, launching a Bitcoin reserve plan while loosening SEC oversight to position itself as a global leader.

- Europe maintains conservative crypto regulation through MiCA framework while exploring digital euro implementation, though internal policy differences between member states persist.

- Asia demonstrates diverse regulatory approaches with 77.7% legalization rate, becoming a major crypto hub capturing over 50% of global trading volume.

- KEY TAKEAWAYS

- 2025 OVERVIEW OF NATIONAL (REGIONAL) CRYPTOCURRENCY LEGALITY

- THE UNITED STATES: FROM REGULATORY GAMING TO STRATEGIC RESERVE PIONEER

- EUROPEAN UNION: CONSERVATIVE REGULATION AND CBDC EXPLORATION

- UNITED KINGDOM: LABOUR’S NEW POLICY AND STABLECOIN BREAKTHROUGH

- ASIA: DIVERSE PATHS AND INNOVATION EXPERIMENTS

- EL SALVADOR AND BHUTAN: CONDUCTING RADICAL CRYPTOCURRENCY RESERVE EXPERIMENTS

- 2025 CRYPTOCURRENCY REGULATORY UPDATES

- DISCLAIMER

- WRITER’S INTRO

CONTENT

2025 OVERVIEW OF NATIONAL (REGIONAL) CRYPTOCURRENCY LEGALITY

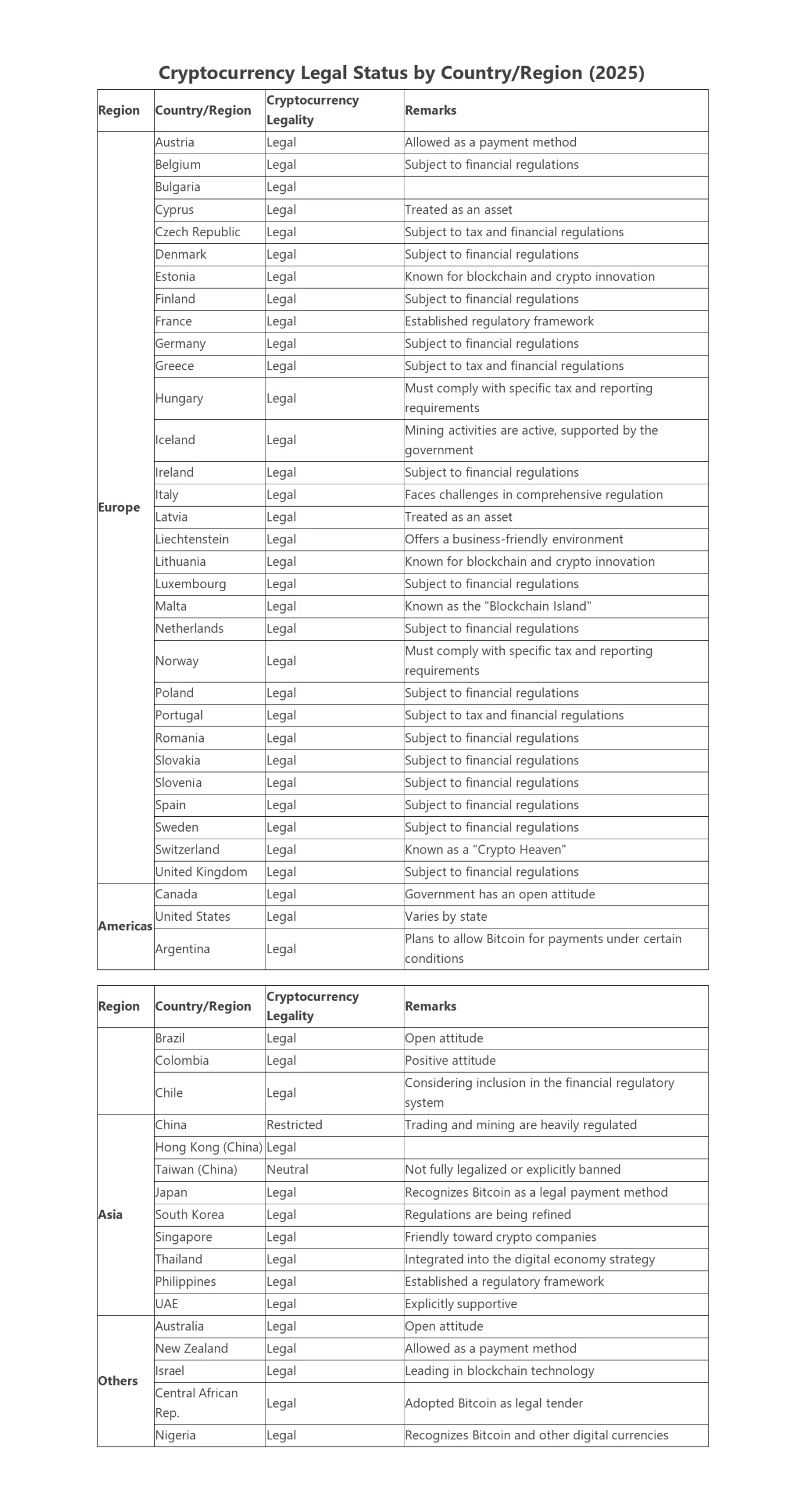

With the rapid development of blockchain technology, the process of cryptocurrency legalization is accelerating globally. By 2025, many countries and regions have explicitly recognized the legality of cryptocurrencies and established corresponding regulatory frameworks. Below is a comprehensive summary of cryptocurrency legalization across various regions worldwide.

Cryptocurrency-Friendly Countries and Regions:

- United Arab Emirates: Legal framework clearly supportive, with Dubai becoming a pioneering city in the cryptocurrency sector.

- Switzerland: Particularly in Zug Canton, Switzerland is committed to becoming a “crypto nation.”

- South Korea: Regulations gradually improving, dedicated to creating a business environment friendly to crypto technologies.

- Singapore: Extremely friendly to cryptocurrency companies, with over 100 registered crypto firms.

- United States: Laws vary by state, regulatory environment is complex, but overall supportive of cryptocurrencies.

- Hong Kong, China: Experience with licensed exchanges and approval of crypto ETFs, attracting Web3 talent.

- Other friendly countries include Estonia, Italy, Russia, Germany, Brazil, etc.

Europe: Europe leads in cryptocurrency legalization, with 39 out of 41 countries recognizing its legality, a rate of 95.1%. Major countries include Austria, Belgium, France, Germany, Switzerland, etc.

Americas: Of the 31 countries in the Americas, 24 recognize cryptocurrencies as legal, a rate of 77.4%. Major countries include Canada, United States, Argentina, Brazil, Chile, etc.

Asia: Asia has also made significant progress in cryptocurrency legalization, with 35 out of 45 countries recognizing cryptocurrencies as legal, a rate of 77.7%. Major countries include Japan, South Korea, Singapore, Thailand, the Philippines, etc. China has implemented strict regulations on cryptocurrency trading and mining activities, but has not completely banned them.

