KEYTAKEAWAYS

- Bitcoin's historical January performance shows a 4:6 up/down ratio, with positive returns notably occurring in post-halving years like 2017 and 2021.

- Critical events include Trump's inauguration, Fed rate decision, and CPI data, potentially triggering significant market movements in January 2025.

- Eight months of halving momentum and three months of Fed rate adjustments position January 2025 for potential crypto market breakout.

CONTENT

Comprehensive analysis of January 2025 crypto market outlook, featuring Trump’s inauguration, Fed rate decision, and Bitcoin’s potential surge to $120K. Includes detailed financial calendar and token unlock schedule.

The first month of 2025 is destined to be turbulent, with Trump’s official inauguration as U.S. President, the Federal Reserve’s first rate meeting of the new year, and the release of key economic data including U.S. Non-Farm Payrolls and CPI before the meeting. The Chinese New Year holiday at the end of the month adds another layer of complexity. All these events could trigger dramatic fluctuations in the crypto market, requiring advance preparation.

In December, Bitcoin first broke through the $100,000 mark, reaching a high of $108,351 (according to Bitget data), followed by three major drops of over 10,000 points. This roller coaster ride shifted market sentiment from FOMO to caution.

So, will these major financial events in January ignite the market and push Bitcoin to break through to $120,000? We’ve compiled a comprehensive January crypto financial calendar covering both crypto and traditional financial events, with detailed analysis of key events and their underlying logic to help you navigate through the complexity and find your path to wealth.

JANUARY CRYPTO FINANCIAL CALENDAR

Key Focus:

