KEYTAKEAWAYS

- Making money in crypto bull markets has always been difficult; true winners weather both bull and bear markets with a solid understanding of crypto's value.

- Many crypto projects struggle due to overvaluation and fake user issues; investors are turning to memecoins instead of traditional altcoins.

- Despite market unpredictability, Bitcoin's long-term trend resembles gold; buying dips remains a viable strategy for patient, value-focused crypto investors.

CONTENT

Explore the challenges of profiting in the current Bitcoin bull market, examining crypto project issues, changing market dynamics, and long-term investment strategies in the volatile cryptocurrency landscape.

INTRODUCTION

Recently, the cryptocurrency market has been unpredictable, leading many to believe this is a strange bull market where no one is making money. Some even complain that this is the most difficult Bitcoin bull market to profit from in history!

As a result, those who typically think “everything looks like the future when the market is good, and every project looks flawed when the market is bad” are now losing money to the point of questioning their life choices and doubting the value of the entire crypto industry.

They believe the bull market is about to end…

MAKING MONEY IN A BULL MARKET HAS ALWAYS BEEN DIFFICULT

Although this bull market is strange, after experiencing so many bull markets, we should be used to it. This point has been analyzed and compared in lots of articles already. In reality, it’s not that this bull market doesn’t make money, but that making money in every bull market is difficult.

It’s important to note that those who made money in past bull markets mostly didn’t enter during the bull market. Those who only sensed the opportunity to “make money” and entered during the bull market will later realize that others are profiting from the money they provided.

Essentially, those who can weather bull and bear markets unscathed are the real winners. Over the years of Bitcoin and crypto market ups and downs, many famous gold rushers have come, including Wall Street genius trader SBF and Do Kwon, known as the “Korean Elon Musk”. They all failed in the crypto market. The lessons learned are simple: besides being eager for quick success and not respecting risks, the most important point is the “wrong crypto value view”.

Many traders, exemplified by figures like SBF, have considered themselves “smart money” entering the market. However, their motivation wasn’t necessarily a belief in the value of Bitcoin and other crypto assets. Instead, they operated under the assumption that there were “plenty of greater fools” in the market. Their strategy, which became prevalent for a time, was to acquire what they saw as essentially worthless Bitcoin at low prices and then flip it to less savvy investors at a profit.

What these traders failed to realize was that in this highly unregulated market, the principle of “big fish eat small fish” would always prevail. In any industry, those who enter without embracing its core values and instead focus solely on exploiting others for quick gains are destined to fail. Even if they taste initial success, the market will eventually turn against them.

This scenario illustrates a fundamental truth: anyone entering an industry without aligning with its proper values and goals, viewing it merely as an opportunity for predatory trading or a “pump and dump” scheme, is bound to struggle in the long run. Even if they experience early wins, they’ll likely fall victim to the market’s inherent mechanisms sooner rather than later.

Perhaps many people have forgotten what the original intention of Bitcoin and the crypto industry was, and the distorted values may result in serious misjudgments.

WHAT WENT WRONG WITH CRYPTO PROJECTS?

In this bull market, a clear characteristic is that many “crypto projects” favored by VCs, including long-standing crypto projects such as Ethereum, Layer2, Metaverse, DeFi, and others that people thought would soar in the bull market, don’t seem to have gained market recognition. Instead, people seem more willing to participate in inscriptions and memecoins. This inevitably makes one reflect: what went wrong with the “crypto projects” that have been built for so many years?

In fact, we can’t blame the market for not “buying” crypto projects; the “crypto projects” themselves have really gone wrong! Recently, we observed that Ethereum GAS prices have even dropped to 1, some Layer2, Metaverse, DeFi projects with few daily active users, and newly listed VC projects that are barely off the ground have market caps of hundreds of millions or even billions.

Given the lack of reliable data, these inflated market capitalizations create a perception of extreme overvaluation and a potential bubble in the crypto market. Understandably, few investors would be eager to buy into such seemingly overpriced assets. Instead, many are drawn to low market cap memecoins, hoping for quick gains. At the same time, they’re becoming increasingly skeptical of various forms of hype and manipulative marketing tactics.

All along, many people have focused too much on the surface and ignored the underlying root causes. In fact, it’s not that crypto projects have no value; many crypto projects’ valuations are not solely measured by active users because they carry tens or hundreds of billions of TVL behind them, and these amounts of funds cannot be ignored.

The most crucial point is that in recent years, the prevalence of “yield farming” and “airdrop hunting” has not only generated a large number of fake users but has also made it difficult for new VC-backed projects to accurately value themselves and focus on building. This has evolved into a widespread issue in the Web3 industry. To a certain extent, these projects have become hostage to the influx of artificial traffic and users. Some organizations even highly customize to profit from the market’s bad atmosphere: creating superficial star teams to deceive VCs, customizing “crypto projects” for “coupon clippers”. No one cares about technology or whether real needs and problems are solved. It’s foreseeable that such VC projects with distorted value orientations will be harvested as soon as they launch and end miserably.

