KEYTAKEAWAYS

- Bitcoin historically performs well in March with an 8:5 gain-to-loss ratio, but current market sentiment shows extreme fear with BTC down 23%.

- Major central bank meetings and US tariffs taking effect in March could further impact market volatility and inflation expectations.

- Technical analysis suggests Bitcoin may find support between $70,000-71,000, potentially creating a "golden pit" buying opportunity similar to previous cycles.

CONTENT

Analyze Bitcoin’s March outlook amid central bank meetings, Trump’s tariffs, and SOL unlocks. Historical March performance is positive, but will BTC bottom at $70,000 before rebounding from extreme fear sentiment?

In February, BTC led the market in a dramatic decline, falling continuously from its opening price of $102,769 (Bitget data) to a low of $78,291 as of writing, a 23% drop. Other altcoins generally saw their values cut in half, or even halved again. Market sentiment nearly collapsed, with the Fear and Greed Index dropping to 21, entering the “extreme fear” zone.

So what will the market do in March? We need to look not only at the market’s internal logic but also at some major events happening in March: In addition to the Federal Reserve holding its second interest rate meeting of 2025, the other two of the world’s three major central banks—the European Central Bank and the Bank of England—will also meet. Central banks from other important economies such as Canada, Japan, and Switzerland will also make interest rate decisions this month.

Additionally, there are potential “black swan” events such as Trump imposing tariffs on Canada and Mexico, as well as changes in the Russia-Ukraine situation. Will March see a drop back to the starting point of this market cycle at $70,000-71,000? Will the market bottom out and rebound?

HOW HAS BITCOIN PERFORMED IN MARCH HISTORICALLY?

