KEYTAKEAWAYS

- Bitcoin is diverging from other cryptocurrencies, showing stable growth backed by institutional investors while altcoins struggle with regulatory challenges and declining retail confidence.

- Market power is shifting from project teams to major institutions, transforming cryptocurrency trading from speculative activity to more regulated, professionally-managed investment vehicles.

- Future success in crypto markets favors established coins with proven track records, while new tokens face increased scrutiny and difficulty attracting institutional capital.

CONTENT

On February 3rd, Bitcoin led a major market decline in the cryptocurrency space. However, Bitcoin itself didn’t drop significantly – from a weekly perspective, Bitcoin remained within its effective fluctuation range and didn’t even break below January’s low of $89,000. Meanwhile, Ethereum led altcoins in a devastating decline, directly pushing the Fear and Greed Index down to 38!

Fear and Greed Index

(Source: CoinMarketCap)

Subsequently, Trump’s 30-day delay in tariff increases actually created more market uncertainty. Rather than completely canceling the increases, the 30-day postponement has become a Damocles’ sword hanging over the market, making participants hesitant to make significant moves. Buyers fear being cut down if they enter, while sellers worry about missing this window of opportunity, potentially leading to a temporary balance between bullish and bearish forces.

Now comes the most crucial question that many are concerned about: Is the bull market still ongoing?

Looking at the most basic indicator of a bull market – “volume” – the bull market appears to be continuing. The current total cryptocurrency market capitalization remains high at $3.2 trillion, indicating that most capital hasn’t left the market. If it were to fall to the bear market position of August 2024 – around $2 trillion – then we might truly be entering a bear market. However, the subsequent bull market logic may differ from the previous three halving cycles. The crypto market is facing major changes, and going forward: Bitcoin is Bitcoin, crypto is crypto!

Total Crypto Market Cap Changes

(Source: CoinMarketCap)

