KEYTAKEAWAYS

- BSC Leads DEX Market – BSC overtook Solana with $1.64B in daily trading volume, driven by PancakeSwap’s dominance and a meme coin frenzy.

- CZ’s Influence Boosts Hype – Former Binance CEO CZ’s purchase of Mubarak token triggered speculation, pushing BSC trading volume and investor interest higher.

- Challenges Remain – BSC faces concerns over centralization, security, and market volatility, needing innovation beyond meme coin trends for long-term growth.

CONTENT

INTRODUCTION

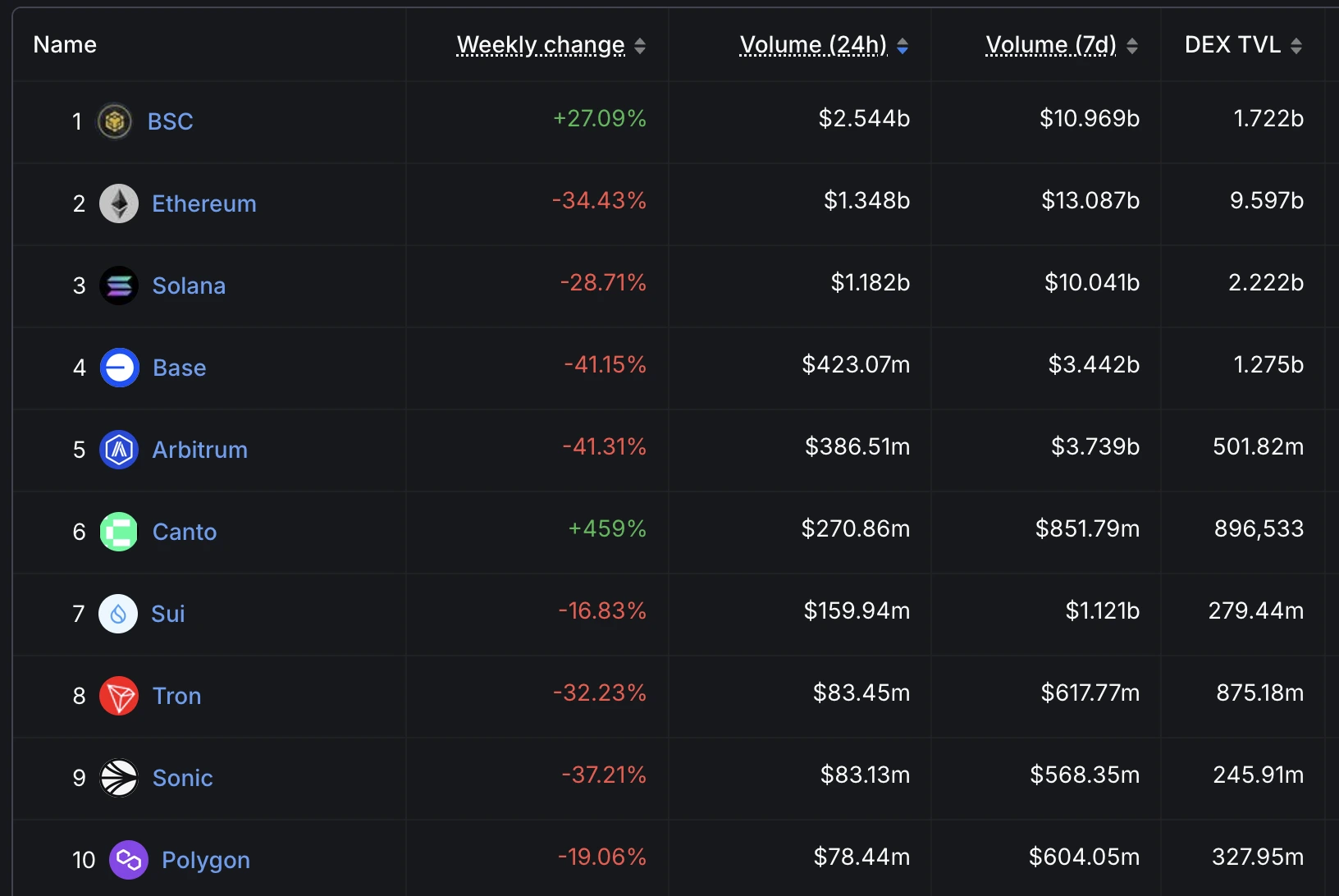

On March 18, 2025, a major event caught the crypto community’s attention: decentralized exchanges (DEXs) on BSC (BNB Smart Chain) recorded a massive $1.64 billion in trading volume within 24 hours. This made BSC the leader among public blockchain DEXs, surpassing Solana. At the same time, BSC’s top DEX, PancakeSwap, became the highest-volume DEX in the market.

