KEYTAKEAWAYS

- Bitcoin’s price often follows a 318-day cycle from its first peak to the next, with analysts predicting a potential new high by January 2025.

- The four-year halving cycle remains a key driver of Bitcoin’s price, but its effects may weaken as the market matures and more participants join.

- Market sentiment and political factors, like Trump’s policies, could influence Bitcoin’s price movements in 2025, making predictions less certain in the evolving market.

- KEY TAKEAWAYS

- BITCOIN’S VOLATILITY AND HISTORICAL DATA

- BITCOIN’S FOUR-YEAR CYCLE: HALVING EFFECTS AND MARKET VOLATILITY

- TRUMP’S TRADE AND MARKET SENTIMENT

- FUTURE PRICE PREDICTIONS: COULD BITCOIN REACH $146,000?

- MARKET SENTIMENT COOLING: FUND OUTFLOWS AND WANING BUYING INTEREST

- CONCLUSION: BITCOIN’S FUTURE REMAINS UNCERTAIN

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Bitcoin’s price fluctuations have sparked speculation about its peak. With historical cycles and market trends in play, experts predict Bitcoin could hit new highs by mid-January 2025.

Bitcoin,the most well-known cryptocurrency globally, has long been a focal point for both markets and investors. As 2024 draws to a close, the fluctuations in Bitcoin’s price have sparked renewed discussions. Bitcoin broke the $100,000 mark earlier this month, followed by a series of price swings.

Some analysts believe that, if historical patterns repeat, Bitcoin might reach new highs in mid-January 2025, before entering a period of adjustment. So, is Bitcoin really nearing the peak of its cycle? What factors are behind this?

BITCOIN’S VOLATILITY AND HISTORICAL DATA

On December 26, 2024, Bitcoin’s price rose by 0.3%, reaching $98,884 per coin. However, the price had previously hit a record high of $108,309 on December 17, only to pull back slightly after the Federal Reserve signaled a hawkish stance.

Historical data shows that Bitcoin typically follows a cycle of about 318 days from its first historical peak to the eventual cycle high. With the initial peak of this cycle occurring on March 5 of this year, some predict that Bitcoin could hit a new high by January 17, 2025.

The 318-day cycle is considered the average time from Bitcoin’s first historical high to its next peak. This cycle reflects the gains and corrections Bitcoin typically experiences within each larger cycle. Analysts, after reviewing past market cycles, have found that the time interval from the first historical high to the next tends to be around 318 days.

BITCOIN’S FOUR-YEAR CYCLE: HALVING EFFECTS AND MARKET VOLATILITY

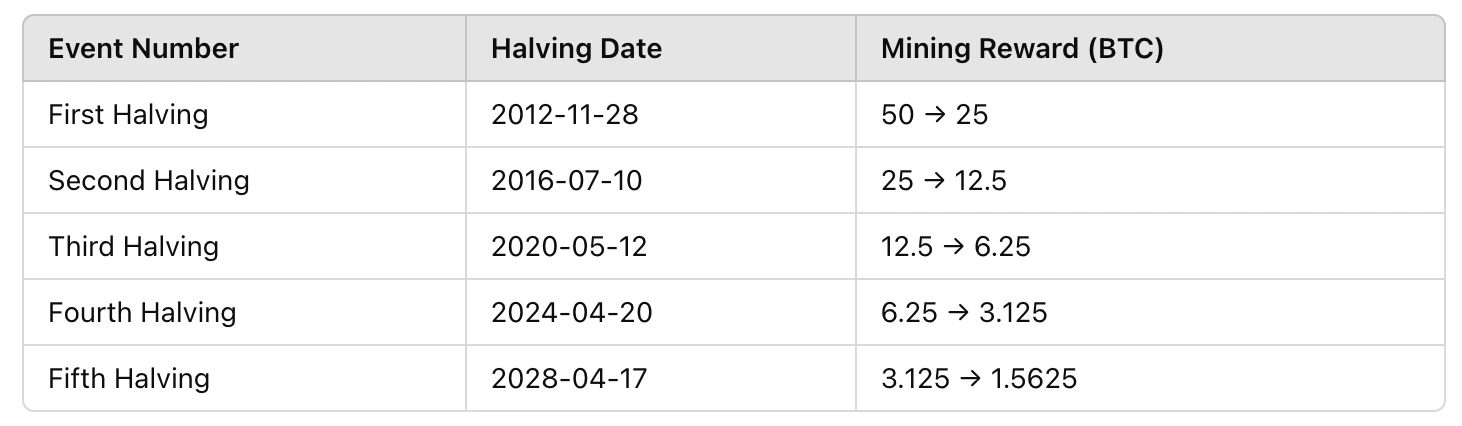

Bitcoin’s price swings largely follow a four-year cycle, closely tied to its halving events. Every time a halving occurs, miners receive half the amount of Bitcoin as a reward, which directly impacts the market’s supply. The most recent halving event took place around April 19-20, 2024, and it was widely regarded as a key driver of Bitcoin’s price increase.

However, some argue that as the halving effect weakens, the price fluctuations may not be as pronounced as in the past. With the market maturing and more participants involved, the supply-demand dynamics induced by halvings might not be as intense. Therefore, while halving events remain a significant factor, they are not the sole determinants of Bitcoin’s price movements.