As a result, people found that impurities were mixed into new and old “crypto projects”. If one rotten apple can spoil the barrel, let alone this being a widespread phenomenon. Therefore, since it’s unclear whether there’s value or not, not buying in has become the best strategy.

Of course, even so, we can’t completely negate most projects that maintain the original crypto values. Bitcoin has brought asset transparency and self-custody, realizing the inviolability of personal property. Ethereum, including Layer2 and other smart contract platforms, has brought a “trustworthy” operating environment for Internet applications, pushing the Internet from online to onchain… After trials, I believe they can still stand firm in the continuous self-correction of the crypto market.

THE BULL MARKET LOGIC HAS CHANGED BUT ALSO HASN’T

The logic of the bull market has changed, but it also hasn’t. All along, most altcoins have just been recipients of the value overflow after Bitcoin surges. When Bitcoin prices enter high ranges and find it difficult to go higher, people discover that many new narratives and low market cap small altcoins seem to be “value depression”. Thus, driven by FOMO emotions, some funds choose to rush towards these peripheral altcoin “small reservoirs”. Due to the small pool size, only a small amount of funds is needed to achieve several times or dozens of times the growth, so people gradually figured out this bull market logic.

But this year, in addition to various new and old altcoins with different concepts, meme projects have fully blossomed. The market has discovered that FOMO emotions can also have containers to collect them. Since FOMO emotions can be directly poured into memecoins, why waste energy on those “altcoin traps” full of “bad apples” prepared for retail investors?

As a result, memecoins directly intercepted funds that should have flowed to altcoins. The bull market logic has changed, but it also hasn’t. It’s just that beside the altcoin pools, a circle of meme pools has appeared to receive the funds overflowing from Bitcoin.

HAS THE BULL RUN ENDED? MOST PEOPLE MAY HAVE LOST DIRECTION

Regarding whether the bull market has ended and whether there will be an altcoin bull run, many people are caught in confusion and contradiction. But what I want to say is, since we’ve long known that “bull markets don’t necessarily mean profits, and bear markets don’t necessarily mean losses” for most people, why are we still so concerned about whether it’s a bull market or not?

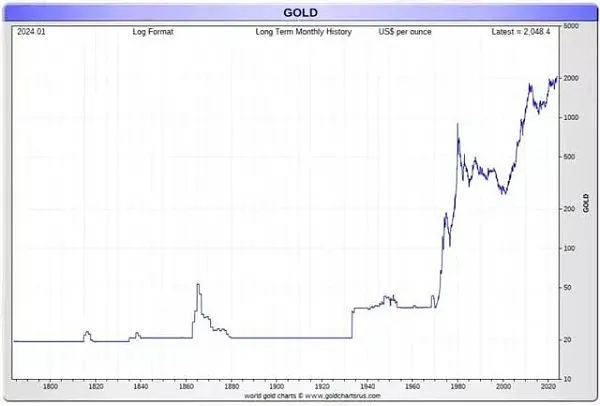

Looking back at the historical data of the gold trend chart over the past 100 years, you’ll find that Bitcoin, this digital gold, and gold have many similarities not only in some attributes but also in trend charts:

- If the timeline is extended, the early price trends, regardless of bull or bear markets, almost become a straight line.

- Prices are always fluctuating, with cycles, always maintaining a long-term spiral upward channel.

So we can draw a conclusion that is likely to be correct: like gold, for Bitcoin, the best long-term strategy within 100 years will always be to buy the dips.

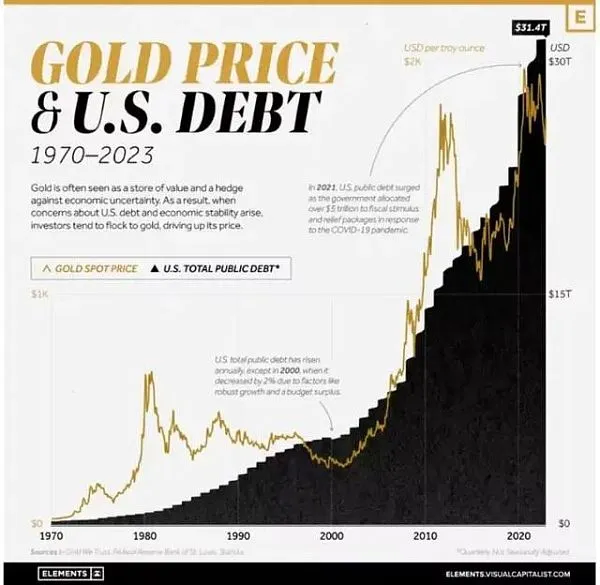

(Gold and US national debt scale trends are positively correlated)

Represented by the United States, the global path of printing money to create huge debts has long been irreversible. The only way to resolve the ever-increasing debt is to start the money printing machine…

SUMMARY

Recently, factors such as Mt. Gox debt settlement and government sell-offs have brought huge negative impacts to the market, but the good side is that these “Swords of Damocles” hanging over the crypto market have also disappeared. If we extend the timeline, the “bull” will always be there. Therefore, there’s no need to worry at all. We just need to quietly hold onto the original intention of crypto and patiently welcome the new era.