(Source: Defillama)

A key moment fueling this surge was the former Binance CEO, Changpeng Zhao (CZ), buying Mubarak tokens on PancakeSwap. This move sparked discussions and excitement across the market. Beyond the numbers, the big question is: is BSC entering a new growth phase? This article explores the factors behind BSC’s rise, its challenges, and future trends.

THE RISE IN BSC DEX TRADING VOLUME: WHAT IT MEANS

Understanding the Data

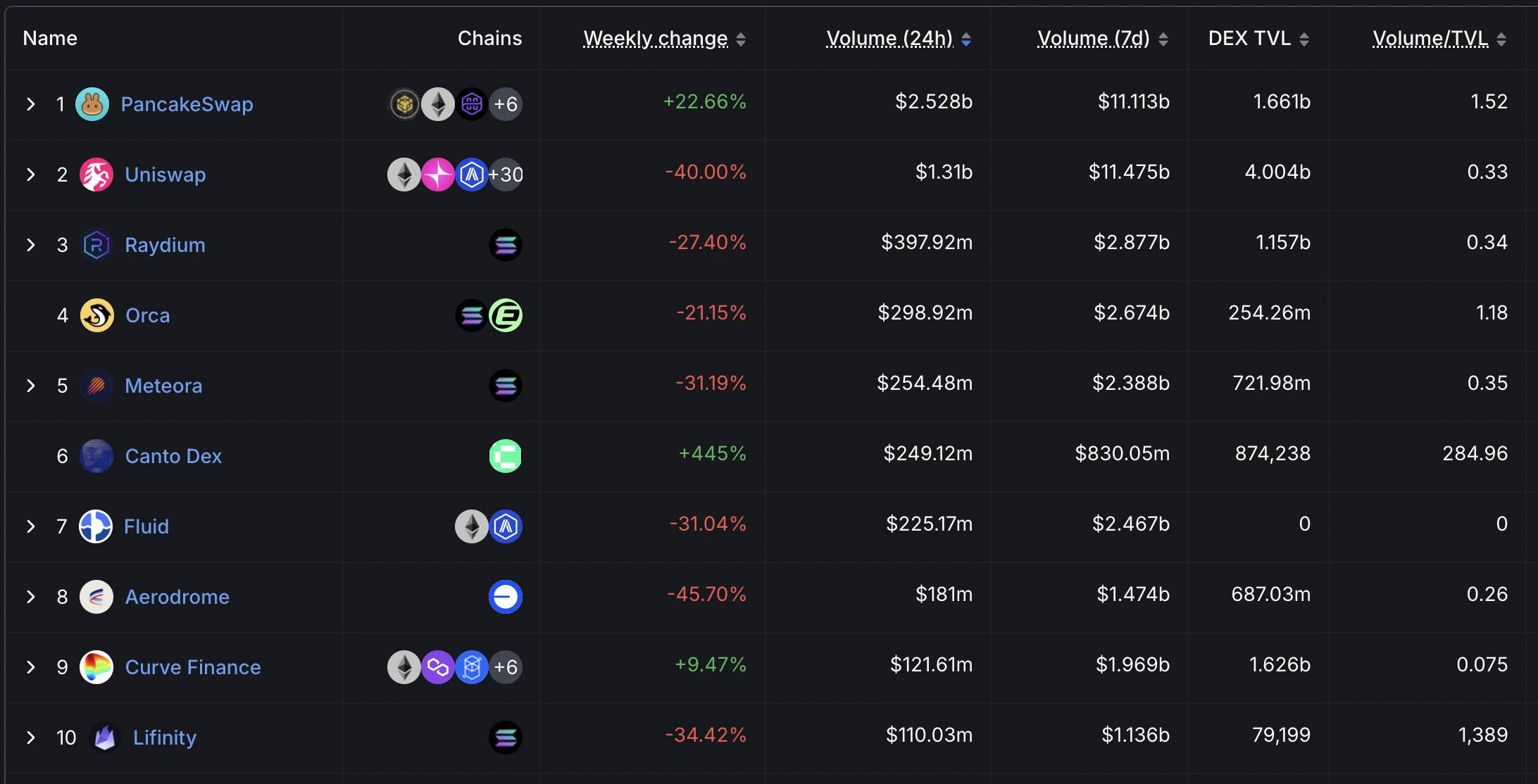

A $1.64 billion trading volume in 24 hours is a significant achievement. It allowed BSC to overtake Solana and become the top public chain for DEX trading. PancakeSwap performed exceptionally well, surpassing Uniswap (Ethereum) and Raydium (Solana) to take the number one spot.

(Source: PancakeSwap)

The crypto market in March 2025 is experiencing a new wave of hype, with meme coins making a strong comeback and DeFi projects seeing renewed interest. CZ’s purchase of 20,150 Mubarak tokens for 1 BNB (around $600) on March 16 acted as a catalyst. Mubarak’s price skyrocketed by over 300% within hours, reaching a market cap of nearly $150 million. This further pushed BSC and PancakeSwap’s trading volume to new highs.