- Federal Reserve Rate Decision

- Trump’s Presidential Inauguration

- U.S. Non-Farm Payrolls Data

- U.S. CPI

- Chinese New Year

A Look Back at Bitcoin’s January Performance

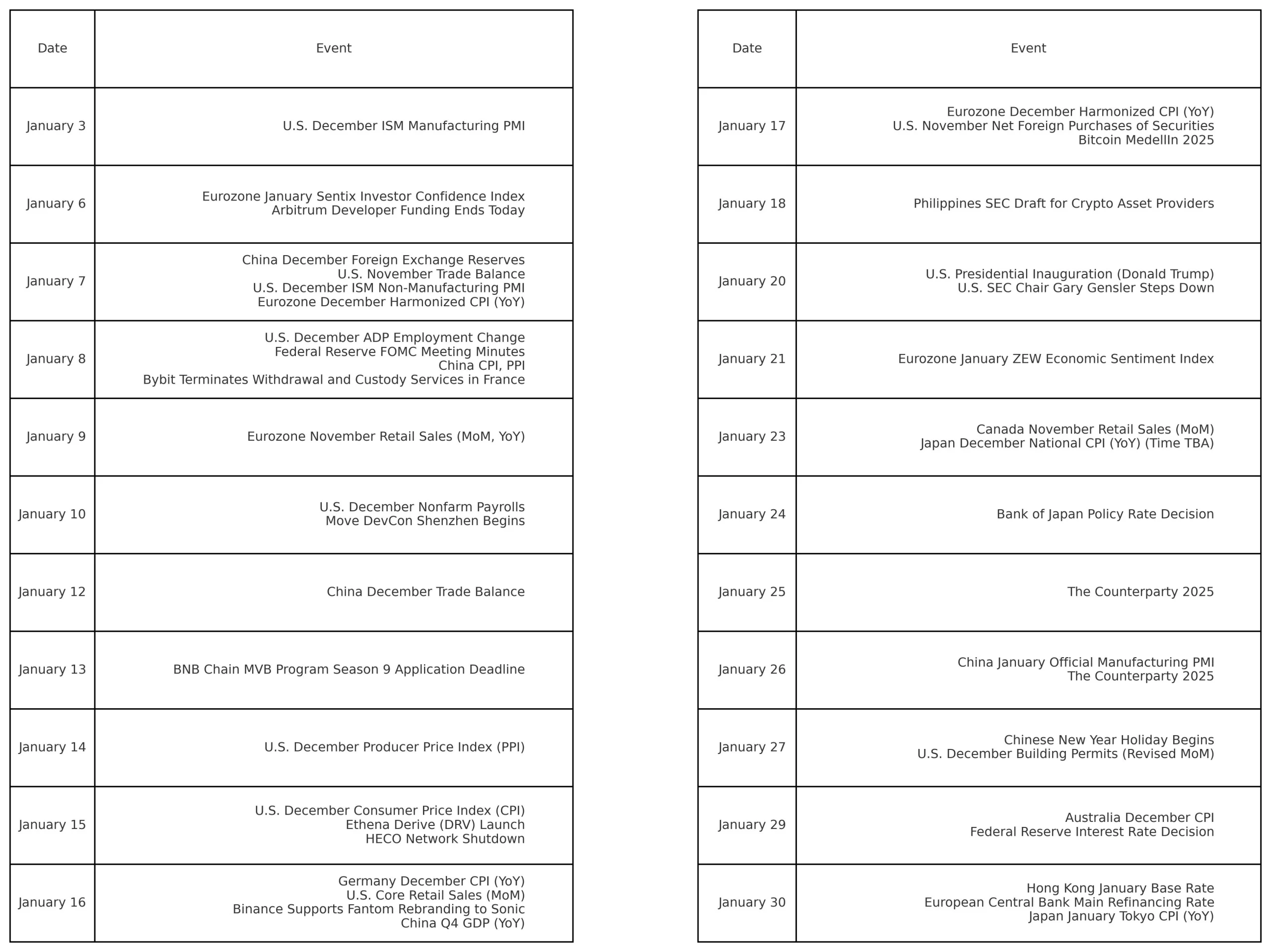

Before diving into the details, let’s review historical January performance of Bitcoin as the crypto market’s bellwether. Here’s the data statistics from TradingView and other third-party platforms:

Bitcoin Historical January Returns

(Created by: CoinRank)

Looking at the chart above, historically, Bitcoin has had more down months than up months in January, with a ratio of 4:6 over 10 years. However, most declining years saw minimal drops – 2015, 2016, and 2018 all fell less than 1%, essentially flat. Notably, in the second year after halving events (2017 and 2021), Bitcoin’s January returns were positive, demonstrating the strong impact of halving cycles.

REVIEW OF MAJOR EVENTS DIRECTLY IMPACTING THE CRYPTO MARKET

Note: All times mentioned below are in New York Time (ET)

- January 8 – Fed FOMC Minutes

The Federal Reserve FOMC minutes are detailed reports released after each monetary policy meeting, documenting discussions, decision-making processes, and economic assessments. These minutes are typically published about three weeks after each meeting.

The minutes have significant reference value for investors, economists, and policy analysts as they provide insights into Fed decision-makers’ views on economic conditions, future policy directions, and financial markets.

Given Powell’s hawkish comments at the December meeting that caused market declines, these minutes are particularly significant. Market participants will be scrutinizing them for insights into the hawkish stance and potential rate cuts at the end of the month, potentially triggering significant market volatility.