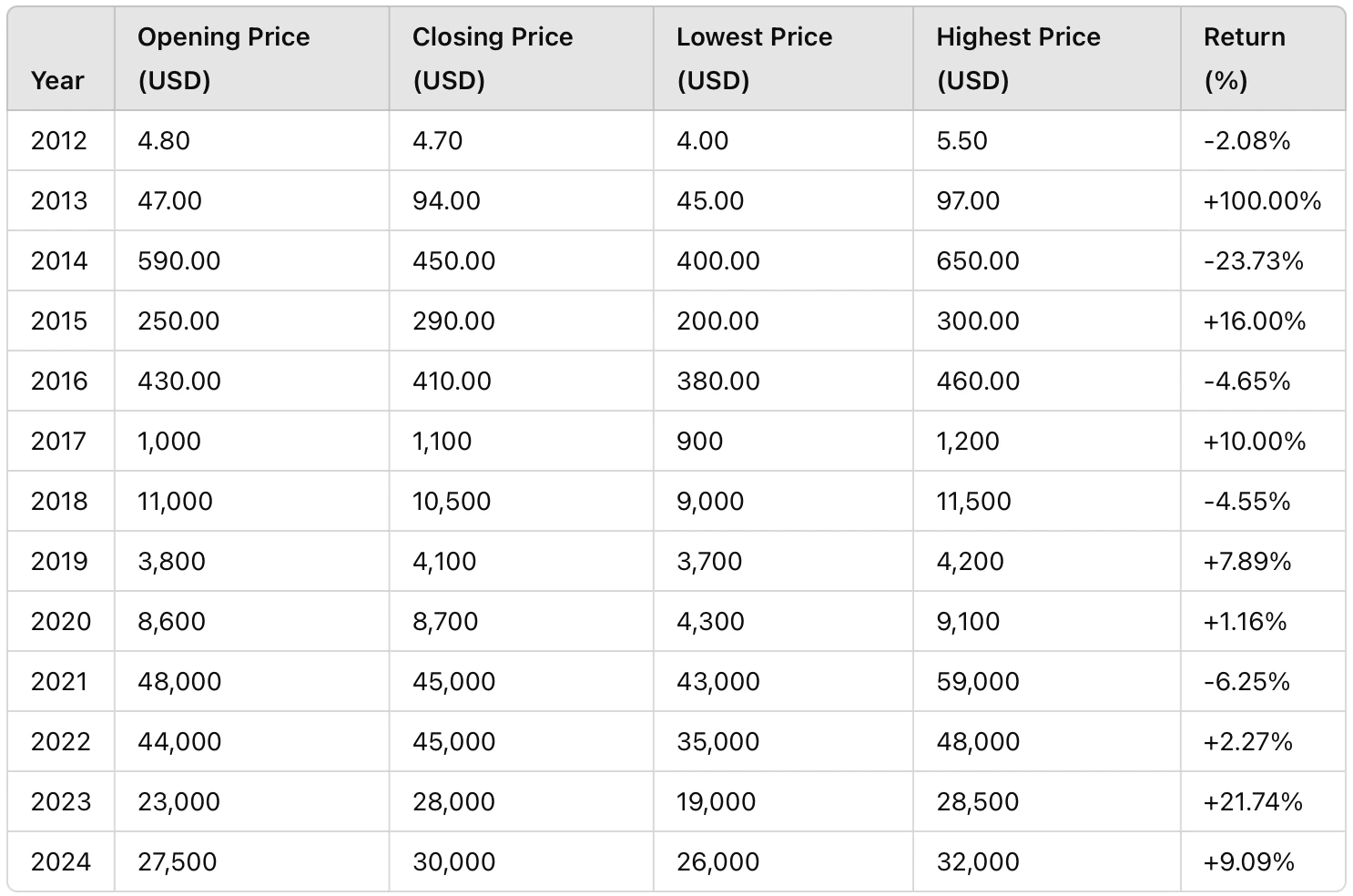

Before getting into the main content, let’s first review how Bitcoin, as the crypto market bellwether, has performed in March historically. Below are statistics from third-party websites like TradingView:

Historical Bitcoin Returns in March

(Source: CoinRank)

From the chart above, we can see that historically, Bitcoin has generally seen positive returns in March. Out of 13 years, the ratio of gains to losses is 8:5, showing that gains have a clear advantage. In the second year after the previous three halvings (2013, 2017, 2021), the ratio was 2:1; in the last five years, it was 4:1.

Therefore, looking solely at historical data, March is a month of harvest for Bitcoin. However, the internal and external environment this March may be more complex, making it difficult to clearly determine whether prices will rise or fall.

REVIEW OF MAJOR EVENTS DIRECTLY IMPACTING THE ENTIRE CRYPTO MARKET’S FLUCTUATIONS

Note: All times mentioned below are in New York time (GMT-5);

Crypto March Financial Calendar

Key Focus:

- Federal Reserve interest rate meeting

- US Non-Farm Payroll data

- European Central Bank interest rate decision

- US tariffs on Canada and Mexico taking effect

- Bank of England interest rate decision

- US CPI

Events with specific timing not yet confirmed:

- Ethereum developers plan to launch the Pectra upgrade in March

March 1, 11.2 million SOL from FTX bankruptcy auction will be unlocked

On March 1, 11.2 million SOL from the FTX bankruptcy auction will be unlocked, worth approximately $2 billion. The unlocked tokens represent about 2.29% of SOL’s current circulating supply.

SOL, as the star performer of this market cycle, rose from a low of $8 during the FTX collapse to a high of $295, a 36x increase, with its market cap briefly entering the top three. From October 2023 to its peak in January 2025, a period of 16 months, how many people were attracted to enter? And how many token holders were given an almost religious illusion that SOL would continue to rise indefinitely, at least surpassing ETH‘s market cap?

With such strong consensus and heavy positions, subsequent price increases would require massive capital. If whales want to drive prices up again, they would need to shake out many holders first. So could a massive token unlock plus negative news wash out many people?

Of course, a massive unlock doesn’t necessarily mean dumping on the secondary market; the tokens might be transferred to major holders or even institutions through OTC deals. But with SOL’s continuous plunge to a low of $130, already halving its value, token holders are not just shaken but have become like startled birds, seeing threats everywhere. Any negative news in the market could trigger a stampede and subsequent crash, as massive unlocks are never bullish, and the market trades on expectations.

As public chains, they tend to fall dramatically during bear markets or bull market corrections because during bull markets, people buy public chain tokens to purchase other altcoins on those chains or to pay for transaction fees. But during bear markets or crashes, this works in reverse, especially for some large stakers.

SOL’s bottom may need to be found between $100-120. As for its impact on the crypto space, I think it’s limited. After all, these unlocks are not enough to shake the current market and may only affect SOL ecosystem altcoins, with very limited impact on other cryptocurrencies.