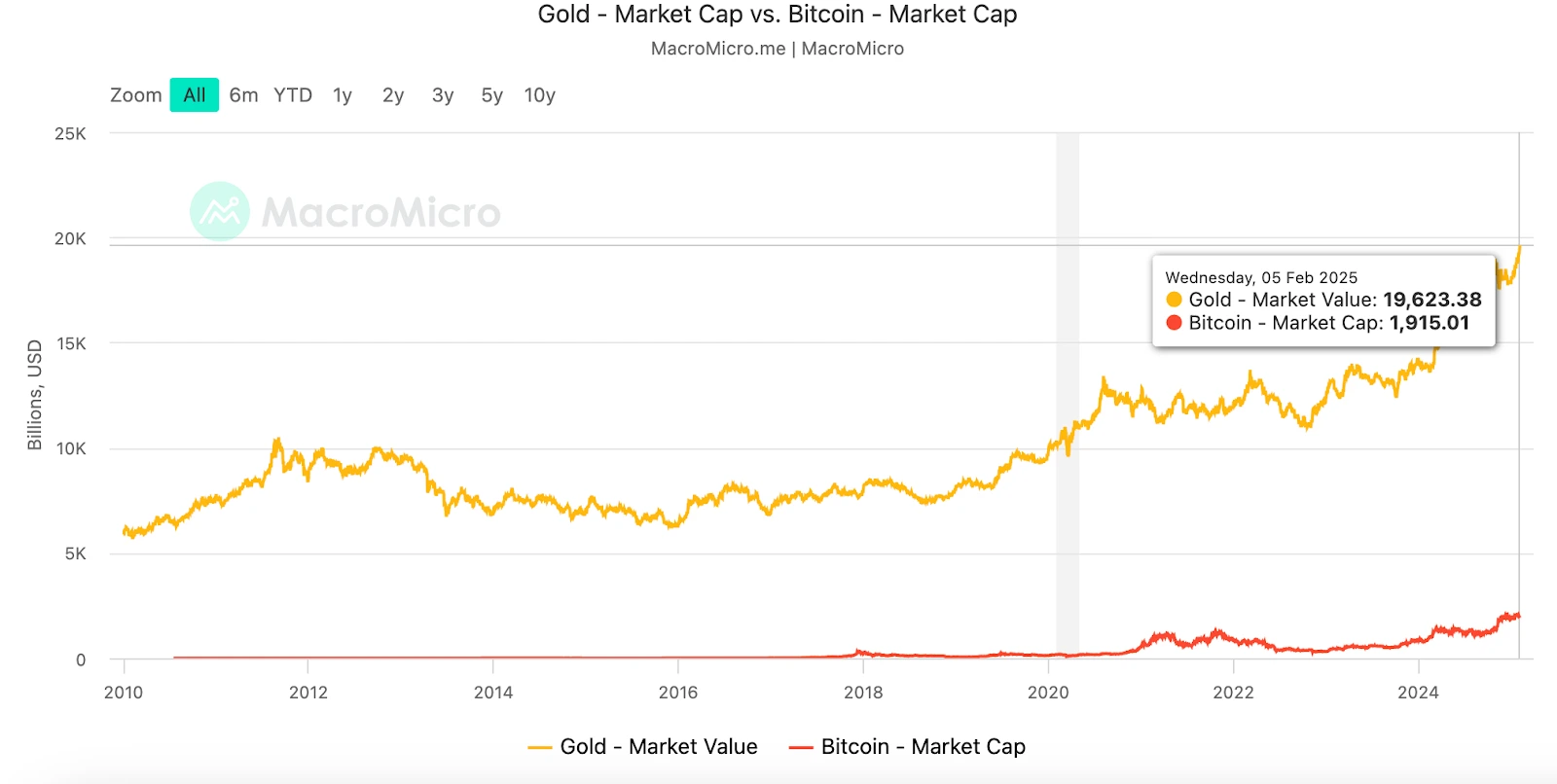

MAJOR SHIFT: BITCOIN AND ALTCOIN DIVERGENCE, IS BITCOIN FOLLOWING GOLD’S STEADY BULL RUN?

Since Bitcoin’s fourth halving, there have been voices suggesting that the fourth halving cycle would be a bull market for Bitcoin alone. Now, ten months after Bitcoin’s fourth halving, this view seems to have been validated.

The divergence between Bitcoin and altcoins has become increasingly apparent. Bitcoin, backed by Wall Street institutions, is dancing solo, continuously breaking new highs and showing characteristics similar to gold’s “steady bull run.” Meanwhile, altcoins generally show weakness, with most cryptocurrencies “following downward trends but not upward ones,” and even failing to experience a significant “altcoin season” during Bitcoin’s rises.

After the approval of spot Bitcoin ETFs, with endorsement and support from major Wall Street financial institutions like BlackRock, Bitcoin has truly become similar to “digital gold” – an asset for combating inflation and hedging risks. The massive influx of institutional funds has provided strong market support for Bitcoin, leading to a steady upward trend similar to gold. This institutional participation not only increases Bitcoin’s market depth but also promotes stable price appreciation, particularly highlighting Bitcoin’s status as a safe-haven asset during times of global financial uncertainty.

Bitcoin vs Gold Market Cap Comparison

(Source: MacroMicro)

In this halving cycle, Bitcoin’s pattern differs from the “dramatic volatility” of the previous three halvings, showing a more stable performance with a typical steady bull run characteristic. Unlike other high-risk assets in the crypto space, institutional investors tend to hold Bitcoin rather than trade frequently. Therefore, Bitcoin’s long-term growth focuses more on market fundamentals and macroeconomic environment changes. Moreover, capital entering Bitcoin tends to remain in Bitcoin rather than flowing out to other altcoins in search of higher returns.

In contrast, altcoins struggle to gain similar recognition due to their lack of clear regulatory frameworks and institutional endorsement. Additionally, due to the two major altcoin cycles during the second and third halving periods, virtually all altcoins experienced 90-95% crashes, including industry-shaking collapses like LUNA and FTX. These events liquidated many large investors, and crypto lending platforms haven’t yet recovered their vitality.