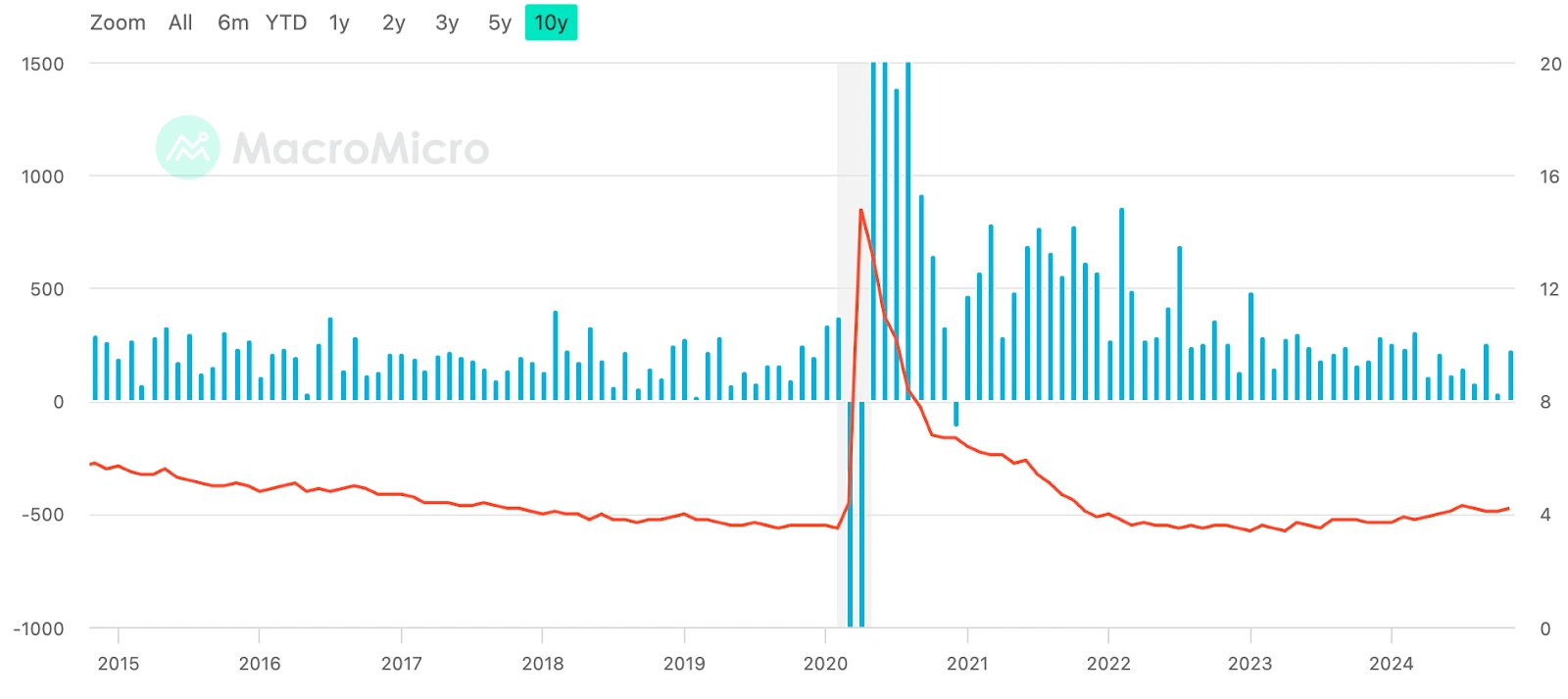

- January 10 – U.S. December Non-Farm Payrolls

Last month’s non-farm payrolls showed stronger-than-expected growth, with unemployment rising as anticipated to 4.2% and job additions of 227,000 – the largest increase since April. This data strengthened market bets on Fed rate cuts, leading to December’s rate reduction and Bitcoin’s subsequent rise to new highs.

Current market expectations suggest moderate figures, with unemployment holding around 4.2% and job additions near 200,000. Such numbers might not prevent the Fed from pausing rate cuts this month unless the data significantly disappoints, forcing Fed officials to reconsider their monetary policy stance.

If the data meets expectations, the crypto market might see initial gains followed by a decline, creating short-term volatility. Risk management will be crucial during this period.

U.S. Non-Farm Employment and Unemployment Rate Changes Over the Past 10 Years

(Source- MacroMicro)