March 4, US tariffs on Canada and Mexico take effect

US President Trump announced that tariffs on Canada and Mexico will take effect as scheduled on March 4, citing the continued flow of drugs into the US from these countries. Additionally, the 10% tariff on all Chinese imports has already taken effect, and by March 4, the additional tariff on Chinese goods will increase to 20%.

This is undoubtedly bearish for the crypto space, especially as the Federal Reserve will hold its second interest rate decision of the year in March. These tariffs will increase the cost of imported goods, particularly in key areas such as energy and manufacturing products, potentially further pushing up US domestic inflation. The Fed has already paused rate cuts as inflation remains above its 2% target, and if tariffs lead to rising inflation expectations, the Fed may be more inclined to maintain high interest rates or even delay rate cut plans.

Escalating tariff conflicts could trigger global trade tensions, and combined with Fed policy uncertainty, this might drive some capital into Bitcoin and other crypto assets as a hedge. However, the risk of Fed tightening would reduce market liquidity, making a decline more likely. While there’s a possibility of “buying the news after selling the rumor,” such bullish sentiment might only result in a small rebound, making it difficult to reverse the overall trend.

March 6, European Central Bank interest rate decision

The current market consensus expects rates to remain unchanged, mainly due to global economic uncertainties, especially geopolitical risks from the Russia-Ukraine war, which may incline the ECB to maintain the status quo. Despite inflation easing, it remains above the 2% target, and rate cuts could exacerbate inflation risks.

Keeping rates unchanged meets short-term expectations, so the market should not react much, but in the long term, it may affect capital flows into the crypto space. However, if subsequent data or other events have an impact, the possibility of a rate cut also exists.