The view that “all altcoins are scams” has become mainstream thinking, and retail investors no longer believe that “this technology represents the future.” As a result, almost all altcoin projects have become a race to exit first, with everyone trying to avoid being the last holder. This psychology affects not only altcoin prices’ long-term growth but also prevents projects from sustaining ecosystem development and technical advancement, creating a vicious cycle.

Of course, most altcoins themselves lack genuine technological innovation or practical application scenarios, relying more on marketing and speculation to attract capital. Investors now judge project value more rationally, and many altcoins’ narrative logic is too hollow to withstand market testing, making it difficult even to achieve another notable rise, further diminishing retail investor confidence.

Furthermore, there are currently over ten million altcoins in the market, with CoinMarketCap alone listing 10.86 million, but the vast majority of projects have no actual value and some even show clear characteristics of Ponzi schemes. This “bad money driving out good money” phenomenon has led to decreased overall trust in altcoins. Many altcoin project teams harvest retail investors through pump-and-dump schemes and false propaganda, further aggravating market chaos. In this halving cycle, many countries have tightened regulations on altcoins, further limiting their upside potential.

The divergence between Bitcoin and altcoins reflects a structural change in the cryptocurrency market, essentially showing its gradual maturation. In the future, this divergence trend may intensify further: Bitcoin will continue to attract institutional capital inflow, becoming the market’s “ballast,” while altcoins may face greater challenges, with only a few projects demonstrating actual value managing to stand out.

THE CRYPTO MARKET’S POWER SHIFT: FROM PROJECT TEAMS TO MAJOR INSTITUTIONS

Previously, market control was typically in the hands of project teams and large holders. These whales owned large amounts of coins and controlled market prices through “market making,” driving price movements up or down through aggressive marketing and social media promotion. Under this model, market capital flow and price fluctuations were controlled by a few individuals, making it prone to manipulation and “retail investor exploitation.”

However, in this cycle, the market is experiencing a profound “power shift”: the dominant force in the crypto market is gradually transferring from early project teams and whales working together to major institutions represented by Wall Street firms, traditional financial capital, and Western government consortiums. This power transfer is not only changing the market’s capital structure but also reshaping the crypto market’s narrative and investment logic.

We know that since 2020, institutional capital represented by Grayscale, MicroStrategy, and Tesla has begun entering the crypto market in force, but their primary target has been Bitcoin, viewing it as an inflation-resistant asset and “digital gold,” incorporating it into their balance sheets or investment portfolios. The continued inflow of institutional capital has made Bitcoin’s trajectory more stable, showing “steady bull run” characteristics.