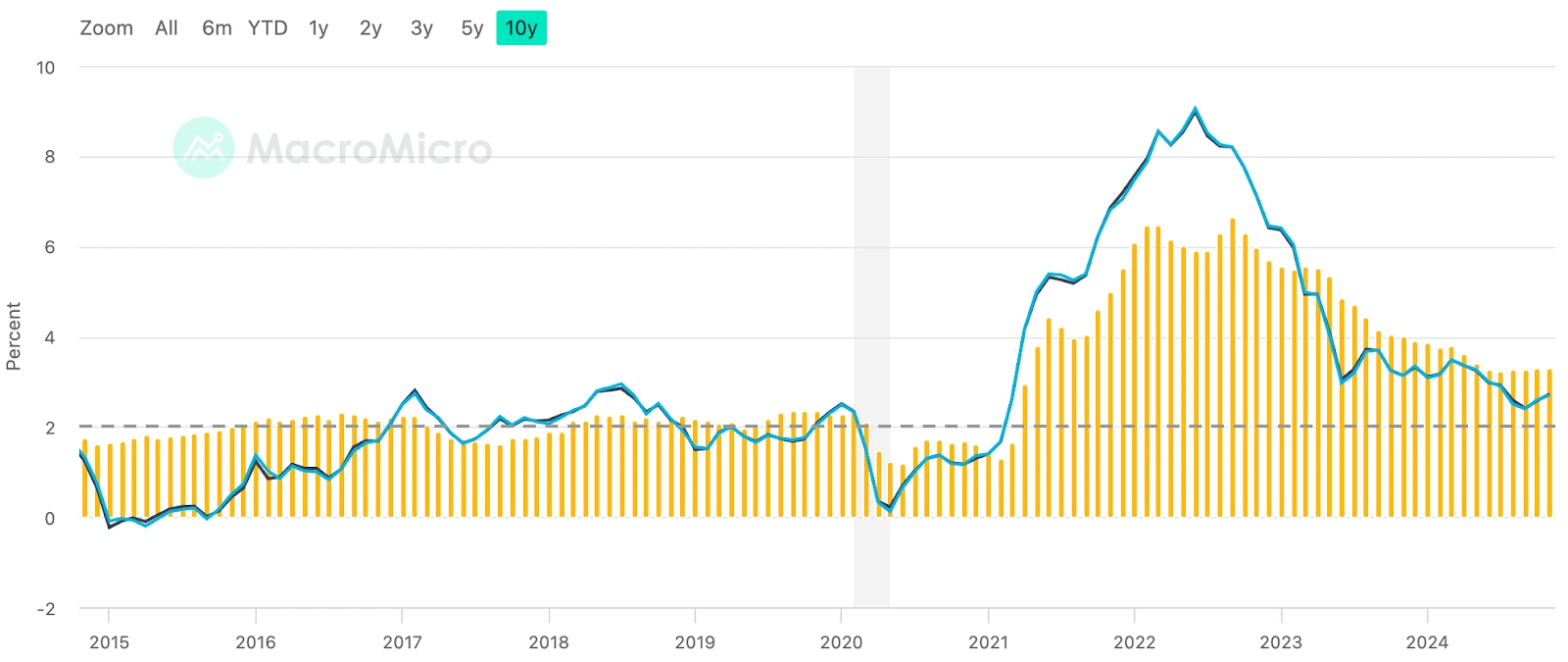

- January 15 – U.S. December CPI Data

As the final major economic release before the month-end Fed meeting, this CPI report is crucial. Moderate numbers might not deter the Fed from pausing rate cuts. If the data shows no significant increase, it would be considered negative for markets, while a substantial rise in CPI might provide positive stimulus, though this possibility seems low at present.

November’s CPI showed 2.7% year-over-year growth, marking the second consecutive monthly increase and a four-month high. While this supported December’s rate cut, the data remained within expectations, giving Fed Chair Powell confidence for his subsequent hawkish commentary that impacted crypto markets.

Currently, this CPI release is unlikely to provide significant positive catalysts for the market. If the data shows little change, we might see brief market volatility with both upward and downward spikes.

U.S. CPI Data Changes Over the Past 10 Years

(Source: MacroMicro)

- January 20 – Trump Presidential Inauguration

Trump’s inauguration is widely viewed as potentially positive for crypto markets, particularly with major crypto influencer Musk holding a significant position in the new administration. As discussed in our previous article “Trump’s Victory and Bitcoin’s Fourth Halving: A Perfect Storm for Crypto Markets,” Trump’s presidency could pressure the Fed to accelerate rate cuts, a key bullish factor for crypto markets.

The timing is particularly significant, with the Fed’s first 2025 rate meeting following shortly after (January 28-29). Some market participants even suggest a conspiracy theory that current market declines in stocks and crypto are deliberately timed to create a springboard for gains after Trump takes office, though this is largely speculative.

The inauguration ceremony is just the beginning – more important will be Trump’s subsequent economic and foreign policies, which will significantly impact all markets, including crypto.

