- Gold and Bitcoin often move together due to their shared role as safe-haven assets, especially during times of economic uncertainty, loose monetary policy, and high inflation expectations.

- Institutional investor interest, the introduction of Bitcoin ETFs, and a revival in retail enthusiasm have fueled a sharp rise in Bitcoin prices, which recently reached new all-time highs.

- Despite the current bullish trend, there are signs that cryptocurrency may face a correction as capital inflows slow and market sentiment wanes, potentially leading to a reversion in prices.

TABLE OF CONTENTS

In recent market dynamics, Bitcoin’s price surge to new highs has drawn significant attention from investors, especially institutional ones seeking safe-haven assets. This rally mirrors the trend in gold prices, highlighting the subtle connection between Bitcoin and traditional safe-haven assets. Against a backdrop of global economic uncertainty and loose monetary policy, Bitcoin is gradually becoming recognized as a form of “digital gold.” Meanwhile, the overall enthusiasm in the crypto market has risen, with an influx of retail funds further driving Bitcoin’s price up. However, as liquidity approaches saturation, market sentiment toward Bitcoin’s potential growth has become more cautious, with a possible risk of correction on the horizon.

In October this year, before the surge in cryptocurrency prices, the market’s focus was primarily on gold, as its price continuously broke through key resistance levels and reached new highs.

(Source: Tradingview)

Meanwhile, Bitcoin’s performance was relatively lackluster, still confined to a downward channel. In October, the $67,000 level was a clear resistance for Bitcoin.

(Source: Tradingview)

If you understand the relationship between gold and Bitcoin, you probably wouldn’t have been pessimistic about Bitcoin at the time; instead, you might have believed it was an ideal opportunity to go long on Bitcoin.

Looking back at history, the prices of gold and Bitcoin have shown similar trends over an extended period, primarily due to the following four reasons:

1. Safe-Haven Attribute: In times of increased economic uncertainty, rising inflation, or heightened geopolitical risks, investors typically shift funds to safe-haven assets to reduce portfolio risk. Gold has long been a traditional safe-haven asset, and Bitcoin, often called “digital gold,” has shown similar behavior driven by safe-haven sentiment.

2. Monetary Policy Influence: When central banks implement loose monetary policies (such as rate cuts and quantitative easing), the real value of fiat currencies is diluted, prompting investors to turn to assets with limited supply. Given that the supplies of gold and Bitcoin are relatively fixed, they both tend to attract more inflows in a loose monetary policy environment, exhibiting similar trends.

3. Inflation Expectation: When inflation expectations rise, investors tend to invest in assets that can hedge against inflation. Both gold and Bitcoin possess anti-inflation characteristics, so demand for them rises during periods of high inflation expectations.

4. Global Capital Flow Impact: As the cryptocurrency market matures, global investors have shown greater interest in Bitcoin, making its trend increasingly influenced by the macroeconomic environment, thus showing a certain degree of linkage with gold.

These factors collectively cause gold and Bitcoin to exhibit converging trends in specific economic cycles and market conditions. However, due to differences in market structure, volatility, and investor composition, their trends are similar but not identical.

So, if you’re familiar with the subtle connection between gold and Bitcoin, seeing gold surge in October might have led you to instinctively consider going long on Bitcoin. Subsequent Bitcoin price movements also validated this viewpoint. In late October, Bitcoin began to mirror gold’s performance, breaking through resistance levels and setting new highs. As of November 4, Bitcoin reached a historic high of $94,000, just one step away from the $100,000 mark.

From a capital perspective, several reasons support the rise of cryptocurrency:

1. Institutional Investor Entry: As Bitcoin gradually gains recognition as a mainstream investment tool, more institutional investors have included it in their portfolios. Asset management firms, hedge funds, and other financial institutions entering the Bitcoin market have injected substantial funds, pushing up its price.

2. Introduction of Bitcoin ETFs: Some countries have gradually approved Bitcoin ETFs (Exchange-Traded Funds), enabling more traditional investors to invest in Bitcoin easily through ETFs. This lowers the investment threshold, broadens Bitcoin’s potential investor base, and increases market demand.

3. Revived Interest in the Crypto Market: Recently, overall enthusiasm in the crypto market has returned, with retail funds flowing in, further boosting Bitcoin’s price.

(Source: Tradingview)

However, after reaching an all-time high in early November, gold prices began to decline. For those focused on macroeconomic asset performance, this opposite trend is worth noting.