Africa: Only 17 out of 44 countries have legalized cryptocurrencies, a rate of 38.6%. The Central African Republic and Nigeria are representatives among them.

Australia: Australia and New Zealand maintain an open attitude toward cryptocurrencies, recognizing their legality.

In 2025, the process of cryptocurrency legalization has significantly accelerated globally, especially in Europe and the Americas. While the Asian region has progressed rapidly, some countries and regions still maintain certain restrictions. The legalization process in Africa is relatively slow, but some countries have begun to recognize the legality of cryptocurrencies. Overall, the potential and opportunities of cryptocurrency as an emerging technology are receiving increasing attention from more and more countries.

THE UNITED STATES: FROM REGULATORY GAMING TO STRATEGIC RESERVE PIONEER

In January 2025, Trump signed multiple executive orders, including establishing a cryptocurrency working group and exploring a national Bitcoin reserve, marking the U.S. shift from strict regulation to strategic support. The U.S. crypto market shows four core trends:

Policy pivot embracing crypto. The Trump administration signed executive orders establishing a digital asset working group, explicitly prohibiting Central Bank Digital Currency (CBDC), and promoting a Bitcoin strategic reserve plan, releasing positive signals.

SEC reform and regulatory loosening. Replaced the SEC Chair, revoked the controversial accounting policy SAB 121, terminated lawsuits against crypto companies like Coinbase and Kraken, demonstrating a flexible regulatory attitude.

Accelerated crypto legislation. Advancing stablecoin regulatory bills, redefining “exchange,” overturning IRS broker rules for DeFi platforms, providing a clearer compliance framework for the industry.

Bitcoin strategic reserve and ETF boom. Trump launched a Bitcoin strategic reserve plan, while crypto ETF applications flourished, covering mainstream assets like LTC, SOL, AVAX, ADA, XRP, though market reaction remains cautious with a strong wait-and-see sentiment.

The U.S. is transitioning from regulatory gaming to strategic support, striving to become a global crypto leader, but policy uncertainties remain, and future directions warrant continued attention.

EUROPEAN UNION: CONSERVATIVE REGULATION AND CBDC EXPLORATION

The Markets in Crypto-Assets (MiCA) regulation, which took effect in late 2024, provides the EU with a unified regulatory framework for crypto assets, strengthening compliance requirements for stablecoins and trading platforms, and pushing the industry toward standardization. However, European Central Bank President Lagarde has clearly opposed including Bitcoin in national reserves, emphasizing its insufficient stability and anti-money laundering risks, demonstrating the EU’s conservative attitude toward cryptocurrencies.