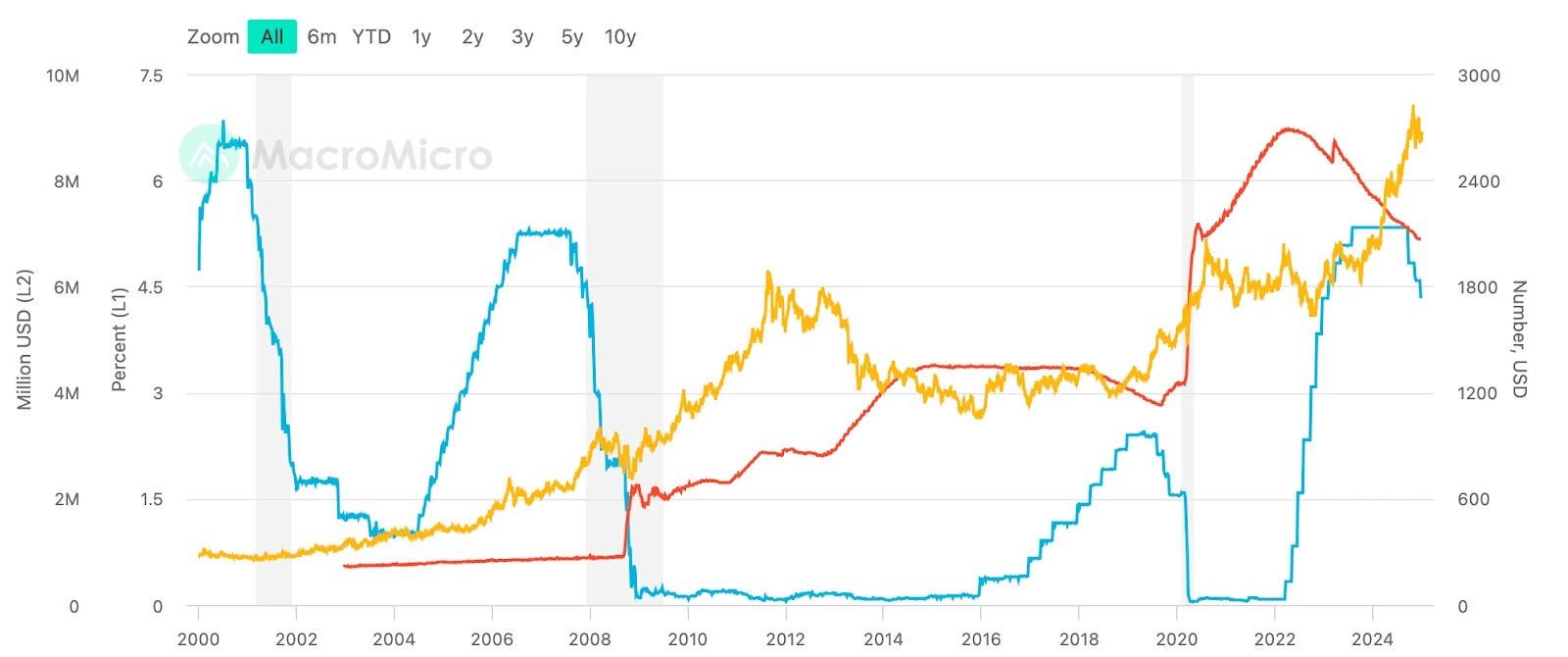

- January 29 – Fed Rate Decision

Current market sentiment suggests the Fed has reached a more “neutral” rate level – high enough to control inflation but low enough to protect the labor market. Fed officials are discussing a slower pace of rate cuts, noting that moving too quickly could keep inflation above the 2% target, while moving too slowly might cause unemployment to spike.

Market consensus strongly favors maintaining current rates, with CME’s “FedWatch” indicating an 89.3% probability of no change and only a 10.7% chance of a 25-basis-point cut. Barring significant surprises in CPI or non-farm payroll data, rates will likely remain unchanged. This might be interpreted as “negative news becoming positive” for crypto markets, potentially driving prices higher.

U.S. Federal Funds Rate & Federal Reserve Balance Sheet Size vs. Gold

(Source: MacroMicro)

- January 27 – February 3 – Chinese New Year Holiday

As the world’s largest traditional festival, Chinese New Year significantly influences East and Southeast Asia, regions that are major crypto market participants. Historically, the holiday period affects crypto markets through:

- Reduced trading activity

- Increased market volatility (due to lower order volume, making large trades more impactful)

- Potential sharp price movements in Bitcoin and other cryptocurrencies

Additionally, some Asian stock markets close early for the holiday, requiring attention to potential spillover effects from traditional financial markets to crypto.

Other Financial Events

- January 7: Eurozone CPI data; U.S. November trade balance

- January 8: ADP Employment Change (Mini Non-Farm), China CPI, PPI data

- January 16: U.S. Core Retail Sales

- January 18: U.S. November Net Foreign Purchose; Philippines SEC crypto asset provider consultation paper

- January 24: Japan National CPI and BOJ interest rate decision

- January 30: Hong Kong base rate; ECB refinancing rate

January Token Unlocks

One-time Unlocks:

- KAS: January 6 – 182.23 million tokens ($20 million)

- ENA: Before January 8 – 12 million tokens ($12.16 million) for ecosystem development

- OP: January 9 – 31.34 million tokens ($57 million)

- CIRX: January 12 – 28 billion tokens ($102.9 million), 62.4% of circulating supply

- APT: January 12 – 11.31 million tokens ($104.2 million), 2.03% of circulating supply

- ARB: January 16 – 92.65 million tokens ($70.9 million), 2.2% of circulating supply

Daily Linear Unlocks:

- SOL: $14 million daily token sales

- WLD: $12.4 million daily token release

- TIA: $5.1 million daily unlock

- DOGE: $4.63 million daily release

- AVAX: $4.02 million daily unlock

- DOT: $2.94 million daily distribution

Specific unlock dates and amounts may be adjusted based on actual circumstances. Token unlocks typically influence token prices, and investors should consider market conditions, risk expectations, and token specifics when making investment decisions.

JANUARY 2025 CRYPTO MARKET ANALYSIS

The crypto market is entering a crucial phase. Historically, the second year after Bitcoin halving events marks the beginning of major bull markets, driving both Bitcoin and altcoin growth. January 2025 could mark the start of the fourth halving cycle’s bull run, with eight months of halving momentum and three months of Fed rate cut implementation already priced in.

Market momentum has been building for both the halving event and Fed rate cuts, positioning the market for a potential new phase in the halving bull market. Any of these financial events could spark market ignition, requiring constant investor vigilance.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!