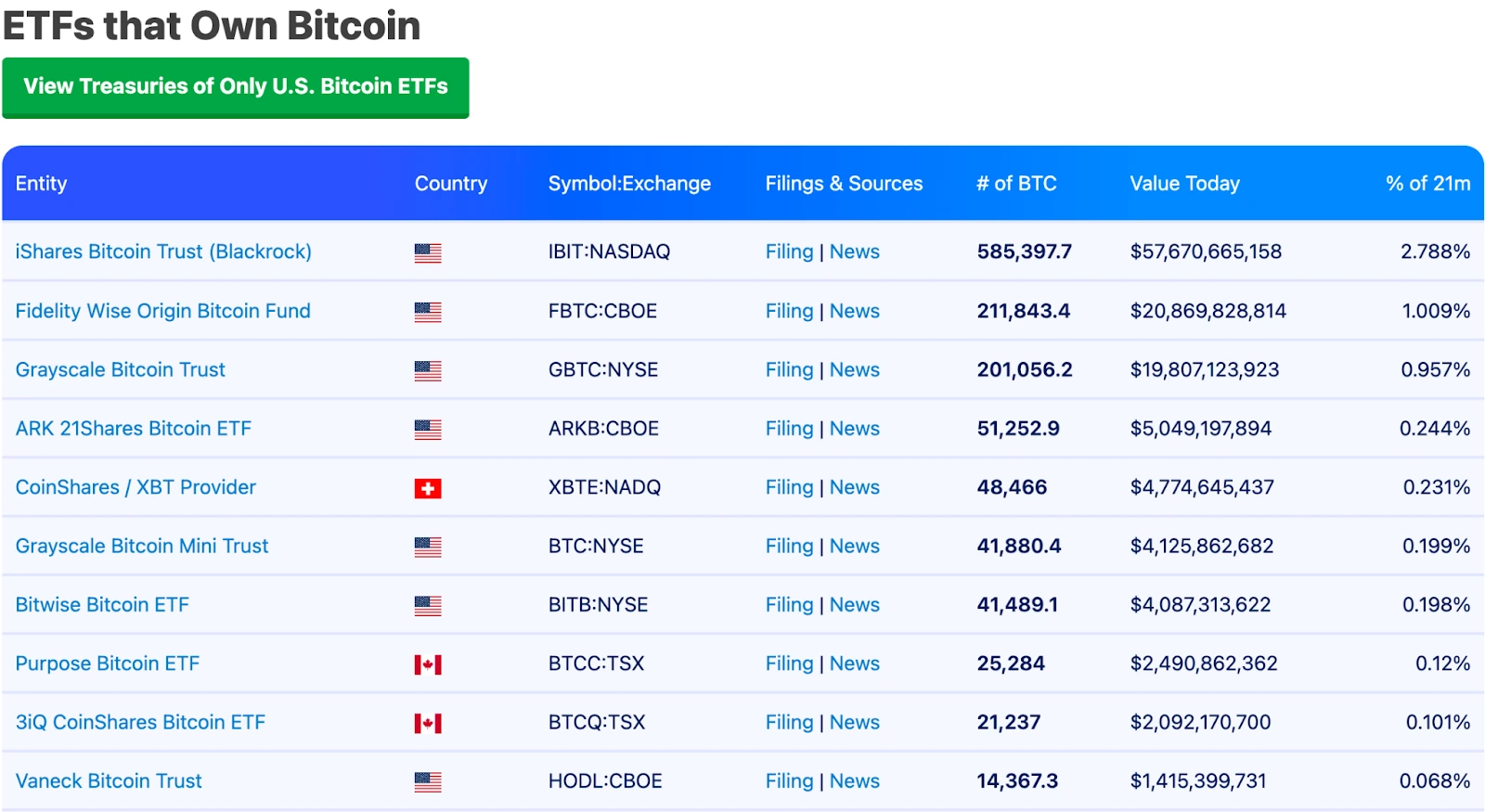

The approval of spot Bitcoin ETFs in this cycle has further accelerated institutional entry. Bitcoin spot ETF holdings have exceeded Satoshi Nakamoto’s holdings, surpassing 1.35 million BTC. The launch of ETFs has transformed Bitcoin from an alternative asset into a mainstream asset, though it has also weakened its decentralization characteristics, with pricing power firmly controlled by Wall Street.

Top 10 Bitcoin ETF Holdings

(Source: Bitcoin Treasuries)

Moreover, European and American governments and consortiums are now entering the crypto space. For example, Trump proposed the “American Bitcoin Strategic Reserve Act,” suggesting that the U.S. Treasury and Federal Reserve purchase a total of 1 million bitcoins over the next 5 years and hold them for at least 20 years. This government-level intervention further solidifies Bitcoin’s market position.

National and Institutional Bitcoin Holdings

(Source: Bitcoin Treasuries)

With institutional capital’s entry, the market’s narrative logic has shifted from early concept speculation to focusing more on projects’ actual implementation capabilities. Institutional investors pay more attention to projects’ technological innovation, business models, and market validation results rather than short-term price fluctuations.

In this market power shift, established mainstream coins like ETH, LTC, BCH, and XRP are more favored by institutional capital due to their market testing and higher liquidity. In contrast, new coins lacking actual value support are gradually being marginalized.

Moreover, institutional investors and governments have raised higher requirements for regulatory compliance of crypto assets. Bitcoin, with its relatively clear regulatory framework and institutional endorsement, has become the first choice for large capital. Many altcoins struggle to attract institutional capital due to their lack of compliance.

