KEYTAKEAWAYS

- Automated trading systems with precise timing can create significant profit opportunities in crypto markets, as demonstrated by BWEnews' rapid response to Binance's announcement.

- Information speed and technological infrastructure are crucial in modern crypto trading, requiring sophisticated systems beyond the reach of typical retail investors.

- While dramatic returns are possible in crypto markets, successful high-speed trading requires substantial capital, technical expertise, and advanced risk management systems.

CONTENT

Explore how BWEnews leveraged automated trading to turn $320,000 into $3.4M during Binance’s $ACT listing. Learn about market information gaps, trading technology, and what this means for retail investors.

Beyond the exciting surge in the crypto market following the US presidential election (with Bitcoin reaching a new all-time high of nearly $90,000), another notable focus has been the previously discussed memecoins and AI memecoins.

Before the post-election market surge, memecoins like $PNUT saw remarkable gains due to their unique narratives (using Peanut the squirrel and AI-connected $GOAT as selling points), and this upward momentum shows no signs of weakening after the election.

Against this backdrop, a recent trading event involving the AI memecoin $ACT has caught many crypto investors’ attention: a trader purchased ACT for 1,558 SOL (worth approximately $320,000) before its Binance listing, and within just ten minutes after listing, their ACT holdings reached approximately $3.4 million in value – meaning this investment increased more than tenfold in less than ten minutes.

So who is this mysterious investor, and how did they manage to time their ACT purchase so perfectly before and after the listing? This article will explore these questions one by one.

AUTOMATED TRADING VS. INSIDER TRADING: UNDERSTANDING BWENEWS’ STRATEGY

A savvy trader has made over $3M in just 1 hour by monitoring #Binance‘s new cryptocurrency listings!

Seconds after #Binance announced the listing of $ACT, he spent only 1,558 $SOL($318K) to buy 10.9M $ACT, now worth $3.4M!https://t.co/qvizsWR4kn pic.twitter.com/3DwrvVGjX2

— Lookonchain (@lookonchain) November 11, 2024

The transaction was initially reported by the data monitoring platform Lookonchain, but subsequent wallet address comparisons by other investors revealed that the investor’s $ACT purchase occurred less than ten seconds after Binance’s official listing announcement, leading to suspicions of insider trading.

However, the wallet owner, BWEnews, later clarified that their team triggered automatic trading within 2 seconds after Binance’s announcement, emphasizing that Binance’s English announcements typically come before Chinese ones, and the announcement timing should be based on the English release time.

这个地址属于我们团队,并不是老鼠仓。公告发布时间为2024-11-11 13:39:29 462,我们的自动交易程序在公告发布后的2秒之后2024-11-11 13:39:31.898发送了这笔交易。

— 方程式新闻 BWEnews ⚡️🚀 (@bwenews) November 11, 2024

【Translation】

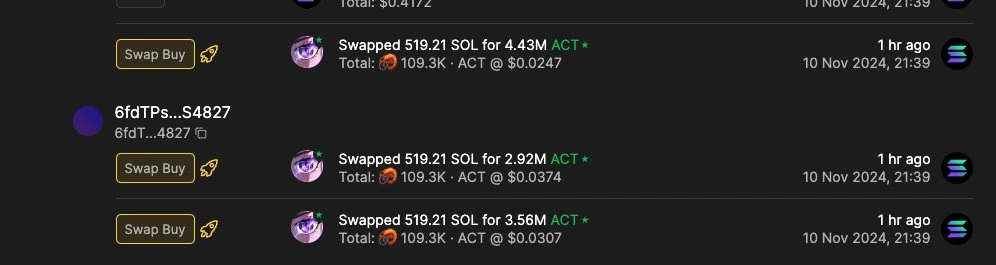

‘I strongly suspect this is insider trading! Tonight when Binance announced the listing of $ACT, the price immediately surged over 10x. Let’s look at this address: 6fdTPs67nxYbz3FriTZm474GPnqytTPVZFsLNnmS4827 – they made three consecutive purchases totaling around 1500 SOL worth of $ACT at 21:39 PST.

When we check Solscan, the exact time of their first transaction was: November 10, 2024 21:39:31

The precise timestamp of the Binance announcement was 1731303578534, which converts to 2024-11-10 21:39:38 PST.

So without even considering the time it took to prepare the funds, this person bought 7 seconds before the Binance announcement! This is crazy!’

-By the original tweet

‘This address belongs to our team and is not front-running. The announcement was released at 2024-11-11 13:39:29.462, and our automated trading program sent this transaction 2 seconds after the announcement at 2024-11-11 13:39:31.898.’

-BWEnews replied

Overall, BWEnews’ successful precise investment relied on their automated trading system capturing information, using this brief information time gap to create this noteworthy event.

BWEnews’ automated trading program sent the transaction 2 seconds after the announcement at 2024-11-11 13:39:31.898 (UTC+8)

(Source: Original Tweet)

INFORMATION SPEED IN CRYPTO MARKETS: LESSONS FROM A RECORD-BREAKING TRADE

Information gaps aren’t unique to the cryptocurrency market; traditional financial market investors frequently use various news and information for decision-making.

For example, in the stock market, investors might hear about a company’s good or bad performance before earnings releases and position themselves accordingly for profit. Or they might hear about a CEO’s unexpected resignation, which could negatively impact investor confidence and lead to short-selling opportunities.

This is even more crucial in the forex market and its products, where exchange rates constantly fluctuate and require more precise timing and judgment. If investors or traders can leverage available information time gaps, they might achieve considerable profits.

Therefore, while BWEnews’ successful operation isn’t unprecedented, the 24/7 nature of the crypto market combined with modern technological assistance has amplified the potential returns.

This event also provides investors with a viable investment strategy: in the crypto market, those who obtain information first are always the biggest winners. Constantly monitoring market dynamics and capturing key information as quickly as possible can likely improve investment success rates.

WHY THIS TRADING STRATEGY ISN’T FOR EVERYONE: A REALITY CHECK

The BWEnews case study perfectly illustrates how the convergence of technology, timing, and market intelligence can create extraordinary opportunities in the cryptocurrency market. Their successful $3.4 million trade wasn’t just about luck – it demonstrated the power of automated systems and the critical importance of information speed in modern crypto trading.

However, it’s important to note that while such dramatic returns are possible, they require sophisticated infrastructure, technical expertise, and careful risk management. For regular investors, the key takeaway isn’t necessarily to replicate such high-speed trading strategies, but rather to understand the fundamental importance of staying well-informed and maintaining vigilance in the fast-moving crypto markets.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!