KEYTAKEAWAYS

-

Telegram's DAU/MAU ratio is significantly lower than other social platforms, indicating a smaller profitable user base.

-

TON's architecture is incompatible with Ethereum's EVM, limiting development opportunities using popular languages like Solidity.

-

Despite its vast user base, Telegram's market penetration and regional distribution present challenges for TON's growth.

CONTENT

TON‘s potential to become the next Solana or Ethereum faces challenges due to low Telegram user engagement, lack of EVM compatibility, and high FDV valuation. Readers can take a deep dive into these limitations with CoinRank through the article.

HIGH EXPECTATIONS FOR TON AS THE NEXT SOL OR ETH

Recent discussions have elevated the narrative around TON (The Open Network) and its integration with Telegram, with many speculating that TON could emerge as the next Solana (SOL) or Ethereum (ETH). However, a detailed analysis by Blockworks Research suggests that TON may struggle to meet these high expectations.

TELEGRAM’S USER ENGAGEMENT CHALLENGES

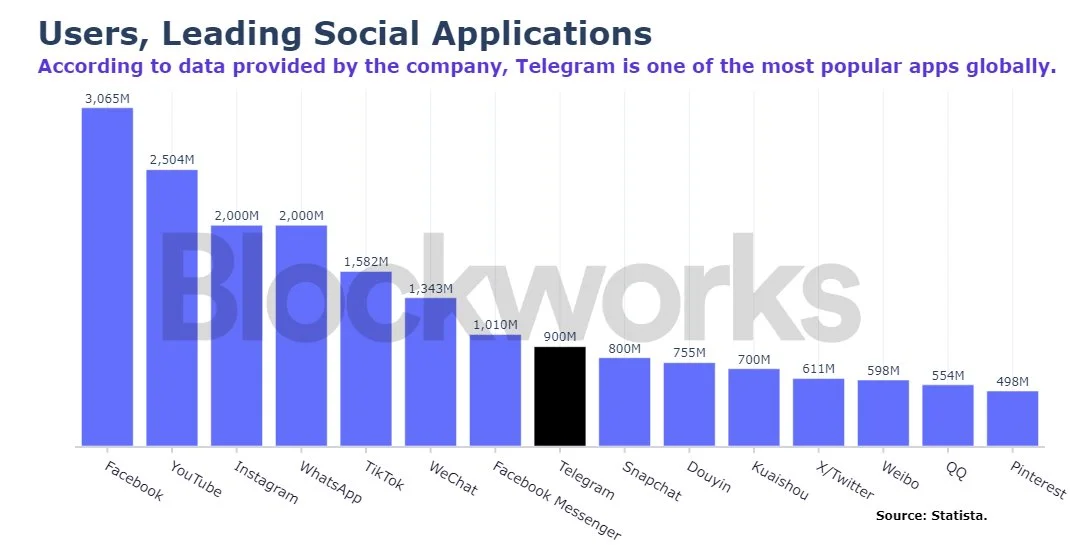

- Global Reach and User Base: Telegram boasts significant global influence and a substantial daily active user (DAU) base, positioning it as one of the most widely used applications globally. According to Telegram’s data, it ranks 8th among global applications with a total user base of 900 million.

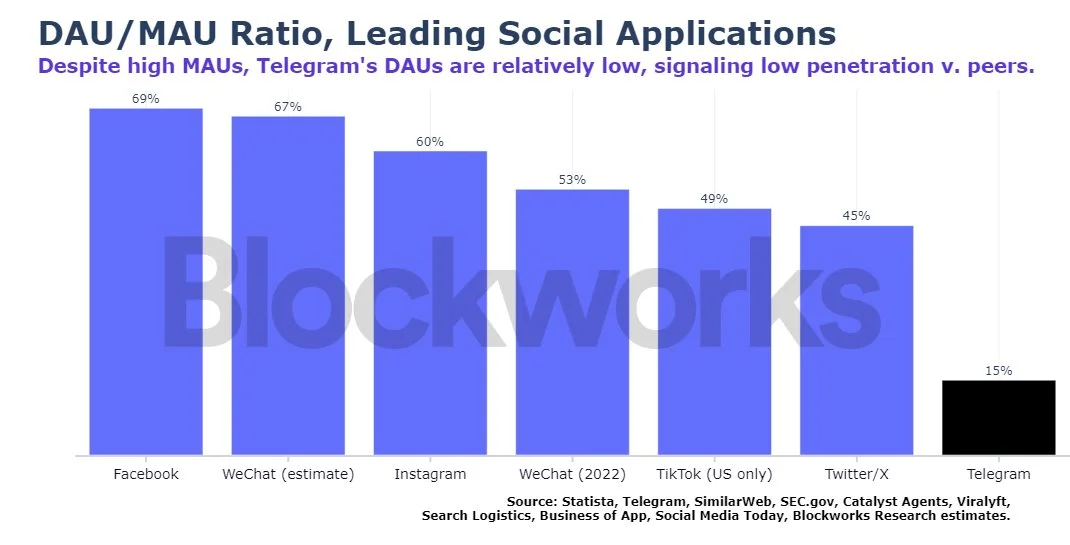

- DAU/MAU Ratio: Despite these impressive numbers, Telegram’s user engagement, measured by the DAU to monthly active users (MAU) ratio, is overestimated. The ratio reveals that while Telegram has a high MAU, its DAU figures are relatively low (between 55 million to 200 million), resulting in a DAU/MAU ratio of just 15%. This is significantly lower compared to other social platforms like Facebook (69%), WeChat (67%), Instagram (60%), TikTok (49% for the U.S. market), and Twitter (45%), indicating a lower market penetration and a smaller profitable user base than anticipated.