In 2025, the EU launched large-scale testing of the digital euro, aiming to explore the potential applications of Central Bank Digital Currency (CBDC). However, public concerns about privacy protection have become a major obstacle, delaying the full implementation of the digital euro.

Nevertheless, significant divergences exist within the EU regarding cryptocurrency policies. For example, the Czech Central Bank is considering allocating 5% of its reserves to Bitcoin, showing an open attitude toward crypto assets; while Germany has strengthened its review of exchange licenses, adopting stricter regulatory measures. This divergence reflects the different positions and exploration directions of EU member states on crypto policies.

The EU demonstrates characteristics of both conservative regulation and innovative exploration in the cryptocurrency field. The implementation of MiCA regulations and the testing of the digital euro mark its efforts in compliance and technological innovation, but internal policy differences and public concerns remain key challenges for future development.

UNITED KINGDOM: LABOUR’S NEW POLICY AND STABLECOIN BREAKTHROUGH

In 2025, the UK Labour government accelerated the development of a regulatory framework for crypto assets, focusing on the regulation of stablecoins and staking services. The new legislative plan aims to incorporate crypto assets into the payment regulatory system, establishing clear regulatory rules while avoiding overlap with the EU’s MiCA framework.

Facing uncertainty in US policies, the UK is actively competing for outflowing crypto companies through clear regulatory rules and tax incentives. The government hopes to position the UK as one of the global centers for the crypto industry by creating a friendly business environment, promoting economic growth and technological innovation.

Under the impetus of Labour’s new policies, the UK is striving to achieve a breakthrough in the stablecoins and crypto assets sectors by accelerating regulatory framework development and attracting businesses to return, demonstrating its ambition to become a global crypto hub.

ASIA: DIVERSE PATHS AND INNOVATION EXPERIMENTS

Japan and South Korea: Pioneers in Compliance

Japan has revised its Payment Services Act, requiring exchanges to implement cold wallet storage and regular audits. South Korea, on the other hand, has introduced a “real-name trading system,” restricting anonymous accounts to enhance transparency and security.

Competition Between Hong Kong (China) and Singapore

- Mainland China: Actively exploring the application scenarios of a central bank digital currency (CBDC) while protecting personal and corporate-held crypto assets. However, strict restrictions remain on exchanges and mining activities.

- Hong Kong (China)’s Open Strategy: Legislative Council members have proposed including Bitcoin in financial reserves, leveraging the “One Country, Two Systems” framework to explore cross-border digital asset pilots.

- Singapore’s Sandbox Mechanism: The Monetary Authority of Singapore (MAS) supports DeFi innovation through regulatory sandboxes but imposes strict controls on retail investor participation in derivative trading.

Emerging Markets in Southeast Asia

Thailand and the Philippines are promoting the use of cryptocurrencies in tourism payment scenarios while strengthening anti-money laundering (AML) regulations to ensure a balanced approach to innovation and security.

Asia is taking a diversified approach to cryptocurrency regulation, with some regions focusing on compliance and others experimenting with innovative frameworks, reflecting the continent’s dynamic and varied crypto landscape.

EL SALVADOR AND BHUTAN: CONDUCTING RADICAL CRYPTOCURRENCY RESERVE EXPERIMENTS

The radical experiments of El Salvador and Bhutan have provided valuable experience and insights for the world, demonstrating both the innovative potential and challenges of small countries in the cryptocurrency field.

El Salvador, as the first country globally to adopt Bitcoin as legal tender, has made real-time adjustments to its “Bitcoin Law.” To secure loan support from the International Monetary Fund (IMF), the government abandoned mandatory Bitcoin acceptance by businesses, shifting to a voluntary model, while maintaining its Bitcoin strategic reserve purchasing plan. Despite foreign exchange reserve fluctuations caused by Bitcoin price volatility, this radical experiment has significantly increased El Salvador’s international visibility and attracted substantial technology investments, injecting new vitality into the country’s economy.

Additionally, Bhutan announced in 2024 that it holds Bitcoin as a national reserve, becoming the first country globally to take this measure. This decision not only triggered a “FOMO effect” (fear of missing out) among neighboring countries but also promoted discussions about crypto assets in the region. However, Bhutan’s Bitcoin reserves lack a transparent management mechanism, raising external concerns about its risk control.

2025 CRYPTOCURRENCY REGULATORY UPDATES

Understanding the latest cryptocurrency policy developments across countries helps to grasp global cryptocurrency market trends, avoid compliance risks, discover investment opportunities, and assist us in making informed decisions in areas such as cross-border transactions and technological innovation.