Short-Term Impact

This surge in activity boosted the price of BNB, the native token of BSC. Since BNB’s value is closely linked to the ecosystem’s activity, more transactions on BSC mean higher demand for BNB.

CZ’s actions also attracted significant attention to PancakeSwap and BSC, leading to an influx of users and liquidity. At the same time, Solana’s trading volume declined slightly, possibly due to network issues or users shifting to BSC. This created a perfect opportunity for BSC’s growth.

Related Reading:

BNB Chain Heading Towards Sub-Second Block Time in 2025, Ecosystem Explosion Imminent

KEY DRIVERS OF BSC’S GROWTH

The Role of PancakeSwap

PancakeSwap is the most important project in the BSC ecosystem. Its low transaction fees (much cheaper than Ethereum), deep liquidity pools, and user-friendly experience attract many retail investors.

(Source: Defillama)

CZ’s purchase of Mubarak took place on PancakeSwap V3, boosting its daily trading volume to $647 million—about 61% of the entire DEX market (according to CoinGecko). The CAKE token’s staking and liquidity mining incentives also encourage user participation. Mubarak’s sudden popularity further accelerated trading activity.

BSC’s Technical and Economic Advantages

BSC stands out due to its low transaction fees (just a few cents per trade) and high transaction speed (hundreds of TPS). These factors make it particularly attractive for meme coin trading.

Additionally, Binance’s support provides BSC with strong financial and user adoption advantages. CZ’s personal influence also plays a major role—his investment in Mubarak was seen as an indirect endorsement, triggering speculative interest.

Another recent development is SpringBoard, a token launchpad similar to Solana’s Pump.fun, which helped launch Mubarak and other projects. This has become a new driver of trading activity on BSC.

Attracting Users and Developers

The number of active addresses on BSC is steadily increasing (data available on DappRadar), and developers are building projects in DeFi, NFTs, and GameFi. CZ’s involvement has boosted community confidence, potentially attracting more developers to the BSC ecosystem.

CHALLENGES AND RISKS FOR BSC

Concerns About Decentralization

BSC has often been criticized for its centralization. With fewer validators and heavy reliance on Binance, some argue that it lacks true decentralization. CZ’s high-profile involvement might reinforce this perception, raising concerns about market manipulation.

Ethereum and Solana, in contrast, are seen as more decentralized. This remains a weakness for BSC.

Volatility and Market Dependency

Much of the recent $1.64 billion trading volume came from meme coins like Mubarak. However, such hype-driven activity may not be sustainable. If the speculation dies down, trading volume could drop significantly.

While CZ’s influence is strong, market enthusiasm can fade quickly without continuous momentum. Additionally, regulators may start looking into CZ’s actions for possible market manipulation concerns.

Security and Trust Issues

BSC has faced security challenges before. The 2022 BSC cross-chain bridge hack, which resulted in over $500 million in losses, still affects user trust.

The rapid rise of Mubarak is exciting, but it may also attract hackers and exploiters. Ensuring the security of the ecosystem remains a priority.

Related Reading:

Can AI Agent Collection Solution Become a Growth Engine for BNB Chain?

FUTURE OUTLOOK FOR BSC

Short-Term Predictions

In the near future, PancakeSwap and BSC’s trading volume will likely remain high due to the ongoing meme coin craze. CZ’s next moves will be critical—if he continues to engage with BSC projects, it could sustain interest and growth.

However, once the meme coin trend slows down, BSC will need new growth drivers. Improving DeFi products and enhancing user experience will be key.

Long-Term Potential

BSC has strong potential in DeFi, GameFi, and Web3. Its close ties to Binance could lead to new financial products and cross-chain innovations.

If CZ can turn his personal influence into long-term trust in the ecosystem, BSC may attract more developers and institutions. This could help it move beyond its reputation as a “cheaper alternative” and establish itself as a true leader in blockchain innovation.

Competitive Positioning

Compared to Solana, Ethereum, and Layer 2 solutions, BSC’s biggest strength is its low-cost transactions. However, to become a true industry leader, it needs to improve in technology (such as consensus mechanisms) and governance (like community DAOs).

The Mubarak phenomenon shows that BSC can attract massive attention. But in the long run, real innovation is necessary to maintain its position.

CONCLUSION

BSC’s $1.64 billion trading volume and CZ’s Mubarak purchase highlight the ecosystem’s energy and potential. PancakeSwap’s dominance, combined with BSC’s technical and economic advantages, gives it a strong position in the crypto space.

However, challenges remain—concerns about centralization, market dependence, and security must be addressed.

Will BSC become the main battlefield of the next crypto bull run? And what will CZ do next? The answers may lie in blockchain data and the choices of the community.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!