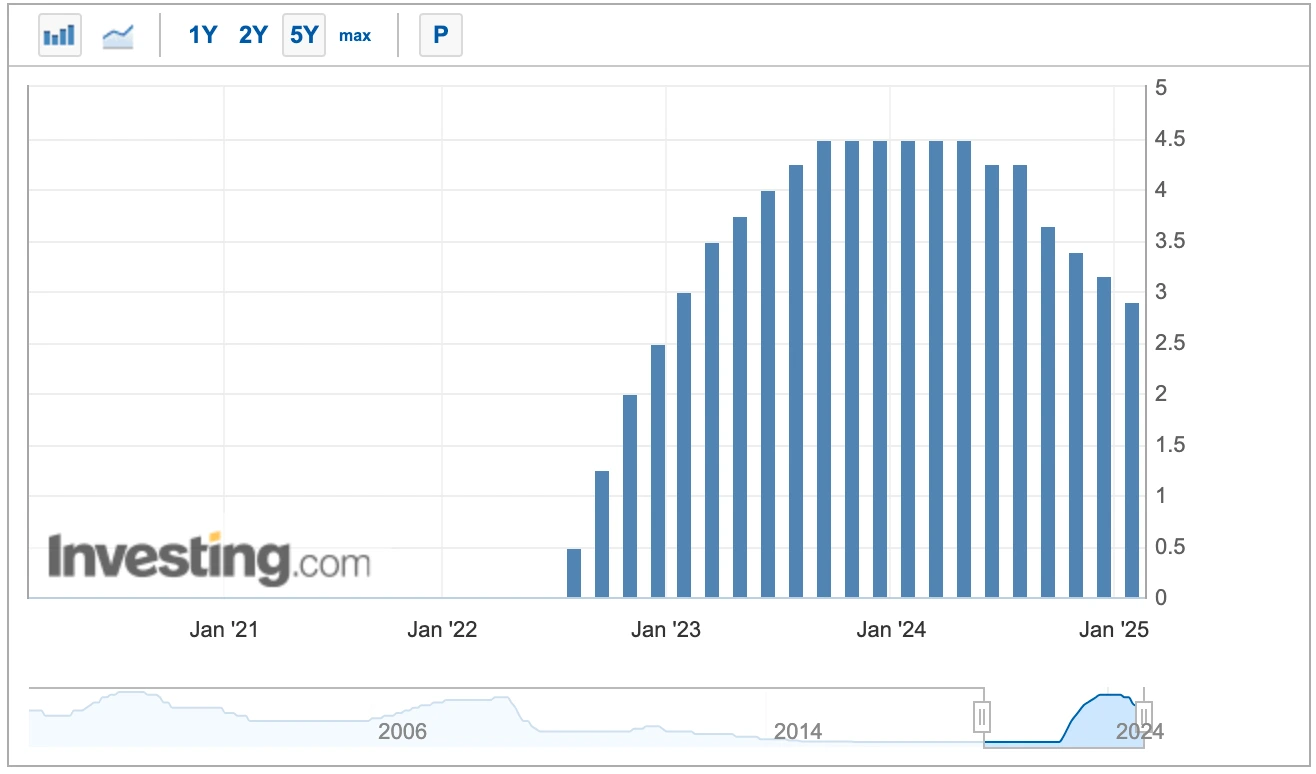

European Central Bank interest rates over the last 5 years

(Source: Investing)

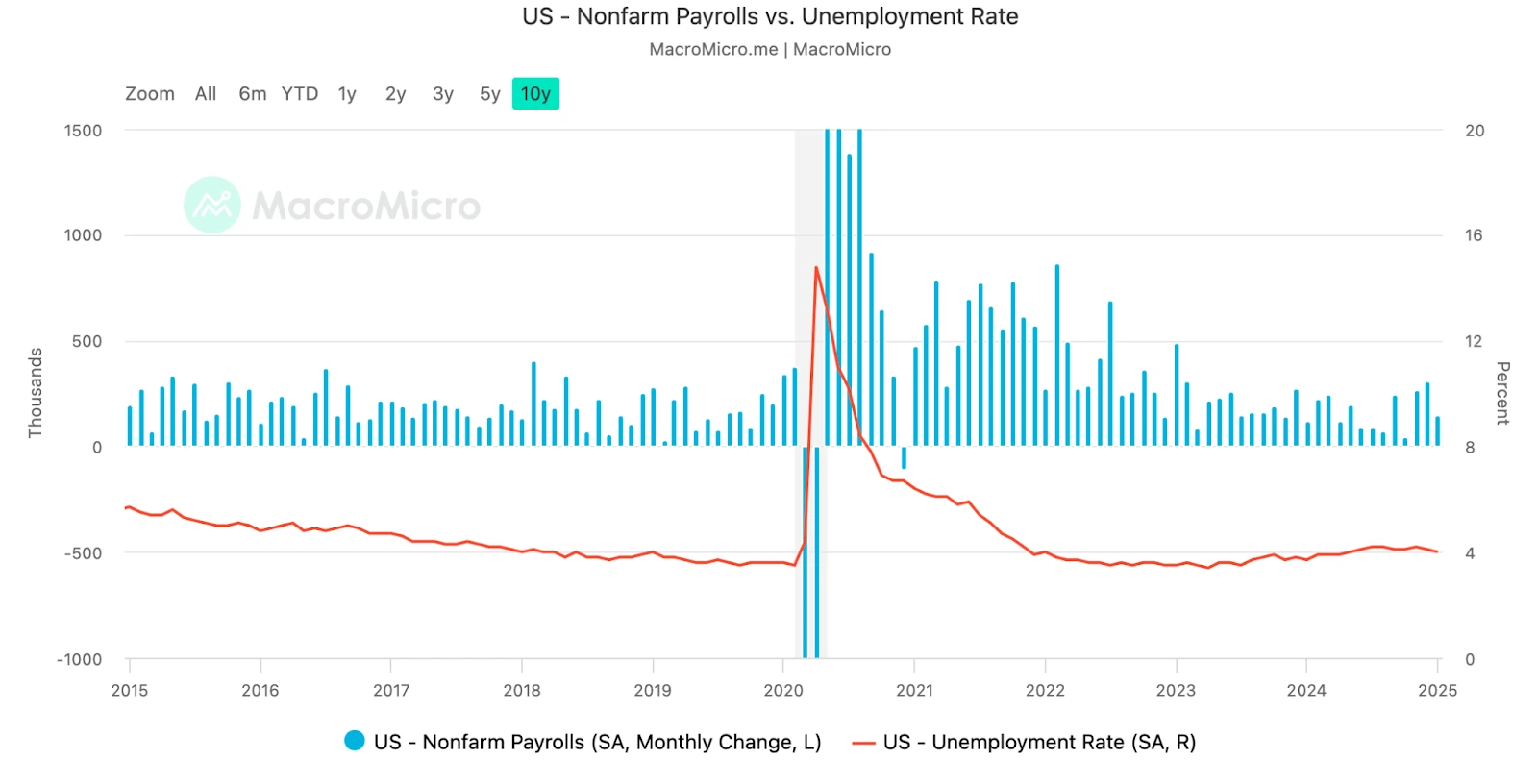

March 7, US February Non-Farm Payroll data

Generally, the Non-Farm Payroll data is the first important economic data published each month. It reflects the development of US manufacturing and service industries and is an important indicator of whether the US economy is functioning well, directly related to Fed monetary policy.