(Source: MacroMicro)

How should we view this round of cryptocurrency trends led by Bitcoin?

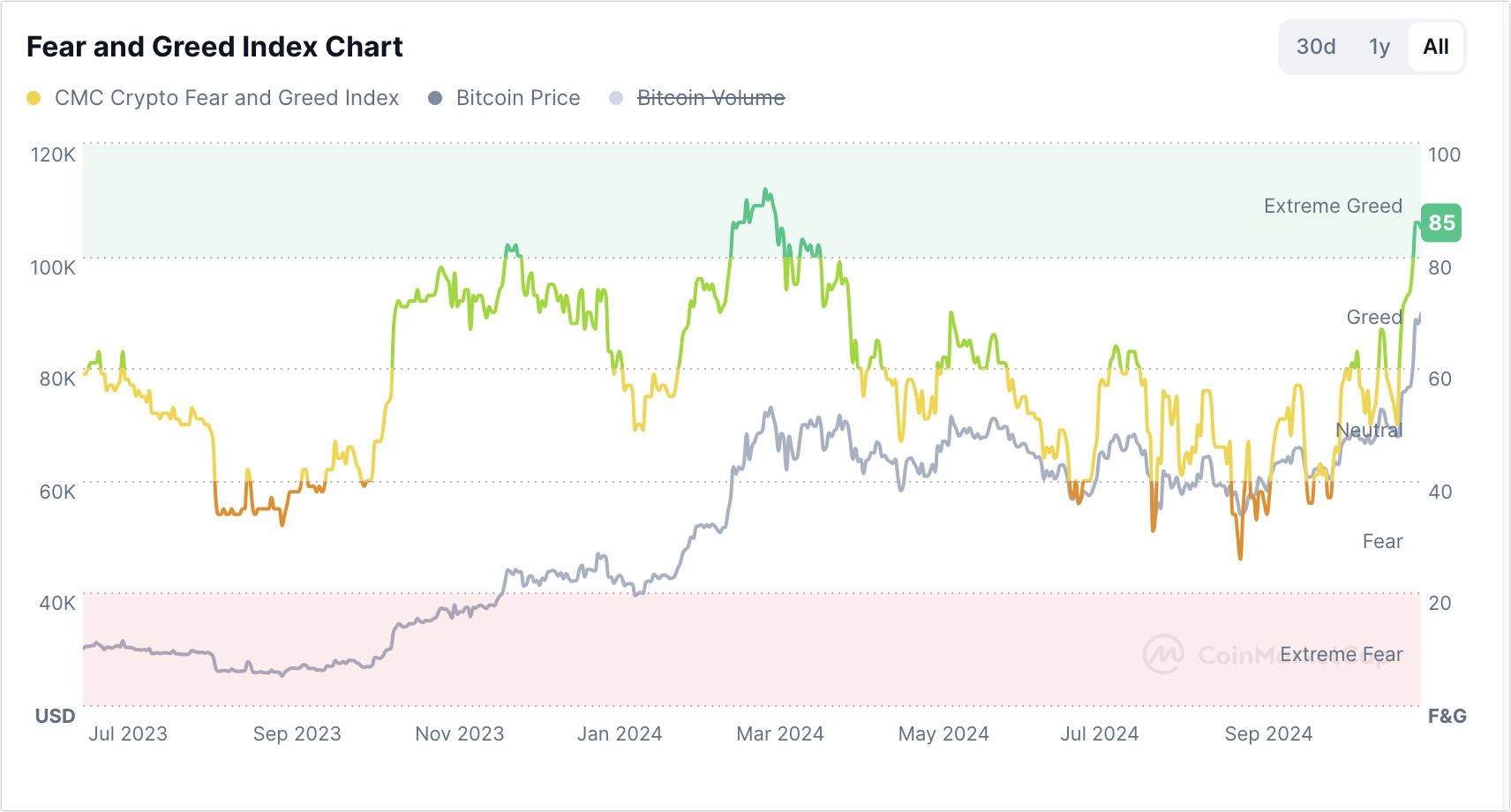

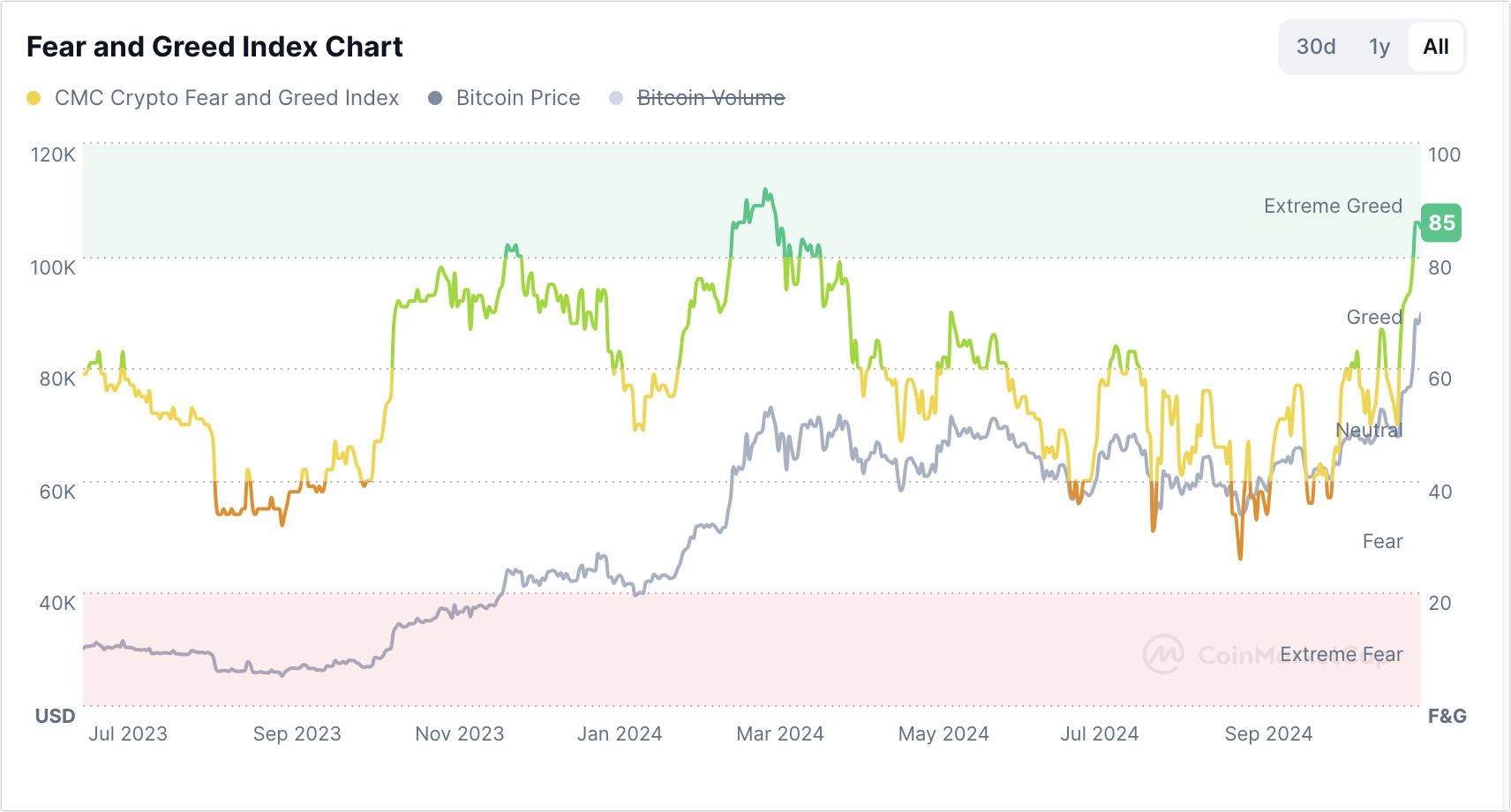

Our view is clear: this surge is largely a catch-up rally driven by capital inflow. As the inflow of funds approaches an end and market sentiment weakens, cryptocurrencies could face a significant correction, ultimately achieving mean reversion.

(Source: Coinmarketcap)

There’s also a viewpoint in the market suggesting that a “Trump 2.0” presidency may lean more toward a “small government” philosophy, favoring decentralized assets like Bitcoin, which could reduce gold’s appeal as a safe-haven asset.

While we cannot completely deny this long-term outlook, we want to remind everyone not to fall into the trap of macro narratives, especially in terms of investment.

Read More;

What You Need to Know About India, the 3rd Largest Economy To-Be

Japan’s Monetary Policy Shift: Lifting the Interest Rate Ceiling and its Implications

CoinRank x Bitget – Sign up & Trade to get $20!