Turkey Strengthens Crypto Regulations (March 13, 2025)

Turkey is advancing crypto regulations, introducing rules for crypto asset service providers (CASPs). The Capital Markets Board (CMB) now has full oversight of crypto platforms, setting standards for operations, capital requirements, and management.

Singapore and Vietnam Collaborate on Digital Asset Regulation (March 12, 2025)

Singapore’s MAS and Vietnam’s SSC are working together to enhance digital asset regulatory frameworks, supporting Vietnam’s efforts to establish clear crypto regulations.

South Korea to Lift Institutional Crypto Ban (March 12, 2025)

South Korea plans to release guidelines in Q3 2025 to allow institutional investment in cryptocurrencies. Non-profit organizations and exchanges may gain access as early as April.

Cayman Islands Updates Crypto Licensing Rules (March 2025)

Starting April 1, 2025, virtual asset service providers (VASPs) in the Cayman Islands must obtain a license from CIMA. Existing VASPs have 90 days to apply, with strict disclosure requirements for custodians and trading platforms.

Russia Explores Digital Currency Trading (March 5, 2025)

Russia’s Finance Ministry and Central Bank are discussing organized digital currency trading under an experimental legal framework, targeting “super-qualified” investors.

Vietnam to Launch Digital Asset Framework (March 2025)

Vietnam aims to introduce a legal framework for digital assets by March 2025 to boost economic growth, providing clarity for crypto businesses.

Morocco Cracks Down on Crypto in Real Estate (March 4, 2025)

Morocco is investigating crypto-related real estate transactions, suspecting digital assets are being used to bypass foreign property purchase laws.

UK Expands Crypto Seizure Powers (February 27, 2025)

A new UK bill proposes expanded powers to seize and destroy crypto linked to criminal activities, enhancing law enforcement capabilities.

Pakistan Forms National Crypto Committee (February 27, 2025)

Pakistan is establishing a National Crypto Committee to develop crypto legislation, following discussions with international digital asset advisors.

Hong Kong Considers Crypto ETF Staking (February 21, 2025)

Hong Kong regulators are exploring crypto ETF staking services and tokenized money market funds, in talks with the Securities and Futures Commission.

Japan Approves New Crypto Regulations (February 19, 2025)

Japan’s FSA has approved a new regulatory framework for crypto exchanges and stablecoins, focusing on user protection and stricter oversight.

Czech Republic Exempts Long-Term Bitcoin Holdings (February 6, 2025)

Czech President signed a bill exempting Bitcoin held for over three years from capital gains tax.

Utah Advances Bitcoin Bill (January 30, 2025)

A Bitcoin bill in Utah has passed committee approval, paving the way for state investment in digital assets.

Jordan Plans Digital Asset Framework (January 28, 2025)

Jordan aims to create a comprehensive digital asset regulatory framework within a year, aligning with global standards.

China’s Guangzhou Promotes Digital Yuan (January 6, 2025)

Guangzhou’s “Digital Yuan 2.0” plan explores using the digital yuan for city-wide prepaid payments and cross-border transactions.

South Korea Eases Institutional Crypto Restrictions (January 8, 2025)

South Korea plans to phase out restrictions on institutional crypto trading, starting with non-profits, as part of broader crypto industry support.

Cambodia Allows Regulated Stablecoins (Early 2025)

Cambodia’s central bank permits regulated stablecoin services but maintains a ban on Bitcoin and unsupported assets.

The global cryptocurrency market is experiencing profound regulatory divergence and market restructuring. The United States demonstrates active support for the crypto industry by promoting innovation and Bitcoin reserve strategies, while the European Union prioritizes stability, emphasizing anti-money laundering and risk control. This opposition is causing divergence in capital and talent flows. Meanwhile, Asia, with its policy flexibility, has attracted over 50% of global crypto trading volume, gradually becoming the industry’s new center and reshaping the global crypto market landscape.

Technology integration and sustainable development have become core industry topics. The Davos Forum consensus points out that the synergistic development of artificial intelligence (AI) and blockchain will play a key role in data management and energy consumption optimization. Additionally, green crypto initiatives are emerging globally, with the EU actively promoting Proof of Stake (PoS) mechanisms to replace Proof of Work (PoW), while the US encourages mining companies to use renewable energy to reduce cryptocurrency’s environmental impact.

In 2025, national policies are entering an intensive implementation period, and the market will experience the growing pains of compliance and long-term value restructuring. Geopolitical variables, such as the Trump administration in the US, the European Parliament’s economic strategies, and policy coordination among Asian countries, will profoundly influence the direction of the global crypto ecosystem.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!