TECHNOLOGICAL AND DEVELOPMENTAL CONSTRAINTS

- Lack of EVM Compatibility: One significant hurdle for the TON ecosystem is its lack of compatibility with the Ethereum Virtual Machine (EVM). TON’s architecture is fundamentally different from Ethereum’s, being asynchronous compared to Ethereum’s synchronous nature. Consequently, TON does not support the development of applications using Ethereum’s Solidity programming language.

- Programming Language Usage: The TON ecosystem primarily utilizes three programming languages: Fift, FunC, and Tact, with FunC being the most commonly used. Despite FunC’s resemblance to the C programming language, it is neither widely known nor highly regarded. According to a 2023 developer survey involving over 90,000 developers, Rust and Solidity are the most favored languages, with Rust preferred by over 80% of developers and Solidity by 46.4%.

MARKET PENETRATION AND REGIONAL LIMITATIONS

- Comparison with WeChat: A significant part of the TON narrative hinges on Telegram becoming the next WeChat. However, unlike WeChat, which is largely confined to the Chinese market, Telegram operates in a market dominated by well-funded tech giants with robust network effects.

- Regional User Distribution: Telegram’s user base is predominantly dispersed across the Asia-Pacific region (excluding China and Eastern Europe), complicating efforts for startups to leverage Telegram for distribution. In 2022, Telegram’s downloads were concentrated in the following regions:

- India: 104 million downloads

- Russia: 34 million downloads

- Indonesia: 27 million downloads

- United States: 26 million downloads

- Brazil: 21.94 million downloads

- Egypt: 14.85 million downloads

- Vietnam: 11.84 million downloads

- Mexico: 11.61 million downloads

- Ukraine: 10.76 million downloads

- Turkey: 9.79 million downloads

CONCERNS OVER FDV VALUATION

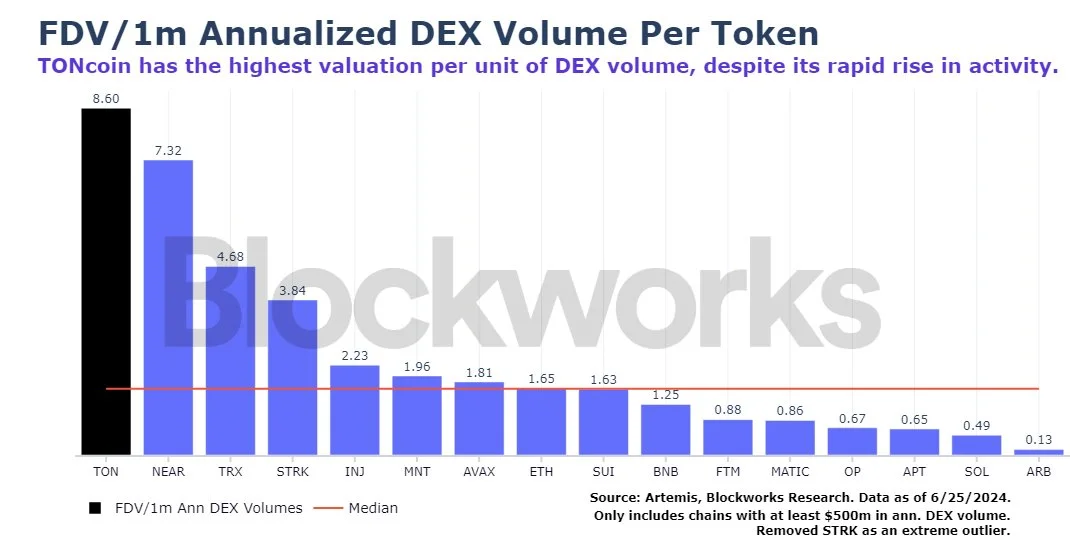

FDV Valuation: Despite these challenges, TON still holds significant growth potential. However, new investors face a lack of a safety margin. TON’s Fully Diluted Valuation (FDV) is 8.6 times its network’s annualized DEX trading volume, placing it at the highest level among all public chains.

Moreover, TON’s FDV is 927 times its network’s annual fees, further emphasizing its high valuation relative to its current usage and revenue.

CONCLUSION

While TON and Telegram present an appealing narrative, especially given Telegram’s vast user base, several limitations, including low user engagement, technological incompatibility, and regional market constraints, may impede TON’s potential to become the next major blockchain platform akin to Solana or Ethereum. The high FDV valuation further complicates the investment landscape, requiring cautious optimism from potential investors.