Specifically, institutional investors focus more on the following aspects when selecting projects:

- Technical Implementation: Whether the project can be practically applied and has real commercial value. For example, Bitcoin’s position as digital gold has gained widespread market recognition, while Ethereum has attracted substantial capital inflow due to its smart contracts and widespread DeFi ecosystem applications.

- Regulatory Compliance: As governments worldwide tighten crypto regulation, institutional entry requires projects to comply with relevant regulations and ensure compliance. Many crypto projects have undergone restructuring and adjustments to adapt to different market legal frameworks.

- Market Maturity: Institutional investors prefer projects that have been market-tested rather than blindly pursuing new, unverified projects. This means early-stage altcoins and immature projects, especially those lacking practical applications and real user bases, find it increasingly difficult to gain institutional favor.

- Transparency and Governance Structure: Compared to traditional project team-led crypto projects, institutions prefer supporting projects with clear governance structures and high transparency. These projects’ decision-making processes and operations better align with traditional financial market requirements, earning institutional investors’ trust.

After this major market power shift, the divergence between Bitcoin and altcoins will become more pronounced. The market’s power shift also marks its transition from early wild growth to maturity. Bitcoin, supported by institutional capital, is gradually developing an independent trend, showing “digital gold” characteristics. The altcoin market will face greater challenges, with only a few projects demonstrating actual value able to stand out. Investors should focus on established mainstream coins that have been market-tested and be cautious of high-risk new coins.

The presence of institutions as market makers has brought enormous capital support to the crypto market and introduced more mature operating methods. Their presence makes the market more transparent, and investors’ choices are no longer limited to speculation and short-term fluctuations but tend toward focusing on long-term stable returns.

FUTURE MARKET CHARACTERISTICS: THE STRONG GET STRONGER, UPDATED UNDERSTANDING IS KEY

As the crypto market’s power shift continues and institutional capital continues to enter, the market’s overall characteristics are undergoing profound changes. The divergence trend between Bitcoin and altcoins is becoming increasingly apparent, and the market’s investment logic and narrative are constantly updating.

Future market characteristics will change accordingly, mainly:

- Greater Bitcoin and Crypto Market Divergence: Bitcoin is Bitcoin, crypto is crypto, as described earlier.

- The Strong Get Stronger: Established mainstream coins are more favored. During the market power shift, established mainstream coins like ETH, LTC, BCH, XRP, and DOGE are more favored by institutional capital due to their market testing and higher liquidity.

Popular cryptocurrencies mainly feature: high market recognition, having survived at least one bull-bear market cycle; strong liquidity, suitable for large capital movement; solid technical foundation with practical application scenarios. These aspects need to be considered when selecting investment targets.

- High Risk of New Coins: Be cautious with coins that had multiple funding rounds. Many new coins conducted multiple funding rounds before listing, resulting in high market caps but low circulation. This high market cap, low circulation model allows project teams and early investors to continuously unlock and sell to harvest retail investors.

Unlock selling pressure makes it difficult for prices to rise and can even lead to crashes. Lacking actual value, these projects rely more on marketing and speculation to attract capital, making it difficult for institutions to favor such projects. For new coins, especially those with multiple early funding rounds and high market caps but low circulation, it’s advised to participate cautiously to avoid becoming the “last holder.”

- Primary Market Opportunities: For wealth creation, focus on the primary market. The primary market often has significant information asymmetry but also harbors higher return potential. Investors seeking excess returns can focus on primary market opportunities.

However, participating in the primary market requires certain thresholds or abilities, such as:

- Project screening ability to identify promising early projects

- Resource integration ability to access quality project investment opportunities

- Risk tolerance ability to bear higher investment risks

Facing major changes in the crypto market, we need to update our understanding, keep up with trends, and invest rationally. Currently, the crypto market is still in its early development stage, full of opportunities and challenges. The future overall market will show “strong get stronger” characteristics. Investors need to focus more on project implementation and technical maturity in the market. The widespread rise of altcoins has become history. Investors should view the market with a long-term perspective, avoid being confused by short-term price fluctuations, and focus on projects’ actual value and long-term potential. Only in this way can one seize opportunities in the crypto market’s transformation and achieve wealth appreciation.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!