Last month’s published US January Non-Farm Payroll showed an increase of 143,000 jobs, below expectations and the lowest level in three months. The January unemployment rate fell to 4.0%, the lowest since May last year. Average hourly earnings increased by 4.1% year-on-year, higher than expected, raising inflation concerns. Although job growth was not particularly outstanding, the declining unemployment rate and strong wage growth indicate that the labor market remains healthy, suggesting this report has little positive effect on rate cuts.

The Non-Farm Payroll data to be released on March 6 is not expected to show significant changes according to market consensus, which may not affect the March 20 interest rate decision result—keeping rates unchanged—unless the data is abnormal. However, since this data will be released close to the Fed’s interest rate decision, it could cause short-term market fluctuations, so contract users need to be particularly aware of risk control.

March 12, US February CPI

On February 12, the January CPI data was released, showing a year-on-year increase of 3.0%, higher than the expected 2.9% and the previous value of 2.9%, rebounding for the fourth consecutive month. Core CPI increased 3.3% year-on-year, higher than the expected 3.1% and the previous 3.2%, basically flat since the second half of 2024. CPI increased 0.5% month-on-month, and core CPI increased 0.4% month-on-month, both higher than the expected 0.3%, and the highest in more than a year.

This shows that US secondary inflation pressure has begun to emerge. After the release, the market lowered its expectations for Fed rate cuts this year, believing that there will be at most one cut in 2025, or possibly none. Unless this CPI data improves, it remains bearish for the market, and BTC may lead the market downward.

US Non-Farm Payroll vs. Unemployment Rate over the last 10 years

(Source: MacroMicro)