Also Read:

TRUMP’S TRADE AND MARKET SENTIMENT

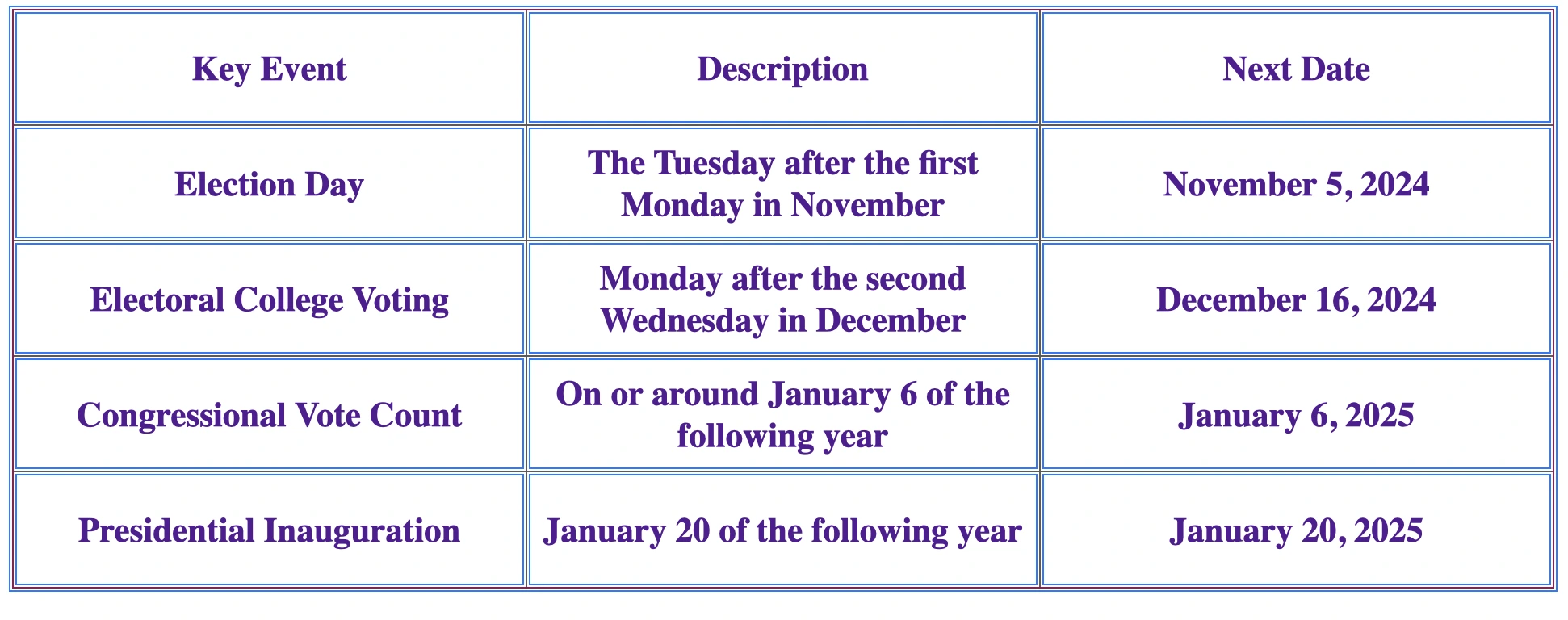

In addition to the halving effect, the policies of Donald Trump are seen as another potential factor influencing Bitcoin’s price. Trump will officially take office on January 20, 2025.

Some analysts believe that his election was one of the catalysts behind Bitcoin’s strong rebound in the fourth quarter of 2024. However, as his inauguration approaches, the “Trump trade” could lose its appeal, leading to a potential cooling off of market sentiment and impacting Bitcoin’s price.

The idea is that Trump’s election sparked optimism among investors, driving up the prices of assets like Bitcoin. However, to implement Trump’s policy promises, complex political processes are required, which may affect market expectations of their impact.

As such, once Trump takes office, the market’s speculative fervor could dissipate, potentially stalling Bitcoin’s bullish momentum.

Also Read:

FUTURE PRICE PREDICTIONS: COULD BITCOIN REACH $146,000?

When predicting Bitcoin’s future price, some analysts look at the historical performance of past cycles. They suggest that the current cycle could see Bitcoin’s price peak at around $146,000 per coin, or even surpass $212,500.

While these numbers are certainly exciting, it’s important to note that Bitcoin’s history as an asset since its launch in 2009 is still relatively short. This makes long-term price predictions uncertain and fraught with risk.

Moreover, with Bitcoin’s market maturing, the halving effect may lose some of its previous potency in driving prices. This suggests that while cyclical volatility will continue to shape Bitcoin’s price, future trends could become more complicated, requiring investors to proceed with caution.

MARKET SENTIMENT COOLING: FUND OUTFLOWS AND WANING BUYING INTEREST

As the year ends, the market’s enthusiasm appears to be cooling. Market data shows that Bitcoin ETFs have experienced fund outflows for three consecutive days as of December 24, indicating that investor interest may be tapering off.

(Source: Coinglass)

Although MSTR announced on December 21 that it had purchased 5,262 Bitcoin at an average price of $106,662 per coin, this amount was significantly lower than its previous purchases, raising questions about whether the company still sees value at current price levels.

This shift points to a potential decline in interest from large institutional buyers, particularly at these price levels. It may also signal a turning point in Bitcoin’s price movements. As investor sentiment evolves, Bitcoin’s performance in the coming weeks could face additional challenges.

Also Read:

CONCLUSION: BITCOIN’S FUTURE REMAINS UNCERTAIN

To wrap things up, while Bitcoin is currently experiencing price volatility at its peak, its future trajectory remains uncertain. Historical data suggests that Bitcoin could hit new highs by January 2025, but a variety of factors, including changes in market sentiment, the weakening halving effect, and the implementation of Trump’s policies, could all influence its performance.

Investors will need to stay vigilant, keeping an eye on these developments and carefully navigating the potential ups and downs in the market.

Ultimately, whether Bitcoin is nearing the peak of its cycle is still up in the air, but as a relatively young asset, its price remains highly unpredictable. Market participants should remain cautious and be prepared for any potential swings in either direction.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!