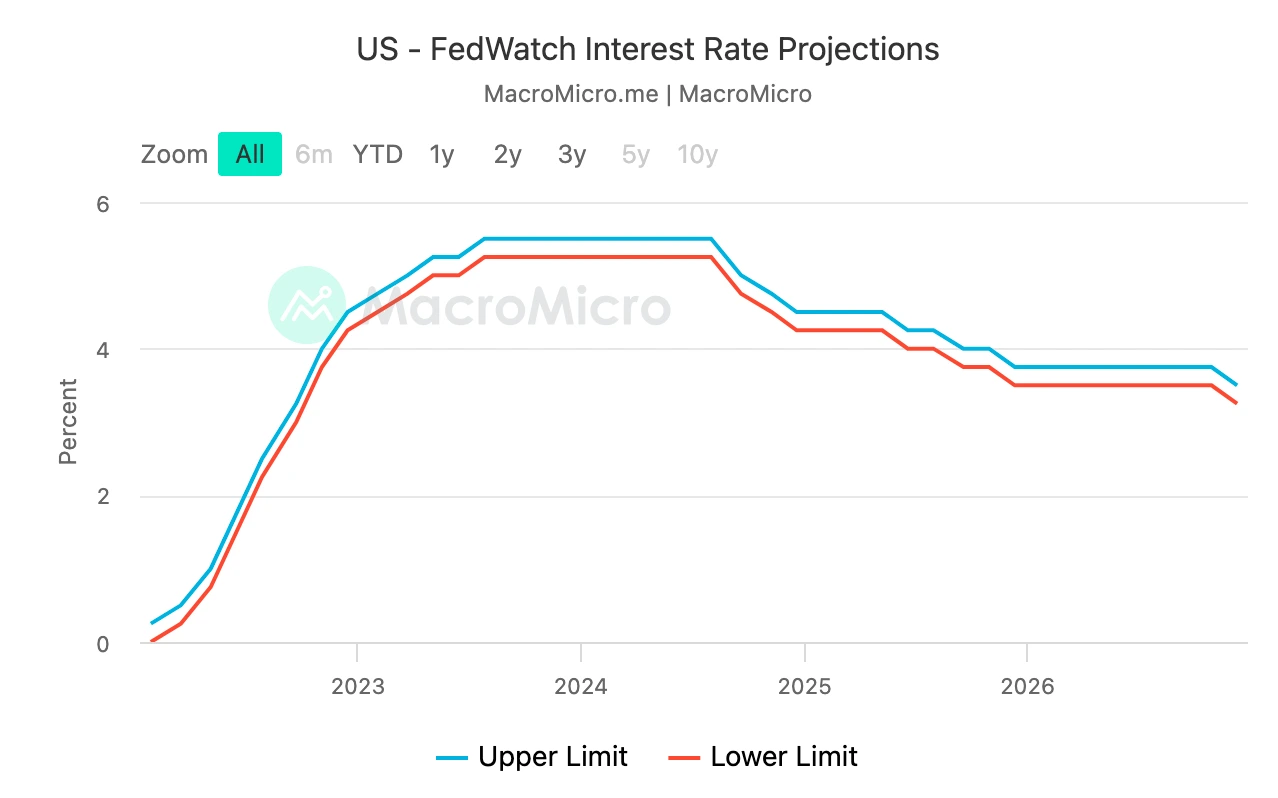

March 20, Federal Reserve interest rate decision, Bank of England interest rate decision

As the main event of global central bank meetings in March, and also the first interest rate meeting since Trump took office, the outcome of this Fed meeting is particularly important and attention-grabbing. The market generally expects rates to remain unchanged at “4.25-4.5%.” Subsequent focus should be on March’s Non-Farm and CPI data performance, as well as whether Trump will use political means to pressure the Fed.

If the February Non-Farm and CPI data released earlier meet expectations and rates remain unchanged, the short-term impact on the market may be volatility in both directions. The long-term impact may turn bearish news into bullish news. If the market has undergone sufficient bottom consolidation before this, it could mark the starting point of a strong rebound.

US FedWatch estimates of Federal Reserve interest rates

(Source: MacroMicro)

The Bank of England’s interest rate decision is also highly likely to remain unchanged. Although it is one of the world’s three major central banks and issues the third largest currency, its impact on the market is still significant, but with the Fed’s interest rate decision coming first, it basically sets the tone for market fluctuations that day.

Other Financial Events

- March 2, Crypto Expo Europe 2025

- March 3, Eurozone February CPI

- March 4, US tariffs on Canada and Mexico take effect; Story staking rewards officially released

- March 5, US February ADP employment figures

- March 10, US February NY Fed 1-year inflation expectations

- March 12, Bank of Canada interest rate decision

- March 13, US February PPI

- March 18, Bank of Japan interest rate decision

- March 19, Eurozone February CPI

- March 20, Swiss Q1 central bank policy rate

- March 28, US February PCE price index

Additionally, attention should be paid to token unlocks for various projects, such as Sui (SUI) unlocking about 22.97 million tokens, dydx (DYDX) unlocking about 8.33 million tokens, ZetaChain (ZETA) unlocking about 44.26 million tokens, etc.

Finally, all the views above are just one perspective, more importantly providing you with a channel to explore, to listen to different opinions for clarity, and to deeply understand the logic behind events, thereby forming your own judgments.

CONCLUSION

With Bitcoin falling below $80,000, we are now entering the end of a downward oscillating market. Of course, it may still drop to the starting point of this market cycle: $70,000-71,000.

However, at present, we have already reached Bitcoin’s chip density area. Even if it continues to fall, it will be in an oscillating downward pattern, and at the strong support of $70,000, there is a high probability of oscillating rebound.

After this wave of decline, we might truly see a golden pit like the ones from March 12 and May 19 in previous years! It’s just that back then, it was a one-time drop, like a big knife cutting to the heart; now it’s a continuous downward trend followed by accelerated decline, more like small knives cutting flesh.

Of course, being cut by small knives is more painful, after all, slow slicing was one of the ten cruel tortures! This halving market cycle is an atypical bull market because the Fed’s interest rate is still at a high level until now, whereas the previous three halvings were all accompanied by low interest rates and abundant liquidity.

However, the Fed cannot maintain high interest rates forever, otherwise either the US economy or the stock market will die. So all we need to do next is prepare for three goods: eat well, sleep well, work well, and be ready for a protracted war.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!